Category Archive: 2) Swiss and European Macro

Swiss Exports Rise Thanks to Higher Export Prices. Sorry, What ????

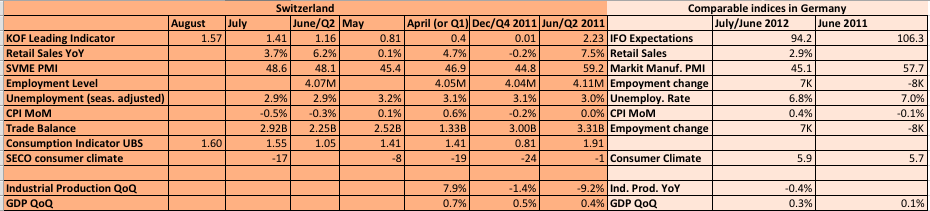

Or how Swiss exporters are able to widen their margins thanks to the SNB currency manipulation Last week the Swiss export data for the third quarter was released. The news agency report was simple: Exports from Switzerland fell by a real 8.0 percent in September to 16.49 billion Swiss francs ($17.87 billion), the Federal …

Read More »

Read More »

74.8 percent of Norwegians Say No to EU Membership

In the latest poll, 74.8 percent of the Norwegian population says no to EU membership, while 17.2 said they would vote yes in any referendum. 7.9 percent have not decided. Seven out of ten voters of the ruling party do not share the party’s views on the EU and would have voted no in a possible referendum, … Continue reading...

Read More »

Read More »

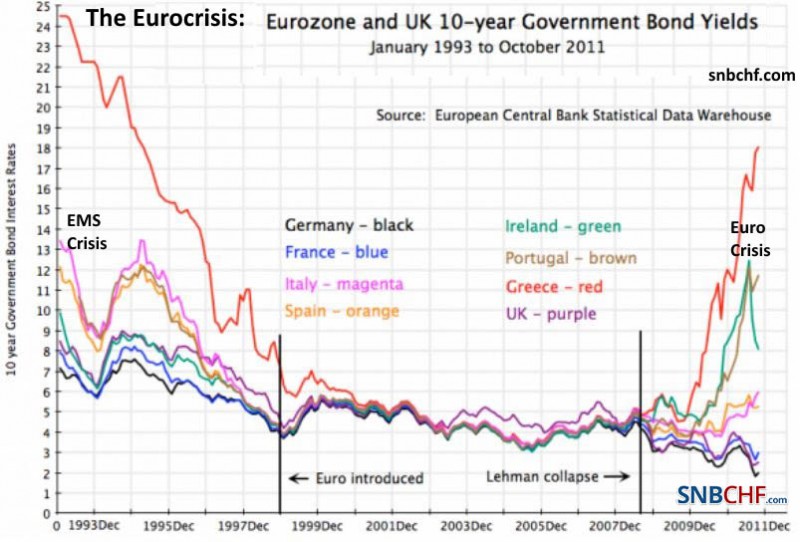

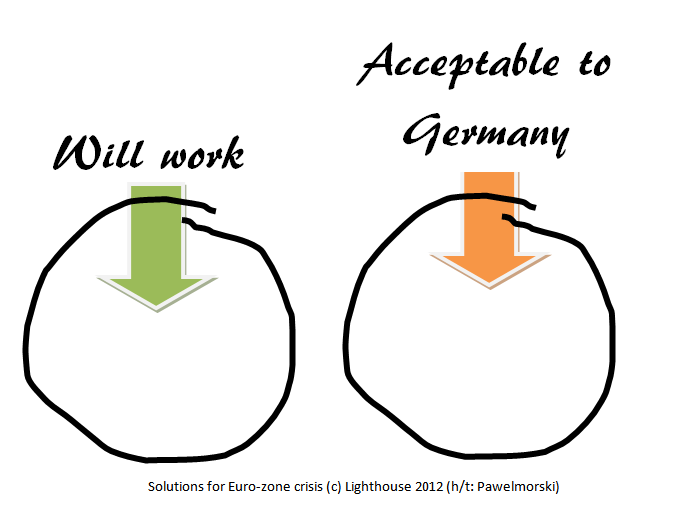

Eurobonds, fiscal or banking union are all pure utopia

Germany’s stance in the euro crisis: More than ESM will not be possible for many years updated on August 31, 2012 German politicians and the German Bundesbank believe that the Euro crisis can be only solved by supply side reforms as formulated in the Euro Plus Pact, reforms that were already successfully introduced during the Thatcher/Reagan era in the …

Read More »

Read More »

The End of ECB Rate Cuts or Draghi against Weidmann to be Continued..

Even in the unlikely case of a fiscal union, the conflict “Draghi against Weidmann”, between the ECB and the Bundesbank will continue for years. The ECB mandate and european inflation figures do not allow for excessive ECB rate cuts or for state financing via the printing press, but Draghi wants to help his struggling …

Read More »

Read More »

8) Euro Crisis and Euro Macro

We are currently looking for a curator that takes over the euro macro category. The Euro Crisis and its Reasons, details and chronology, German economists ,Eurobonds, fiscal or banking union,Who Says No to Austerity, Says Yes to the Northern Euro Ways to the Northern Euro

Read More »

Read More »

All roads lead to a euro zone break-up

For us all roads lead to a euro zone break-up and multiple sovereign defaults. Our reasoning can be summarized as follows: Equities are worthless when associated debt becomes encumbered (risk capital takes the first loss). Equity is not an asset; it is merely the remainder that is left over once debt is subtracted from …

Read More »

Read More »

Otmar Issing’s new book on the euro crisis

We well remember when the über-bailouter of the Financial Times Wolfgang Münchau claimed that except some old economy professors like Otmar Issing nobody in Germany would like to abolish the euro. According to Münchau the euro can be saved only via a fiscal and a banking union. The response to Münchau’s post could be … Continue reading...

Read More »

Read More »

Guest Post: Six Reasons Why Italy May Exit the Euro Before Spain; Ultimate Occupy Movement

Six Reasons Why Italy May Exit Before Spain

1) Rise of the Five Star Movement

2) 44% of Italians view the euro negatively, only 30% favorably. That is biggest negative spread in the eurozone. In Spain more view the euro positively than negative, albeit by a small 4 percentage point spread.

Read More »

Read More »

Full text Spanish banks bailout: Memorandum of Understanding

Here the full text of the European’ Commission’s Memorandum of Understanding with Spain regarding the bailout of the Spanish banking sector released earlier today.

Memorandum of Understanding on Financial-Sector Policy Conditionally

Read More »

Read More »

Diskussion beim IFO-Institut: Die Schuldengemeinschaft und Generationengerechtigkeit

Die Aufklärung für den mündigen Bürger über ESM, Eurobonds, Schuldengemeinschaft und Generationengerechtigkeit. Nehmen Sie sich die Zeit und Sie können die kommende Politik Merkels und den weiteren Verlauf der Eurokrise voraussehen, möglicherweise sogar mit ihrem Investment .

Read More »

Read More »

German constitutional court needs 3 months to decide about the injunction

The German constitutional court will need up to 3 months for the injunction. Weidmann's critic on the ESM in detail. Estimations of German liability between 900 bln. and 2 trillion EUR.

Read More »

Read More »

Update vom Deutschen Verfassungsgericht 11. Juli

Deutsches Verfassungsgericht braucht 3 Monate für seinen Eilentscheid, der nun eine halbe Hauptsachenentscheidung ist. Die Wahl im Gericht zwischen der system-relevanten Bank ESM und dem "Herausschmeissen" der Südländer aus dem Euro und vieles aus dem Verfassungsgericht.

Read More »

Read More »

German constitutional court injunction decision on ESM and the potential referendum

What is the injunction procedure of the German constitutional court exactly about. What are the arguments of the Anti-ESM and the Pro-ESM fractions ?

Read More »

Read More »

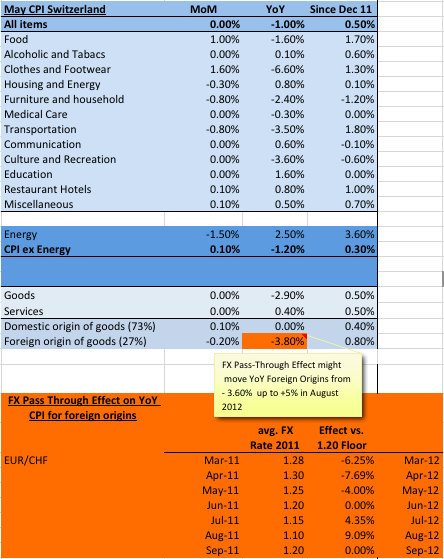

Switzerland in MoM deflation due to cheaper energy and clothes

Slowing energy prices (MoM -4.2%) and seasonal effects for clothes and footwear (MoM -2.8%) drove Switzerland in a slight deflation on monthly basis again.

Read More »

Read More »

Only 17% of German voters in favor of Eurobonds

Voters are strongly against many other European utopias The newest poll of the Forsa institute, here in the left-wing Stern and the conservative Welt, shows that Germans are strongly against Eurobonds and many more European “utopias”, as we called it. The German chancellor Angela Merkel recently connected her life with the fulfillment of the voters wish to …

Read More »

Read More »

Wolfgang Münchau, FT: Merkel was the winner of the Euro summit

Wolfgang Münchau endorsed many of our arguments Wolfgang Münchau, Financial Times, has endorsed many of our arguments of our Friday's opinion about the Euro summit where we stated that there was nothing really new. Münchau even claims that "The real victor in Brussels was Merkel."

Read More »

Read More »

At the Euro summit there was nothing really new. What was the party about ?

At the euro summit today there was essentially nothing what was really surprising. We wonder what markets are so excited about.

Read More »

Read More »

Merkel: ‘No Eurobonds as Long as I Live’, Hollande: ‘Eurobonds will take up to 10 years’

German chancellor Angela Merkel today confirmed the content of our article that Eurobonds are pure utopia. She vows "No Eurobonds as Long as I Live".

Read More »

Read More »