Category Archive: 2) Swiss and European Macro

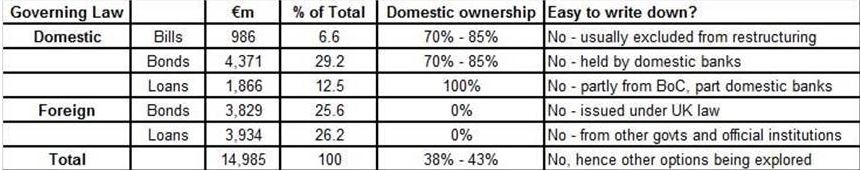

Cyprus: The initial compromise and reactions

The initial compromise The Cyprus compromise combines a 10 billion € bailout with European, basically German tax-payers money, that also obliges rich account owners (9.9% levy) – rich Russians and Brits – and poorer account owners (6.75% levy) – Cypriot tax-payers money – to take part in the deal. Initial reactions from Zerohedge over Keynesian mainstream …

Read More »

Read More »

Cyprus Levy on Deposits: New Escalation or Final Stage of Euro Crisis?

Nicosia will impose a 9.9 percent one-off levy on deposits above 100,000 euros in Cypriot banks. This constitutes maybe the final stage of the euro crisis, with the very last country to be rescued. Or will it be a new escalation and may be the most dangerous one, a bank-run? How many Cyprus clients managed …

Read More »

Read More »

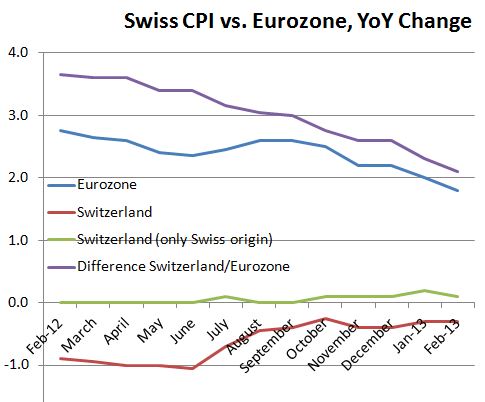

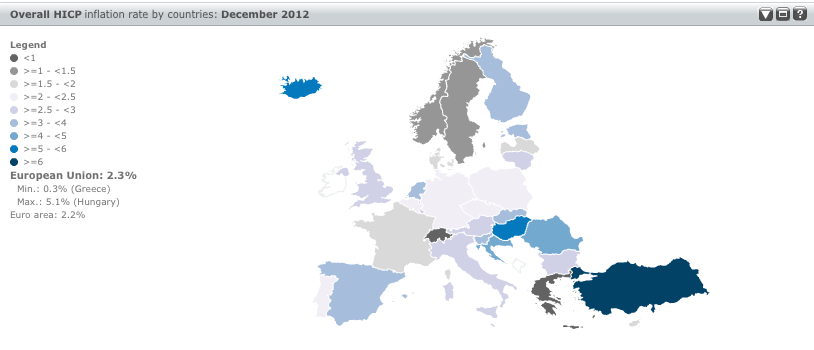

Difference between Eurozone and Swiss Inflation Rates Continues to Shrink

The gap has fallen from 3.7% in February 2012 to 2.1%. Swiss CPI is rising on monthly basis, but still negative with 0.3% YoY.

Read More »

Read More »

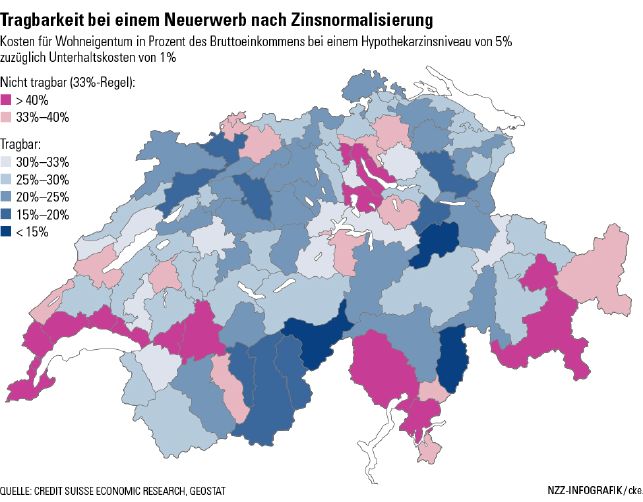

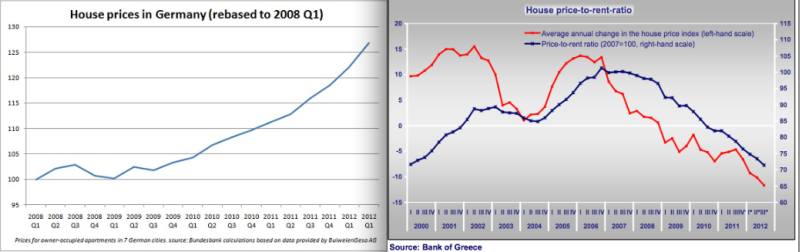

Credit Suisse Study: Swiss Real Estate Market Needs Higher Rates

A new study by Credit Suisse claims that the SNB needs to hike interest rates in order to avoid excessive risk taking in real estate markets; in particular around the centers of Geneva and Zurich, but also in the Southern Swiss cantons with lower income, but high real estate prices.

Read More »

Read More »

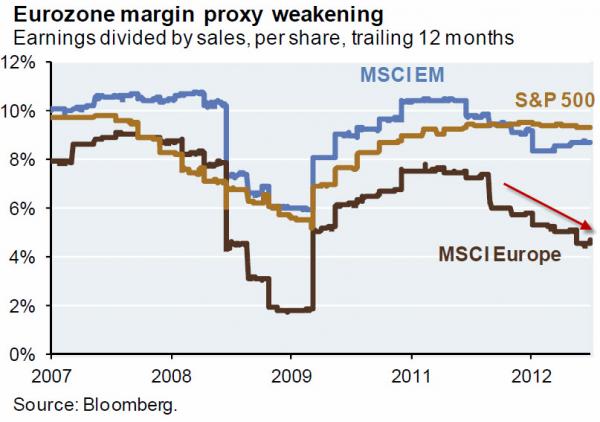

A Century Of French And Italian Economic Decline

Italy overtook Japan with the worst real GDP growth of all advanced economies since 1991 (0.79% per year, an amazing and sad distinction). Italians and French are clearly getting tired of austerity.

Read More »

Read More »

Das beeindruckende Comeback Berlusconis.

Wir sind beeindruckt von dem Leitartikel der Weltwoche, der doch ganz unserem Gedankengut entsprochen hat. Der deutsche Kanzlerkandidat Steinbrück hat der deutschen Demokratieverachtung und EU-treuen Überheblichkeit dann noch das i-Tüpfelchen hinzugefügt. “Zwei Clowns haben gewonnen.“ Von Roger Köppel, Die Weltwoche Demokratie ist, wenn es anders herauskommt, als Meinungsführer, Journalisten und tonangebende Politiker gedacht...

Read More »

Read More »

Über die Arroganz und Demokratiefeindlichkeit der deutschen und Schweizer Medien

Deutsche und Schweizer Medien sind oft vereint mit den Europäischen Leadern, Deutschen Exporteuren und den Finanzmärkten im Kampf gegen den gemeinsamen Feind, Silvio Berlusconi, das Enfant Terrible, das Gegenteil der Schweizer Bescheidenheit- und “Bloss nicht zu laut”-Etikette. Berlusconi soll Schuld sein am Abstieg Italiens seit den 90igern, obwohl auch die Linke mit Romani Prodi zweimal …

Read More »

Read More »

Italy: A Sustained US Recovery Will Make a Eurozone Split Up Possible

We reckon that a sustained US recovery will make it possible that the eurozone splits up. Today's Italian elections are maybe the start of an upcoming Italian euro exit.

Read More »

Read More »

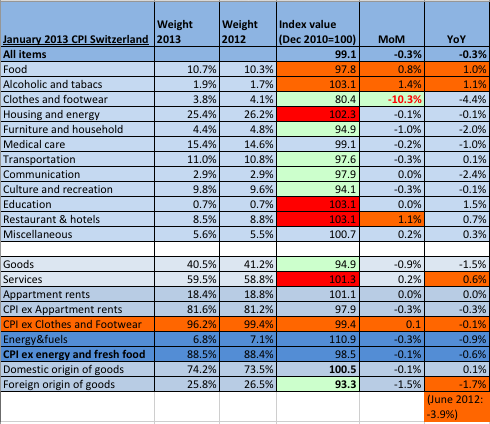

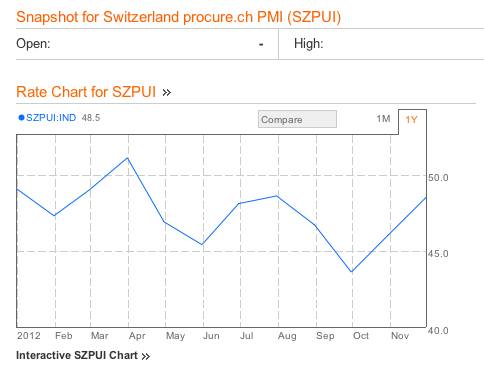

Switzerland’s Slow Way to Inflation

UPDATE February 2013 inflation data: The inflation figures for February showed the upwards movement we expected. On monthly basis inflation rose by 0.3%. The Swiss CPI is getting closer and closer to the one of the euro zone. We explain the January 2013 data on Swiss inflation and indicate which components drive the consumer …

Read More »

Read More »

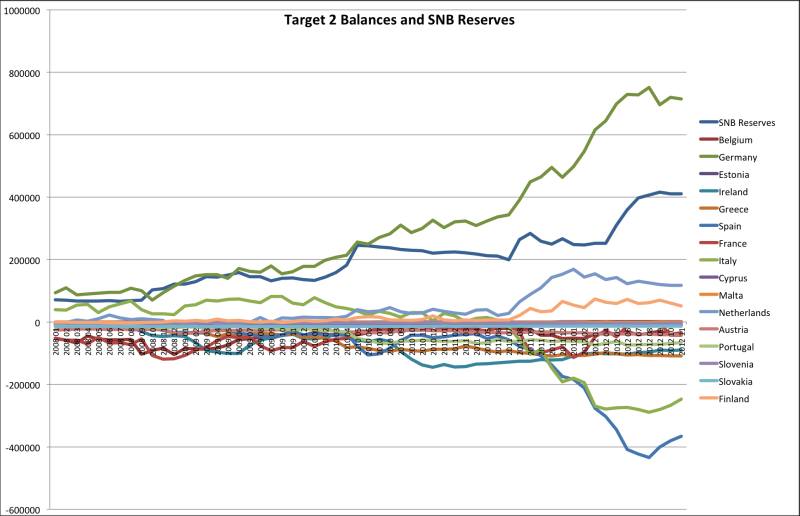

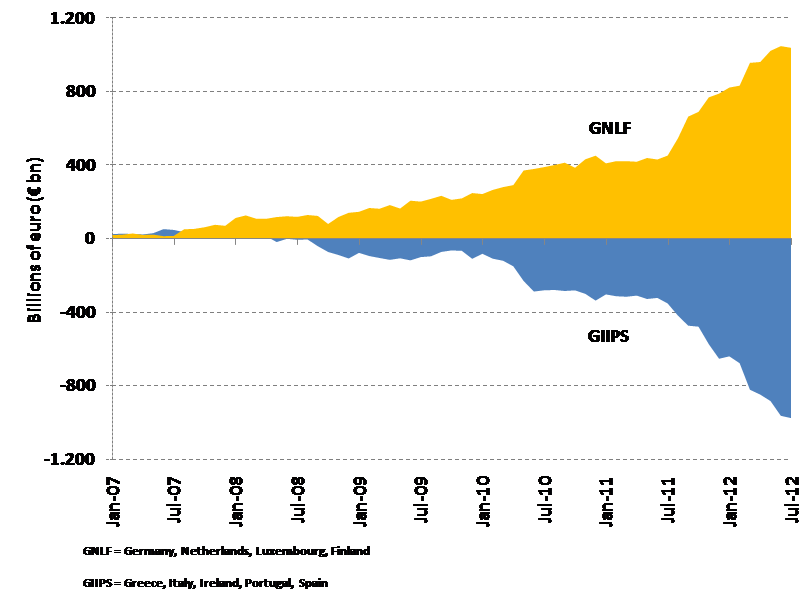

Target2 Balances and SNB Currency Reserves: Same Concept, Update February 2013

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

Bad News for SNB: While Target2 Imbalances Diminish, SNB Reserves Remain the Same

As we explain here, , Target2 balances and SNB currency reserves represent the same concept, namely capital flight (in a positive and negative sense) and current account imbalances. While Target2 numbers for Germany and Northern Europe go down, SNB reserves remain the same, only 3 billion CHF away from record highs.

Read More »

Read More »

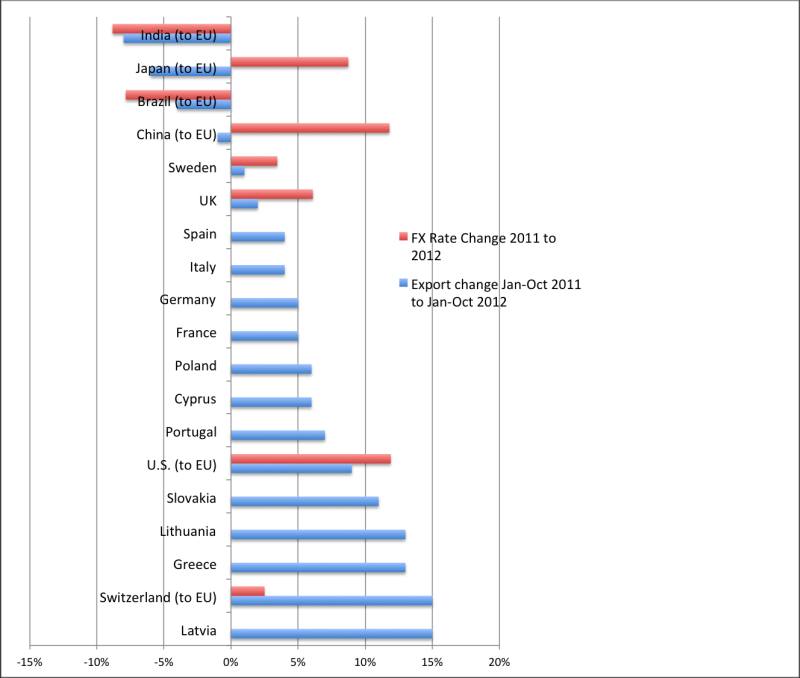

Comparing Trade Balances with FX Rates: Will the European Miracle End?

Eurostat recently published the European exports, imports and trade balance for the first ten months of 2012 compared to 2011. These show heavy improvements for the Southern member states but also a strong dependency on a weak euro.

Read More »

Read More »

Deflationary Risks? Comparing Swiss, Swedish and Norwegian Inflation and Exchange Rates

When the Swiss National Bank introduced the 1.20 lower limit, it wanted to eliminate the deflationary risks for Switzerland. For a certain period, namely when a global recession was looming in Autumn 2011, and the Swiss franc was hovering around 1.10, this risk was really present. In this post we would like to know if …

Read More »

Read More »

Pictet on the sudden EUR/CHF Appreciation

While we blamed FX traders, that were waiting months for some good European news to push down the CHF, Pictet finds some more explanations.

Read More »

Read More »

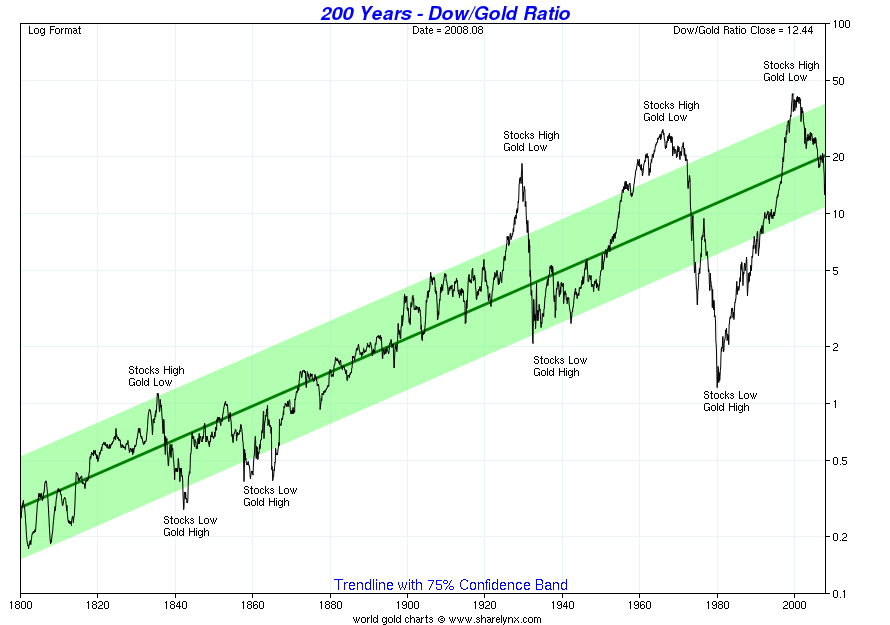

German Currency and Gold Reserves and the German Trade Surplus

During the Bretton Woods system, Germany managed to obtain current account surpluses. They converted these surpluses into gold. At the time they bought it at 35$ per ounce at a relatively cheap price – at the end of the 1960s the price was augmented to 42$. At the end of the 1960 and with …

Read More »

Read More »