Category Archive: 2) Swiss and European Macro

GDP: Switzerland Enters Boom and.. incredibly.. SNB is Still Printing Money

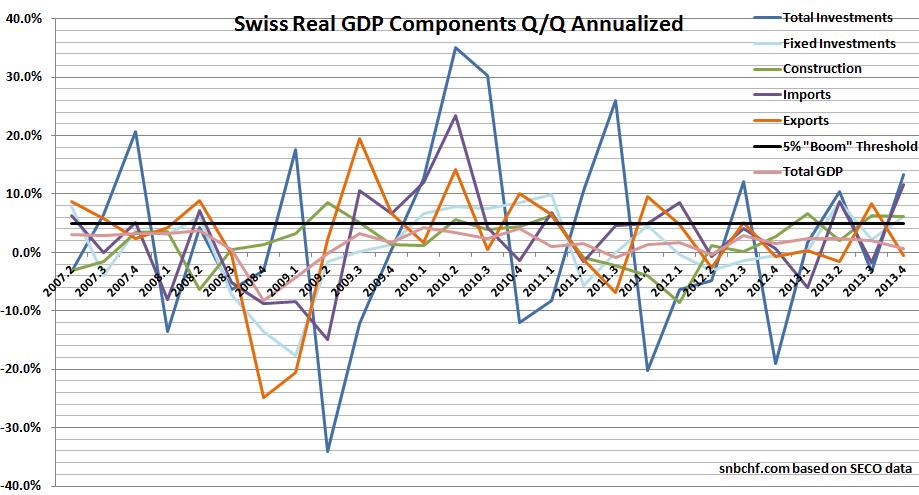

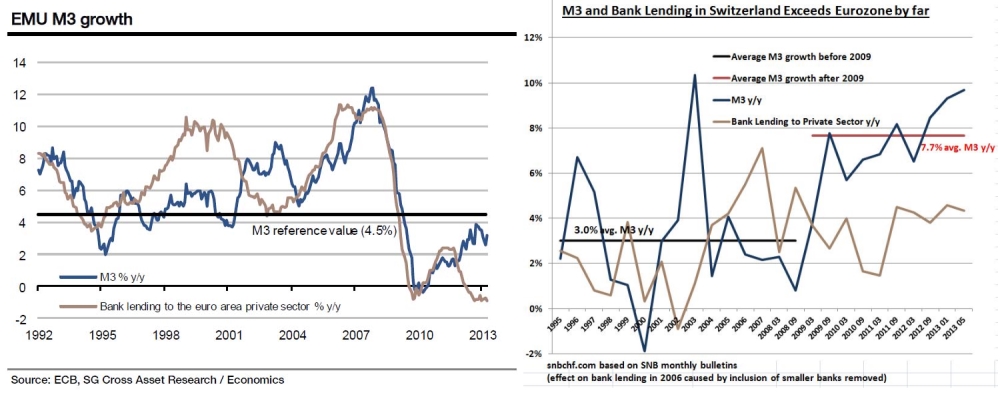

According to the latest data from the SECO,Swiss GDP rose by 0.2% in Q4/2013. Despite the relatively weak headline, the detailed data showed a couple of characteristics that speak for an upcoming boom. At the same time, the Swiss National Bank is printing money again: both the monetary base and money supply are increasing.

Read More »

Read More »

UBS Consumption Indicator Points to 2.5 Percent Swiss GDP Growth in 2014

FacebookShare As usual, the Swiss economy seems to be better than economists thought. After 1.40 still in December, the UBS consumption indicator has risen to 1.81, a value higher than the ones in 2012, when private consumption increased by 2.4%. Similarly as last year, the latest reading contradicts UBS’s own growth forecasts, albeit this year …

Read More »

Read More »

Pros and Cons of the Swiss Countercyclical Capital Buffer

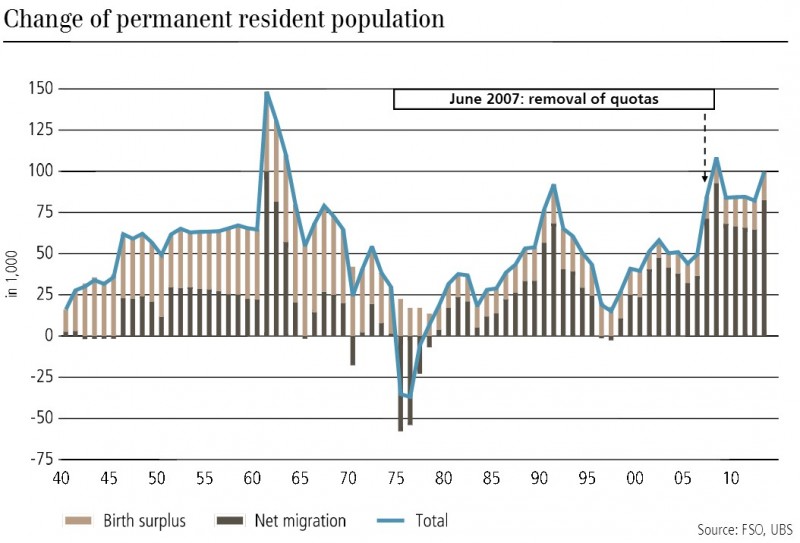

Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks' collateral in the form of real estate falls in value. Therefore the banks' assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called...

Read More »

Read More »

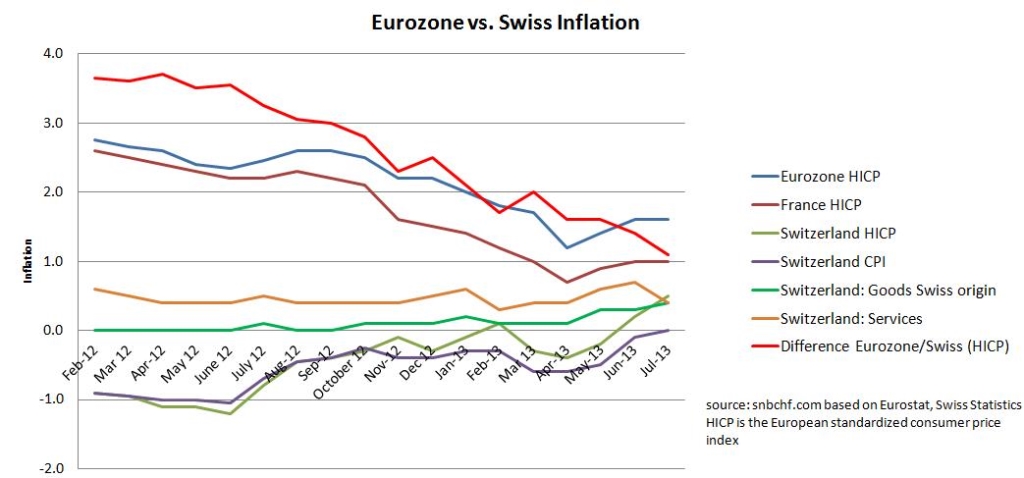

Inflation Difference between Eurozone and Switzerland Narrows to 0.5 percent

Another five months till Swiss inflation is higher? When the European economy starts to expand again, who will hike rates first, the SNB or the ECB? December Update According to Swiss Statistics the inflation rate remained stable at 0.1% y/y, while the inflation measured by the European HICP standard was +0.3% y/y, slightly higher than … Continue reading »

Read More »

Read More »

2013 Posts on Swiss Macro

2013 Posts on Euro Crisis and Euro Macro

An Upcoming Italian Success Story?

While the mainstream is still talking about potential riots in Italian streets, we rather see positive adjustments in the Italian economy.

Read More »

Read More »

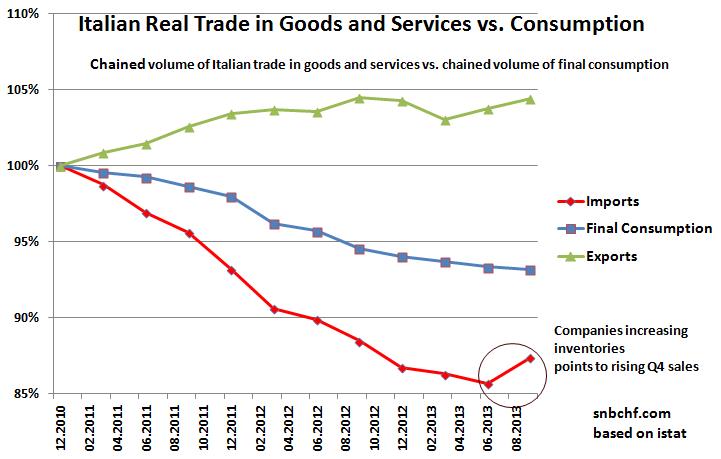

An Upcoming Italian Success Story?

Higher exports show that Italy's economy is trying to become a new German Companies seem to hide their competitiveness. A question remains: Will Italian companies really invest in Italy and create jobs?

Read More »

Read More »

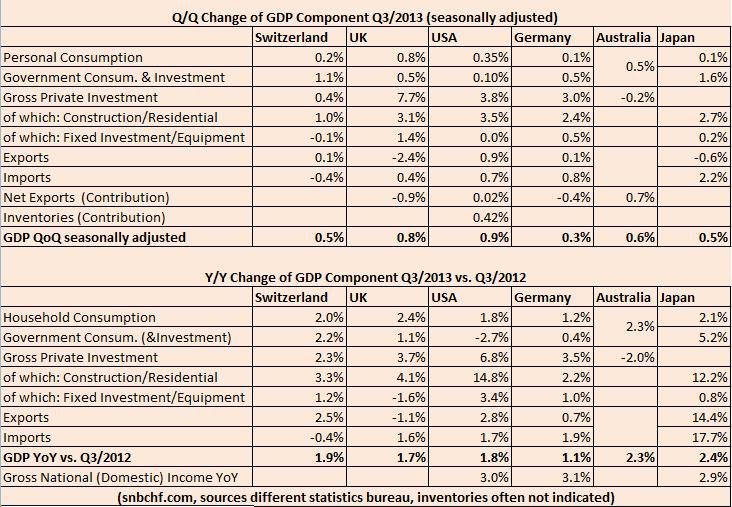

Swiss GDP Details Compared to UK, USA, Germany, Japan and Australia, Q3 2013

The Swiss GDP was again one of the strongest major economies. The quarterly growth rate in the third quarter was 0.5%, the yearly one 1.9%. U.S. GDP improved by 3.6% QoQ annualized. For comparison purposes, our figures are not annualized; hence the equivalent is 0.9% QoQ. In Japan and Switzerland private consumption rose by 0.1% … Continue reading...

Read More »

Read More »

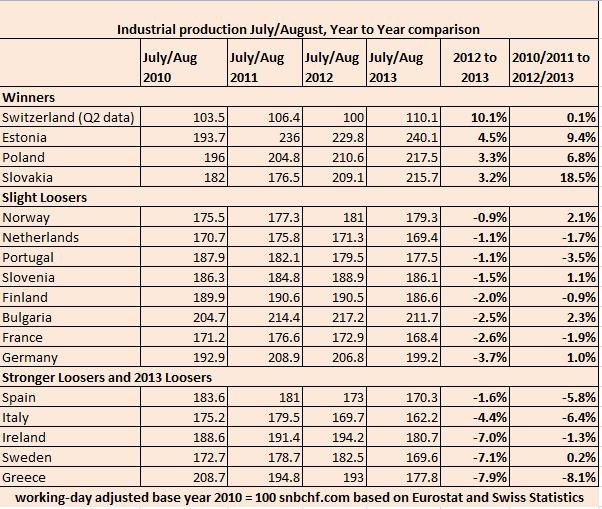

European Industrial Production Still Contracting, Switzerland Expanding Again

Swiss industrial production is rather insensitive to price changes and to the recent slowing of global demand thanks to the concentration on pharmaceuticals and luxury products. Based on Eurostat’s industrial production for July and August , we compared the values from 2010 to 2013 for these two summer months. This aggregated two-months comparison is …

Read More »

Read More »

8a) Italy and the Euro Exit

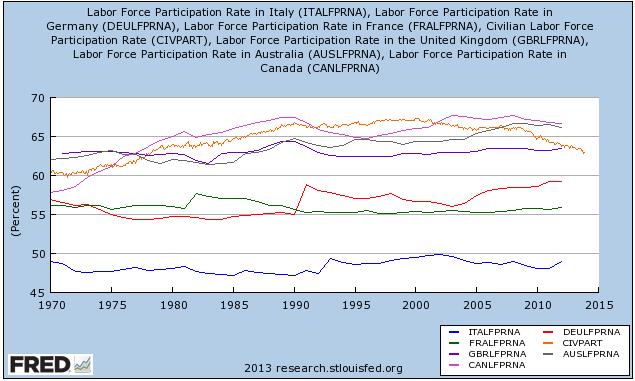

Italy, other peripheral economies and later France will follow Japan for a decade or more of balance sheet recession: stagnant wages, falling real estate prices and a reduction of private debt.

Read More »

Read More »

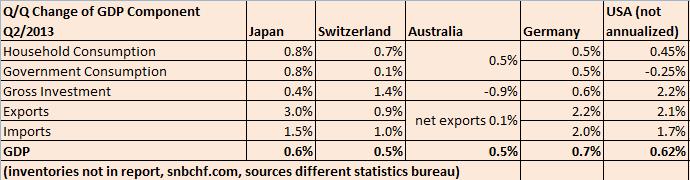

Swiss Q2 GDP Details Compared to Japan, Germany, Australia and U.S.

The Swiss GDP for Q2/2013 was in line with its peers in developed countries. The quarterly (not annualized) change was +0.5% compared to 0.6% for Japan and the United States, +0.7% for Germany and +0.5% for Australia. Swiss and Japanese growth was driven more by consumption, while the U.S. advances were based more on …

Read More »

Read More »

Inflation Difference (HICP) between Eurozone and Switzerland Narrows from 1.4 percent to 1.1 percent

According to Swiss statistics, the yearly change in the Swiss consumer price index has risen from -0.1% to 0%. The headline MoM figure fell by 0.4% due to the yearly sell-off in the retail sector. The difference between euro zone and Switzerland in terms of the European Harmonized Index of Consumer Prices HICP has … Continue reading »

Read More »

Read More »

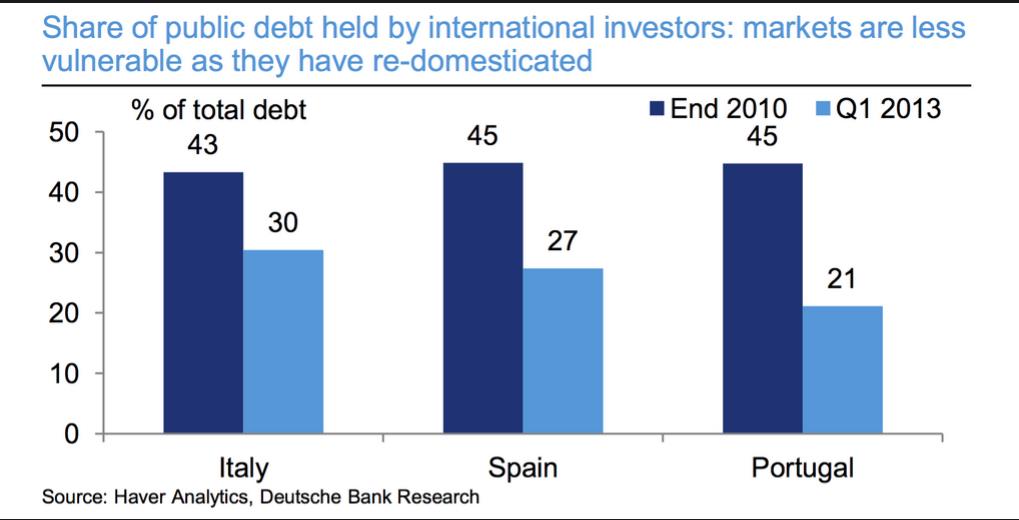

European Banking Assets and Debt

Still in summer 2013, too much debt was an issue. By 2014 things have changed: Europeans have too many savings.

Read More »

Read More »