Category Archive: 2) Swiss and European Macro

Is Grexit Back on the Table?

Defying the expectations a few months ago, Greece remained in the Economic and Monetary Union. It recently succeeded in implementing sufficient reforms to earn another tranche of aid. However, the entire exercise exhausted whatever trust the...

Read More »

Read More »

France’s Revival or Politics Trumps Economics

With the ECB poised to take additional steps down the unorthodox monetary policy route, financial and economic forces are as potent as ever. However, there is a subtle shift taking place that few seem to recognize. It is the re-emergence of...

Read More »

Read More »

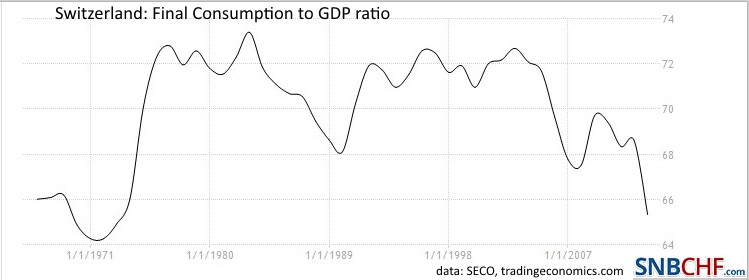

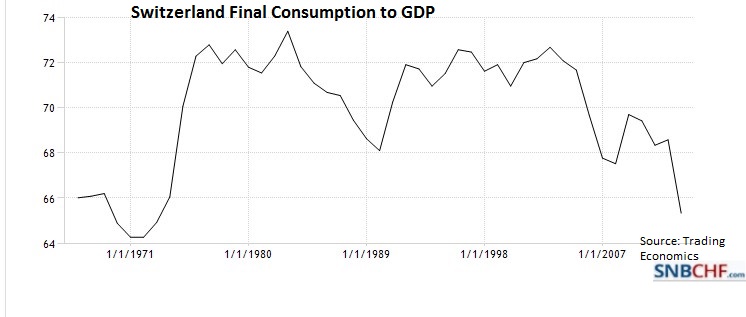

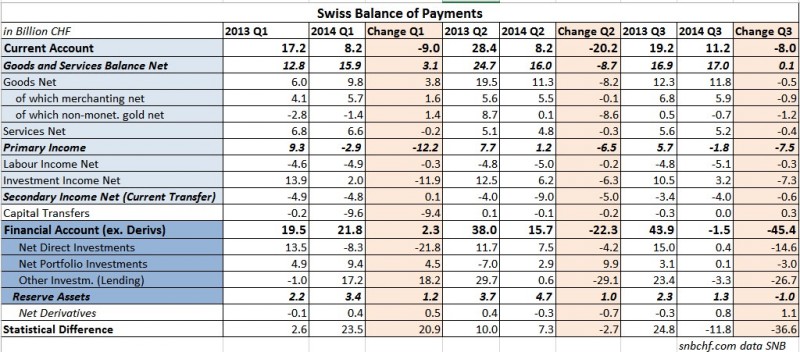

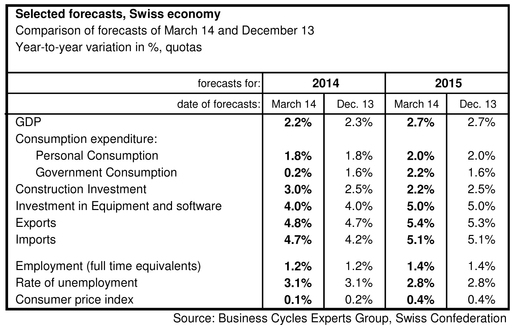

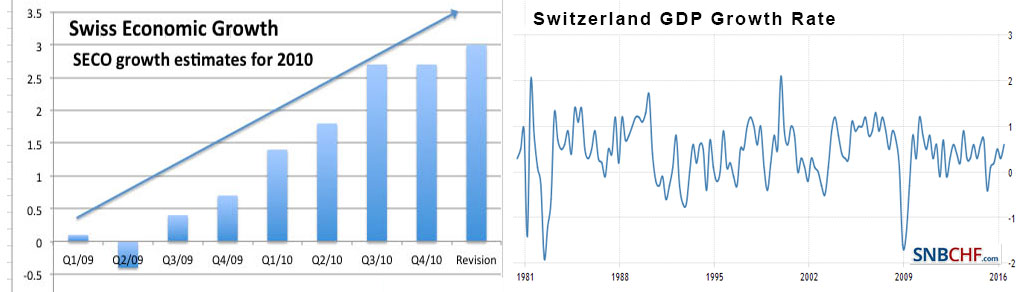

Swiss GDP 2014 +1.9%. Trade Surplus Contributed More than Half, Consumption Lagged

According to the figures of Swiss Statistics, the Swiss trade surplus rose by 10.4% in 2014. Therefore its contribution to the 2014 real GDP is higher than 50%. Private consumption lagged compared to the other components of Gross Domestic Product.

Read More »

Read More »

Q1/2015: Swiss Real GDP Rises by 15 percent … in Euro Terms

George Dorgan shows that Gross Domestic Product (GDP) is a measurement in the local currency. Effectively, Swiss real GDP rose by 15% in Euro terms, but fell slightly in CHF. He also emphasizes that Switzerland needs a big rebalancing of its economy, away from exports towards consumption. The Swiss National Bank was right to remove the euro peg. The move towards consumption is only possible when the Swiss franc is stronger because consumers will...

Read More »

Read More »

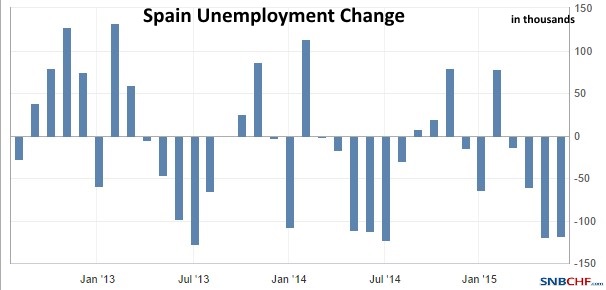

Eurocrisis, Myth and Reality, part 1: Big Job Creation in Spain

In the new series George Dorgan suggests that the euro crisis is a temporary development but not a long-lasting crisis. In the first part he shows that Spain actually created a lot of jobs in last twenty five years.

Read More »

Read More »

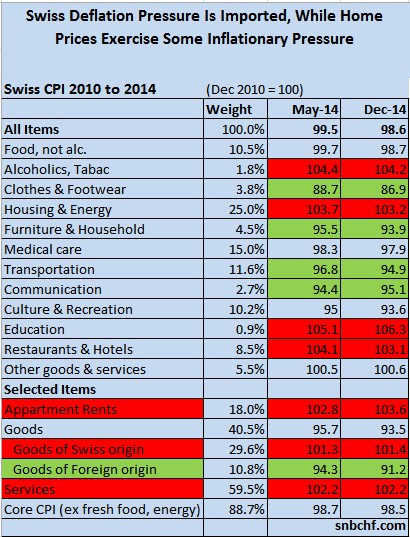

Downwards and Upwards Drivers of Swiss Inflation

In the following we present the drivers of Swiss price inflation. We first present the components of the consumer price index. Then we explain which are upwards-drivers of inflation and which ones cause downwards adjustments.

Read More »

Read More »

2014 Posts on Swiss Macro

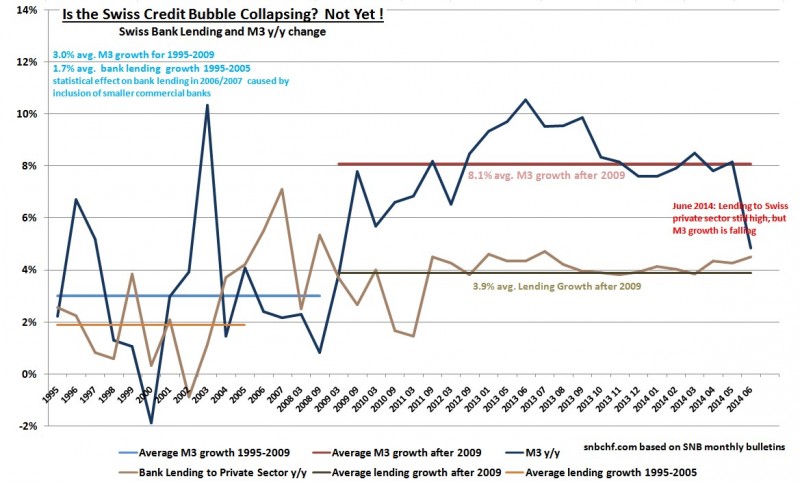

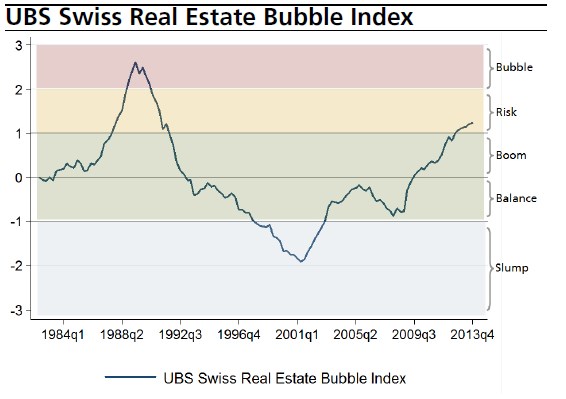

2014: Swiss Credit Bubble Popping? No, Lending to the Swiss Private Sector is even Accelerating!

Despite macro-prudential measures like the countercyclical capital buffer, Swiss credit to the private sector is rising more quickly than previously. On the other side, real estate prices are not increasing so rapidly any more. Global risks let M3 money supply growth slow in June 2014.

Read More »

Read More »

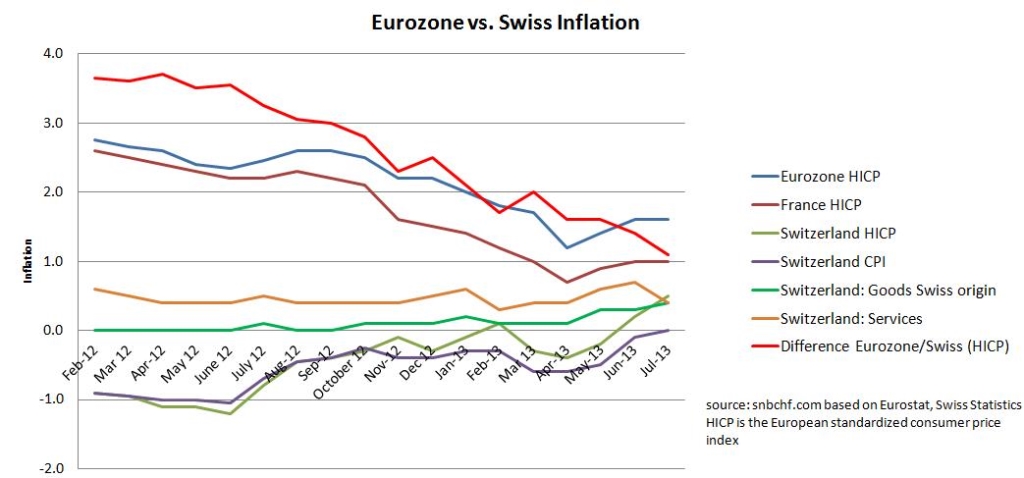

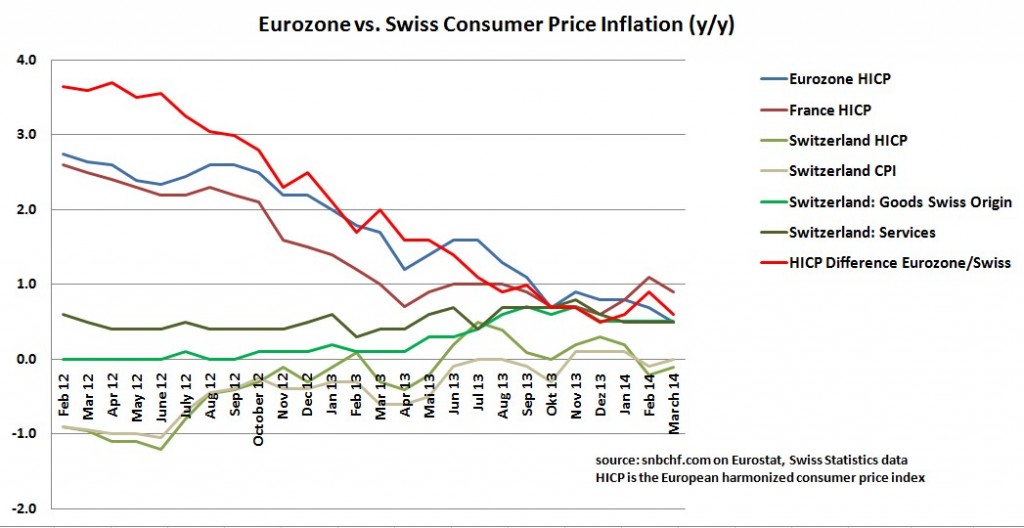

Inflation Difference between Eurozone and Switzerland Narrows to 0.3 percent

According to Swiss Statistics the inflation rate has risen to 0.2% y/y – as for both the Swiss CPI standard and the European HICP standard.

Read More »

Read More »

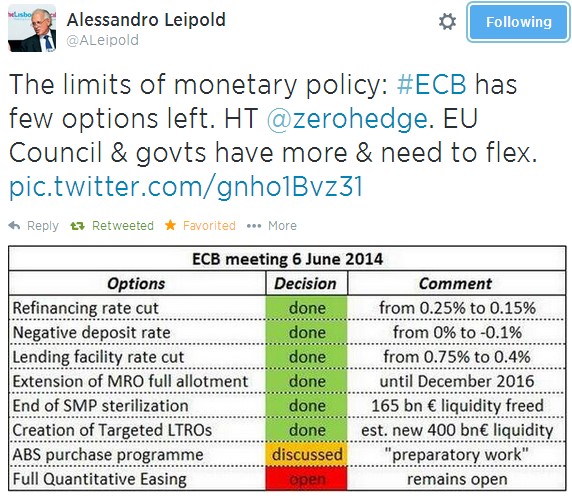

ECB Measures Background: How to Reduce German Competitiveness and Talk down the Euro

In our view, the ECB measures of June 2014 want to increase German lending, spending, salaries and inflation. Finally they target a reduction of German competitiveness. The ECB wanted to talk down the euro but will not succeed. We explain why the measure are bullish for the euro. We expect EUR/USD of 1.40 in the … Continue...

Read More »

Read More »

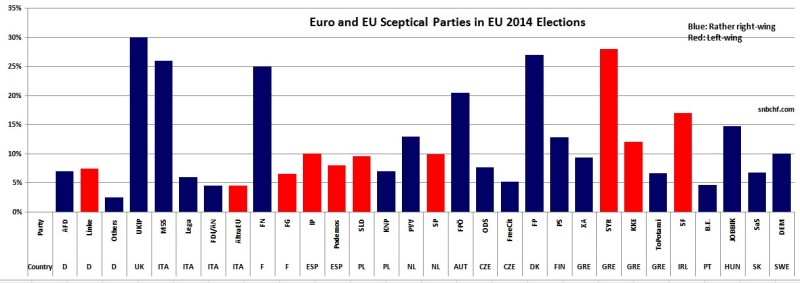

Euro and EU sceptical Parties in EU 2014 Elections: The Economic Danger Is Left not Right

The tendency of the European parliament elections seems to be that in the Northern countries rather right-wing parties obtain more votes, like British UKIP, German AFD, Danish People’s Party, Austrian FPÖ or Sweden Democrats. In the austerity countries the left-wing movements are getting stronger and stronger, led by SYRIZA in Greece and Sinn Fein in …

Read More »

Read More »

Update 2014: Swiss home price to income ratio small in historic and global comparison

Based on four different data sources, we prove that Swiss the home price to income ratio is small in global comparison and in a historic perspective. Combined with another decade of near zero interest rates, reason enough to think that the Swiss real estate boom should continue for another decade.

Read More »

Read More »

Swiss Yearly Inflation Rate Overtakes First Eurozone Countries

According to Swiss Statistics the yearly inflation rate is at 0.0%, and the monthly rate is +0.4%. The Spanish CPI is already under zero at -0.2%, and the Italian one is at +0.3%, not to speak about severe Cyprus or Greek deflation . Still in February 2012, the difference between the Swiss and Euro …

Read More »

Read More »

The New Widow-Maker Trade: Short Italian Government Bonds

We think that, similarly as Japanese JGBs, Spanish and Italian Government Bond Yields will continue its race to the bottom, Short Italian Bonds is the new Widow-Maker Trade.

Read More »

Read More »