Category Archive: 2) Swiss and European Macro

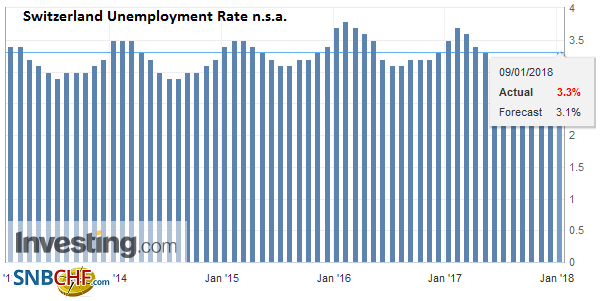

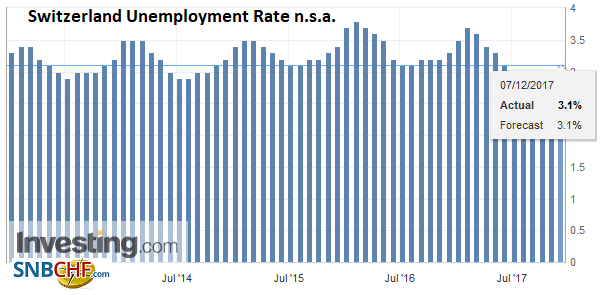

Switzerland Unemployment in December 2017: Up to 3.3 percent due to winter, seasonally adjusted unchanged at 3.0 percent

Registered unemployment in December 2017 - According to the State Secretariat for Economic Affairs (SECO) surveys, 146,654 unemployed people were enrolled at the Regional Employment Centers (RAV) at the end of December 2017, 9,337 more than in the previous month. The unemployment rate rose from 3.1% in November 2017 to 3.3% in the month under review. Compared to the same month of the previous year, unemployment fell by 12,718 (-8.0%).

Read More »

Read More »

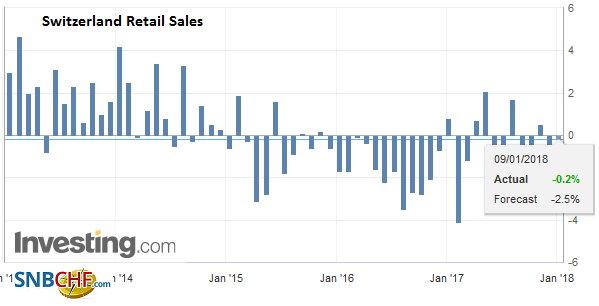

Swiss Retail Sales, November: +0.2 Percent Nominal and -0.2 Percent Real

Turnover in the retail sector rose by 0.2% in nominal terms in November 2017 compared with the previous year. Seasonally adjusted, nominal turnover rose by 1.4% compared with the previous month. These are the provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

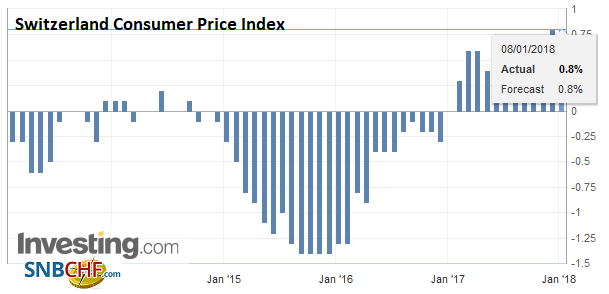

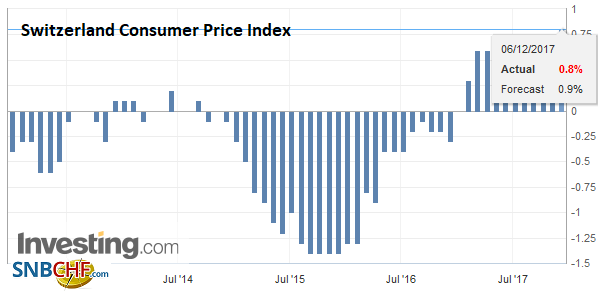

Swiss Consumer Price Index in December 2017: +0.8 YoY, unchanged MoM

The consumer price index (CPI) remained unchanged in December 2017 compared with the previous month, reaching 100.8 points (December 2015=100). Inflation was 0.8% compared with the same month of the previous year. Average annual inflation reached 0.5% in 2017. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

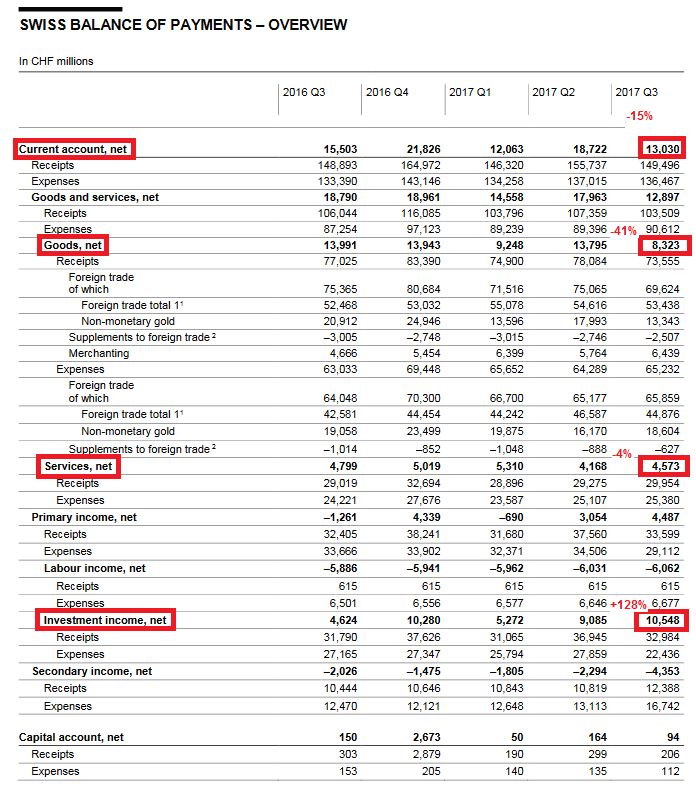

Q3/2017: Swiss Current Account Surplus significantly down

The Swiss current account surplus went down by 15% against the same quarter in 2016. In the third quarter of 2015. The current account surplus was still at 22 bn. CHF.

It seems to be a change in the usual movement that sees a higher Q3 surplus compared to the other quarters.

Read More »

Read More »

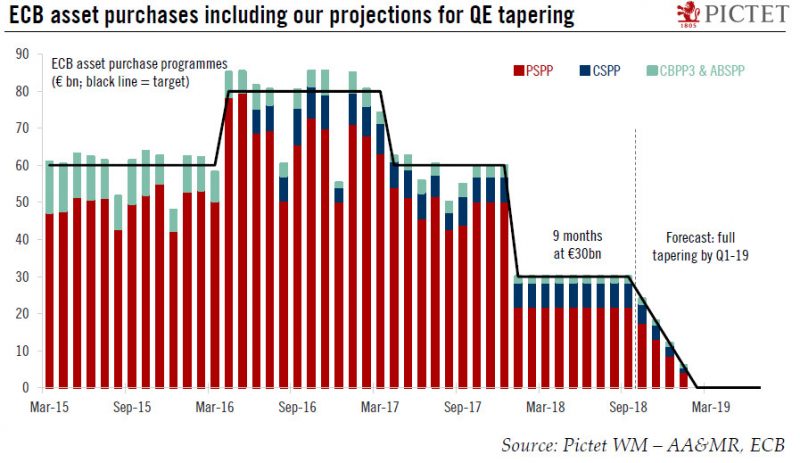

2018 ECB outlook – Mission: possible

We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data. Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year.

Read More »

Read More »

Switzerland UBS consumption indicator November: Solid private consumption in 2018

At 1.67 points, the UBS consumption indicator was above its long-term average in November, indicating solid consumption growth in 2018. Thanks to solid economic growth, private consumption will likely continue expanding despite rising inflation.

Read More »

Read More »

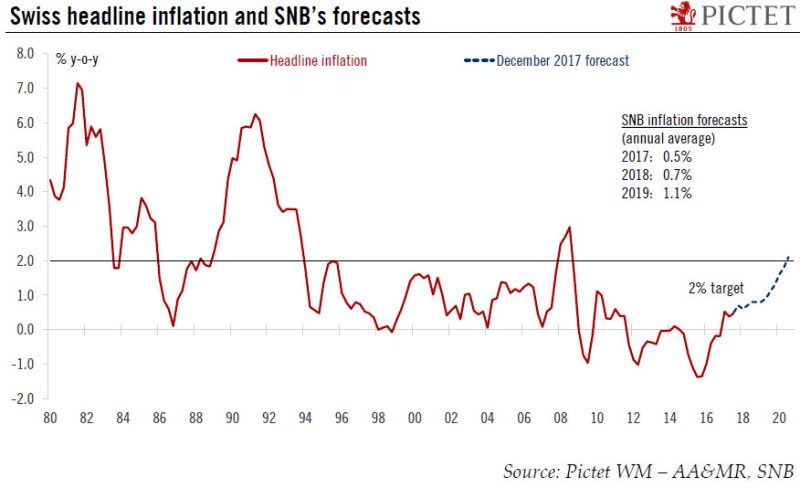

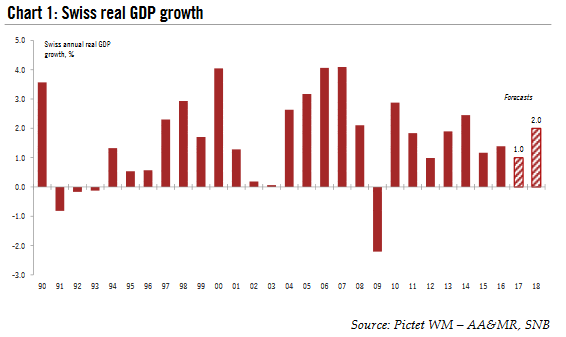

Increasingly optimistic on Swiss outlook

At its December meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. More specifically, the SNB maintained the target range for the three-month Libor at between - 1.25% and-0.25% and the interest rate on sight deposits at a record low of - 0.75%. The SNB also reiterated its commitment to intervene in the foreign exchange market if needed, taking into account the “overall currency situation”.

Read More »

Read More »

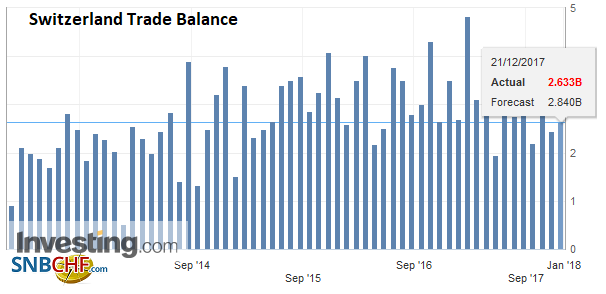

Swiss Trade Balance November 2017: Foreign Trade in Verve

Swiss foreign trade proved dynamic in November 2017. After correction of working days, exports grew by 9.5% and imports even 16.4% year on year, both boosted by rising prices. In real terms, they increased by 4.4 and 6.8%, respectively. The balance commercial loop with a surplus of 2.7 billion francs.

Read More »

Read More »

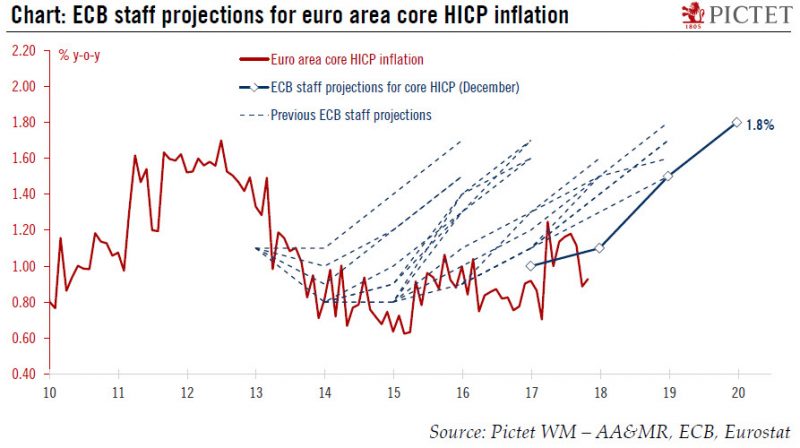

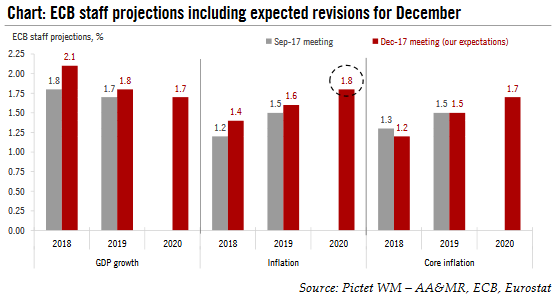

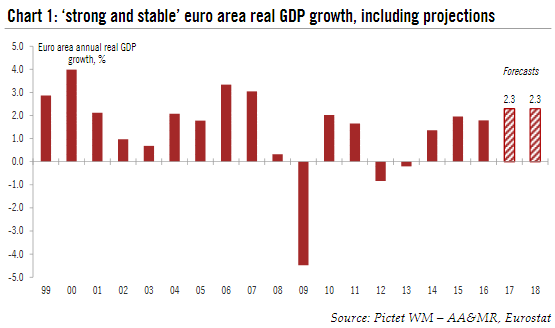

ECB closer to the 2% inflation target than meets the eye

During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation. The key word was “confidence” - in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its mandate.

Read More »

Read More »

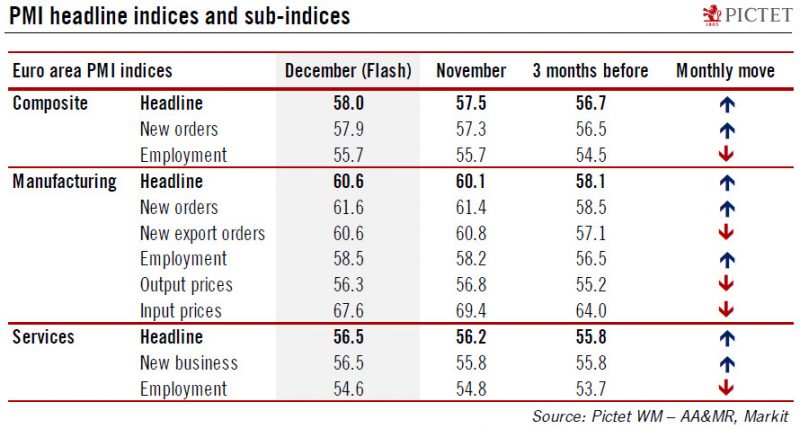

Euro area: The sky is the limit

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors.

Read More »

Read More »

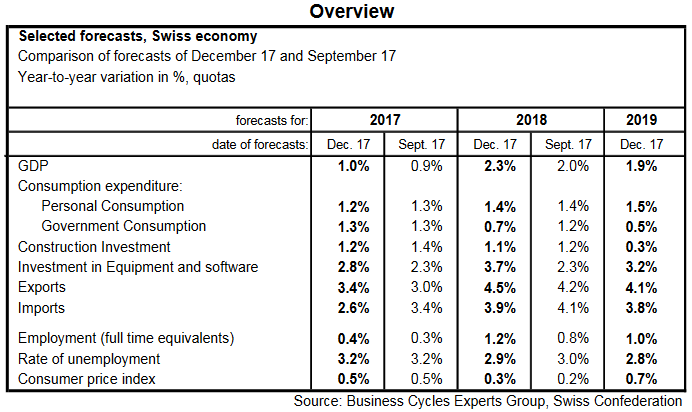

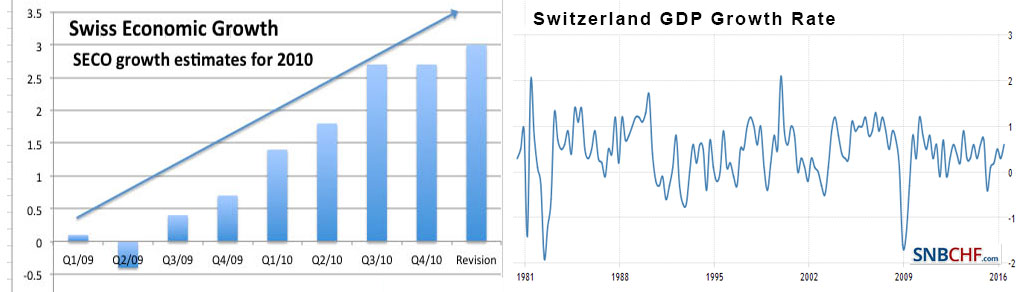

Switzerland’s Economic Recovery gains momentum

Economic forecasts by the Federal Government’s Expert Group – Winter 2017/2018* The Federal Government’s Expert Group expects the Swiss economy to make a speedy recovery over the next few quarters. While only moderate GDP growth of 1.0% is anticipated in 2017 due to a weak first half of the year, the forecast for GDP growth in 2018 is strong at 2.3% in the course of the global economic upturn.

Read More »

Read More »

ECB preview: close to target…by 2020

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon. We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone.

Read More »

Read More »

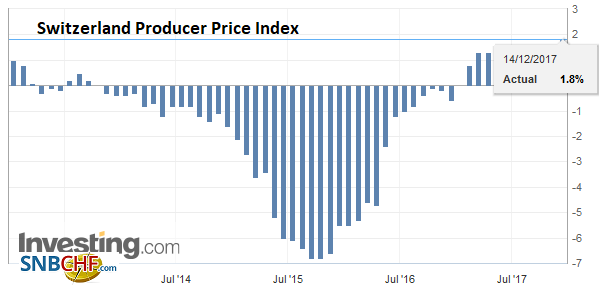

Swiss Producer and Import Price Index in November 2017: +1.8 YoY, +0.6 MoM

The Producer and Import Price Index rose in November 2017 by 0.6% compared with the previous month, reaching 101.6 points (base December 2015 = 100). The rise is due in particular to higher prices for petroleum products, chemical and pharmaceutical products and scrap. Compared with November 2016, the price level of the whole range of domestic and imported products rose by 1.8%.

Read More »

Read More »

The Swiss economy is gaining momentum

Swiss growth was disappointing at the end of 2016 and in the first half of 2017. Consequently, GDP growth this year is likely to be just 1.0% , its lowest level since 2012 . However, a wide set of statistics are already painting a considerably more positive picture of strengthening growth as we approach the end of 2017. Of particular note is the increasing contribution of manufacturing to real GDP growth.

Read More »

Read More »

Euro Area Forecast to Grow 2.3percent in 2018

2017 was the year of the ‘Euroboom’ and the removal of political tail risks. Moving into 2018, we mark-to-market strong economic data, including carryover and revisions. We forecast annual GDP growth of 2.3% both in 2017 and 2018. Qualitatively, our forecasts reflect our view that the euro area has reached ‘escape velocity’, with important implications for investors.

Read More »

Read More »

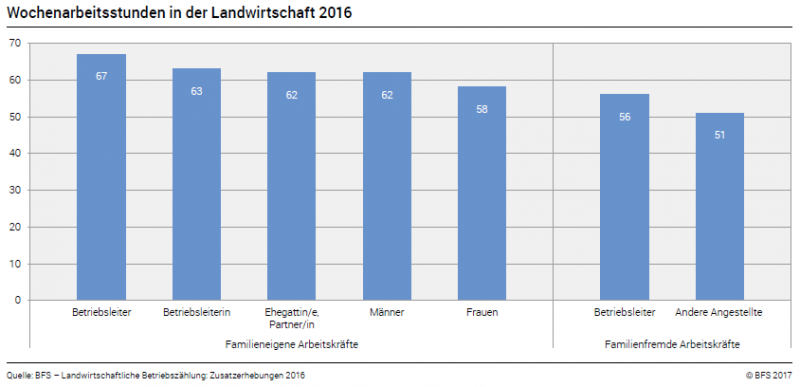

Farm Census 2016: Swiss farmers work well over 60 hours per week

For several years the average Swiss farmer has been working well over 60 hours per week. With their off-farm jobs, part-time farmers also work long hours. From 2010 to 2016, however, the hours worked fell by one hour per week. Over the same period, farms greatly increased the direct sale of farm products (+60%). Despite the long working hours, in many cases it is very likely that a family member will take over the farm. These are some of the latest...

Read More »

Read More »

L’Union européenne fait semblant de lutter contre l’évasion fiscale. Attac

Les paradis fiscaux lovés au coeur de l’UE, de l’Asie et des Etats-Unis d’Amérique sont occultés… L’analyse vire à la farce! Après avoir étudié la situation de 92 pays en matière de lutte contre l’évasion fiscale, l’Union européenne n’en retient donc que 17 sur sa liste noire des paradis fiscaux. Parmi ces États dits « non-coopératifs » on trouve, entre autres, le Panama, la Tunisie, les Emirats arabes unis, Trinité et...

Read More »

Read More »

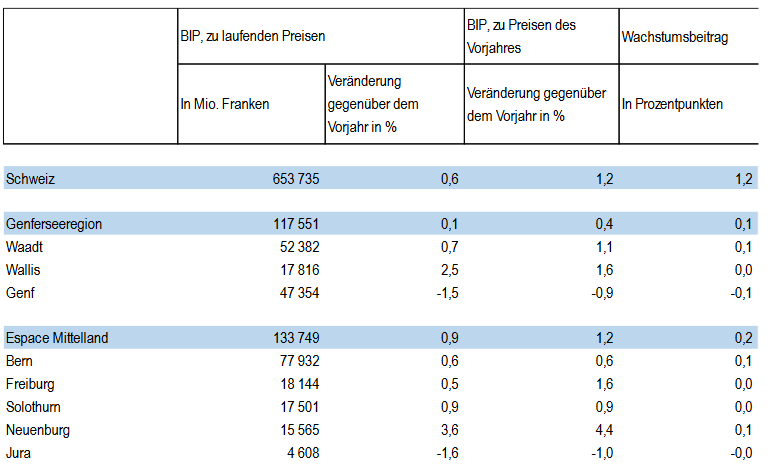

Gross domestic product by canton in 2015: Economic activity slowed down in Switzerland in 2015

Gross domestic product (GDP) growth slowed between 2014 and 2015 in most cantons. Nevertheless, the cantons of Neuchâtel (+ 4.4%), Schaffhausen (+ 2.9%), Schwyz (+ 2.9%) and Zug (+ 2.8%) recorded a clearly positive development. The canton of Zurich once again made the biggest contribution to the nationwide growth.

Read More »

Read More »

Switzerland Unemployment in November 2017: Up to 3.1 percent from 3.0 percent, seasonally adjusted decreased to 3.0 percent from 3.1 percent

Registered unemployment in November 2017 - According to the State Secretariat for Economic Affairs (SECO) surveys, at the end of November 2017 there were 137'317 unemployed registered at the Regional Employment Centers (RAV), 2'517 more than in the previous month. The unemployment rate rose from 3.0% in October 2017 to 3.1% in the month under review. Compared with the same month of the previous year, unemployment fell by 11,911 persons (-8.0%).

Read More »

Read More »

Swiss Consumer Price Index in November 2017: Up +0.8 percent against 2016, -0.1 percent against last month

The consumer price index (CPI) fell by 0.1% in November 2017 compared with the previous month, reaching 100.9 points (December 2015=100). Inflation was 0.8% compared with the same month of the previous year.

Read More »

Read More »