We have upgraded our growth projection for this year and next. There are upside risks to our forecast that the ECB will start hiking rates in Q3 2019.

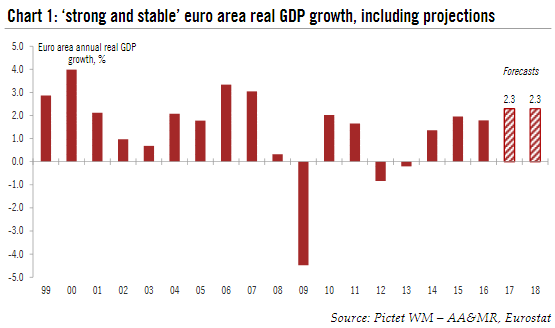

Taking account of stronger growth momentum, the carryover effect and upward revisions to past data, we have upgraded our euro area annual GDP growth forecasts to 2.3% both in 2017 and 2018. Our forecasts remain consistent with a very gradual slowdown in the quarterly pace of GDP growth, to 2% by end-2018. We view the likelihood of a domestically-generated recession as very low.

The main downside risks are exogenous, including a disorderly Brexit or a sharper-than-expected slowdown in emerging-market growth. Some volatility is likely to return around the Italian elections early next year. A moderate tightening of domestic financial conditions in the form of a slightly stronger currency, higher sovereign bond yields and/or wider corporate debt spreads may only slow growth momentum, but not bring it to a halt.

Importantly, we believe that the euro area has reached escape velocity in the sense that a self-sustained, credit-fuelled, job-rich expansion will prove to be more resilient to external shocks while deficits and imbalances are reduced over time.

Below the surface of strong headline growth, the business cycle is improving in terms of content with credit-fuelled investment spending leading to more self-sustained job creation, consumption, and deficit reduction. In turn, improved quality of growth should provide greater visibility to investors.

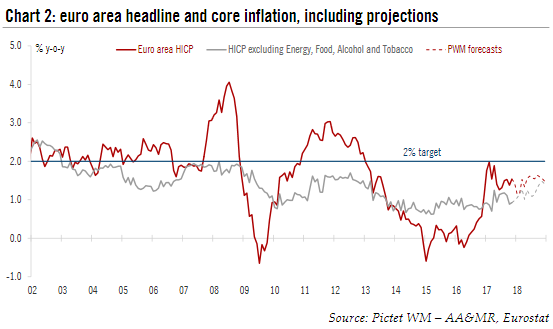

We have made no significant change to our inflation outlook as a stronger cyclical upswing is being offset by a weaker starting point in Q4 2017. We forecast headline inflation at 1.5% on average in 2018-19 as core inflation slowly rises from 1% in 2017 to 1.2% in 2018 and 1.5% in 2019.

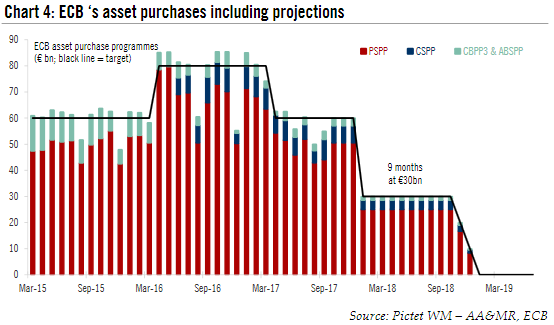

We expect the ECB to terminate its QE programme by Q1 2019 and to start hiking rates in Q3 2019, with risks tilted towards an earlier move.

In terms of European integration, we expect a two-stage process, starting with the most consensual initiatives (security, banking union), followed by a roadmap for building a stronger euro area (joint investment plans; revamped European Stability Mechanism, fiscal capacity).

-

The euro area has entered a new expansion phase, which we expect to remain strong, broad based, synchronised across countries and sectors, self-sustained and resilient to external shocks.

-

We still forecast a very gradual slowdown in the sequence of quarterly GDP growth rates, to around 2% by end-2018, as the result of less favourable tailwinds (global growth) as well as some modest headwinds (tighter financial conditions). However, we view the likelihood of a domestically-generated recession as very low. The main downside risks are exogenous, including a disorderly Brexit or a sharper-than-expected slowdown in emerging-market growth.

-

Quality over quantity. Below the surface of strong headline growth, the business cycle is improving in terms of content with credit-fuelled investment spending leading to more self-sustained job creation, consumption, and deficit reduction. In turn, improved quality of growth should provide greater visibility to investors.

-

Slowly rising core inflation. Stronger growth should push core inflation higher, but from a lower-than-expected starting point in Q4 2017. We believe that the euro area Phillips curve is alive, albeit flatter, non-linear and mis-specified. We forecast headline inflation at 1.5% on average in 2018-19 while core inflation would rise only slowly from 1% in 2017 to 1.2% in 2018 and 1.5% in 2019.

-

ECB to talk the talk in 2018 and walk the walk in 2019. The ECB is expected to terminate QE by early 2019 and deliver a first rate hike in September 2019, with risks tilted towards an earlier move.

-

From political fragmentation to slow integration. Some volatility is likely to return around the Italian elections early next year. In terms of European integration, we expect a two-stage process, starting with the most consensual initiatives (security; banking union), followed by a roadmap for building a stronger euro area (joint investment plans; revamped European Stability Mechanism; fiscal capacity).

A credit-fuelled, job-rich expansion led by investment

|

Consumer spending has been the main driver of euro area growth in the past few years, with job creation gathering pace recently and further supporting households’ disposable income. The numbers of people employed in the euro area has increased by almost 7 million since hitting a trough in 2013, bringing employment above its pre-crisis level in Q1 2017. Employment growth has broadened, spreading to countries that were hard hit by the financial crisis, while unemployment is now at its lowest level in eight years. Hiring intensions are at record highs, suggesting that there is scope for further improvement. Buoyant consumer confidence and favourable bank lending conditions should also support momentum in household consumption.

Capital expenditurehas picked up meaningfully in 2017. The acceleration has been mainly driven by the construction sector and is now a key source of stronger domestic demand. As construction activity is still 19% below its pre-crisis (2008) level, it has further room to improve inasmuch as the sector’s expansion cycles tend to last longer than the upward phase of economic cycles. Machinery and equipment investmentshould also improve. Supportive factors include reduced political risks, strong corporate profits and cash flows as well as an improving credit impulse.

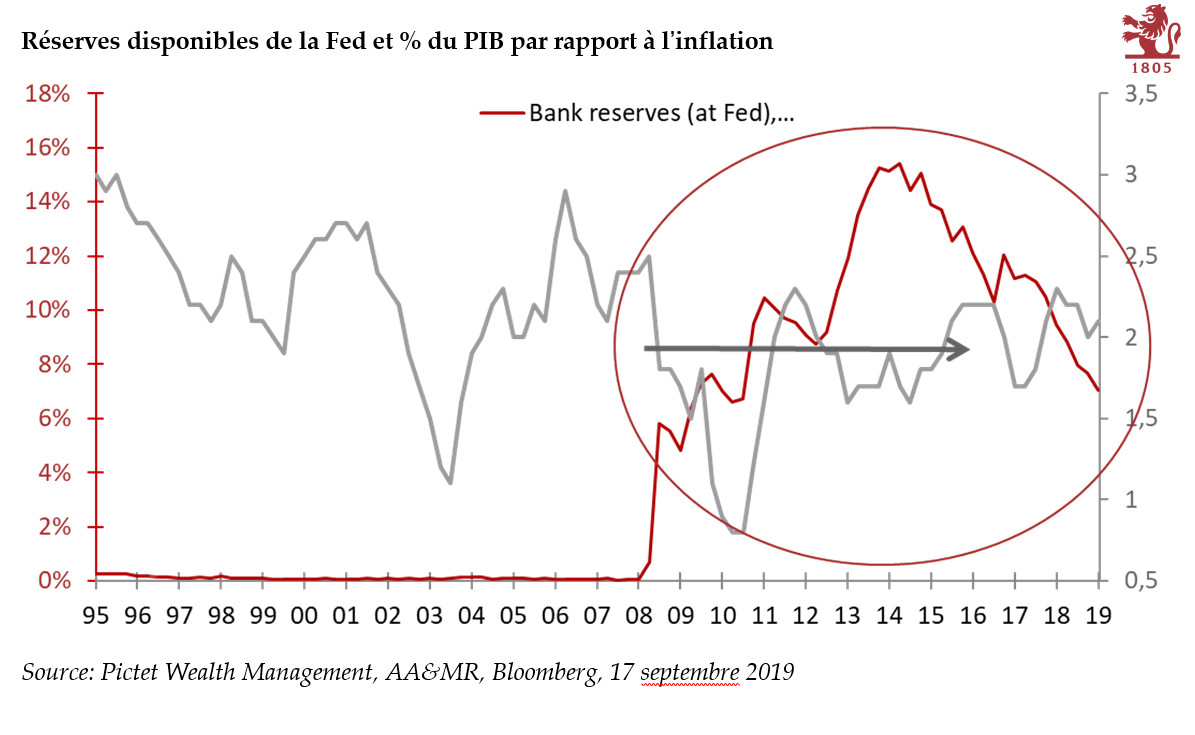

Annual growth in euro area bank loans to non-financial corporations has edged higher this year, to close to 3% y-o-y in October, although the use of internal sources of finance likely explains why credit growth has not picked up even faster despite favourable market conditions. The latest credit flows and bank lending surveys suggest that the trend is turning upward, including for SMEs benefiting from an easier access to credit.

A further modest easing in the euro area aggregate fiscal stance is also likely to support domestic demand. The fiscal outlook in most member states has been improving, largely due to the ECB’s compression of risk premia and funding costs, and to robust economic growth. We see room for additional fiscal easing within existing rules, depending on political will and incentives. In particular, the fiscal stance is expected to be (mildly) supportive in Germany and in France, but close to neutral in Italy and Spain.

Finally, external demand has been one of the key drivers of a stronger momentum this year. Upside in terms of export growth looks limited, yet the contribution of external trade is likely to increase in 2018 in most countries.

|

Euro Area Real GDP Growth |

Core inflation warming up at lastAbove-potential GDP growth implies that core inflation is likely to rise gradually in 2018 as our working assumption remains that the euro area Phillips curve still holds, albeit with a lag and taking into account broader measures of labour underutilisation. We expect core inflation to edge higher on a more sustained basis from its current level of close to 1%, ending 2018 at around 1.4%, and 1.2% on average for the year (up from 1.0% in 2017). Looking ahead, a further reduction in economic slack would push core inflation even higher in 2019, to around 1.5% on average.

|

Euro Area Headline and Core Inflation |

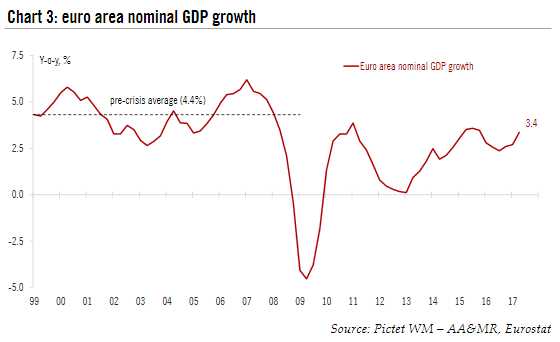

| Euro area headline inflation is likely to be more volatile, averaging 1.5 % in 2018-19 (after 1.6% in 2017), with upside risks (commodity prices) and downside risks (past EUR appreciation) broadly offsetting each other. In all, nominal GDP growth is likely to rise slightly further, to close to 4.0% in the next couple of years. |

Euro Area Nominal GDP Growth |

ECB: hawkish background noiseThe ECB managed to sell its latest decision to recalibrate its QE programme as a non-event, keeping market expectations in check ahead of its 26 October meeting. Now with asset purchases expected to continue until September 2018 at a reduced pace of EUR30bn per month, the Governing Council is unlikely to actively discuss major policy changes before the middle of 2018.

What will change, in the meantime, is the ECB’s communicationas we expect incremental hawkish changes in 2018. Although the ECB should keep, if not strengthen its commitment to keep policy rates at present levels until “well past” the end of net asset purchases, it will likely make some changes including a possible “de-linking” of QE guidance and the inflation outlook.

|

ECB Asset Purchase |

| Either way, we still expect the ECB to terminate asset purchases by early 2019 and to deliver a first refi rate hike in September 2019, with risks skewed towards earlier tightening. As a first step, we expect the ECB to move back to the symmetrical 25bp rates corridor that prevailed before QE, hiking the deposit facility rate to -0.20% (from -0.40% currently) and the main refinancing rate to 0.05% (from 0%). |

ECB Real GDP Growth Forecast |

Country outlook: re-convergence

Germany

France

Italy

Spain

Tags: Macroview,newslettersent