Category Archive: 2) Swiss and European Macro

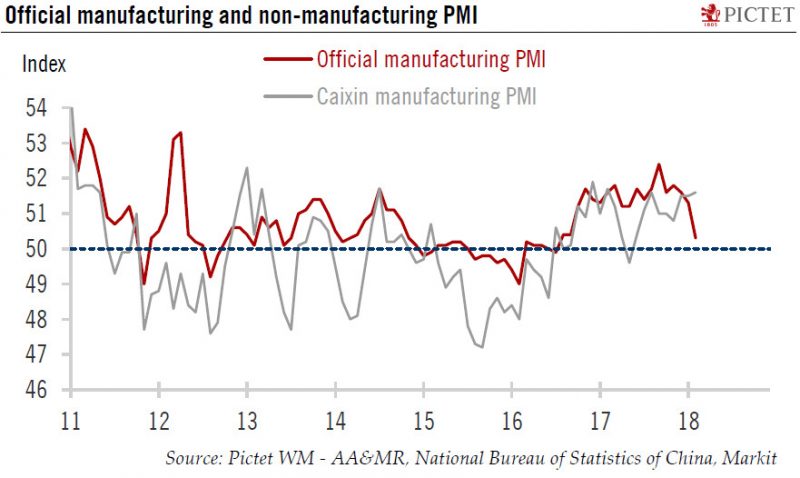

China: February PMIs point to deceleration in industrial activity

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month

Read More »

Read More »

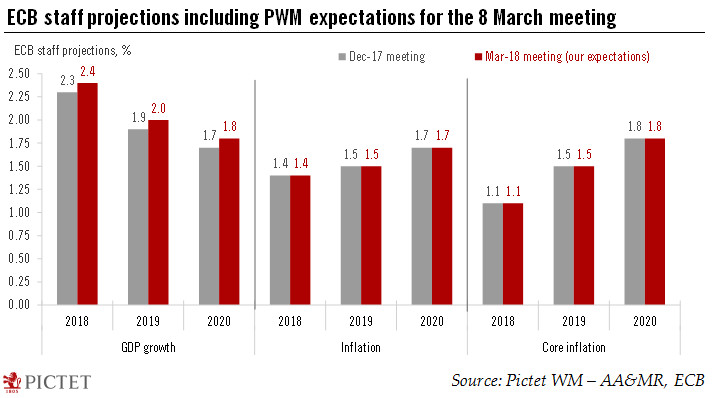

Europe – ECB preview

Market participants have enjoyed a protracted period of very low volatility, but it may well have come to an end in 2018. Central banks are often said to be responsible for the disappearance of volatility, for example through their large-scale asset purchases, which have compressed the term premium. But, now that the same central banks are heading for the exit from unconventional policies, they, too, need to relearn how to live with volatility.

Read More »

Read More »

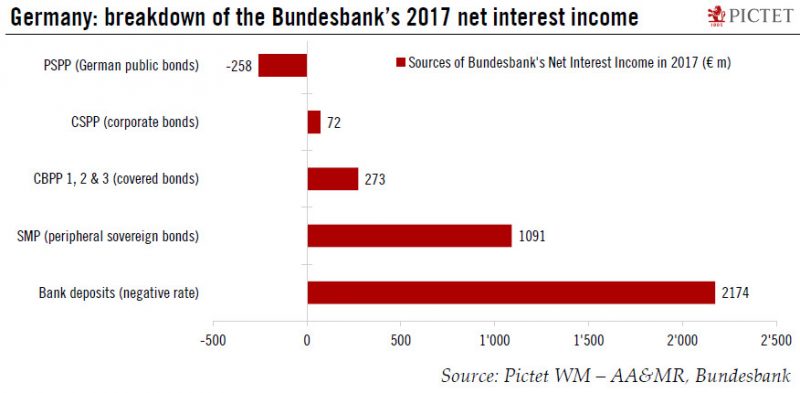

ECB policy is boosting the Bundesbank’s profits

This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end of 2017, and the corresponding flows of income stemming from its asset purchases. Remember that QE is largely...

Read More »

Read More »

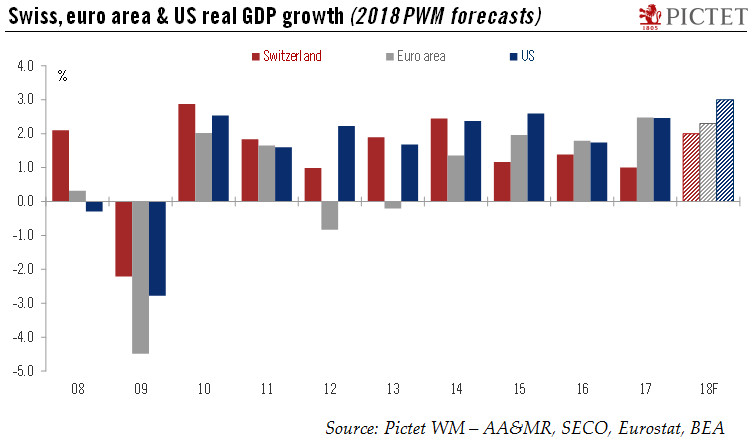

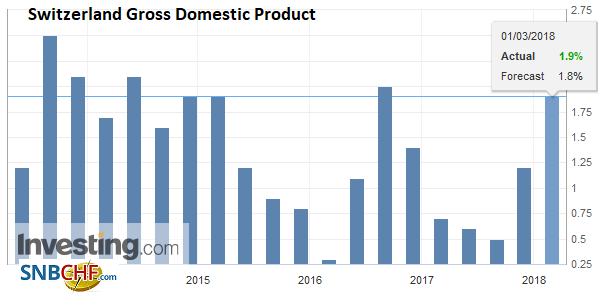

Switzerland: So far so good

According to the State Secretariat for Economic Affairs (SECO)’s quarterly estimates, Swiss real GDP rose by 0.6% q-o-q in Q4 (2.4% q-o-q annualised; 1.9% y-o-y), above consensus expectations (0.5%). The Swiss economy expanded by 1.0% in 2017 overall, in line with our own forecast. This comes after GDP growth of 1.4% in 2016 and 1.2% in 2015.

Read More »

Read More »

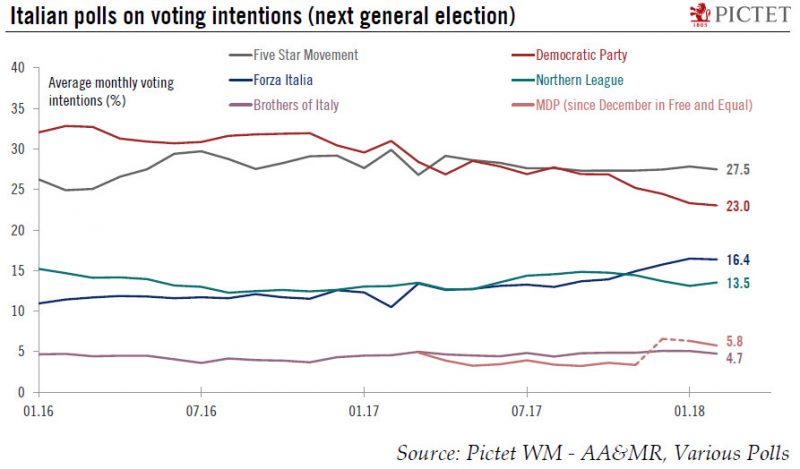

Who will tackle Italy’s root problems?

The Italian general election campaign is in its final stretch before voting on 4 March. The election will take place under the new electoral law (Rosatellum bis), which allocates 37% of parliamentary seats via the principle of "first-past-the-post" and 61% via proportional representation, with the remaining 2% reserved for overseas constituencies (see our previous Flash Note for further details).

Read More »

Read More »

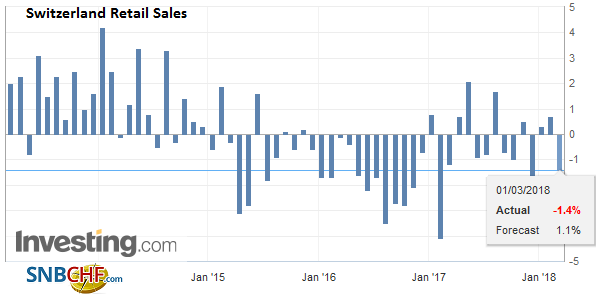

Swiss Retail Sales, January: -0.8 Percent Nominal and -0.6 Percent Real

Turnover in the retail sector fell by 0.8% in nominal terms in January 2018 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Switzerland GDP Q4 2017: +0.6 percent QoQ, +1.9 percent YoY

Switzerland’s real gross domestic product (GDP) grew by an above-average 0.6% in the 4th quarter of 2017.1 Growth was broad-based across the various business sectors, with manufacturing, construction and most service sectors, particularly financial services, providing momentum. On the expenditure side, growth was underpinned by consumption and investment in construction but was hindered by investment in equipment and foreign trade.

Read More »

Read More »

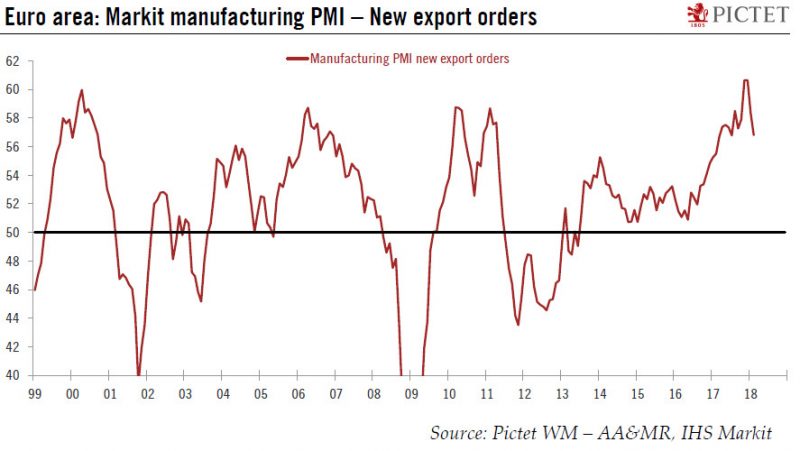

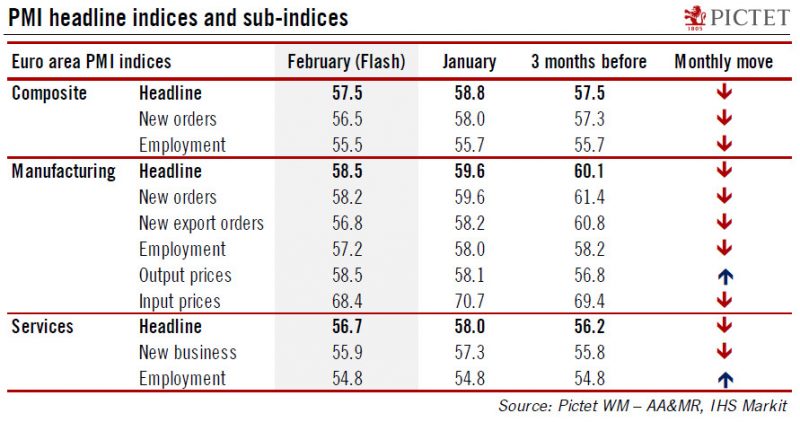

Europe chart of the week – Business surveys

There was a broad-based setback in euro area business surveys in February, whether in terms of country or of sector. The Flash composite PMI slipped to 57.5 in February from 58.8 in January. The month-to-month dip was the biggest since 2014. National business surveys painted a similar picture.

Read More »

Read More »

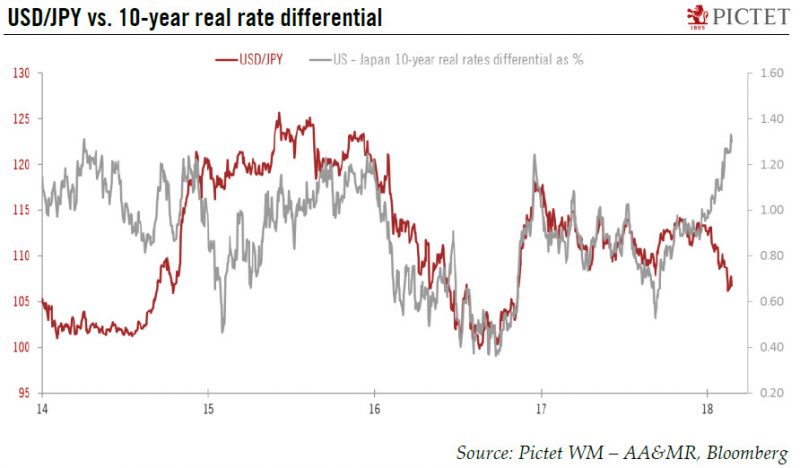

Less scope for yen and Swiss franc depreciation

The start of the year has seen the Japanese yen and Swiss franc appreciate strongly against the US dollar (they rose by 5.6% and 4.4% respectively between 1 January and 22 February) despite higher US yields. However, this rise in US yields came with heightened market volatility, favouring safe haven currencies such as the yen and franc.

Read More »

Read More »

Euro area: Flash PMI surveys pass their peak

The IHS Markit flash composite purchasing managers’ index (PMI) for the euro area eased to 57.5 in February from 58.8 in January, below consensus expectations (58.4). The index marked its the largest monthly decrease since August 2014. Activity in both services PMI (-1.3 points to 56.7) and manufacturing (-1.1 points to 58.5) cooled in February. But while the breakdown by sub-indices showed that the pace of growth in new orders and output slowed...

Read More »

Read More »

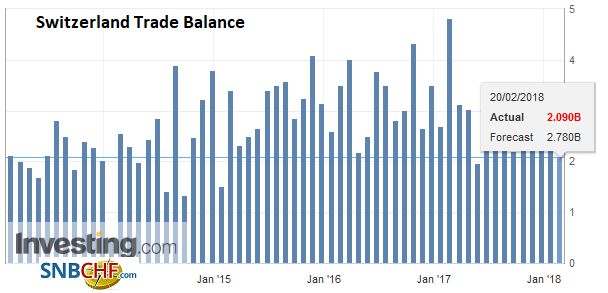

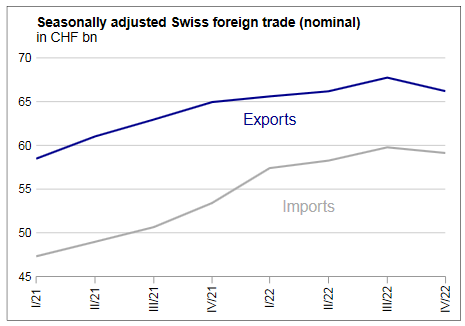

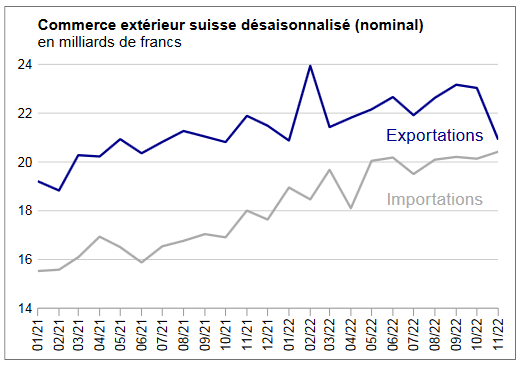

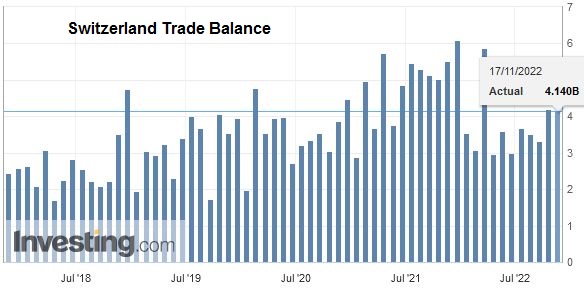

Swiss Trade Balance January 2018: Imports Cross the 17 Billion Franc Mark

Although exports fell in January 2018 from the December peak, their trend remains upward. Imports, for their part, began the year with fanfare to sign a record result. In both traffic directions, chemicals and pharmaceuticals made rain and shine.

Read More »

Read More »

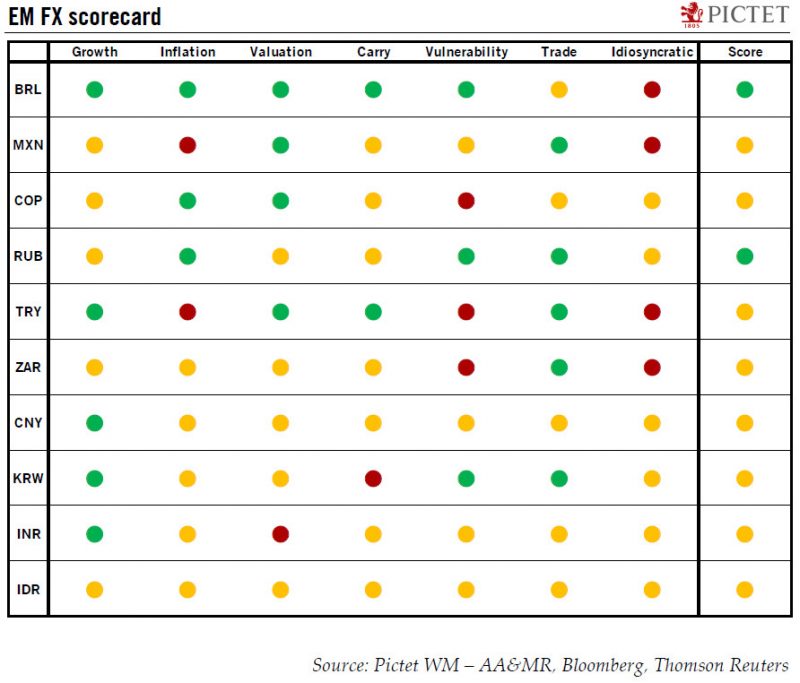

Our emerging market currencies scorecard gives good marks to real and rouble

The scope of this note is to present a score card for Emerging Market (EM)currencies, designed to assess the attractiveness of a given currency over the coming 12 months. The scorecard (see chart), constructed using a rules - based methodology, suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.

Read More »

Read More »

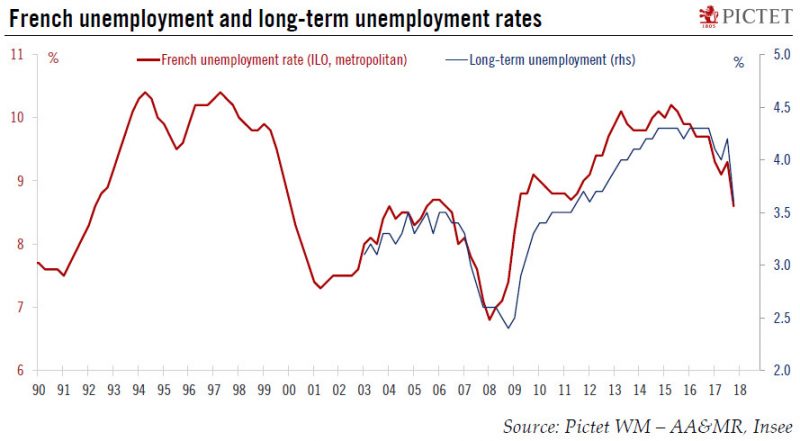

Europe chart of the week – French unemployment

French unemployment fell surprisingly fast in Q4 2017, to a new cyclical low.France registered the largest drop in unemployment in about ten years in Q4 2017. In metropolitan France, the number of unemployed fell by 205,000 to 2.5 million people, pushing the ILO unemployment rate down to 8.6% of the labour force (-0.7pp), its lowest level since Q1 2009.

Read More »

Read More »

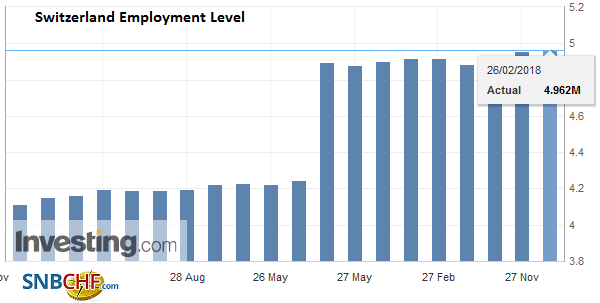

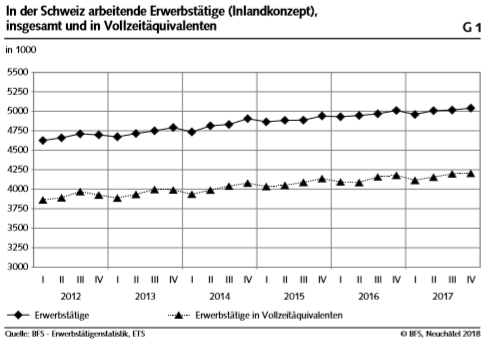

Swiss Labour Force Survey in 4th quarter 2017: 0.6 percent increase in number of employed persons; unemployment rate based on ILO definition at 4.5 percent

The number of employed persons in Switzerland rose by 0.6% between the 4th quarters of 2016 and 2017. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined from 4.6% to 4.5%. The EU's unemployment rate decreased from 8.3% to 7.4%. These are some of the results of the Swiss Labour Force Survey (SLFS) conducted by the Federal Statistical Office (FSO).

Read More »

Read More »

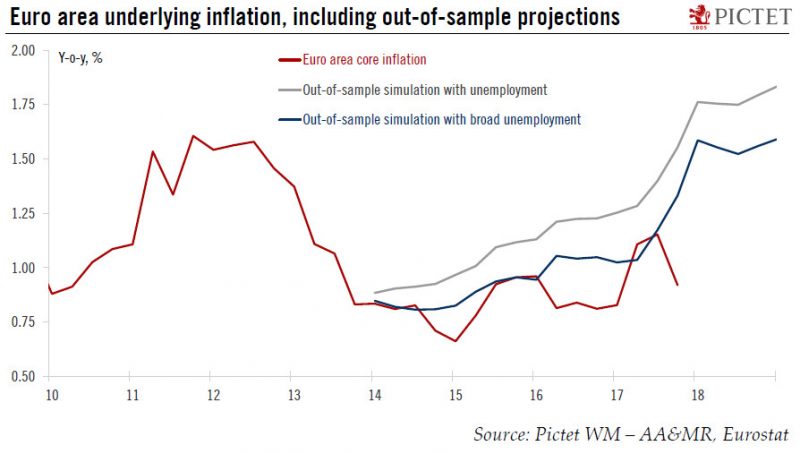

Euro area inflation: the Phillips curve and the ‘broad unemployment’ hypothesis

Monetary policy in 2018 is all about the Phillips curve. The extent to which wage growth and inflation respond to falling unemployment will shape the monetary tightening cycle. If recent price action is any guide, any surprise on that front could result in market overreaction and volatility spikes. The most elegant description of the current state of research was provided by ECB Executive Board member Benoît Coeuré last year, who described the...

Read More »

Read More »

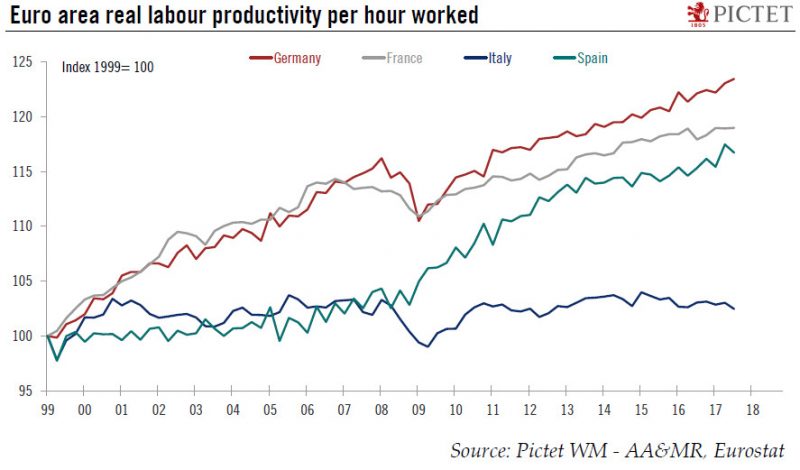

Europe chart of the week – Italian productivity

With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard. Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history. However, cyclical strength is masking structural...

Read More »

Read More »

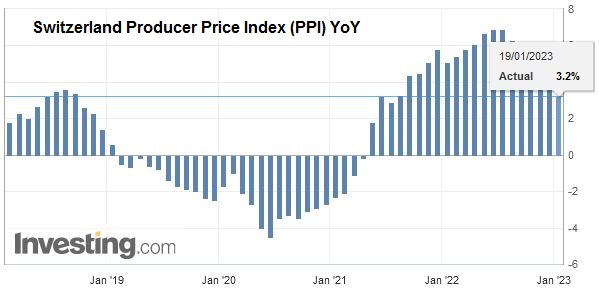

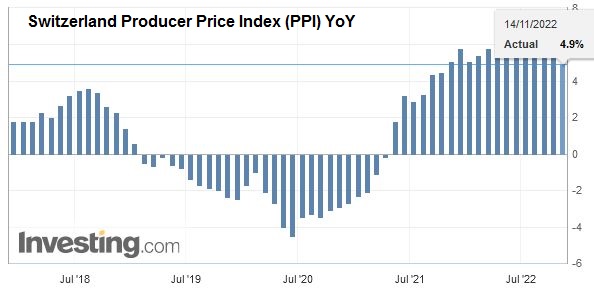

Swiss Producer and Import Price Index in January 2018: +1.8 YoY, +0.3 MoM

Neuchâtel, 13 February 2018 (FSO) - The Producer and Import Price Index rose in January 2018 by 0.3% compared with the previous month, reaching 102.2 points (December 2015=100). The rise is due in particular to higher prices for petroleum products, electricity and gas as well as metals and metal products. Compared with January 2017, the price level of the whole range of domestic and imported products rose by 1.8%. These are some of the findings...

Read More »

Read More »

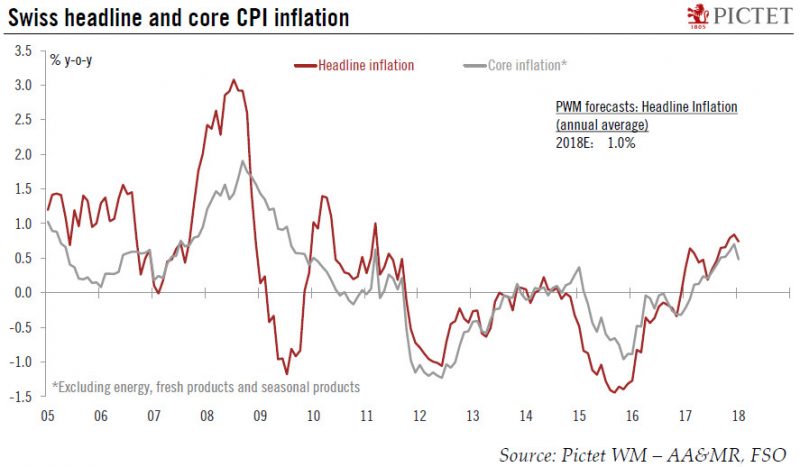

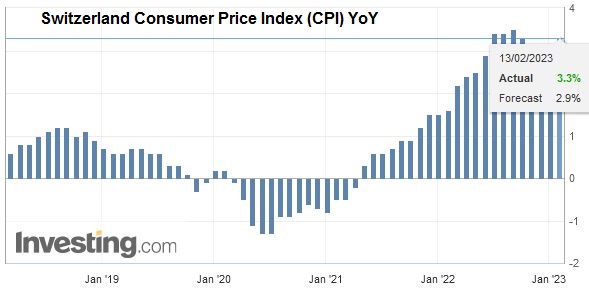

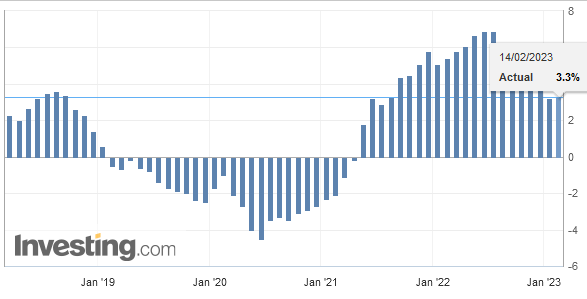

Switzerland: inflation edged lower in January

According to the Swiss Federal Statistical Office (FSO), the headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation (CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) also eased, from 0.7 % y-o-y in December to 0.5% y-o-y in January (see Chart 1), back to the level of October 2017.

Read More »

Read More »