Category Archive: 2) Swiss and European Macro

Eurobonds, fiscal union or banking union are all pure utopia

Eurobonds are light years away.Germany wants the following order: 1) Euro Plus Pact 2) Fiscal Compact 3) ESM 4) Political union 5) Fiscal union 6) Eurobonds

Read More »

Read More »

The German supply-side reforms or will German companies take over the PIIGS ?

Words heart on German street in 2010 during the first Greek bailouts were that Germany should obtain the Greek islands as collateral if Greece is not able to pay back the debt to Germany. But even today German n-tv is reporting about many Greek real estate brokers that are currently delling islands. If it is not that type … Continue...

Read More »

Read More »

The Northern Euro introduction: A retrospective from the year 2030

A retrospective from the year 2030 on two decades of failed european integration policy and 10 years of successful disintegration policy The following essay shows that currency regimes come and go over the time. Nothing is stable with the time, especially the use of a currency. What has never happened in history is the use …

Read More »

Read More »

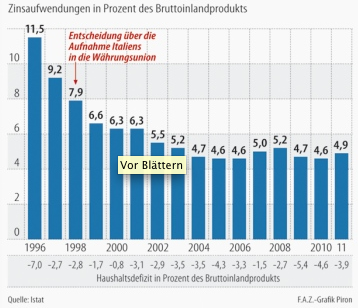

Italy: About the Hypocrisy of Politicians and the Blindness of the English-Speaking Financial Papers

Just a little wrap-up of two tweets read in 5 minutes, to which I finally added a bit more out of my recent Tweets. One Tweet: The British finance minister Osborne has emphasized that the euro zone needs to protect its peripheral economies. “The whole of Europe needs to become more competitive and productive. That …

Read More »

Read More »

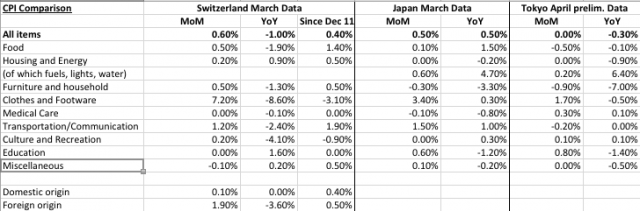

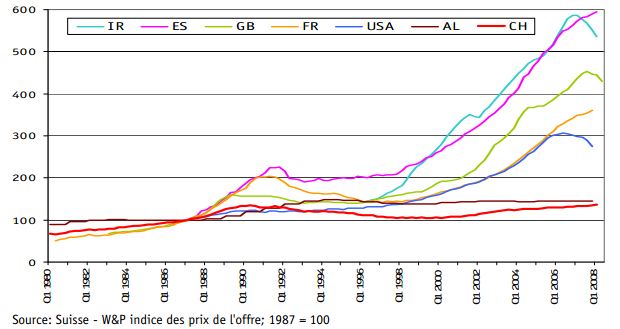

Why is the Swiss safe-haven so completely different from the Yen ?

4 future scenarios for the Swiss franc and the Japanese yen For many people it is astonishing that the Swiss franc continuously rises against the euro, especially when markets are up. Is the CHF no safe-haven any more ? This year the Japanese yen has strongly fallen against the major currencies. Together with the upturn …

Read More »

Read More »

Why the Euro Crisis may last another 15 years

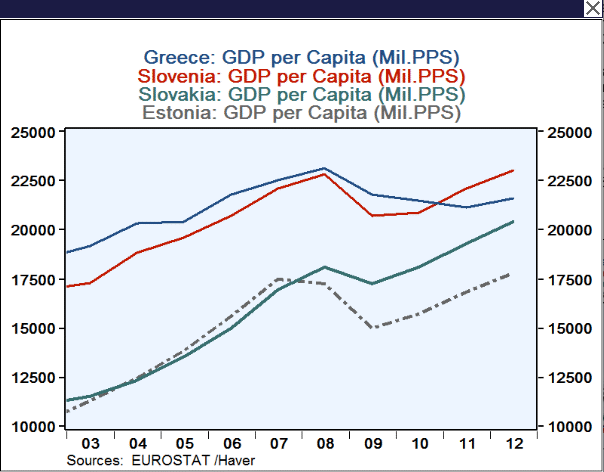

Abstract In the following article we will explain which types of crisis occur in the euro area and will argue that this crisis will last at least another fifteen years. (1) Competitiveness crisis: Before the euro introduction peripheral countries regularly saw their currency depreciate against the German Mark and helped them to increase their competitiveness. …

Read More »

Read More »

The new European Save-Havens: Trade SEK/CHF and NOK/CHF

After the announcement of the floor in the EUR/CHF pair, many predicted the Swedish and the Norwegian Krone to take the place of the Swiss Franc as European save-haven against the Euro turmoil (http://on.ft.com/pKSJ1V). Both countries possess a low level of debt, positive trade balance and very competitive economies.

Read More »

Read More »

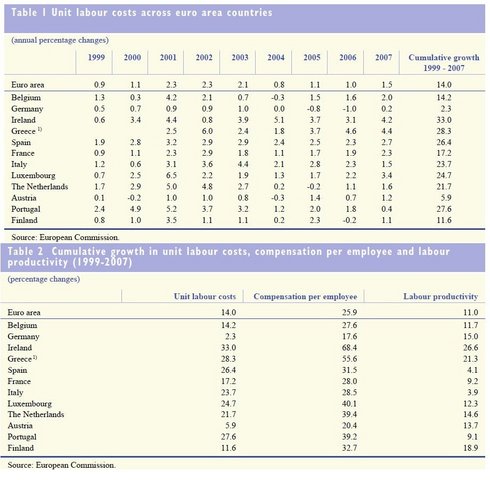

Jürgen Stark’s resignation and the ECB 2005 warning about labor cost divergence in the Euro-zone

The Wirtschaftswoche reports about the real reasons of ECB Chief economist Jürgen Stark’s resignation. The reasons are rather political, namely a protest against European governments:

Read More »

Read More »

The Spanish Ailing Car Industry

Extracts from Think Spain. October 2005. Foreign companies who manufacture cars in Spain are facing a fresh crisis. In addition to the problems of VW subsidiary Seat, various others are being forced to take decisions about the renewal of a number of different models which are reaching the end of their life-cycles. While …

Read More »

Read More »

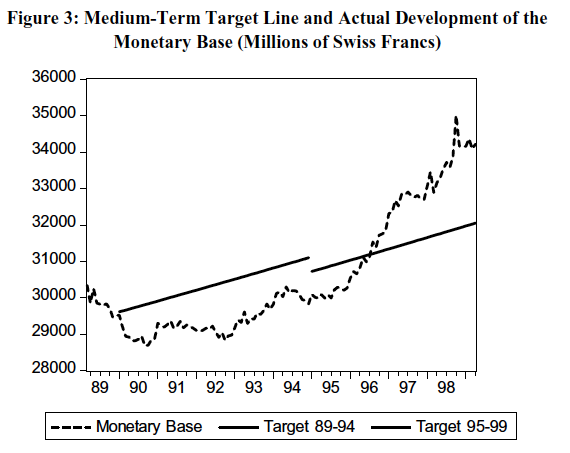

Swiss Inflation, GDP, Monetary Base between 1974 and 2000

Some background statistics on the Swiss monetary policy in the 1970s from Swiss Monetary Targeting 1974-1996: The role of internal policy analysis. More details and monthly data on inflation here.

Read More »

Read More »