The German public remained very skeptical towards the required Greek economic re-balancing given that Greeks want to achieve it with higher wages and more consumption.

According to world bank indicators the household consumption share of Greek GDP is 71% compared to Spain 58%, Italy 60%, Portugal: 65% (source World bank). Greek government consumption is at 17% of GDP, it has fallen from 18% in 2010 and 21% in 2009. The 17% are now lower than the levels in Spain or Italy. Total Greek consumption to GDP is at 90%, this is only a bit less than the failed states Ukraine (95%) and Zimbabwe (105%).

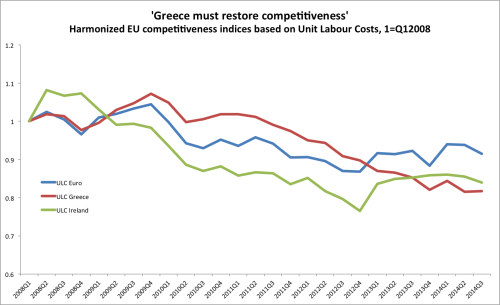

The only thing the Troika managed to achieve was a fiscal adjustment as documented here. But the adjustment of salaries did not happen. Greek labor remains too expensive, the current account is improving only very slowly : too low compared to the high debt levels. At the end of 2014, the mainstream criticized Russia but the Russians have a cheap currency and labor now, and still a solid current account surplus.

For Greece the situation seems hopeless: Holiday packages from Germany to Greece often cost twice as much as the ones to Turkey, or 30% more than the ones to Spain. They are as expensive as packages to Egypt, even if Greece is much closer.

Ordinary Germans are pretty sympathetic to the ideas of Michael Pettis. Pettis advocates that Greece exits the euro zone, because a cheaper currency would reduce the consumption share and increase total production, in the Greek case this means more tourists.This would increase total employment. Prices would come down to Turkish levels. Hence the euro remains the major Greek problem, because they compete with Turkey or Egypt.

Tsipras, however, wants to reduce Greek competitiveness, he would like to

” Increase in the statutory minimum wage from €530 a month to €751 and end to privatisations.” (source)

For comparison: Minimum wages are at 250 € in Slovakia or 390 € in Turkey (July 2014 data). And Steve Keen is still wondering why Greek unemployment is at 27% instead 14% as initially planned in the deal with EU. And in his view that only governments can create jobs, he claimed “the EU violated the contract”.

Steve Keen is an academic who wanted to avoid the so-called “Minsky Moment”, the moment when economies implode due to massive debt.

But now he changed his mind and has become friend with Yanis Varoufakis, the Greek finance minister, actor and pop star. Steve tells us

Yanis, in contrast, filled the stage as soon as he began to speak, engaged the audience with direct eye contact, and spoke like an orator rather than a mere academic. His face also had a perennial wry smile to it, and his presentation included plenty of ironic humor

Being seduced by this charming guy, Steve changed his mind. He wants to achieve more Minsky moments instead less.

Obvious that Steve Keen is the designated hedge fund manager for the Greek economy. Steve is supposed to drive it into the next Minsky Moment.

Like the central bankers and many hedge funds, Steve Keen fights fire with more fire, namely

1. Borrow in foreign currency

2. Increase wages and consumption.

The moral of the story comes from Mike Shedlog that describes how the Swiss Franc Trade Wiped Out Everest’s Main Hedge Fund.

Morals of the Story

- Don’t borrow money in other currencies, especially long-term mortgages.

- Don’t expect currency interventions to work forever.

- Don’t believe statements made by central bankers. They are not the economic wizards they are made out to be, and they often lie when it suits their purpose.

- It only takes one wrong macro bet with leverage to make a fortune or wipe you out.

- When you are speculating with other people’s money [example Steve & Yanis], especially when you take in a 20% performance fee, there is a huge incentive to make leveraged bets.

Source Mike Shedlog

German ordinary people are as usual more intelligent than the economists. They compare holiday prices and understand that Greece is still too expensive and that the country either needs more deflation or, better, an exit from the euro.

They quickly developed a new hashkey in Twitter. #Tsiprasfacts

The Tsiprasfacts

Tsipras did not stop to promise miracles.

The followings are the best example for the #Tsiprasfacts

If Merkel Tsipras pronounces the fullest confidence ,she must resign two weeks later.

Er schnupft zur Entspannung Olivenkerne #tsiprasfacts

Being the Left was yesterday, now we go right

He forms a cabinet only with men.

Chuck Norris designated as Greek special envoy for negotiations with the EU Troika. #Tsiprasfacts

Tsipras can Triforce #Tsiprasfacts

Philipp

Philipp  Lukas Grimm

Lukas Grimm  Plusmid

Plusmid  Mario

Mario  tagesschau

tagesschau  Norbert Schepers

Norbert Schepers  Detlef Guertler

Detlef Guertler