UPDATE February 2013 inflation data:

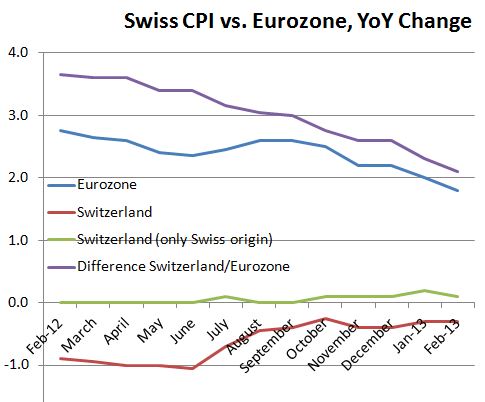

The inflation figures for February showed the upwards movement we expected. On monthly basis inflation rose by 0.3%. The Swiss CPI is getting closer and closer to the one of the euro zone.

We explain the January 2013 data on Swiss inflation and indicate which components drive the consumer price index (CPI).

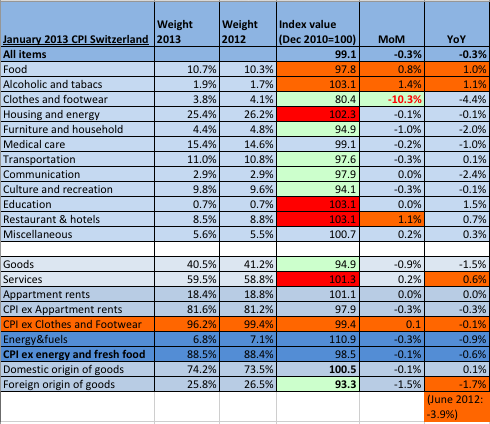

Recently Fritz Zurbrügg, a member of the SNB board, indicated that negative interest rates are off the cards. Yesterday’s Swiss inflation figures confirmed his view. While food, beverages, restaurants and hotel prices moved upwards by around one percent in a single months, last but not least, due to the weaker franc, the yearly sales of clothes and footwear helped to keep prices in check. According to the CPI ex clothes and footwear, Swiss prices are up 0.1% on monthly basis and down -0.1% on a yearly basis.

The headline figure shows -0.3% yearly inflation after -0.4% in December. This deflationary number is still driven by imported products, this month in particularly by clothes, but also by imported furniture, household stuff or package holidays (contained in “culture and recreation”). These categories still show weak index values far under the 100 of December 2010. Apartment rents, education, restaurant and hotels that are driven by local prices and services, however, are already above the 100 benchmark.

Swiss statistics did the yearly adjustment of basket weights. While for the Chinese CPI (see details in our chapter on purchasing power parity) the weight for food is falling and the one for rent and energy is rising, the opposite happens in Switzerland. The share of food and beverages increased from 10.3% to 10.7%, while housing and energy went down from 26.2% to 25.4%. In both China and Switzerland, the share of medical care is on the rise. Thanks to falling import prices, the weight of foreign goods has diminished, while services are up already 0.6% on the year. Similarly as in other countries, the hedonic adjustments for (in Switzerland mostly imported) items with an improved technology helped to weaken inflation especially in the categories “communication”, “medical care” (for imported material), “household” and the subitem “cars” inside “transportation”.

Strong oligopolic structures keep prices in many Swiss sectors high and put upwards pressure on inflation. For example the Swiss “communication” component shows an index value of 97.9 while Germany has 93.8 (both basis 2010); this despite the weak euro and the strong franc.

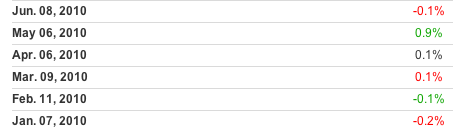

Should the global recovery story continue, we see a similar upwards movement in Swiss prices like in 2010, when strong global growth and the “seasonal clothes price effect” pushed the CPI to +0.9% in the single month of April 2010. As consequence the SNB had to withdraw from currency interventions at the level of EUR/CHF of 1.40. Here the MoM inflation figures of 2010, which might similarly show up in 2012.

The quick way to inflation is not realistic

If, however, strong U.S. and global growth lets the EUR/CHF improve to 1.30 or more, we see Swiss inflation rise to over 2% in one year time, out of the SNB price stability target, with the consequence that the bank will hike interest rates and sell some of its masses of foreign currency, driving both the EUR/CHF and inflation down again.

See more details on downwards and upwards drivers of Swiss inflation here.

Are you the author? Previous post See more for Next postTags: China,China Consumer Price Index,Deflation,food inflation,Swiss economy,Swiss National Bank,Switzerland,Switzerland Consumer Price Index,Switzerland inflation

1 ping

Lesenwertes aus Finanzwelt, Investments und Devisenhandel | Pipsologie

2013-02-16 at 22:49 (UTC 2) Link to this comment

[…] Der schweizerische Weg zur Inflation. (Englisch) […]