For us all roads lead to a euro zone break-up and multiple sovereign defaults.

Our reasoning can be summarized as follows:

- Equities are worthless when associated debt becomes encumbered (risk capital takes the first loss). Equity is not an asset; it is merely the remainder that is left over once debt is subtracted from assets.

- Recent GDP growth was possible only thanks to massive deficit spending and monetary easing; however, the marginal utility of additional debt and additional monetary easing is trending towards zero. Global debt has risen much faster than global GDP. The world has reached the Keynesian endpoint (where the economy cannot be stimulated anymore due to the weight of heavy debt burden). Increase in debt is inflationary, but high and stable debt as well as de-leveraging is deflationary.

- The 2008/9 financial crisis was contained thanks to governments (read: taxpayers) absorbing bank debt. Any progress households made on de-leveraging has been added back onto them via bailouts. Meanwhile, the escape hatch of government bail-outs is closed as many governments face insolvency. Capital markets deny refinancing their considerable mountains of debt.

- The US has the advantage of producing the world’s reserve currency, guaranteeing access to most commodities. This will hold true even in case the dollar is being further devalued, as long as key commodities are priced in dollars. Trillions of US dollars have found their way into the balance sheets of foreign central banks; the burden of devaluation is hence shared with millions of unsuspecting Chinese, Japanese, Russians and others.

- Europe, however, is unable to solve its crisis due to insurmountable differences in fiscal policies, trade balances and scarred memories of hyperinflation in the past century.

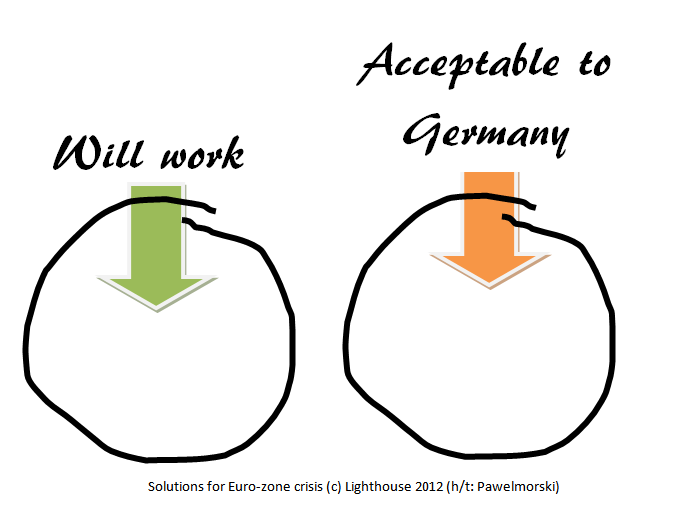

There are only two solutions to the Euro zone crisis:

- Jokes aside, the Euro-crisis will only be solved once the causes (trade imbalances, high deficits) are removed.

- Trade imbalances can only be healed by relative improvement in unit labor costs between the North and the South

- This can only be achieved through

(1) severe deflation for the PIIGS- leading to social unrest – or

(2) devaluation by the PIIGS – meaning Euro exit or

(3) substantial inflation in Germany (unlikely to happen). - Fiscal deficits can only be reduced by austerity (higher taxes, lower spending, or both). Stalling economic growth will lead to higher unemployment and possibly social unrest.

- Another alternative is to default on debt (which, coincidentally, would also be the consequence of a Euro-exit).

- In the end, all roads lead to a euro zone break-up and multiple sovereign defaults.

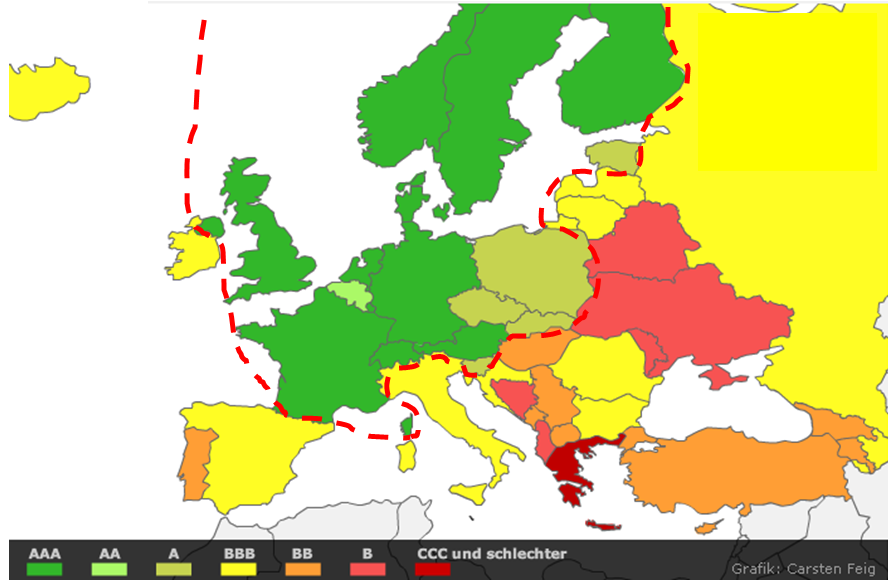

In the above map you will notice the red “demarcation” line between A- and non-A-rated countries. It is the divide between the fiscally responsible North and the profligate South & East.

Germany and France are number 1 and 2 EU members by GDP, and together account for 36% of the EU’s economic power (29% of population). But France is culturally closer to Italy and Spain; it historically had a weak currency, and frequently suffered devaluations in the European Exchange Rate Mechanism (the managed floating rate mechanism before the introduction of the Euro). It is clear that as the Franco-German axis breaks, the European project is dead.

CONCLUSION: Sooner or later, something has got to give. There are no good outcomes. Deleveraging of excessive debt levels hurts, especially if the country seen as imposing those conditions is doing relatively fine. A Euro-exit by Germany, possibly together with the Netherlands, would be the least catastrophic “solution”, allowing the rest of Europe to regain competitiveness by weakening their Euro. However, such an outcome is unlikely, as Germany would be seen as the one ending European integration (and, in addition, losing all control over the fiscal policies of its neighbors).

Alexander Gloy is founder and president of Lighthouse Investment Management.

Alexander Gloy is founder and president of Lighthouse Investment Management.

Tags: Alexander Gloy,austerity,Bailout,competitiveness,debt,deficit,Deflation,deleveraging,Euro exit,Keynes,Labor costs,labour costs,Lighthouse Investment,PIIGS,Spain

2 comments

1 ping

Ole C G Olesen

2012-08-28 at 19:33 (UTC 2) Link to this comment

I dis-agree … not on the issue whether the EORO will break or not … i simply do not know

BUT ..Your argumentation is full of FLAWS.

FIRST : The EURO AREA does NOT owe any signifficant amount of DEBT externally

on the contrary the Area is OWED several TRILLIONS of USD by the external world

This means that how to handle the internal DEBT is in the Hands of exclusively

the Area itself… it has the freedom to find an equitable solution.

The basis for this state of affairs is that the AREA overall and over time has had

both a POSITIVE Trading Account Balance as well as a POSITIVE Current account balance vis a vis

the remaining world ,,, contrary to the Anglosaxon Sphere ..only surviving on …DEBT

Europe still enjoys that privilege .. and a weakening ( most wellcome ) of the EURO will strengthen

those balances ! As has already happened !

SECOND : The INFRASTRUCTURE in place in the EURO – AREA is second to none in the remaining world

( the USA is approx 20 Years behind that capital intensive curve ! )

Even more important that this INVESTMENT ..is paid for by EURO AREA CAPITAL ..not obtained

by External Debt

THIRD : CAPITAL- wise the EURO AREA is by far the RICHEST AREA of the WORLD

FOURTH : The EURO Area has an educated and disciplined Population … in the time to come ..manual labours

importance for production will steadily decline and Cheap labour will have little impact on Price .

Furthermore the innovative / scientiffic part of the EURO area still ( in combination ) surpasses any

other area of the world in quality . design and width . But the individual european countries need

each other to gain the SIZE necesary to reap the fruits of this competitive advantage on the Global

sceene . The fantastic story of AIRBUS illustrates this very well . Take a look at Dassault Systemes or

for ex the Chip maker daughter company of Phillips … as examples of some of many other forward

looking companies with unsurpassed potential .

There are so many more areas where Europe is UNRIVALLED ..in fact !

Socially …scientifically … infrastructurally and productivity wise …

The Area even has most of the material recources it needs..and is far beyond any other area in

regards to the sustainable use of these recources .

In SUMMARY : The prospects for the EURO AREA ..acting in Federation ..are quit good … as any person who

can THINK ..should realize … and ofc this is a THORN in the FLESH of the hopelessly indebted

Anglosaxon Empire … exclusively surviving on DEBT ..and MILITARY BLACKMAIL

And above is WHY .. the EURO ..in spite of the ongoing ANGLOSAXON attack on it ..has not

changed dramatically in value during the last 3 years .

You see CURRENCY TRADERS are quity sophisticated people ..in general . .

George Dorgan

2012-08-28 at 19:39 (UTC 2) Link to this comment

Thank you Ole,

I am in principle of your opinion, but just of the Northern part, which is a lot more competitive than the anglo-saxons.

But not of the Southern one, and this difference might ultimately lead to a split-up, the question is just when.

Tempesta perfetta? | Non al Denaro. Non all'Amore. Nè al Cielo.

2015-05-25 at 23:45 (UTC 2) Link to this comment

[…] poi alla Germania ancora non sta bene… ad un certo punto quella è la porta anche per lei. Un Euro nord ed uno sud per uno o due decenni e poi si vede non sarebbe la tragedia […]