Home › 6a) Gold & Monetary Metals › 6a.) GoldCore › Rick Rule – Gold Helps Me Sleep at Night

Permanent link to this article: https://snbchf.com/2022/10/flood-rick-rule-gold-helps-sleep/

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF hovers around 0.8650, upside likelihood appears possible as the US election looms

6 hours ago -

US Dollar rallies on Wednesday with US yields surging higher

2 days ago -

USD/CHF depreciates to near 0.8650, downside risk seems restrained due to higher US yields

3 days ago -

USD/CHF Price Forecast: Corrects to near 0.8630 despite upbeat US Dollar

4 days ago -

USD/CHF Price Prediction: Consolidates within short-term uptrend

9 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 4.2 billion francs compared to the previous week

11 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

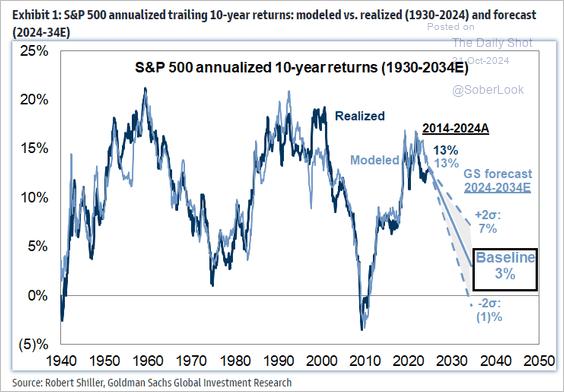

Lower Forward Returns Are A High Probability Event

Lower Forward Returns Are A High Probability Event -

USD/CHF hovers around 0.8650, upside likelihood appears possible as the US election looms

-

Teslas Geheimwaffe: Die Fabrik, nicht das Auto?

Teslas Geheimwaffe: Die Fabrik, nicht das Auto? -

Dreading Republican Rule

-

US Wahl schon entschieden? Was passiert nach der Wahl?

US Wahl schon entschieden? Was passiert nach der Wahl? -

Why You Should Start SMALL in Real Estate – Jaren Sustar

Why You Should Start SMALL in Real Estate – Jaren Sustar -

Wie viel Geld macht wirklich glücklich?

Wie viel Geld macht wirklich glücklich? -

Erik Prince, Peter Thiel, and Other “Libertarian” Advocates for the Warfare State

-

The Pyramid Scheme of Home Insurance

-

The Revolution Continues: The Ranks of Anti-Fed Republicans Grow

More from this category

Lower Forward Returns Are A High Probability Event

Lower Forward Returns Are A High Probability Event25 Oct 2024

- USD/CHF hovers around 0.8650, upside likelihood appears possible as the US election looms

25 Oct 2024

- Dreading Republican Rule

24 Oct 2024

- Erik Prince, Peter Thiel, and Other “Libertarian” Advocates for the Warfare State

24 Oct 2024

- The Pyramid Scheme of Home Insurance

24 Oct 2024

- The Revolution Continues: The Ranks of Anti-Fed Republicans Grow

24 Oct 2024

- Gold’s Future Depends Crucially on China

24 Oct 2024

- What is Bolstering the Chinese Economy?

24 Oct 2024

Swiss Bankers Association critical of “Too-big-to-fail” measures

Swiss Bankers Association critical of “Too-big-to-fail” measures24 Oct 2024

- Free Markets Don’t Need Government Regulation

24 Oct 2024

- Trump’s Latest Tariff Plan Just Replaces One Tax with Another

24 Oct 2024

Turn Around Tuesday Comes Late

Turn Around Tuesday Comes Late24 Oct 2024

- Playing With Fire and Its Critics

24 Oct 2024

- No Compromise With the Fed!

24 Oct 2024

- Living With Hamilton’s Curse

24 Oct 2024

VanEck senkt Ethereum-Preisziel deutlich nach Modellaktualisierung

VanEck senkt Ethereum-Preisziel deutlich nach Modellaktualisierung24 Oct 2024

- About Natural Order and its Destruction

24 Oct 2024

- The Fed Does Not Benefit Ordinary Americans

24 Oct 2024

- How Capitalism Defeats Racism

24 Oct 2024

- Why Should We Fight Wars for Ukraine and Israel?

24 Oct 2024

Rick Rule – Gold Helps Me Sleep at Night

Published on October 14, 2022

Stephen Flood

My articles My videosMy books

Follow on:

The former President and CEO of Sprott, was last on the show at the beginning of February, so it’s an understatement to say he and GoldCore TV host Dave Russell had a few things to catch up on!

From US dollar strength (it’s all relative) to the price of gold through to how Rick is advising investors right now, Dave asks the former President and CEO of Sprott all the questions to help you better navigate these trying times.

If you enjoy this interview then perhaps you’d like to watch The M3 Report, our flagship show on all things metals, markets and money. Our latest episode features Mr Rick Rule himself and the GoldCore team ask why current UK financial policy is an absolute ‘clusterfudge’, these days.

Enjoy!

Follow on:

No related photos.

Tags: Commentary,commodities,Deflation,Economics,Featured,Federal Reserve,federal-reserve,Geopolitics,Gold,housing bubble,hyperinflation,inflation,Interviews,News,newsletter,Precious Metals,silver,Stock markets