Tag Archive: Economics

Bastiat And The “Broken Window”

In times of disaster and destruction, a common narrative often emerges that rebuilding efforts will lead to economic growth. The idea that repairing damage and replacing destroyed goods creates jobs that spur consumption and stimulate economic activity is tempting. However, as French economist Frédéric Bastiat explained in his famous “Broken Window Theory,” this reasoning is fundamentally flawed. Rather than generating net economic benefits,...

Read More »

Read More »

The permacrisis strategy: the mortal dangers of our “new normal”

Share this article

Over the last years, we have encountered an abundance of alarmist and hysterical “warnings” and admonitions, foretelling the impending doom of the world as we know it. Market corrections have served as an excuse for scaremongers to cultivate panic over a total systemic collapse. Surprising political shifts, like unexpected electoral results, have been coopted to support extreme scenarios, predicting the fall of the current world...

Read More »

Read More »

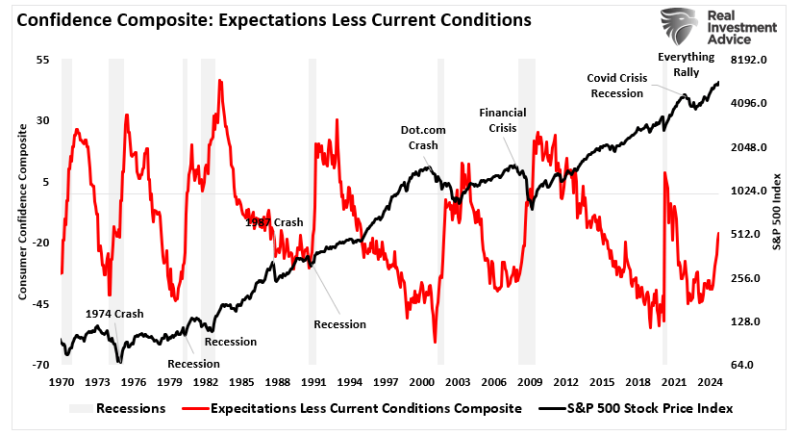

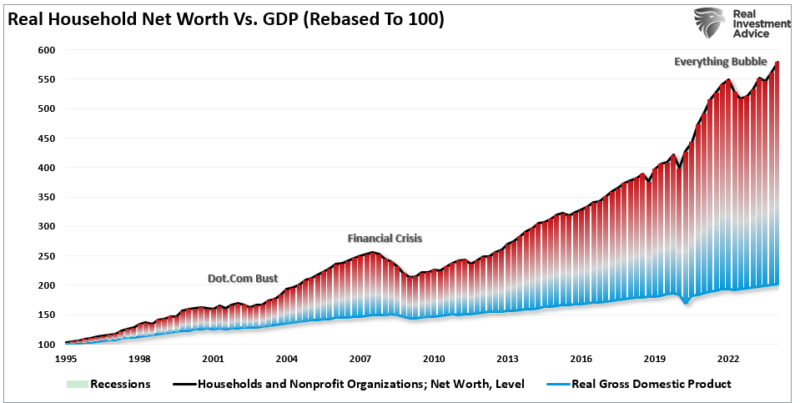

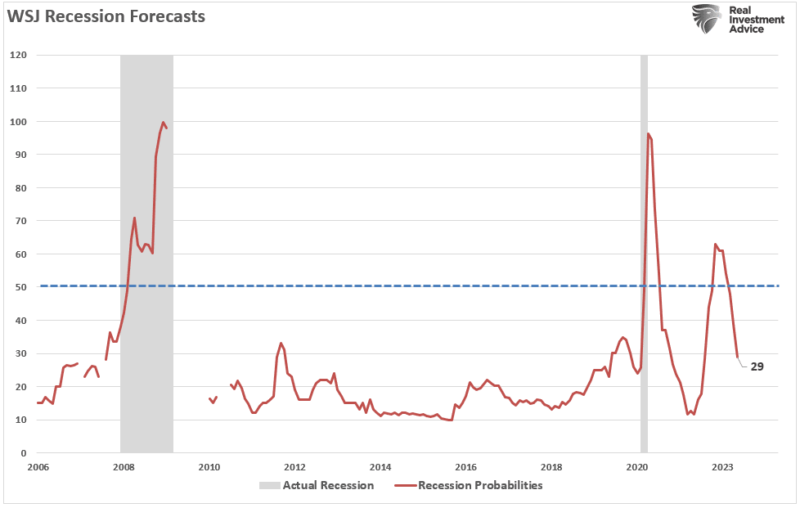

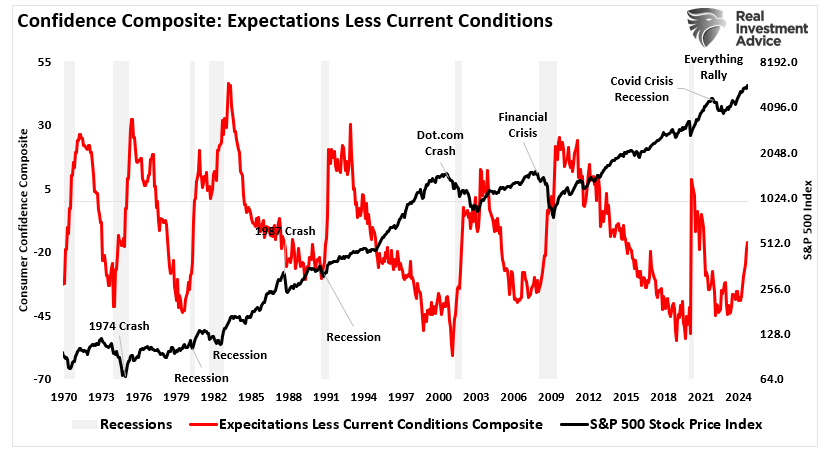

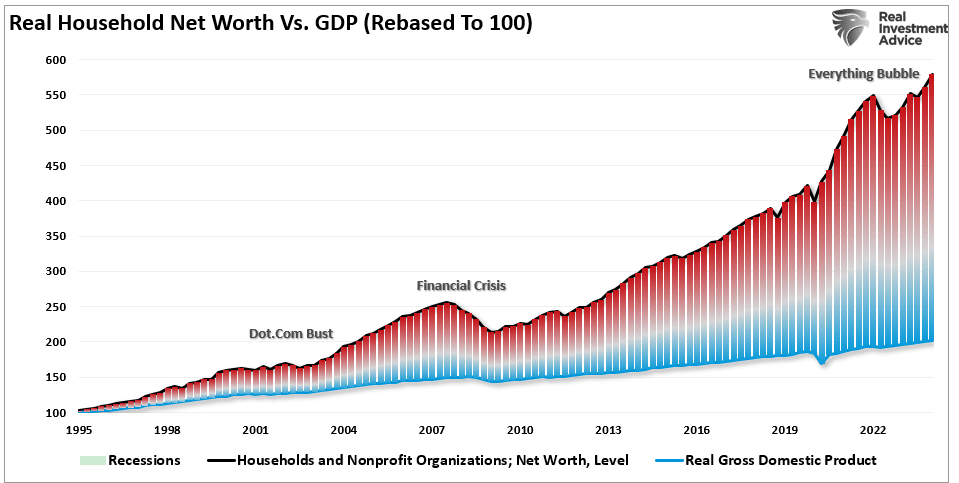

GDP Report Continues To Defy Recession Forecasts

The Bureau of Economic Analysis (BEA) recently released its second-quarter GDP report for 2024, showcasing a 2.96% growth rate. This number has sparked discussions among investors and analysts, particularly those predicting an imminent recession. There are certainly many supportive data points that have historically predicted recessionary downturns. The reversal of the yield curve inversion, the 6-month rate of change in the leading economic index,...

Read More »

Read More »

Technological Advances Make Things Better – Or Does It?

It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever.

Economists and experts have long argued that technological advances drive...

Read More »

Read More »

Economic Growth Myth & Why Socialism Is Rising

I was recently asked about the seemingly strong “economic growth” rate as the Federal Reserve prepares to start cutting rates.

“If economic growth is so strong, as noted by the recent GDP report, then why would the Federal Reserve cut rates?”

It’s a good question that got me thinking about the trend of economic growth, the debt, and where we will likely be.

Since the end of the financial crisis, economists, analysts, and the Federal...

Read More »

Read More »

UBI – Tried, Tested And Failed As Expected

A Universal Basic Income (UBI) sounds great in theory. According to a previous study by the Roosevelt Institute, it could permanently increase the U.S. economy by trillions of dollars. While such socialistic policies sound great in theory, history, and data, they aren’t the economic saviors they are touted to be.

What Is A Universal Basic Income (UBI)

To understand why the theory of universal basic income (UBI) is heavily flawed, we need to...

Read More »

Read More »

The road to Serfdom: are we on the final stretch?

Share this article

An attempt at an analysis from the perspective of a free Swiss individual

What you’re about to read is the abridged and condensed English translation of a speech I gave in Munich in November 2023. You can find the full speech, in German with English subtitles, here.

It tackles the very difficult, but also very crucial, subject of individual freedom, or what is left of it these days, and it seeks to offer a constructive...

Read More »

Read More »

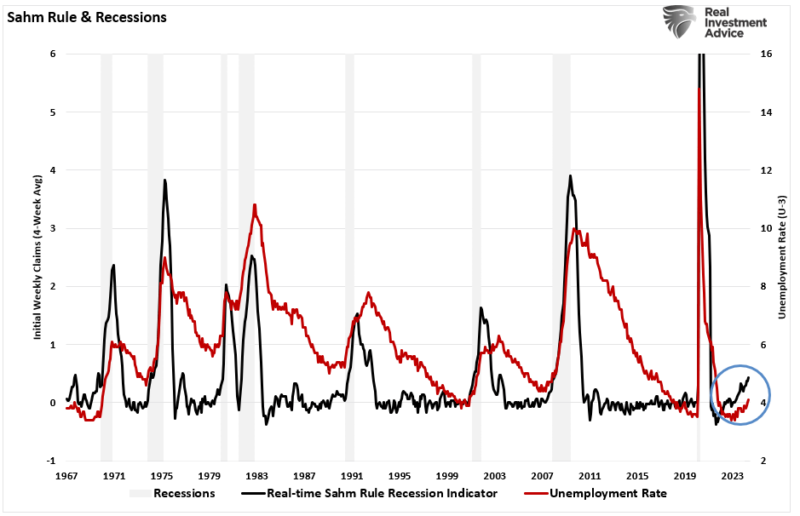

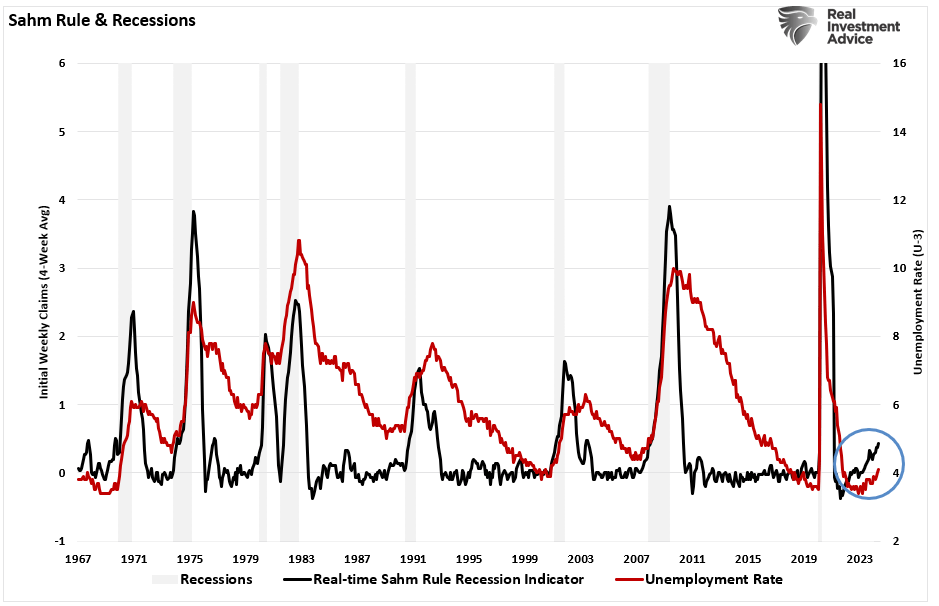

The Sahm Rule, Employment, And Recession Indicators

Economist Claudia Sahm developed the “Sahm Rule,” which states that the economy is in recession when the unemployment rate’s three-month average is a half percentage point above its 12-month low. As shown, the latest employment report has triggered that indicator.

So, does this mean a recession is imminent? Maybe. However, we can now add this indicator to the long list of other recessionary indicators, also flashing warning signs.

As...

Read More »

Read More »

Economic freedom: Politics, of course, by its nature is always the pursuit of the Left

Share this article

Article II of II, by Claudio Grass

Collectivism is extremely versatile and very easy for political animals to “sell” to the public and to weaponize. Politics, of course, by its nature is always the pursuit of the Left, if we are to follow strict definitions. It seeks to influence and coerce others and it abhors individual liberties and self-determination. What we know as far-right is national socialism and the rest is...

Read More »

Read More »

Economic Freedom: The Cornerstone of Western Civilization

Share this article

Part I of II, by Claudio Grass

Western civilization – with all its scientific and technological progress, artistic prowess, philosophical and sociopolitical evolution, moral values, ethical principles and rich culture – took millennia to reach its famed “Enlightenment” point. It has been a rollercoaster, violently swinging from highs to lows and from darkness to light, from autocracy, tyranny and despotism to humanism and...

Read More »

Read More »

Social justice and other evils

Share this article

The post-covid years have brought about an unquestionable acceleration and intensification in the attacks against the Western value system, against basic Enlightenment ideas and principles and against the pillars of the very civilization that gave us all the liberties, the rule of law and the justice system that we enjoy today (or used to enjoy until fairly recently at least).

All-important and self-evident ideas like the...

Read More »

Read More »

Interview with Executive Global: “The Return of Marxism in the West”

Our special interview on Swiss Wealth Advisor with CLAUDIO GRASS, CEO and Independent Precious Metals Consultant, explores the manner in which astute investors may preserve wealth against the backdrop of debilitating central economic planning and monetary inflation.

Read More »

Read More »

Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year.

Read More »

Read More »

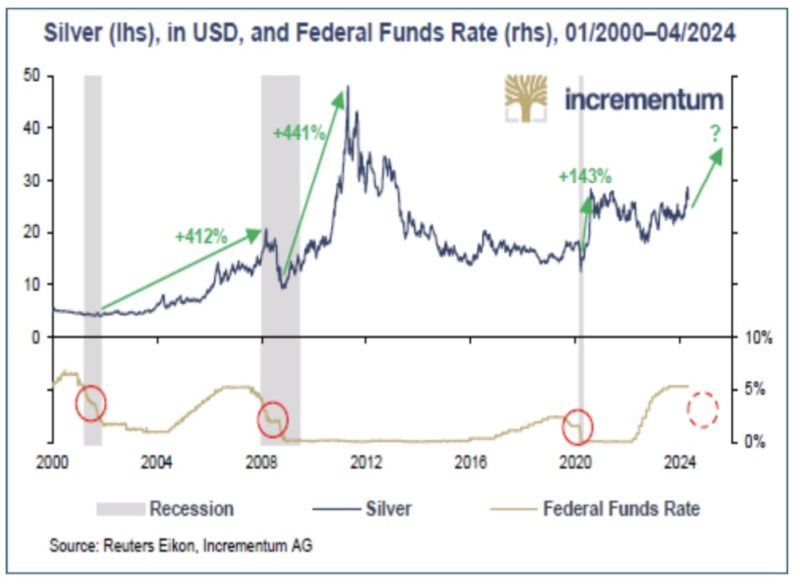

Saving in gold is the only reliable way to save

Share this article

For the longest time, according to conventional and widely embraced wisdom, all responsible and prudent members of society had to have a savings account. All those hardworking taxpayers and all those forward-thinking and sensible individuals that understand the importance of planning ahead, of being prepared for whatever the future holds and of securing a better life for their children, have traditionally been expected to put...

Read More »

Read More »

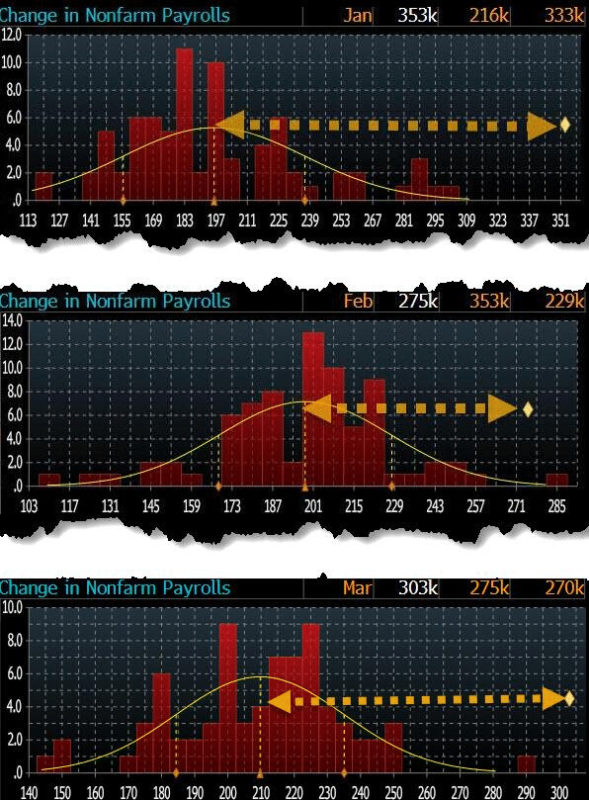

Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border.

Read More »

Read More »

Is gold too expensive to buy right now?

Share this article

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?

Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions...

Read More »

Read More »

Sound Individualism vs Toxic Collectivism

When it comes to the State, however, and all its ministries, branches and institutions, a very different set of rules seems to apply – a much more lenient, flexible and liberal one.

Read More »

Read More »

Private property rights under siege

People invest in gold for many different reasons. Many do so out of concern over economic, monetary or political uncertainty. Others seek a hedge against inflation, a way to protect and preserve the real purchasing power of their savings.

Read More »

Read More »