Tag Archive: hyperinflation

“Sound money must be anchored to and backed by real, tangible assets”

Dani Stüssi interview with Claudio Grass

Over the last few years, the financial woes and daily pressures that have been unleashed upon the average citizen, saver and taxpayer have put the spotlight on money itself. Countless ordinary people who have otherwise never seriously pondered these questions, began to question basic principles like: what makes their paycheck shrink from month to month, what or who actually responsible of it and what,...

Read More »

Read More »

A conversation with Prince Michael of Liechtenstein

On November 15th, 2021, almost 20 months ago, I once again had the rare and delightful opportunity to have a conversation with Prince Michael. His insights, and especially his directness and unequivocal honesty, have frequently provided me with a lot of food for thought in the past. This interview was no different. His candid and unfiltered responses to a wide variety of questions and topics made this conversation as illuminating as it was...

Read More »

Read More »

A crack-up boom in the making

The great Ludwig von Mises first described the concept of a crack-up boom as part of the Austrian business cycle theory, based on real life events that to an unsuspecting bystander might have appeared unconnected, or perhaps even quite bizarre and counterintuitive. Indeed, such a bystander might think the same of today’s economy and would likely have trouble making sense of the picture painted by stock markets, by our monetary and fiscal policies...

Read More »

Read More »

Inflation risk takes center stage – Part II of II

A lot of people might be aware of historical cases of hyperinflation, like that of Hungary and the Weimar Republic, or even contemporary ones, like that of Venezuela. And yet, these are taught or reported like extreme cases, very far removed from the daily experience of most modern Western citizens.

Read More »

Read More »

US election: Red flags for investors

Outlook and wider impact. As showcased during the debates and in the entire campaign rhetoric, politicians in the US but also in Europe, are solely focused on promoting solutions that only serve to paper over the problems and address the symptoms of the disease.

Read More »

Read More »

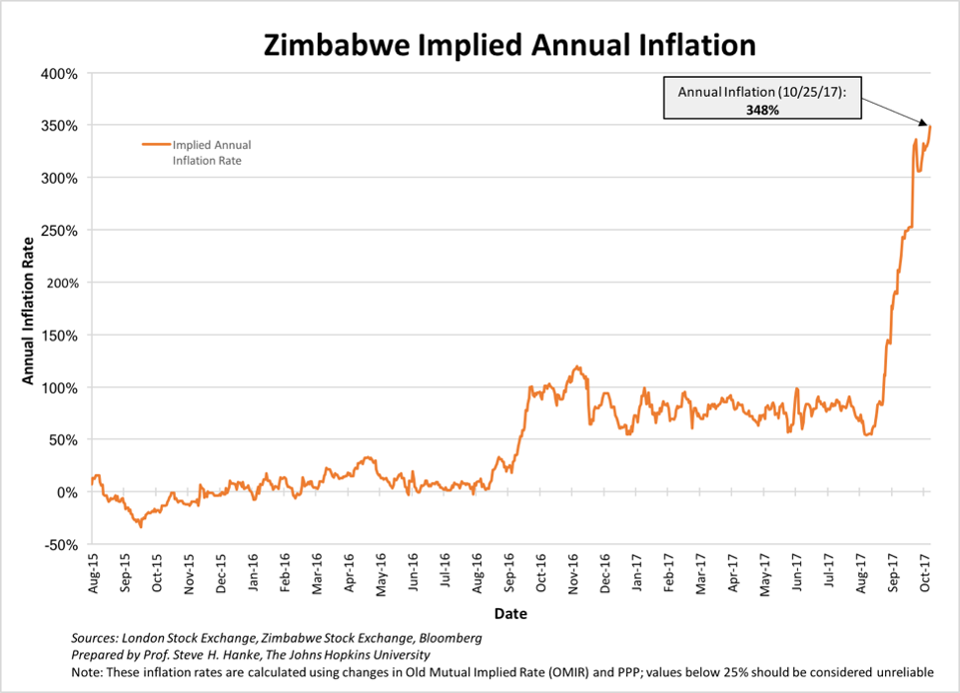

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

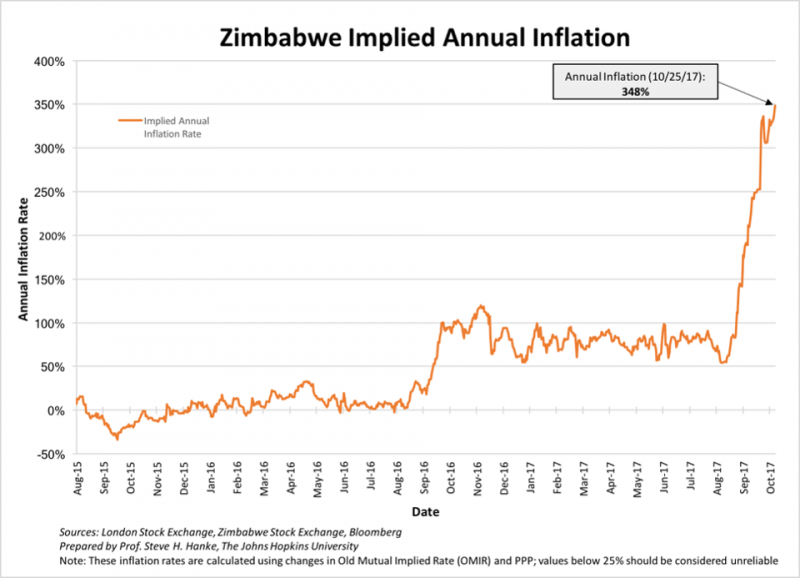

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe. Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis. Venezuela's new 100,000-bolivar note is worth less oday thehan USD 2.50. Maduro announces plans to eliminate all physical cash. Gold rises in response to ongoing crises.

Read More »

Read More »

Can Switzerland Survive Today’s Assault On Cash And Sound Money?

“Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world than in Switzerland.”

Read More »

Read More »

100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world's largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump.

Read More »

Read More »

“This Is Total Chaos” – Venezuela Shuts Colombia Border To Stop “Mafia” Currency Smuggling

As if things were not already chaotic enough in the socialist utopia of Venezuela, following President Nicolas Maduro's decision to follow Indian PM Modi's playbook and announce that the nation's largest denomination bill (100-Bolivars - worth around 3c) will be pulled from circulation in 72 hours, he has tonight closed the border to Colombia to crackdown on currency smuggling by so-called "mafias".

Read More »

Read More »

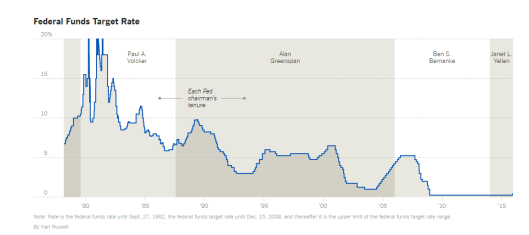

Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today's uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of "helicopter money" is about to be unveiled in Japan by the world's most experimental central bank. However, as Nomura's Richard Koo warns, central banks may get much more than they bargained for, because helicopter money "probably marks the end of the road for believers in the omnipotence of monetary policy who have continued to press for further...

Read More »

Read More »

“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that - as we predicted last week - Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual...

Read More »

Read More »

Fearing Confiscation, Japanese Savers Rush To Buy Gold And Store It In Switzerland

Japan has pushed further away from being the nation that embraces "Krugman Era" economics and deeper into the new "Bernanke Era" economics of helicopter money. As a result Japan's citizens have been on a blitz to save what little purchasing power they still possess, before hyperinflation finally arrives.

Read More »

Read More »

Nigeria Currency Devaluation Looms As FX Forwards Crash To Record Lows

Despite US equity investors' exuberance over bouncing crude oil prices, the world's crude producers continue to suffer and while Venezuela is in the headlines every day (having already collapsed into chaos), Nigeria appears the nearest to that abyss ...

Read More »

Read More »

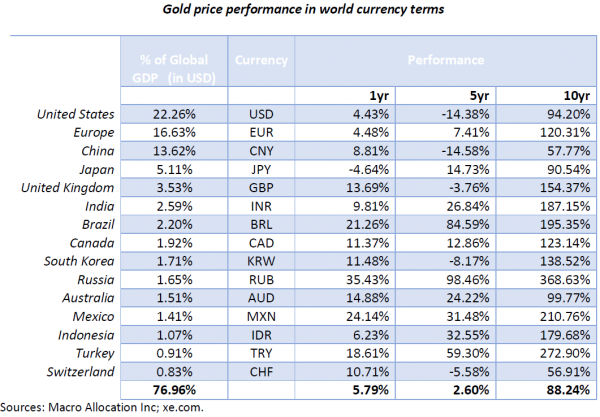

The Global Monetary System Has Devalued 47 percent Over The Last 10 Years

Authored by Paul Brodsky via Macro-Allocation.com,

We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most political...

Read More »

Read More »

Rick Rule – Gold Helps Me Sleep at Night

2022-10-14

by Stephen Flood

2022-10-14

Read More »