Tag Archive: deleveraging

Who is the Biggest Debt Time Bomb: Japan, France, the UK or the United States?

Some must reads: According to the Economist the biggest time bomb in the euro zone crisis is France.

We wonder why the United States and Britain, that have same weak trade balances, the same weak competitiveness and a debt overhang, shouldn't have a problem?

Just because France must do austerity according to the German Fiscal Compact wish, and the US and Britain do not need to do this?

Or like Ray Dalio called it, are the US and Britain...

Read More »

Read More »

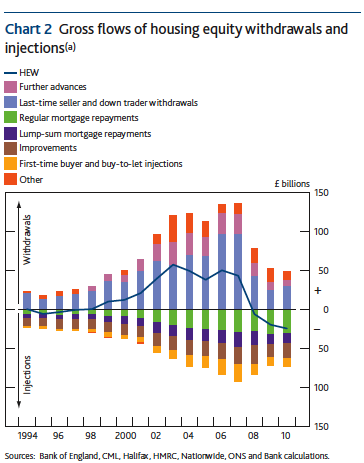

The Balance Sheet Recession: UK Q2 Housing Equity Injection Largest Since Q2 2011

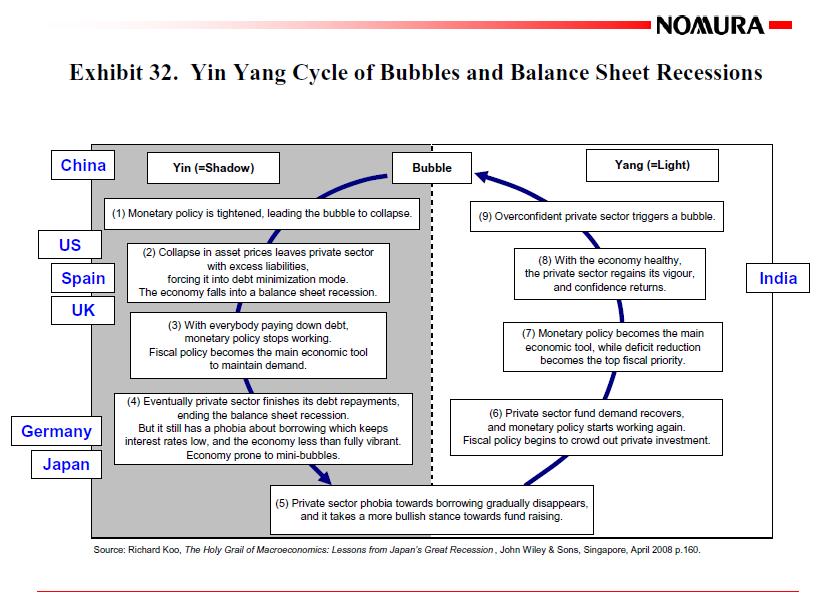

The American-Taiwanese economist Richard Koo, is the chief-economist of the Nomura Research Institute. In his theory of the Balance Sheet Recession he distinguishes between the “Yang” phase of the economy and the “Yin” phase (the so-called “balance sheet recession”). In “Yang” times companies want to increase profit and people consume a big part of their pay …

Read More »

Read More »

The “Beautiful” De-Leveraging

A beautiful deleveraging balances the three options. In other words, there is a certain amount of austerity, there is a certain amount of debt restructuring, and there is a certain amount of printing of money. When done in the right mix, it isn’t dramatic. It doesn’t produce too much deflation or too much depression. There is slow growth, but it is positive slow growth. At the same time, ratios of debt-to-incomes go down. That’s a beautiful...

Read More »

Read More »

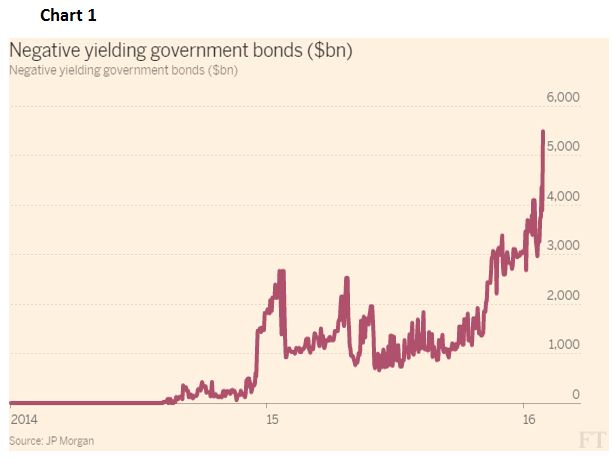

All roads lead to a euro zone break-up

For us all roads lead to a euro zone break-up and multiple sovereign defaults. Our reasoning can be summarized as follows: Equities are worthless when associated debt becomes encumbered (risk capital takes the first loss). Equity is not an asset; it is merely the remainder that is left over once debt is subtracted from …

Read More »

Read More »

Full text Spanish banks bailout: Memorandum of Understanding

Here the full text of the European’ Commission’s Memorandum of Understanding with Spain regarding the bailout of the Spanish banking sector released earlier today.

Memorandum of Understanding on Financial-Sector Policy Conditionally

Read More »

Read More »

The Northern Euro introduction: A retrospective from the year 2030

A retrospective from the year 2030 on two decades of failed european integration policy and 10 years of successful disintegration policy The following essay shows that currency regimes come and go over the time. Nothing is stable with the time, especially the use of a currency. What has never happened in history is the use …

Read More »

Read More »