The American-Taiwanese economist Richard Koo, is the chief-economist of the Nomura Research Institute.

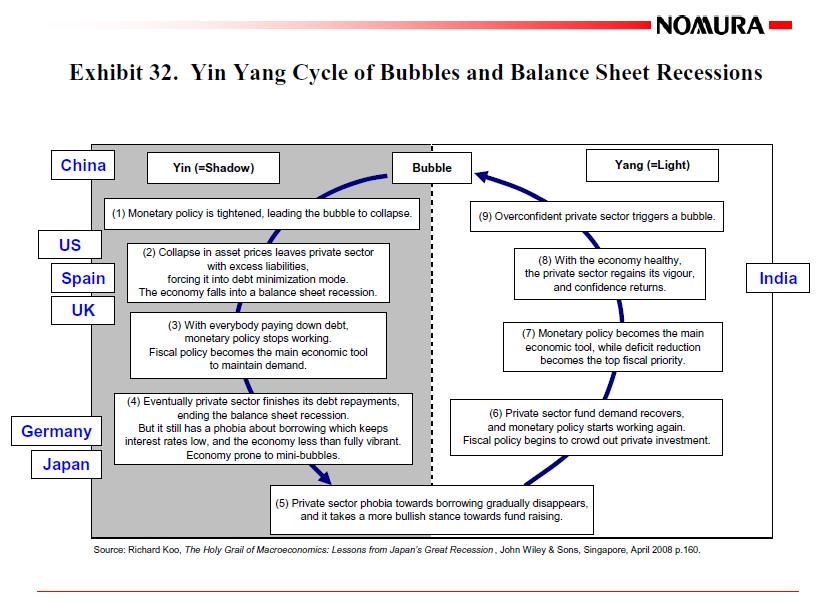

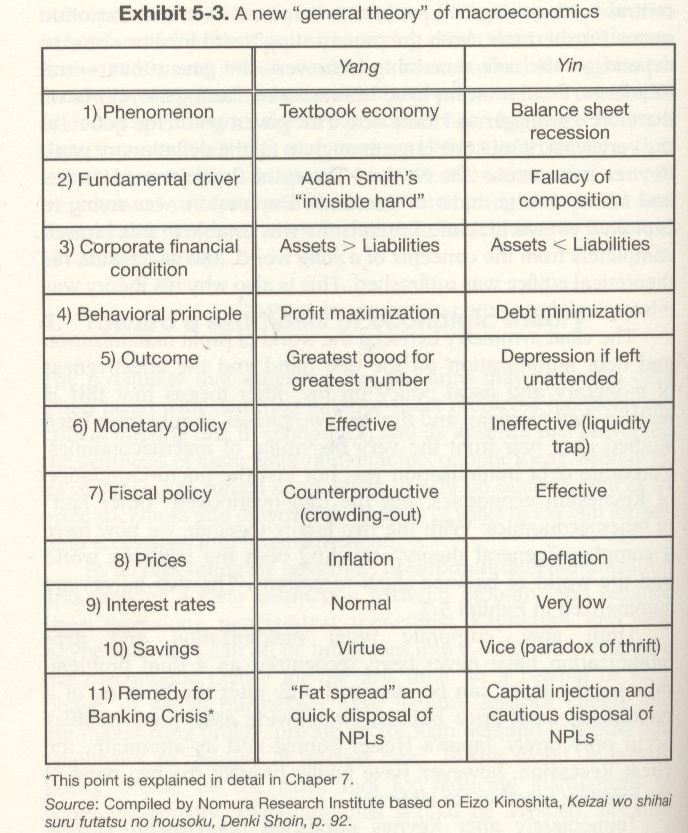

He distinguishes between the “Yang” phase of the economy and the “Yin” phase (the so-called “balance sheet recession”). In “Yang” times companies want to increase profit and people consume a big part of their pay rises. The mainstream economic principles are fully valid (for details see short-run, medium-run, long-run). In the very rare “Yin” periods, however, economic actors give a higher importance to debt reduction than to profit maximization.

Richard Koo’s book

Koo’s Theory: The Balance Sheet Recession

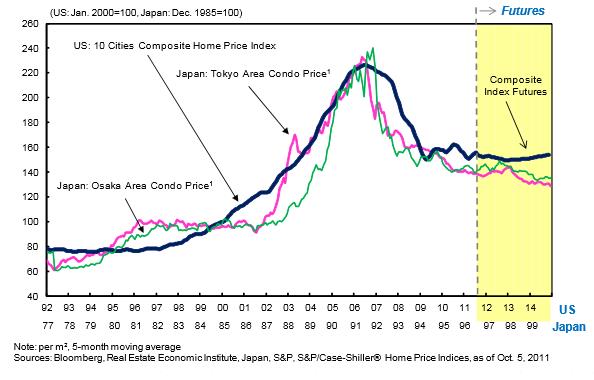

Koo’s theory is related to economists like Walter Bagehot, Hyman Minsky, Charles Kindleberger, who similarly to Austrian economists introduced a “Boom and Bust Cyle” or “Financial Instability Theory” caused by excesses of the financial sector. The boom phase is often visible in excessive appreciation of assets price (see below) and high debt. The sharp distinction to Austrians, however, is that Koo’s recipe against a balance sheet recession is public spending.

In the “balance sheet recession /Yin” phases economic actors want to reduce costs and debt. Many economic principles are only partially or not valid at all. Their underlying assumptions, that firms want to maximize profit and that the propensity to consume is considerably higher than zero, are not valid.

The way economies get into the balance sheet recession is the following:

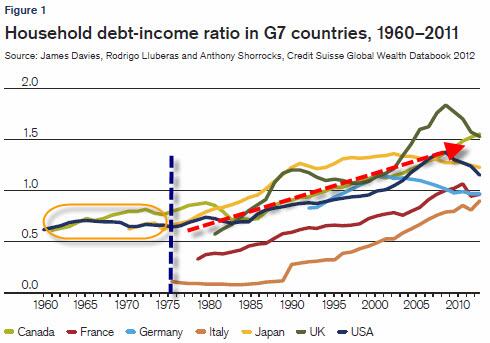

- The private sector builds up massive debt levels to buy property and speculative assets.

- Asset prices edge up as demand rises but then eventually the bubble bursts and the private sector is left with declining wealth but huge debt. Often richer, informed investors are able to sell the property early, but the ordinary people are often left with asset “under-water”.

Symptoms of a balance sheet recession:

- The private sector then starts restructuring balance sheets – and stop borrowing – no matter how low interest rates go.

- All effort is devoted to paying back debt (de-leveraging). Households increase their saving and reduced spending because they become pessimistic about the future.

- For borrowers who are under-water, a credit crunch might emerge – even if there are enough funds, banks cannot find credit-worthy borrowers to lend to.

- Attempts at pumping liquidity into the banks will fail because they are not reserve-constrained. They are not lending because no-one worthy wants to borrow

Koo’s Way-out from a balance sheet recession:

- According to Koo, the only way out of the “balance sheet recession” is via sustained public sector spending.

- The faltering spending causes the economy to grow very slowly. Especially when public spending helps, a recession and Irving Fisher’s deflationary spiral and the above credit crunch can be avoided. Still it leads to disinflation taking place over years and potentially to deflation, but not to a sudden .

Koo expects all countries who got stuck in a real estate bubble before 2008, to live a long-lasting balance sheet recession (Yin phase), whereas in 2010 Japan and Germany were about to leave the balance sheet recession.

Here the April 2008 version, when Koo thought that even China could see a balance sheet recession.

Central bankers and economists especially in the English-speaking countries and very influential papers like “The Financial Times” or “The Economist” strongly rely on the economic principles valid in the “Yang” phases and reckon that monetary policy is able to solve the issue of weak demand.

Koo’s new “general theory” of macroeconomics

Richard Koo created a new general theory of macroeconomics along the Yang and Yin phases.

Balance sheet recession in regular economic data: Home owners are paying down debt

The following news shows how the balance sheet recession affects daily life. British home owner continue to pay down their mortgages, instead taking loans against it as before the crisis. This reduces the ability for spending and therefore the GDP.

WEDNESDAY, OCTOBER 3, 2012 – 04:52

BOE: UK Q2 Housing Equity Injection Largest Since Q2 20l1

LONDON (MNI) – UK homeowners continued to inject substantial amounts of equity into their properties in the second quarter of this year, Bank of England data show.

Second quarter housing equity withdrawal was -9.829 billion, a net equity injection, the largest injection since the -10.187 billion HEW outturn in Q2 2011. Since June 2008 the BOE data have shown net injections, with the onset of the financial crisis rapidly reversing the previous trend for UK homeowners to borrow against their properties.

With mortgage rates and volumes low by historic standards the data have shown homeowners increasing their equity. HEW as a share of post-tax income held steady at -3.6% in Q2 and was last lower at -3.9% in Q2 2011.

Housing equity withdrawal is a measure of secured borrowing not invested in the housing market. It is the net result of increases in mortgage lending and capital grants minus household investment in housing

or the following from a FreddieMac analysis:

As we noted above, our analysis also shows that more borrowers are paying their principal down faster than the scheduled amortization prior to refinancing. Before the Great Recession this segment represented between 3 and 9 percent of all borrowers by year; since then about 11 to 19 percent have paid down additional principal prior to refinance. (source Freddie Mac)

The Balance Sheet Recession in the United States

Thanks to the St. Louis Fed (direct link)

Germany and Japan reduced private debt since year 2000, while others accumulated

Read also: Koo’s 2012 update of the balance sheet recession

See more for