Tag Archive: austerity

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

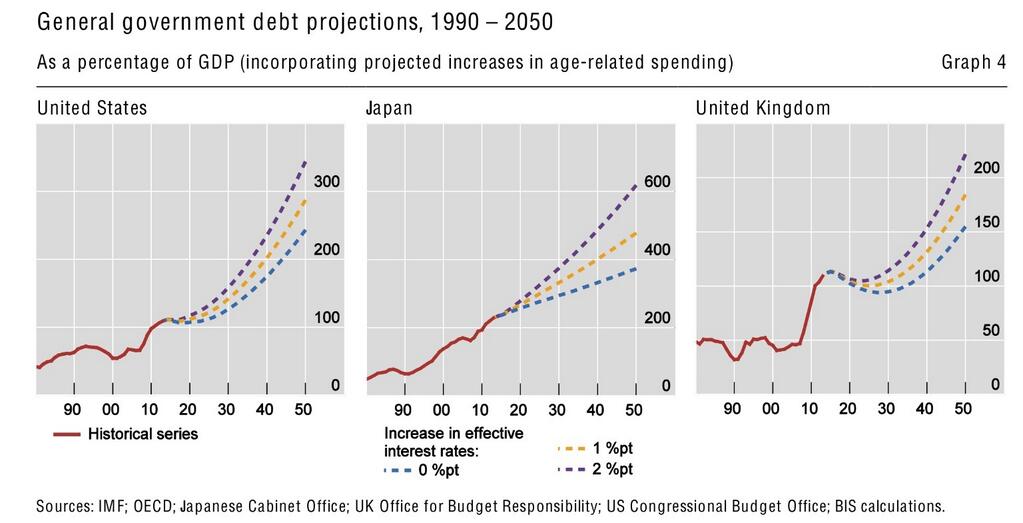

Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Read More »

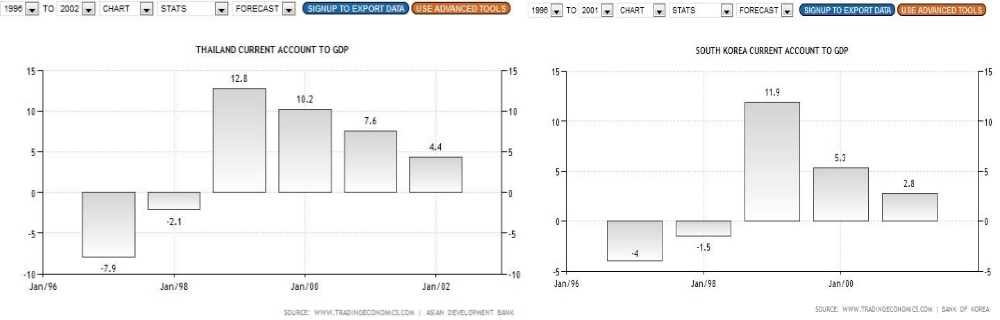

Financial Cycles History, 1998-2002: The Dotcom Bubble and Bust and European and Asian Austerity as its Enabler

In this post we present financial and credit cycles in the history: Due a weak credit cycle, Germany was a weak economy under many other weak ones.

Read More »

Read More »

Why There Won’t Be A Strong Dollar, Even If The Financial Establishment Thinks So

In this second part of our series we provide arguments why the widely expected strong dollar period might not come. We look at the most important economic indicators that might justify a stronger dollar: the ISM manufacturing index and the interest rate differences between the U.S. and Europe.

Read More »

Read More »

Strong Dollar: the Parallels Between Now, the 1980s and 1998-2002, Part 1: Austerity

We examine the relationship between strong dollar phases and austerity in other parts of the world. Between 1983 and 1985 one reason for the strong dollar were high real interest rates in the U.S. after the defeat of the Great Inflation period, the enforced austerity in Southern America and cheap commodity prices caused by generally …

Read More »

Read More »

Why it Makes Sense to Exit the Euro Zone in Times of Balance Sheet Recessions

Italy will follow Japan for decade(s) of balance sheet recession. There is one mean to avoid it. The periphery should use current positive market sentiments and low inflation to exit the euro zone.

Read More »

Read More »

Fast Fact: Germany paid 5% Interest and Had 0.5% Average Growth between 1996 and 2002

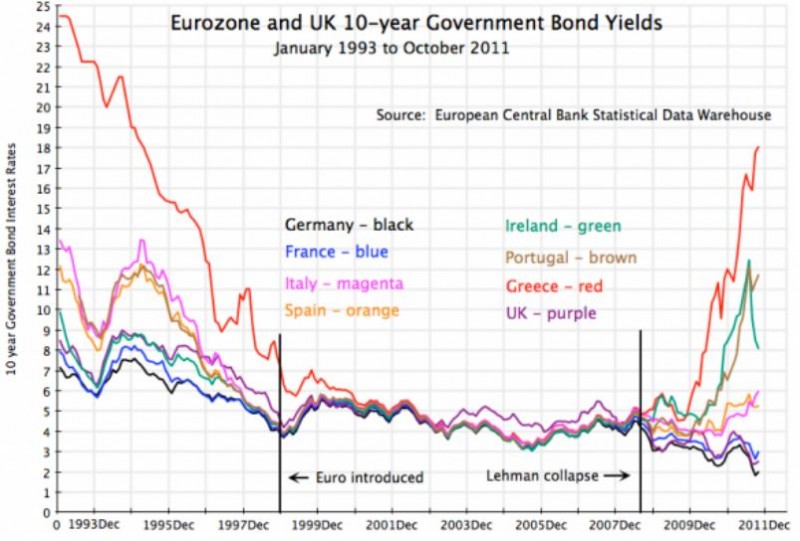

Most recently the Bundesbank critised the ECB decision to reduce Italian yields contained in the OMT program. To put things into perspective: Germany paid 5% interest for 10 years government bonds between 1996 and 2002. This at average inflation-adjusted GDP growth rates of 0.5%. But there was no ECB that was buying German bonds …

Read More »

Read More »

The Transfer Union from South to North since 2008: Wolfgang Schäuble, the Evil Genius of the Euro Crisis

Wolfgang Schäuble has become the evil genius of the euro crisis. He has understood that the Cyprus crisis won't lead to a bank-run and collapse of capital markets. We all know that the US is now recovering.

Read More »

Read More »

A Century Of French And Italian Economic Decline

Italy overtook Japan with the worst real GDP growth of all advanced economies since 1991 (0.79% per year, an amazing and sad distinction). Italians and French are clearly getting tired of austerity.

Read More »

Read More »

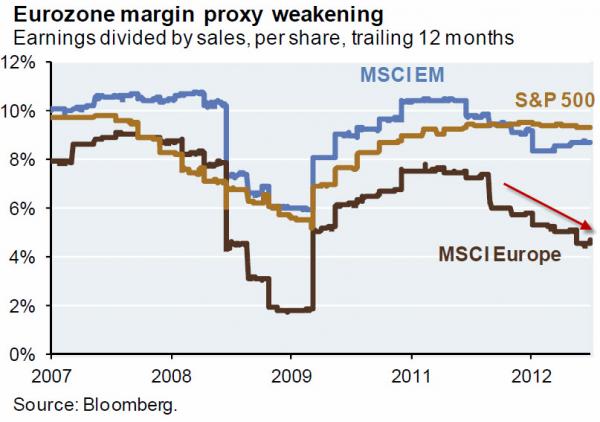

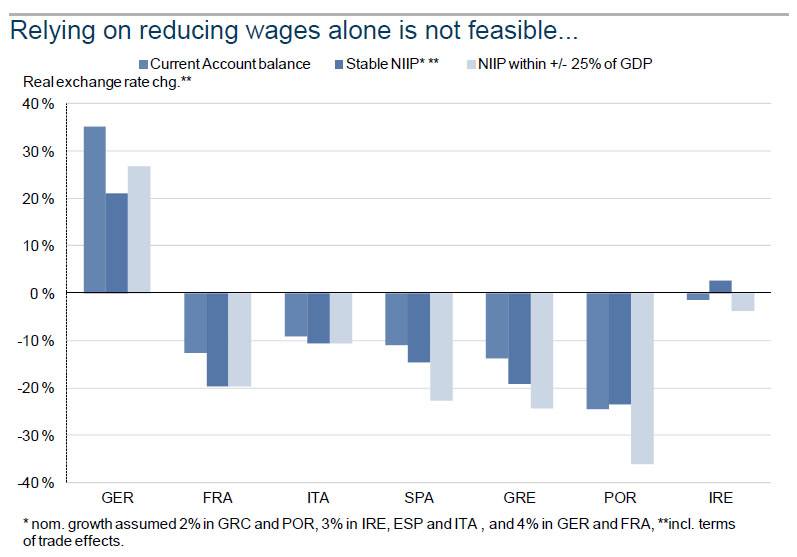

Goldman Sachs: Reducing Wages in Periphery Is Not Enough

The must-read Goldman analysis on Zerohedge: it is not enough to reduce wages in Greece or Spain. These countries will see lost decade(s). Completely in-line with our analysis that

Read More »

Read More »

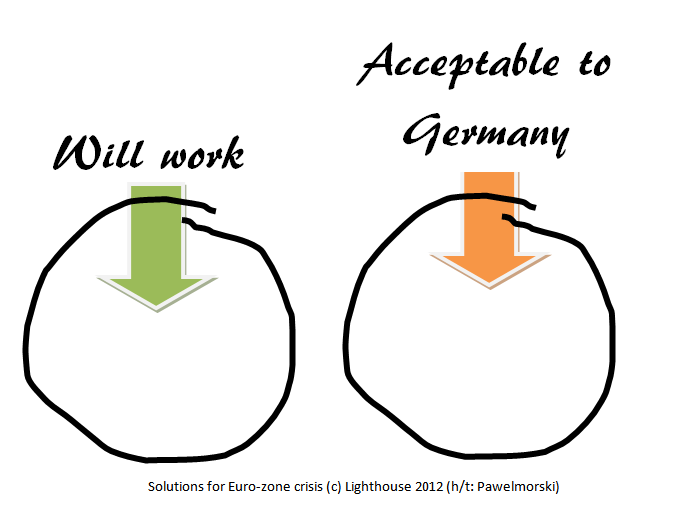

Who Says No to Austerity and Global Imbalances, Must Say Yes to the Northern Euro

Eventually the euro will be abolished, a Northern Euro introduced: politicians and their economic advisors might just be waiting for a calm moment, especially with upcoming German inflation.

Read More »

Read More »

About the Impossibilities of the Common-Currency-Recession-Austerity Cycle

Charles Wyplosz, Professor of International Economics, Graduate Institute, Geneva repeats our arguments in "Who says No to Austerity, Says Yes to the Northern Euro" about the impossibility of getting out of the common currency - recession - austerity - cycle. Similar as we do, he proposes a public...

Read More »

Read More »

History: The Lost 1980s Decade in Latin America

Peripheral Europe is going to follow step and step the Mexican and the resulting Latin American debt crisis of the 1980s.

Read More »

Read More »

The “Beautiful” De-Leveraging

A beautiful deleveraging balances the three options. In other words, there is a certain amount of austerity, there is a certain amount of debt restructuring, and there is a certain amount of printing of money. When done in the right mix, it isn’t dramatic. It doesn’t produce too much deflation or too much depression. There is slow growth, but it is positive slow growth. At the same time, ratios of debt-to-incomes go down. That’s a beautiful...

Read More »

Read More »

The End of ECB Rate Cuts or Draghi against Weidmann to be Continued..

Even in the unlikely case of a fiscal union, the conflict “Draghi against Weidmann”, between the ECB and the Bundesbank will continue for years. The ECB mandate and european inflation figures do not allow for excessive ECB rate cuts or for state financing via the printing press, but Draghi wants to help his struggling …

Read More »

Read More »

All roads lead to a euro zone break-up

For us all roads lead to a euro zone break-up and multiple sovereign defaults. Our reasoning can be summarized as follows: Equities are worthless when associated debt becomes encumbered (risk capital takes the first loss). Equity is not an asset; it is merely the remainder that is left over once debt is subtracted from …

Read More »

Read More »

At the Euro summit there was nothing really new. What was the party about ?

At the euro summit today there was essentially nothing what was really surprising. We wonder what markets are so excited about.

Read More »

Read More »

The win of the pro-bailout parties in the Greek elections was no win for the SNB

The win for the pro-bailout parties in the Greek elections was no win for the Swiss National Bank (SNB), even if the fear of an immediate bank-run and extreme money flows into Switzerland are avoided. Also the fact that QE3 is not coming in the next weeks did not help the SNB.

Read More »

Read More »