Even in the unlikely case of a fiscal union, the conflict “Draghi against Weidmann”, between the ECB and the Bundesbank will continue for years. The ECB mandate and european inflation figures do not allow for excessive ECB rate cuts or for state financing via the printing press, but Draghi wants to help his struggling home country.

For anybody who had read our posts on the euro crisis in the last months, the recent discussion between Draghi and Weidmann was no surprise.

For anybody who had read our posts on the euro crisis in the last months, the recent discussion between Draghi and Weidmann was no surprise.

These were our ideas:

- Eurobonds, fiscal or banking union are all pure utopia (on June 22nd, 2012, also here on Testosteronepit)

- Germany and other Northern states will not pay for cheaper PIIGS funding (starting at point 19 of our Italy essay, on July 22nd)

- The Northern states prevent any further funding like ECB monetizing. Therefore it can be expected that ECB purchases of government bonds will be limited this summer despite market turbulences

- Even the German opposition is against a direct ESM financing of PIIGS banks or a banking union. (point 20, on July 22nd)

- Bold steps are taken only when the global economy is in danger (like in autumn 2011) (see point 22). This is NOT NOW.

- Economic data: The euro zone crisis seems to be far away from Germany despite some bad PMI data.

- Why the euro has recovered? Here we explain why the German Q3 GDP growth will be stronger than the UK again. The reasons for the recent German bad PMI data can be found in the bust of the QE2 induced Chinese real estate bubble and austerity in the periphery, but not in a significant reduction of German consumer demand.

The conflict between the ECB and the Bundesbank has only started

Bloomberg even called the Bundesbank to put up or to shut up.

Weidmann decided not to shut up but to put up:

Weidmann: ‘Too Close to State Financing Via the Money Press’ (Der Spiegel)

Juergen Stark, the former ECB chief economist who quit in protest against the ECB, piled on the German resistance in the Handelsblatt on Tuesday, saying the ECB is out of her mandate when she finances states and she would ultimately no longer be able to deliver stable prices.

Draghi answered to the critics:

Draghi Hits Back At German Criticism Of ECB Bond Plan (Bloomberg)

Like always Bloomberg claims that “Chancellor Angela Merkel … signaled broad support for ECB bond buying. One should remember that Merkel often only talks, but others like Weidmann act.

Austria, Netherlands and Finland have strong Anti-Euro oppositions, Germany not yet

The sentiment against the euro is stronger in the Netherlands, where for the first time left-wing parties oppose the euro and this probably with success. Together with the right-wing Freedom party of Geerd Wilders, anti-euro parties might achieve 35%.

In Austria the business man Frank Stronach initiated a libertarian anti-euro movement. This adds another party to the already existing right-wring anti-euro FPÖ and BZÖ, who count already now about 20-25% of votes.

The ani-euro party True Finns achieved 19% in the 2011 elections. Even if they did not join the government, their opposition puts pressure on the finnish government. The continous Finnish demand for collateral at any bailout makes this obvious.

Given this strong opposition in other countries, it is clear that Weidmann is not alone to oppose the ECB decisions.

Bloomberg should remember that Merkel wants be reelected in autumn 2013:

- More than half of Germans want Greece to leave the euro. Many politicians of Merkel’s party want these German votes and utter these ideas in public.

- Germans do not want a banking union, therefore the German opposition is against it (see point 20 here). Merkel would be stupid to leave this critics to the opposition and risk her re-election.

- 51% of Germans think that Germany is better off without the euro.

The ECB Price Stability Mandate and the Governing Council

Bloomberg is correctly saying that Germany does not have more votes in the ECB governing council than other countries, each vote of the 23 governing council members counts as one equal vote.

However the ECB does not have a dual mandate like the Fed. The target of the ECB mandate is ONLY price stability, defined as 2% harmonized consumer price inflation (HICP). As opposed to the Fed, there is a one clear quantitative target of (close to) 2%. Therefore it is not a majority that decides, like Bloomberg suggested, but a clear and simple number. If the central bank decides to cut rates even if inflation is over 2% then she must have good reasons that inflation will go down under 2%. Otherwise she violates her mandate, even if “legitimized” by a majority decision.

The leading ECB executive body consists of the six members from the “executive board”, of which four often come from the big countries Germany, France, Italy and Spain. Monetary decisions are taken by the “governing council”, the members of the executive board together with the seventeen national central bank presidents.

The following is the current composition of the ECB governing council. There are three groups:

- “Doves” or pro europeans from countries that profit of european institutions (like Belgium and Luxembourg)

- Central bankers from countries with higher inflation and low debt, they will need higher rates. They tend to be hawks, even if their countries take profit of EU adhesion funds.

- The ones from countries without structural problems who finance the other ones (via ESM or ECB bond buying), the “hawks.”

| Members of countries with structural problems, “doves”,

or strong pro-European

|

Countries with higher inflation,

low debt, rather hawks when inflation picks |

Countries without structural problems, “hawks” |

| Mario Draghi, ECB president,

Ignazio Visco (both Italy) |

Jozef Makúch (Slovakia): 3.8% inflation | Peter Praet, Executive board (chief economist) |

| Vítor Constâncio, ECB vice pres.

Carlos Costa (both Portugal), |

Ardo Hansson (Estonia): 4.1% infl. | Jörg Asmussen, Executive board |

| Luc Coene (Belgium) | Josef Bonnici (Malta): 3.8% inflation | Ewald Nowotny (Austria) |

| Georgios Provopoulos (Greece) | N,N., member of the executive board | Jens Weidmann (Germany) |

| Benoît Cœuré, Executive board,

Christian Noyer (both France) |

Erkki Liikanen (Finland) | |

| Yves Mersch (Luxembourg) | Klaas Knot (Netherlands) | |

| Marko Kranjec (Slovenia) | ||

| Patrick Honohan (Ireland) | ||

| Luis Maria Linde (Spain) | ||

| Panicos Demetriades (Cyprus) |

Further ECB Rate Cuts not be expected

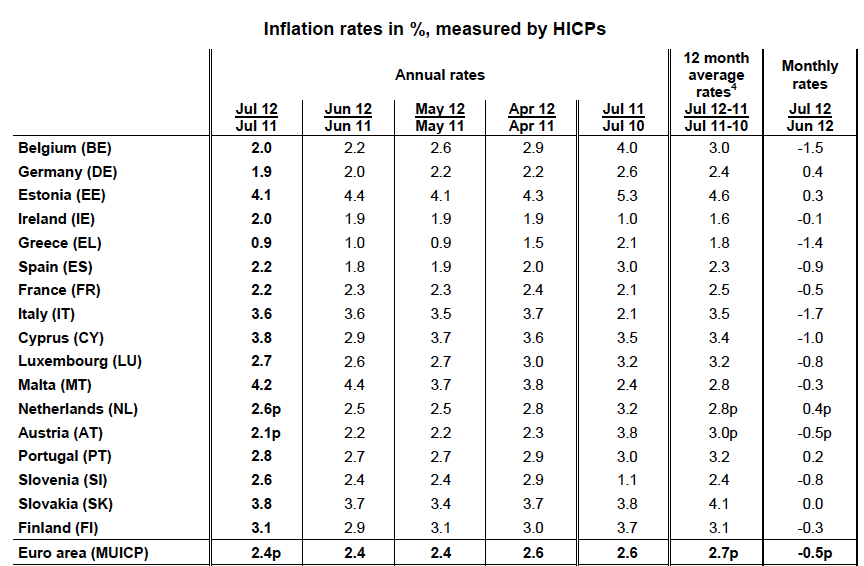

When Draghi cut rates recently, his argument was that HICP inflation would fall under 2%. Looking at the details of the HICPs, we can see that the recent ECB rate cut was close to contradicting the ECB mandate, only the majority of doves might have helped him to sustain this risky decision.

Draghi can be happy that the low German inflation (1.9%) pushed down total inflation in the Euro zone. His home country Italy had 3.6% inflation, a number clearly out of the ECB price stability mandate of 2% !

The HICP baskets of many Southern and Eastern European countries have heavy weights in food, energy and other consumption goods, because these countries are poorer than e.g. United States, Germany, Japan or Switzerland. For China this point is even stronger, therefore economists regularly speak of Chinese “food inflation”.

A (slowly) recovering US, bad harvests and demand from developing economies put upwards pressure on oil and food prices. This and higher German and Northern and Eastern European wages might prevent that total euro zone HICP inflation moves under the threshold levels of 2%, whereas disinflation will reign in Spain and soon in Italy for a couple of years.

This means that there is no room for further ECB rate cuts. On the contrary, in December 2012, one year after the cheap oil and food prices of end 2011 , deflationary tendencies might wash out on YoY basis, and the ECB will need to hike rates again.

And Bloomberg and Draghi will shut up again.

Tags: austerity,Bailout,Draghi,ECB,Euro crisis,Eurobonds,European central bank,Eurozone,Eurozone Consumer Price Index,Fiscal Union,food inflation,Libertarian,PMI,Switzerland,Testosteronepit,zone