Tag Archive: Euro crisis

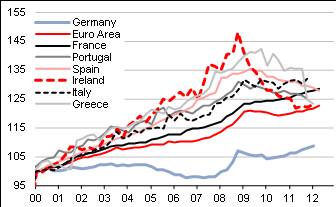

“The Eurozone faces the worst combination of economic and systemic risk”

The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally.

Read More »

Read More »

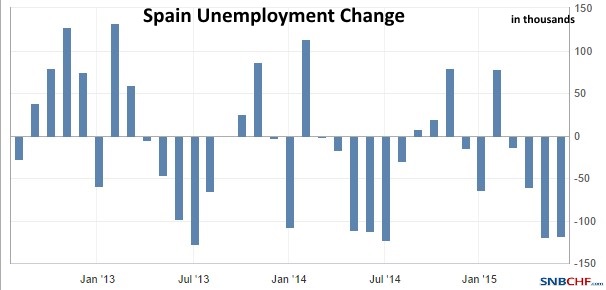

Eurocrisis, Myth and Reality, part 1: Big Job Creation in Spain

In the new series George Dorgan suggests that the euro crisis is a temporary development but not a long-lasting crisis. In the first part he shows that Spain actually created a lot of jobs in last twenty five years.

Read More »

Read More »

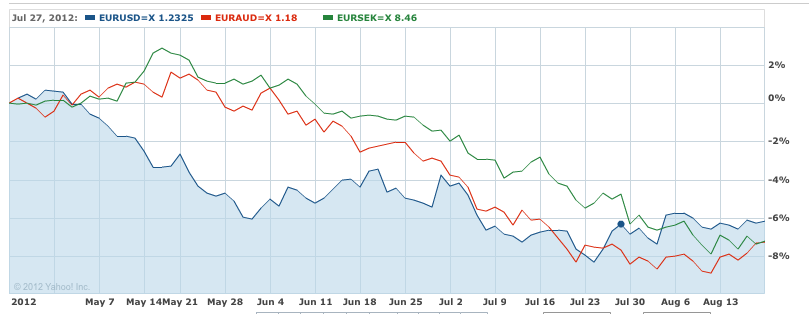

(13.1) Is the Swedish Krona a Safe-Haven?

Arguments in favor of and against the Swedish Krona,as safe-haven during the euros crisis. Extracts from tradingfloor.com

Read More »

Read More »

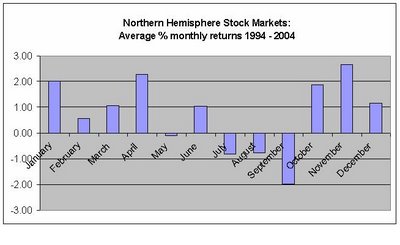

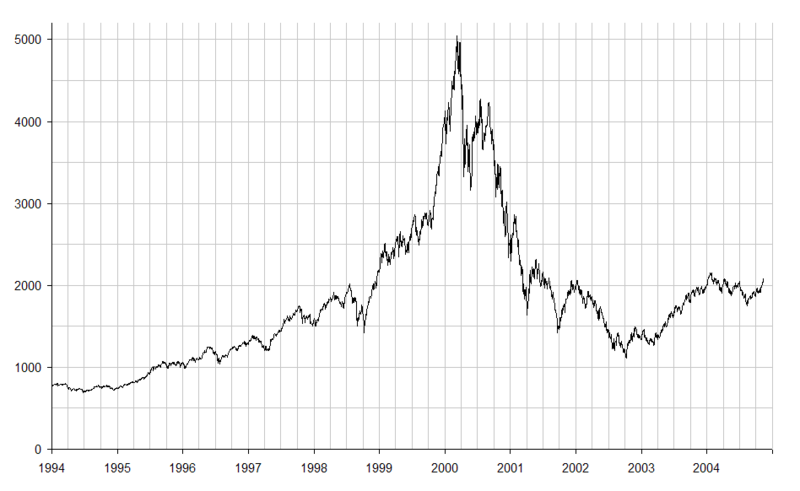

The “Sell in May, Come Back in October” Effect and the 19 Fortune-Tellers of the FOMC

The U.S. economy regularly improves between October and April, this year additionally fueled by "unlimited" quantitative easing, weaker gas prices and higher competitiveness thanks to a stronger Chinese yuan and weaker Asian economies. Update 2013: The Case-Shiller index continued to climb in April 2013; it became clear that this year the "Sell in May" …

Read More »

Read More »

Cyprus Levy on Deposits: New Escalation or Final Stage of Euro Crisis?

Nicosia will impose a 9.9 percent one-off levy on deposits above 100,000 euros in Cypriot banks. This constitutes maybe the final stage of the euro crisis, with the very last country to be rescued. Or will it be a new escalation and may be the most dangerous one, a bank-run? How many Cyprus clients managed …

Read More »

Read More »

The “Get Stress in May and Relax in October Effect” for the SNB

The U.S. economy regularly improves between October and March. The SNB should use the moment to sell some currency reserves. From May on, the typical seasonal effects will push the SNB into a defense.

Read More »

Read More »

Sinn: The Euro Crisis Is Not Solved

In 2012, austerity, the commitment of ECB and Fed and the weak euro helped to reduce peripheral yields, current account and partially fiscal deficits. The euro zone has possibly won the war. Now the weak countries need to win the peace, namely generate growth via competitiveness says

Read More »

Read More »

German Economists and Merkel, the Implicit Followers of the Gold Standard

With ECB's OMT & "conditionality", that requires austerity and implicitly reduction of salaries in European periphery, Merkel & German economists have created consequences similar to a gold-standard.

Read More »

Read More »

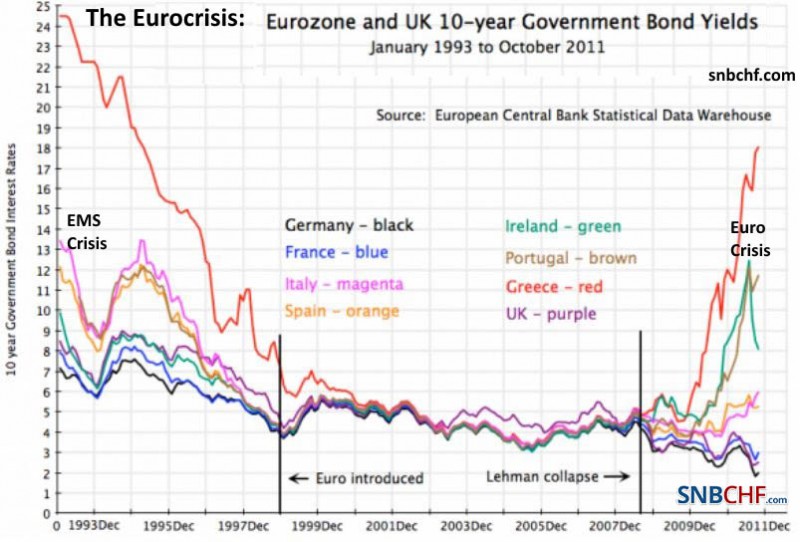

The Euro Crisis: Details and chronology and the German Perspective on it

The history of EU reforms, bailouts during the euro crisis and the German perspective on them

Read More »

Read More »

What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?

On Friday there was a big movement in the EUR/CHF. First it went up to 1.2154, fell later down to 1.2080 in the main American trading and rose again to 1.21 in the low-volume trading time. We repeat our entry from Friday, because we continuously updated the post after new developments, e.g. after the … Continue reading »

Read More »

Read More »

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

In this post we show that the risks the Fed, the ECB and the Bundesbank incur are far smaller than the one the Swiss SNB takes. The Fed has “just” an inflation risk, that could cost 200 billion US$, 1.2% of US GDP. The ECB and Bundesbank have the risk that the euro zone splits … Continue reading »

Read More »

Read More »

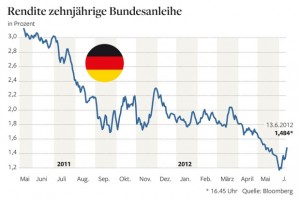

Eurobonds, fiscal or banking union are all pure utopia

Germany’s stance in the euro crisis: More than ESM will not be possible for many years updated on August 31, 2012 German politicians and the German Bundesbank believe that the Euro crisis can be only solved by supply side reforms as formulated in the Euro Plus Pact, reforms that were already successfully introduced during the Thatcher/Reagan era in the …

Read More »

Read More »

The End of ECB Rate Cuts or Draghi against Weidmann to be Continued..

Even in the unlikely case of a fiscal union, the conflict “Draghi against Weidmann”, between the ECB and the Bundesbank will continue for years. The ECB mandate and european inflation figures do not allow for excessive ECB rate cuts or for state financing via the printing press, but Draghi wants to help his struggling …

Read More »

Read More »

The Swiss television interview with Thomas Jordan, or was it Leonid Brezhnev ?

Today Thomas Jordan gave a quick interview in the Swiss television. Everything was so well prepared and as sterilized. Thomas Jordan learned all answers by heart and was answered the questions about one second after the question was asked. It reminded me of an interview in Soviet television with former Soviet leader Leonid Brezhnev. Each …

Read More »

Read More »

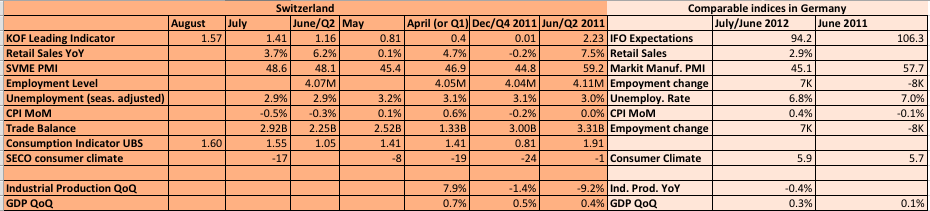

Why the euro has recovered? or are Markit PMI really reliable?

Here a follow-up of our contribution on Seeking Alpha written on August 15th, with the title “Are Markit PMIs really reliable?“. We recommended to go long the euro and the Swiss franc against the US dollar and sterling, because the Markit PMIs were not in line with trade balance data. Previously we suggested in … Continue...

Read More »

Read More »

8) Euro Crisis and Euro Macro

We are currently looking for a curator that takes over the euro macro category. The Euro Crisis and its Reasons, details and chronology, German economists ,Eurobonds, fiscal or banking union,Who Says No to Austerity, Says Yes to the Northern Euro Ways to the Northern Euro

Read More »

Read More »