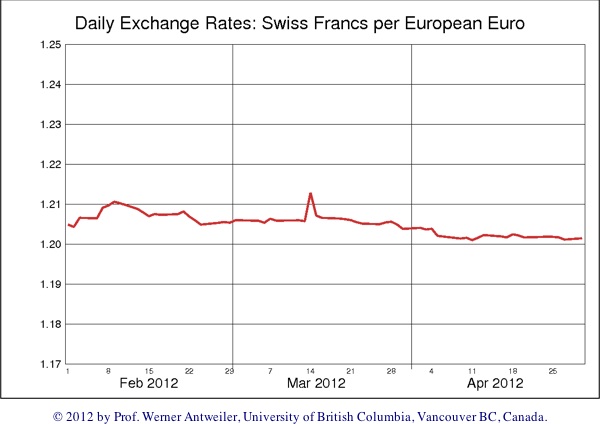

On Friday there was a big movement in the EUR/CHF. First it went up to 1.2154, fell later down to 1.2080 in the main American trading and rose again to 1.21 in the low-volume trading time. We repeat our entry from Friday, because we continuously updated the post after new developments, e.g. after the NFP data. Many subscribers did not read the whole story.

After the slight contraction of Swiss GDP by 0.1%, rumors on a floor hike are coming up again. We just wonder if these FX speculators have deep pockets enough to absorb all SNB reserves.

Secondly, we wonder why the FX market moves the exchange rate to more than 1.2150, when there is just a rumor of a 1.22 floor. There is no room left to make gains for these traders, but they simply have a big risk.

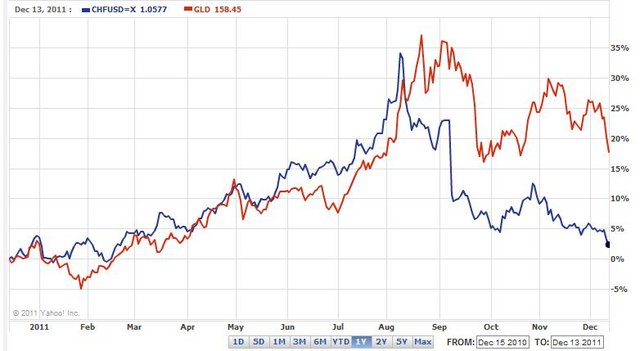

Thirdly, the ugly US NFP today will trigger stronger safety flows into gold and the correlated Swiss franc.

- Forex traders

- Hedge funds with mid- and long-term perspective

- Private investors, their asset managers and non-financial companies

- Global Macro funds and investment bank traders

Forex Traders

Volumes caused by these Forex traders are relatively low in the medium and long-term. Their trading may effect exchange rates; but as quickly as these traders buy their positions, they sell it again. If the SNB does no big CHF purchases, the EUR/CHF can remain several weeks above the floor level of 1.2010. Between November and April 2012, the SNB bought francs and slowly moved the exchange rate from 1.22 towards 1.20, often only 1-2 pips per day. This was similarly based on rumors about a floor hike, especially before the March SNB meeting. Since November 2011, the Swiss economy has recovered more than expected, however the euro crisis has deepened. The SNB seems to be happy with the 1.20, because it stabilized the Swiss economy, but she is unhappy with the explosion of reserves. Hiking the floor would be the worst thing the SNB could do. It would increase her risk tremendously. Already now 73% of each Swiss income is invested in euro. We might have entered a phase during which the SNB is able to sell some of her reserves to these FX traders. We explained in a previous post that due to seasonal factors these selling phases often last from September/October to March. Between April and September, however, the central bank had to increase reserves and/or accepted a defeat. 2007-October 2009: EUR/CHF moves downwards from 1.60 to 1.50. Despite currency interventions the SNB cannot stop the trend. April 2009-April 2010: EUR/CHF depreciates from 1.50 to 1.40. The SNB is able to sell reserves, but must accept losses. April 2010- June 2010: The SNB is constrained to increase reserves from 200 to 300 bln. CHF, but the exchange rate stays around 1.40. In June 2010 the SNB accepts its defeat. July 2010 – August 2011: EUR/CHF moves from 1.40 down to levels around 1.10, when Swiss inflation picked up. The SNB is able to sell reserves of around 50 bln. CHF, but takes big losses. September 2011: The SNB hikes the exchange rate to 1.20 from low levels that even touched parity. This costs 130 bln. CHF in reserves. September 2011 – March 2012: Speculation about a floor hike: The SNB sells euros and the market is happy to buy them. Thanks to these traders the SNB sells Forex positions of 35 bln. CHF May 2012-July 2012: The SNB must strongly intervene and increase reserves by around 140 bln. CHF. We think that this pattern, namely rise of reserves followed by reserves selling and potential SNB losses will continue over the next five to ten years. The EUR/CHF is poised to fall to parity, the question is just when. If the global economy improves then maybe next year due to slowly upcoming Swiss inflation. If not then it will take 2-5 years,; during this time money will continue to flow out of euro zone, may be now even out of Germany. For us, the euro crisis has just started in summer 2011. Till then there was another crisis, namely the one of the United States. Due to the relatively high USD/CHF exchange rate and rising QE3 hopes, we are not sure that the SNB will be even able to reduce reserves between September 2012 and March 2013. There were some blogs and media who blamed hedge funds to bet against the Swiss National Bank (SNB). This seems to be finished by now, the EUR/CHF is currently rising again. Hedge funds effectively moved funds back into the franc in May this year after Thomas Jordan declared that the floor will not be raised: “We can not arbitrarily manipulate our currency. In an even worse crisis situation this would be disastrous and counterproductive. The minimum price must be legitimized. The current minimum rate is realistic and has helped the Swiss economy.” Like often, hedge funds are the first to react to a longer term trend. By now hedge funds are already sufficiently invested in francs or they closed their short positions. “What we have seen is strong inflows into the Swiss franc in May and June and predominantly from hedge funds. Hedge funds have been buying the Swiss franc since the start of May and they were already reducing their short positions in April,” said Richard Cochinos, currency strategist at BofA-Merrill Lynch Global Research. (source WSJ in July, 13th, 2012) Volume caused by hedge funds is low to moderate. Their horizon is medium to long-term. Between May and July, money from rich private investors, their asset managers and non-financial companies moved into francs. After some discussions in the Swiss press in May about the floor, these moves even intensified. The CHF is similarly attracting as gold and often moved in strong correlation with the yellow metal, at least till the moment when the SNB set the floor. According to flow data from UBS all four types of clients–asset managers, private clients, hedge funds and non-financial companies–sold the euro against the franc last week. What’s more, asset managers have been doing this for 10 straight weeks, while firms have been at it for eight weeks and private clients for 12. (source WSJ in July, 13th, 2012) To our minds, these investors cause about of 90% of mid and long-term volume of Swiss franc investments. Their horizon is long-term. They want return of money and not return on money. With the CHF they are sure that the money comes back. As opposed to FX traders they usually do not sell their positions. After the ECB decided the lira-isation of monetary policy, i.e. low growth (enforced by conditionality and austerity) and high inflation (caused by monetary expansion), we expect further inflows into the Swissie in the next weeks. These inflows will come especially from rich German investors, who strongly doubt the ECB policy: Handelsblatt’s deputy editor in chief, Florian von Kolf wrote, “Today is a black day for democracy…Merkel is silent…seemingly happy to have been partly relieved from her here Sisiphus task to save the euro”. . Even the socialist opposition is against the ECB move. DPA reports that SPD parliamentary leader Frank-Walter Steinmeier argued that the ECB’s decision is the “documentation of Chancellor Merkel’s failure…[while Weidmann] protests but Merkel gives the green light”, The floor level 1.2010 should be reached in the next weeks, depending on the speed the SNB sets on selling her euro reserves. May be already in the next week at the SNB monetary policy assessment meeting. Global macro funds and traders of (especially) US investment banks anticipate the movements of long-term investors. Therefore the EUR/CHF fell again today, when the bad US job numbers came in, QE3 talks intensified and demands for safety beyond the dollar rose. These funds and the investment banks are able to generate a lot bigger volume than the FX traders mentioned above. Carry traders, a fifth group, who base their trade on cheap CHF financing, are not present any more, at least for the Swissie. Their aim was return on money. They dominated the CHF market between 2004 and 2008 based on far too cheap money from the SNB. Trade with the SNB, macro funds and rich investors, buy francs and sell the euro. It is perfectly possible that the SNB Forex reserves rise this week, but FX traders push the EUR/CHF upwards. Over the mid-term the SNB will try to sell her euros and the EUR/CHF will move downwards again. The bad US NFP today will trigger stronger safety flows from long-term investors into gold and Swiss francs. In late and Asian low-volume FX traders with their rumor story will take over the command again. On Thursday after the SNB meeting, all these rumors should be finished. Were hedge funds betting against the SNB ?

Private investors, asset managers and non-financial companies

Global Macro funds and investment banks traders

How to trade it ?

Tags: Deposits,ECB,Euro crisis,Federal Reserve,Gold,Monetary Base,monetary data,Monetary Policy,QE3,Quantitative Easing,SNB sight deposits,Swiss National Bank,Switzerland Money Supply,UBS

5 pings

Guest Commentary: Isnt Wonderful to Trade With a Strong Central Bank Behind You? | Forex Trader Markets | The future of Forex is here…

2012-09-13 at 18:42 (UTC 2) Link to this comment

[…] we stated already in a previous post, if the SNB does start not big CHF purchases, the EUR/CHF can remain several weeks above the floor […]

Guest Commentary: Isnt Wonderful to Trade With a Strong Central Bank Behind You?

2012-09-13 at 19:19 (UTC 2) Link to this comment

[…] we stated already in a previous post, if the SNB does start not big CHF purchases, the EUR/CHF can remain several weeks above the floor […]

Guest Commentary: Isnt Wonderful to Trade With a Strong Central Bank Behind You? | Top Binary Options Brokers Reviews

2012-09-13 at 21:08 (UTC 2) Link to this comment

[…] we stated already in a previous post, if the SNB does start not big CHF purchases, the EUR/CHF can remain several weeks above the floor […]

Guest Commentary: Isn’t Wonderful to Trade With a Strong Central Bank Behind You? |

2012-09-14 at 03:43 (UTC 2) Link to this comment

[…] we stated already in a previous post, if the SNB does start not big CHF purchases, the EUR/CHF can remain several weeks above the floor […]

Guest Commentary: Isnt Wonderful to Trade With a Strong Central Bank Behind You? | Currency Forex News

2012-09-15 at 09:58 (UTC 2) Link to this comment

[…] we stated already in a previous post, if the SNB does start not big CHF purchases, the EUR/CHF can remain several weeks above the floor […]