Tag Archive: SNB sight deposits

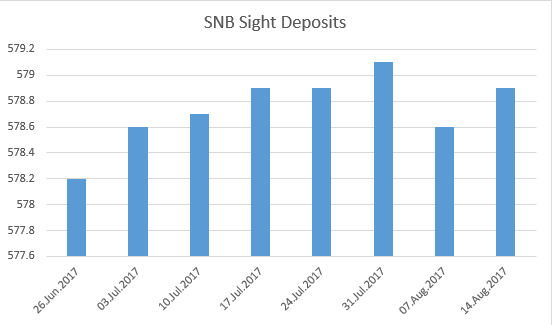

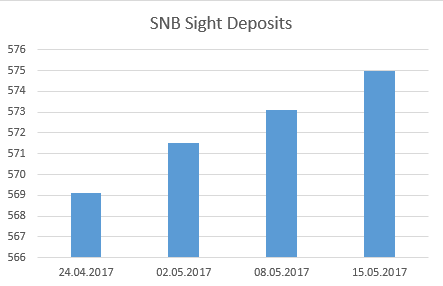

SNB Sight Deposits: increased by 2.4 billion francs compared to the previous week

The sight deposits at the SNB increased by 2.4 billion francs compared to the previous week.

Read More »

Read More »

Interim results of the Swiss National Bank as at 30 September 2021

The Swiss National Bank reports a profit of CHF 41.4 billion for the first three quarters of 2021. The profit on foreign currency positions amounted to CHF 42.2 billion. A valuation loss of CHF 1.3 billion was recorded on gold holdings. The profit on Swiss franc positions amountedto CHF 0.8 billion.

Read More »

Read More »

SNB Profit in Q1 to Q3 2020: CHF 15.1 billion Despite Covid19

The Swiss National Bank reports a profit of CHF 15.1 billion for the first three quarters of 2020. We explain why these profits are possible.

Read More »

Read More »

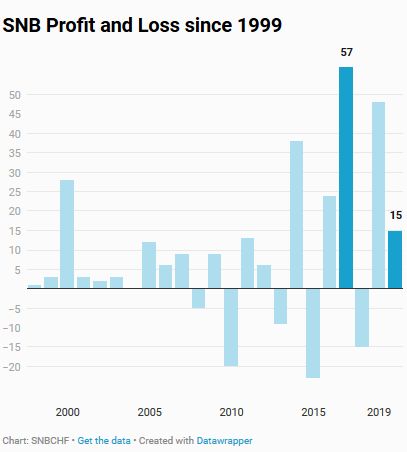

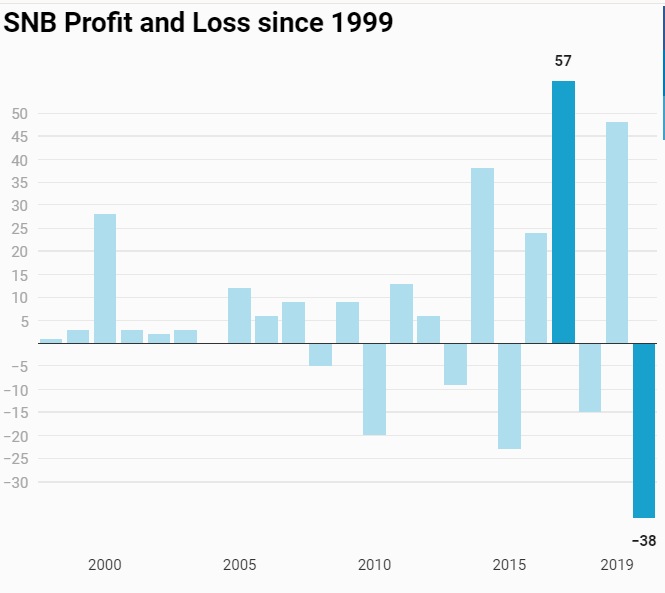

SNB Interim Results: -38 Billion, An Analysis

The Swiss National Bank reports a loss of CHF 38.2 billion for the first quarter of 2020. The loss on foreign currency positions amounted to CHF 41.2 billion.

Read More »

Read More »

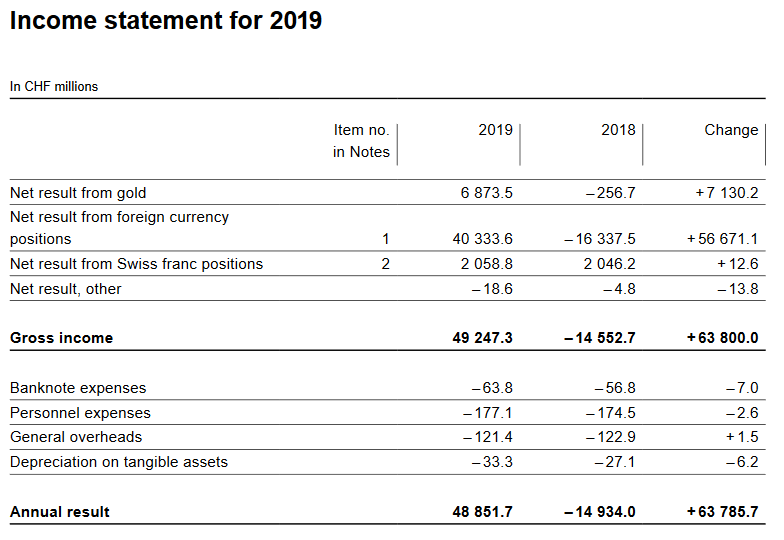

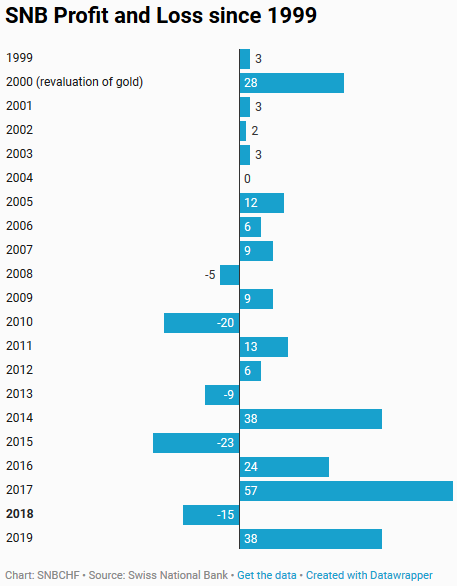

SNB Profit in 2019: 48.9 billion (2018: loss of CHF 14.9 billion, 2020 Does not Look Good)

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was … Continue reading »

Read More »

Read More »

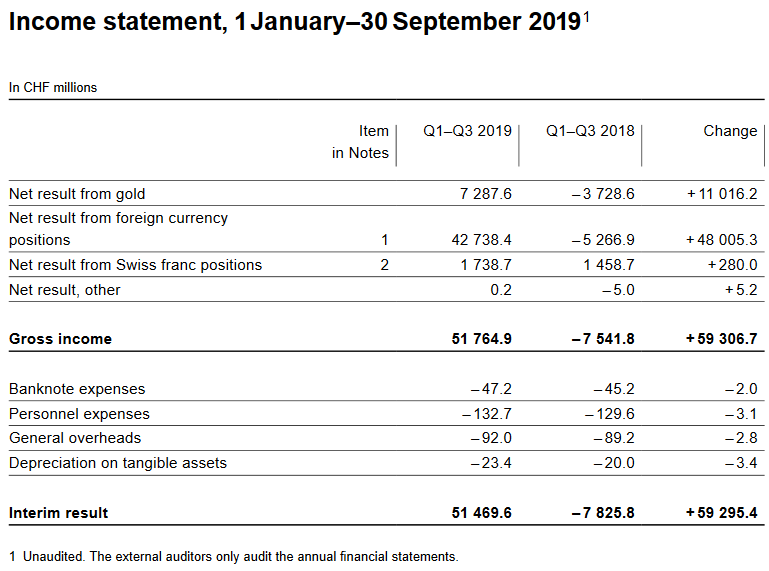

The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019

The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019. The profit on foreign currency positions amounted to CHF 42.7 billion. A valuation gain of CHF 7.3 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.7 billion.

Read More »

Read More »

SNB reports a profit of CHF 38.5 billion for the first half of 2019.

The Swiss National Bank reports a profit of CHF 38.5 billion for the first half of 2019. The profit on foreign currency positions amounted to CHF 33.8 billion. A valuation gain of CHF 3.8 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.1 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets.

Read More »

Read More »

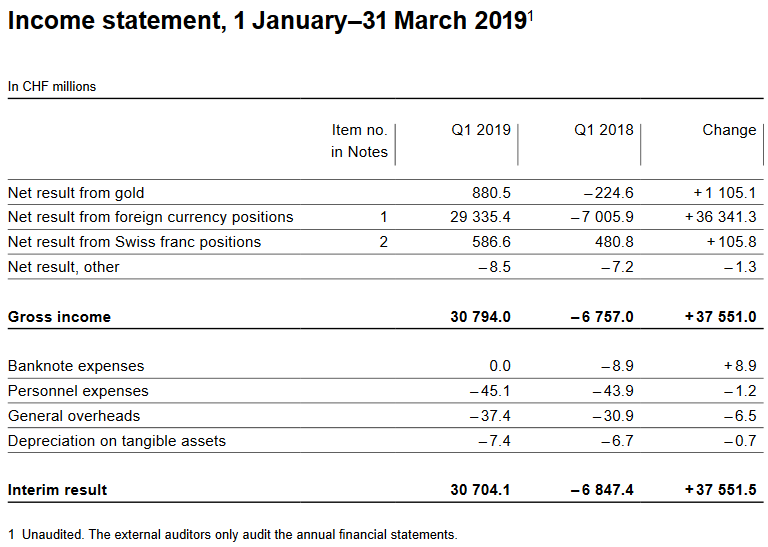

SNB Results: Big Win After Big Loss in Q4 2018

The Swiss National Bank reports a profit of CHF 30.7 billion for the first quarter of 2019. The profit on foreign currency positions amounted to CHF 29.3 billion. A valuation gain of CHF 0.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 0.6 billion.

Read More »

Read More »

SNB loses 15 billion in 2018

The SNB earned 2 billion on negative interest rates (Swiss franc positions below), but lost nearly 17 billion CHF on FX investments, of which 5 bn on bonds and 12 bn on stocks. Gold was nearly unchanged.

Read More »

Read More »

Provisional Results 2018: Will the SNB ever make profits again?

15 Billion Francs Losses in 2018. Given that the good years have finished: Will the SNB will ever make profits again? And compensate for the ever rising Swiss franc?

Read More »

Read More »

SNB reports a loss of CHF 7.8 billion for third quarter of 2018

The Swiss National Bank (SNB) reports a loss of CHF 7.8 billion for the first three quarters of 2018. A valuation loss of CHF 3.7 billion was recorded on gold holdings. The loss on foreign currency positions amounted to CHF 5.3 billion. The profit on Swiss franc positions was CHF 1.5 billion.

Read More »

Read More »

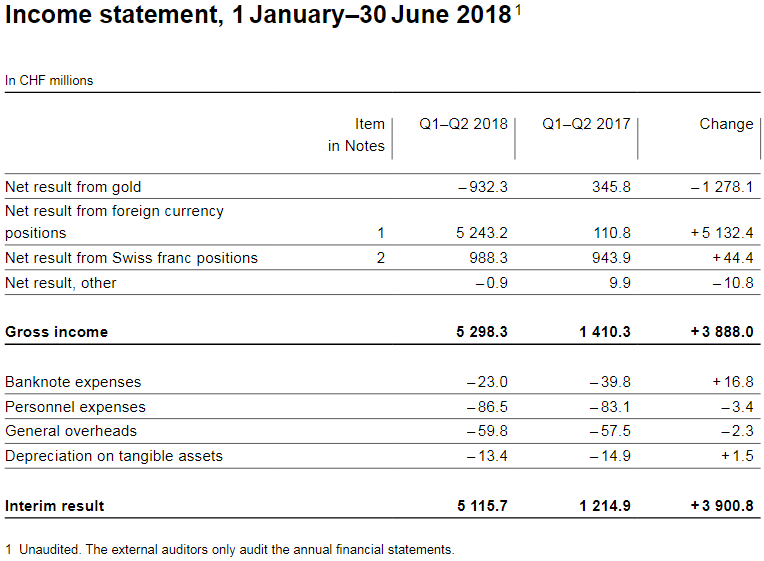

SNB reports a profit of CHF 5.1 billion for the first half of 2018

The Swiss National Bank (SNB) reports a profit of CHF 5.1 billion for the first half of 2018. A valuation loss of CHF 0.9 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.2 billion. The profit on Swiss franc positions was CHF 1.0 billion.

Read More »

Read More »

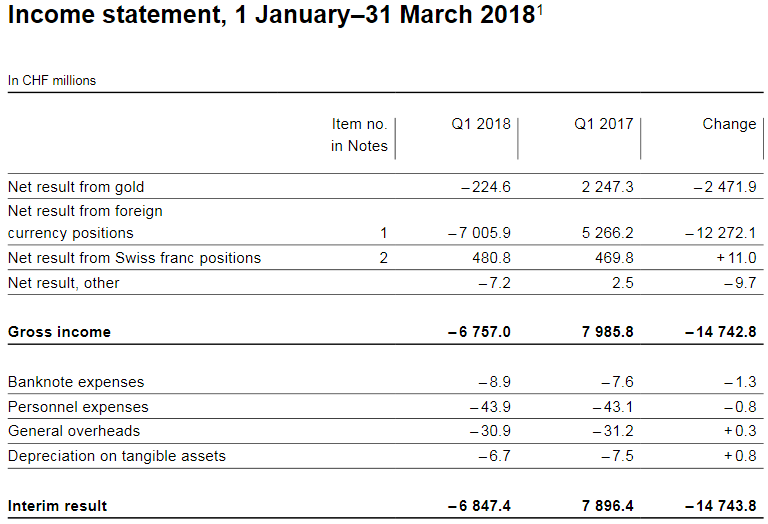

SNB loses 6.8 billion in Q1/2018

The Swiss National Bank (SNB) reports a loss of CHF 6.8 billion for the first quarter of 2018. A valuation loss of CHF 0.2 billion was recorded on gold holdings. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are therefore to be expected, and only provisional conclusions are possible as regards the annual result.

Read More »

Read More »

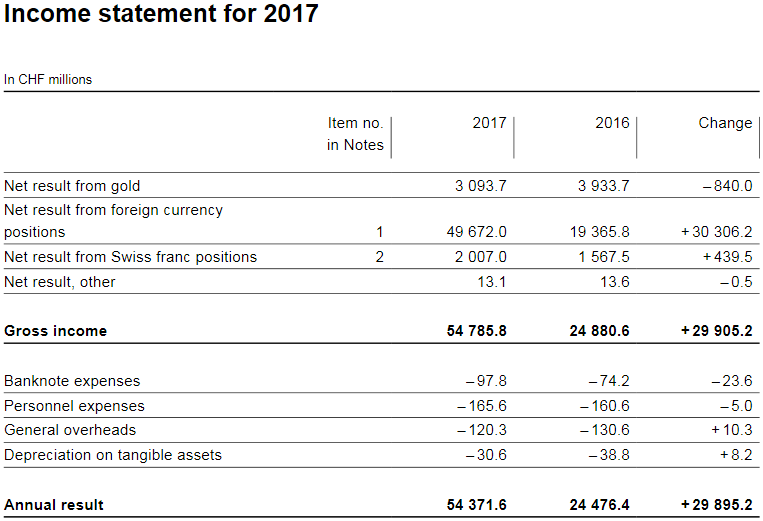

SNB reports a profit of CHF 54.4 billion for 2017

The Swiss National Bank (SNB) reports a profit of CHF 54.4 billion for the year 2017 (2016: CHF 24.5 billion). The profit on foreign currency positions amounted to CHF 49.7 billion. A valuation gain of CHF 3.1 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 2.0 billion.

Read More »

Read More »

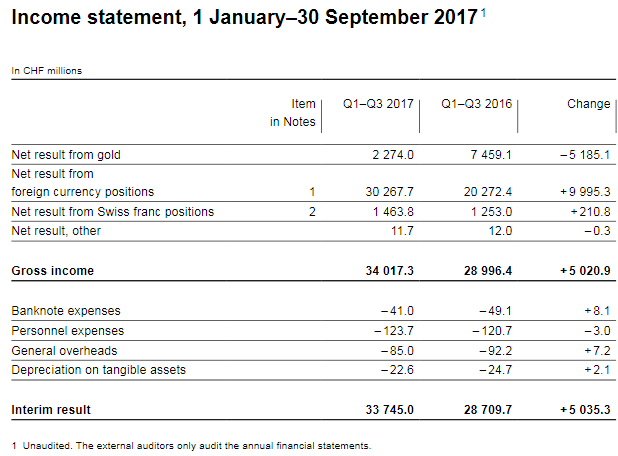

The good years have started, increasing SNB Profits

The Swiss National Bank (SNB) reports a profit of CHF 33.7 billion for the first three quarters of 2017. But in 2017, the picture is changed. Assuming a "biblical" cycle of seven good years and seven bad years, the SNB could now increase profits every year - thanks to a weaker franc and the seven good years.

Read More »

Read More »

Weekly SNB Interventions and Speculative Positions: Investors do not take North Korea dispute seriously

Despite the tensions between Donald Trump and North Korea's Kim Jong-un, the EUR/CHF only depreciated to 1.13. In the last week, the SNB did not have to intervene. This proves that investors have not taken the tensions seriously.

Read More »

Read More »

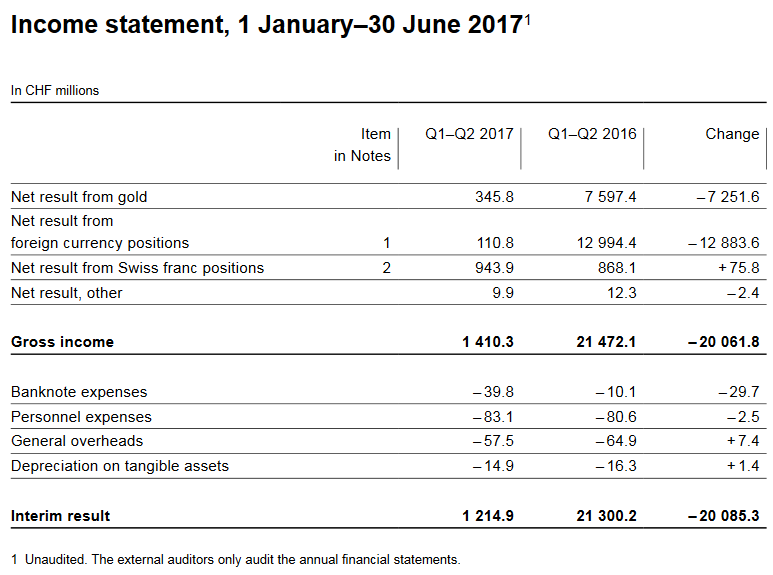

SNB reports a profit of CHF 1.2 billion for the first half of 2017

The Swiss National Bank (SNB) reports a profit of CHF 1.2 billion for the first half of 2017. A valuation gain of CHF 0.3 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 0.1 billion and the profit on Swiss franc positions stood at CHF 0.9 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets.

Read More »

Read More »

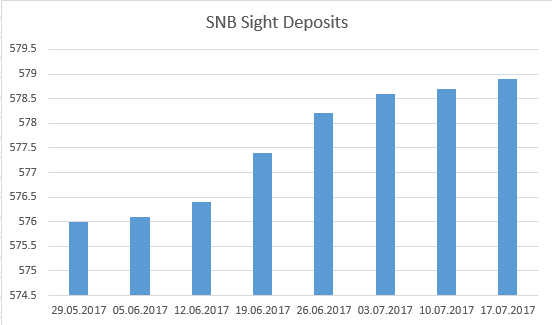

Weekly SNB Interventions and Speculative Positions: Hawkish ECB, less SNB interventions

Hawkish comments by Mario Draghi boosted the EUR against both USD and CHF. It also reduced the need for SNB interventions. The question is how long Draghi will remain hawkish, especially next winter, when headline inflation in the euro zone may fall under 1%.

Read More »

Read More »

Weekly SNB Interventions Update: Slight Rise after Weeks of Near-Zero Interventions

The pro-European politician Macron has won the French elections. His success moved the EUR/CHF up to 1.0980, mostly caused by FX speculators. But "serious" investors (not FX speculators) did not follow the political event, but focus on monetary policy. A ECB rate hike is very, very far, see why....

Read More »

Read More »

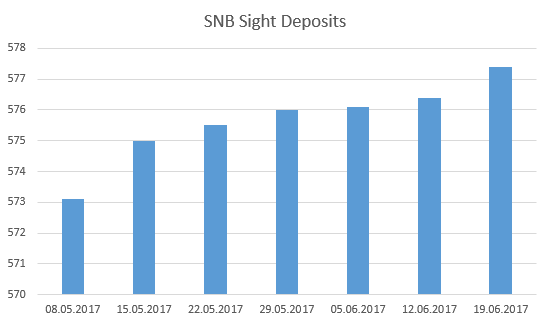

Weekly SNB Interventions and Speculative Positions: More Interventions at higher Euro rate

The pro-European politician Macron has won the French elections. His success moved the EUR/CHF up to 1.0980, mostly caused by FX speculators. But "serious" investors (not FX speculators) did not follow the political event, but focus on monetary policy. A ECB rate hike is very, very far, see why....

Read More »

Read More »