Tag Archive: SNB sight deposits

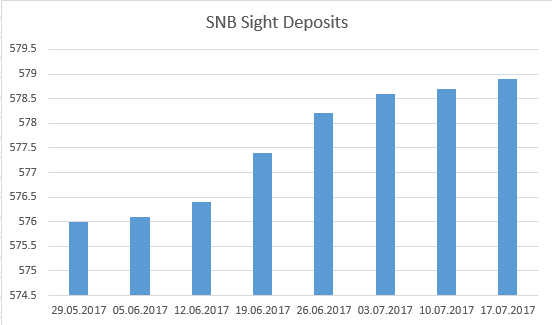

Weekly Sight Deposits and Speculative Positions: SNB Intervenes, Speculators Short CHF again

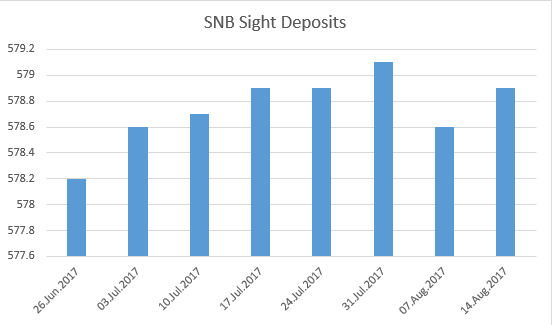

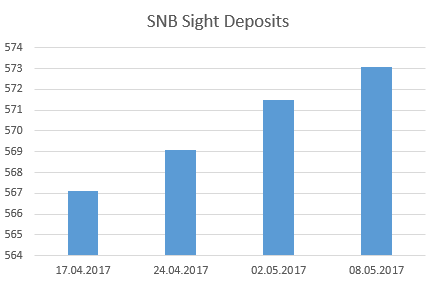

Last week's data: FX: EUR/CHF was between 1.07 and 1.0750. SNB sight deposits: SNB intervenes for 0.7 bn. CHF at the EUR/CHF 1.07 level. CHF Speculative Positions Speculators went net short CHF with 10K contracts, this is still far from the 26.K contracts record.

Read More »

Read More »

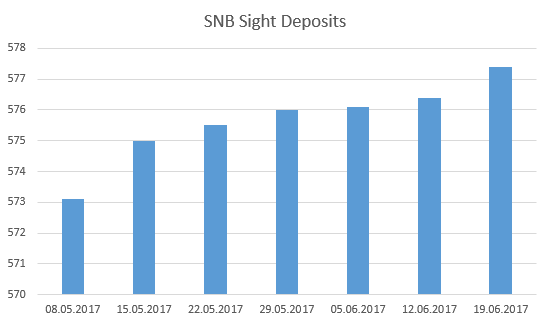

Weekly Sight Deposits and Speculative Positions: SNB intervenes, while Speculators go Long CHF

The Fed has hiked rates and with this fait accomplis speculators sold the news. They closed their short CHF and opened new CHF longs. The SNB, however, intervened again for 0.5 billion CHF.

Read More »

Read More »

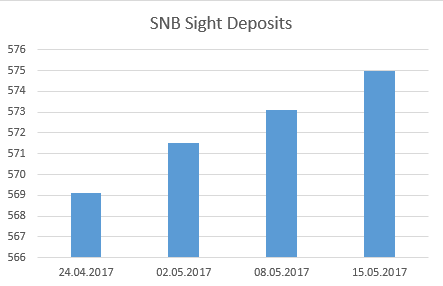

Weekly Sight Deposits: No SNB Interventions, Short CHF nearing records

Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later.

Read More »

Read More »

Weekly Sight Deposits: Investors hedge with Swiss Franc again for the coming inflation cycle.

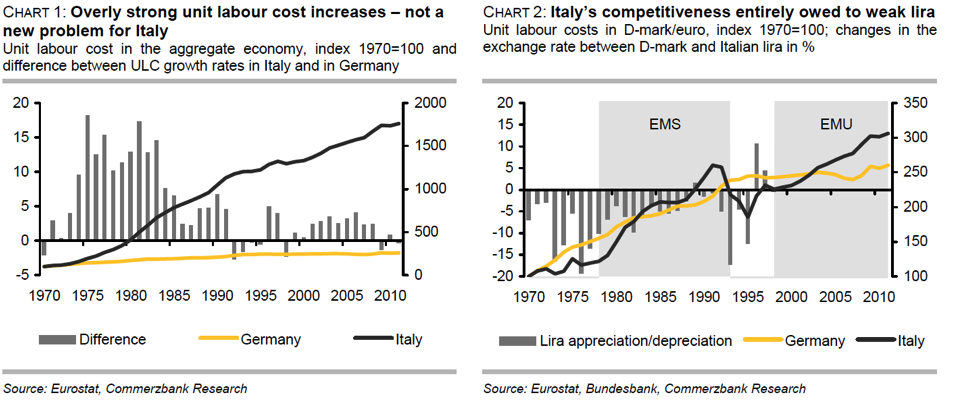

We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts – i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up U.S. wages.

Read More »

Read More »

Weekly Sight Deposits: Investors hedge against Trump’s inflationary policy with Swiss Franc.

We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts - i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up wages. According to Lars Christensen Trumpeconomics is also about monetary stimulus: Trump would push for a more jobs and a dovish Fed, same as his fellow...

Read More »

Read More »

SNB Sight Deposits November 7: No interventions, EUR/CHF under 1.08 with political jitters

Sight Deposits: show that the SNB has not intervened to sustain the euro, that dipped under EUR/CHF 1.08. We considered the 1.08 as line in sand for the SNB. The odds of Trump are rising. This causes fear and demand for Swiss Franc. The EUR/CHF fell to 1.0750. Speculators were net short CHF January 2015, shortly before the end of the peg, with 26K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25K contracts. We see...

Read More »

Read More »

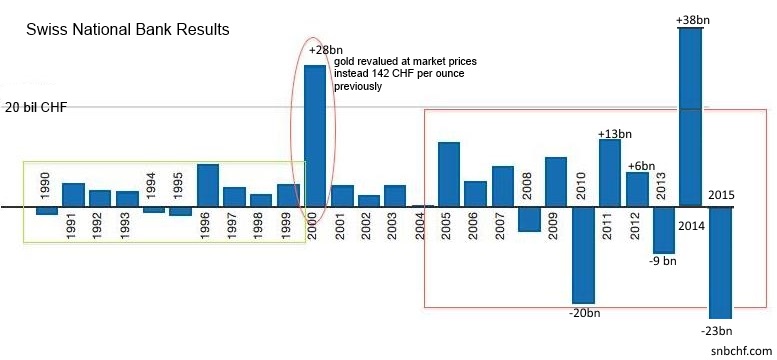

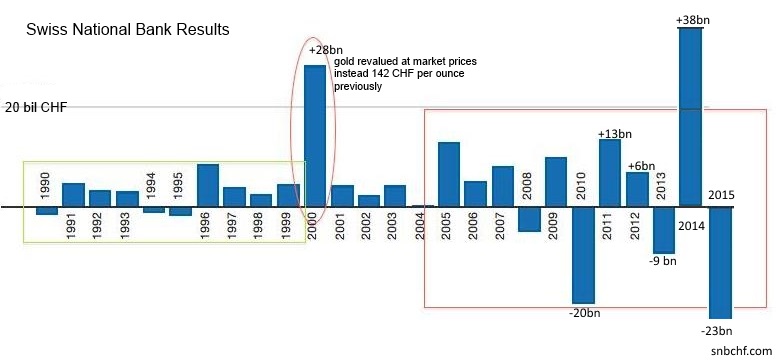

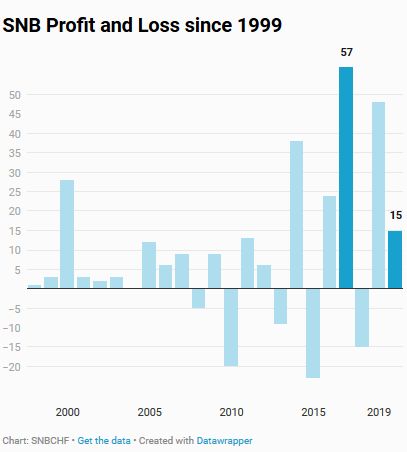

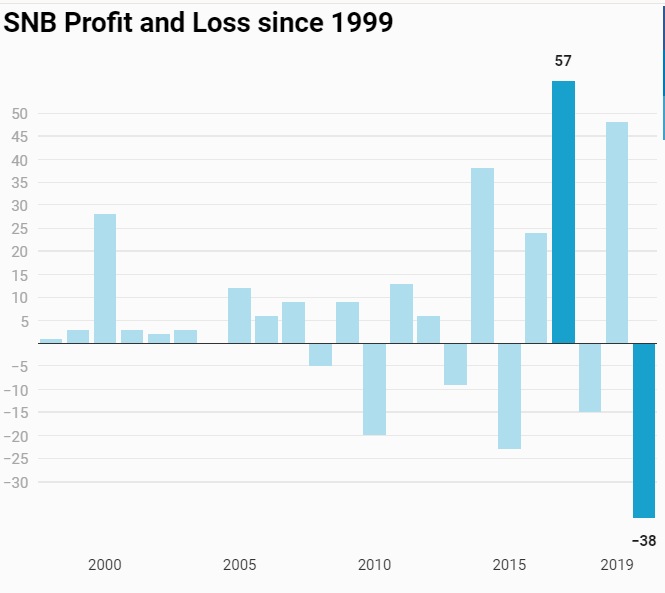

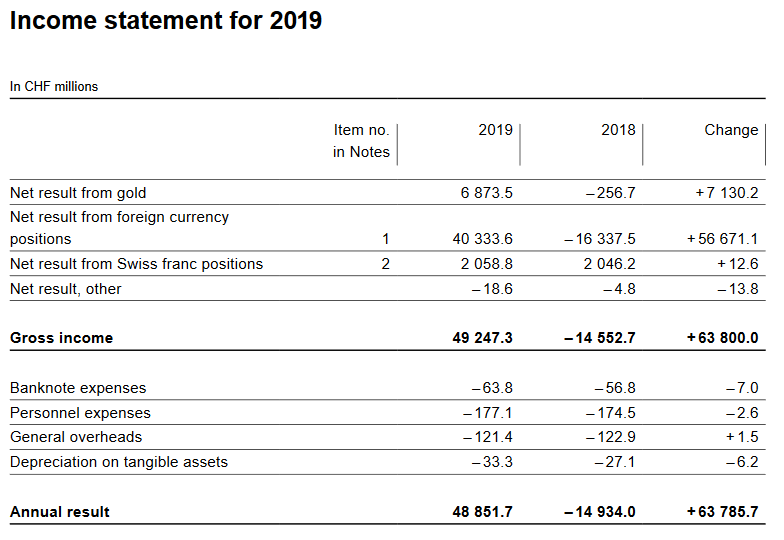

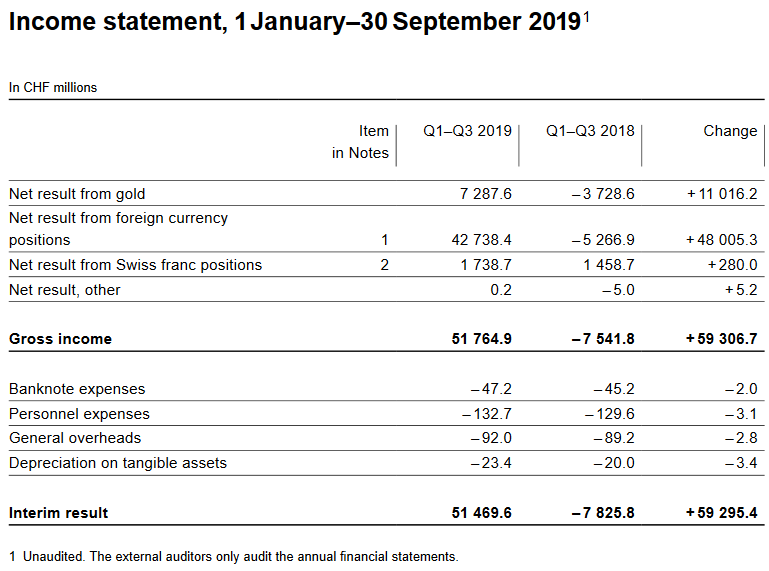

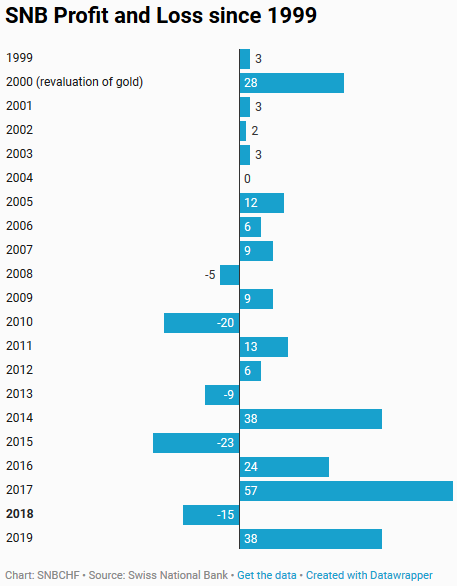

Swiss National Bank Results Q3 / 2016: Volatility of Results is Increasing

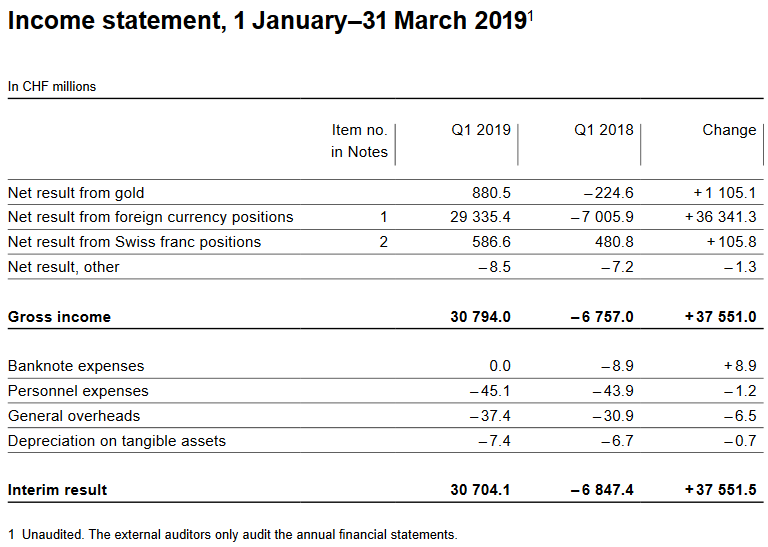

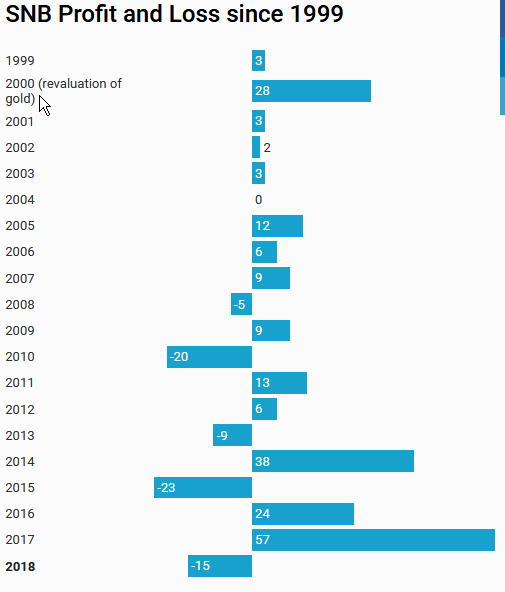

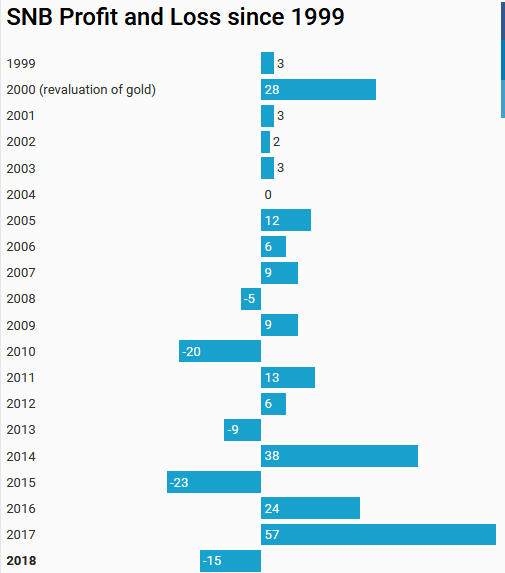

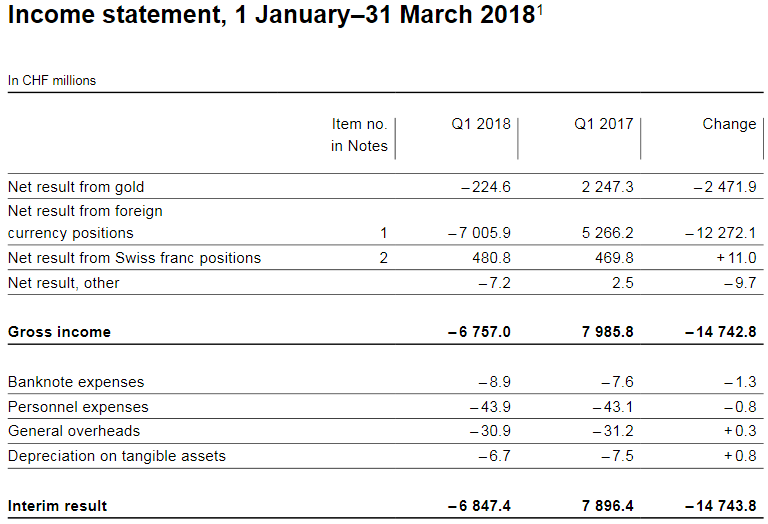

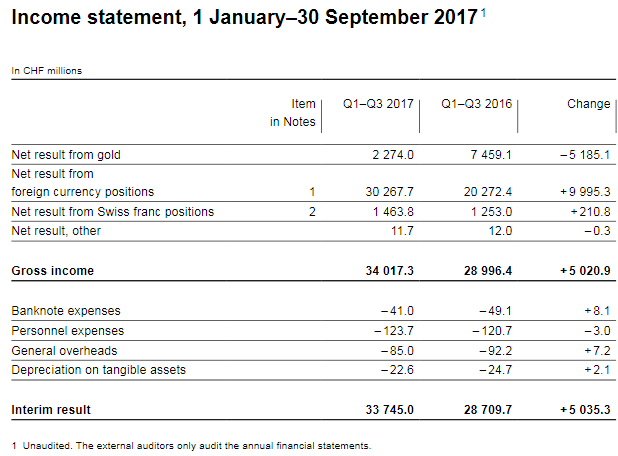

Interim results of the Swiss National Bank as at 30 September 2016 The Swiss National Bank (SNB) reports a profit of CHF 28.7 billion for the first three quarters of 2016. But the volatility is rising: The SNB may lose 50 billion in one year and win 60 billion in the next year or the opposite.

Read More »

Read More »

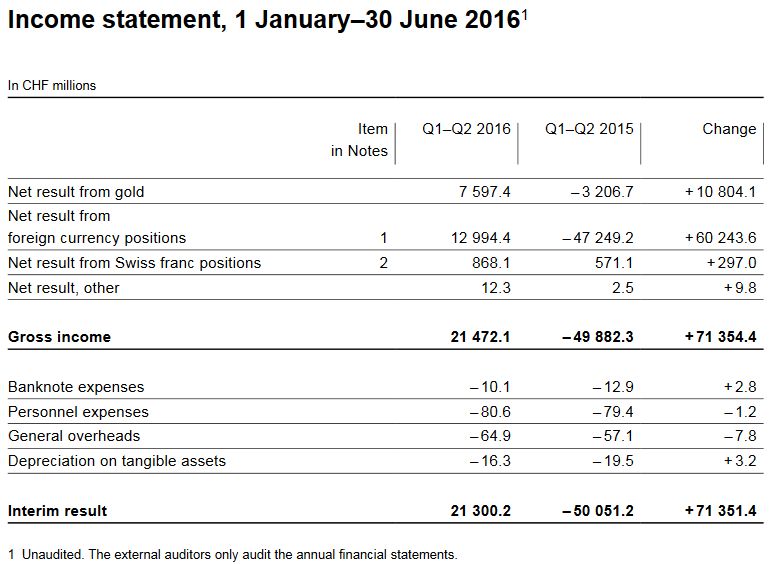

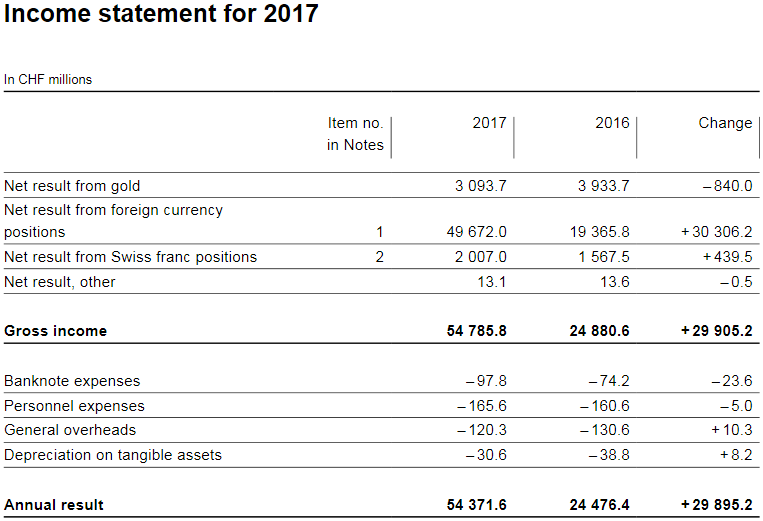

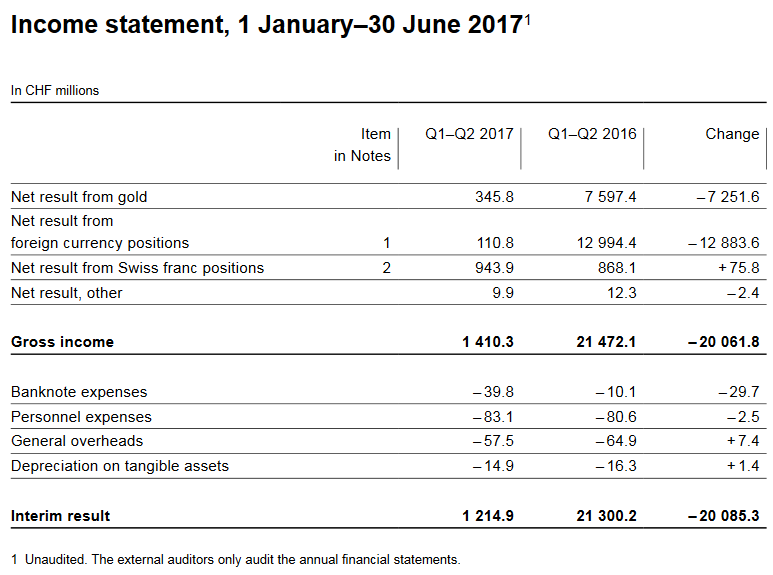

Interim results of the Swiss National Bank as at 30 June 2016

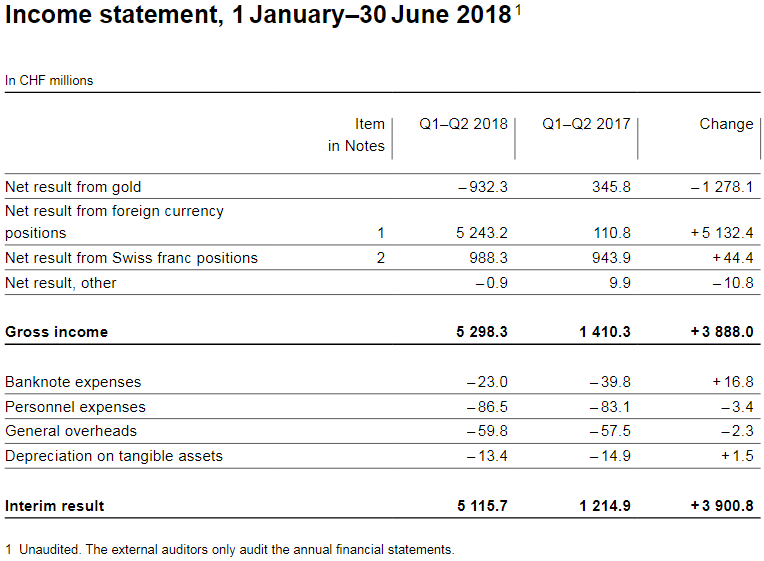

The Swiss National Bank (SNB) reports a profit of CHF 21.3 billion for the first half of 2016. A valuation gain of CHF 7.6 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 13.0 billion.

Read More »

Read More »

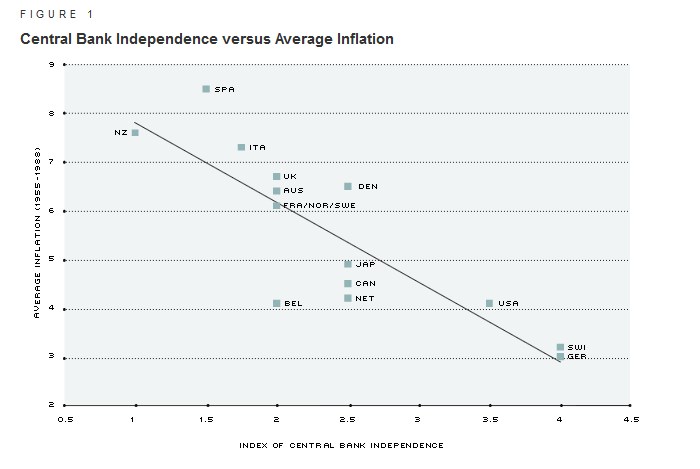

Central Bank Independence in Switzerland: A Farce

articles by Marc Meyer, one of the most critical voices against the SNB.

This post explains

--- That the SNB does not understand what assets and liabilities are - and therefore - it speculates with massive leverage.

--- The difference between good and bad deflation

--- Both the SNB and the Swiss government do what some Swiss exporters want. Therefore, the formerly admired central bank independence in Switzerland has become a farce.

Read More »

Read More »

Swiss National Bank Results 2015 and Comments

The Swiss National Bank (SNB) is reporting a loss of CHF 23.3 billion for the year 2015 (2014: profit of CHF 38.3 billion). The loss on foreign currency positions amounted to CHF 19.9 billion. A valuation loss of CHF 4.2 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.2 billion.

Read More »

Read More »

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

Where does SNB intervene against overvalued CHF, do they sell EUR & USD? (April Update)

In his first response to the Swiss financial tsunami on January 15, George Dorgan suggested that the EUR/CHF of 1.10 will not be reached any time soon. He explains where the SNB should intervene and if they sell Euros and dollars.

Read More »

Read More »

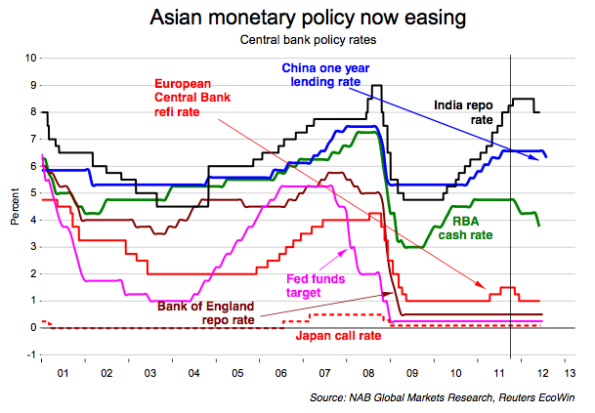

(3) Inflation, Central Banks and Interest Rates

In this chapter we connect three related concepts: inflation, central banks and interest rates.

Read More »

Read More »

(6) FX Theory: Carry Trade and Reverse Carry Trade

This page discusses two closely related concepts: the carry trade and the reverse carry trade.

Read More »

Read More »

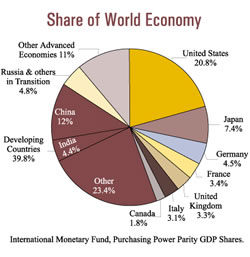

CHF Is No Safe-Haven, but a Safe Proxy for Global Economic Growth

In our view the Swiss franc is not a pure Safe-Haven, but a "Safe Proxy for Global Economic Growth". Global investors want to participate via the purchase of safe Swiss multi-nationals in global growth. This means inflows into Swiss franc denominated assets. Together with the big Swiss trade surplus, this implies a stronger franc. China stands for global economy, its slowing growth has a negative influence on the profits of Swiss multi-nationals...

Read More »

Read More »

Is the SNB Intervening Again?

Update March 21, 2014: Total SNB sight deposits increased to 367.8 bln. CHF, but flows reverted a bit. Foreign banks and “non-banks” reduced their CHF exposure at the SNB to 50.8 bln, possibly converting a part of the difference into USD. Dollars are more useful when sanctions will hurt both Russian and German firms. On … Continue...

Read More »

Read More »

No SNB Intervention: Massive Swiss M0 Increase due to Post Finance Transformation into a Bank

SNB did not intervene. Deposits of Swiss Post Finance had been reclassified from other sight liabilities to deposits of domestic banks.

Read More »

Read More »

Sight Deposits are Rising Despite Weaker Franc

Despite the weaker franc, sight deposits at the SNB are still rising. Last week they increased by 300 million CHF – details here. For us the SNB is not buying euros, but traders are taking more and more derivative (carry trade or FX positions) against the franc that do not show up in the sight … Continue reading...

Read More »

Read More »