Tag Archive: SNB sight deposits

EUR/CHF to 1.25?

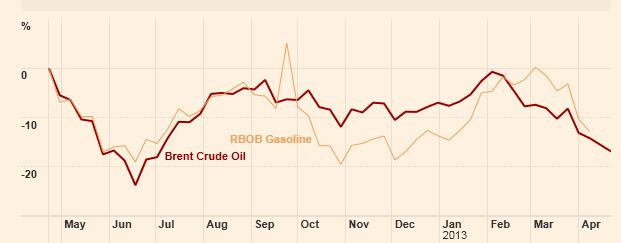

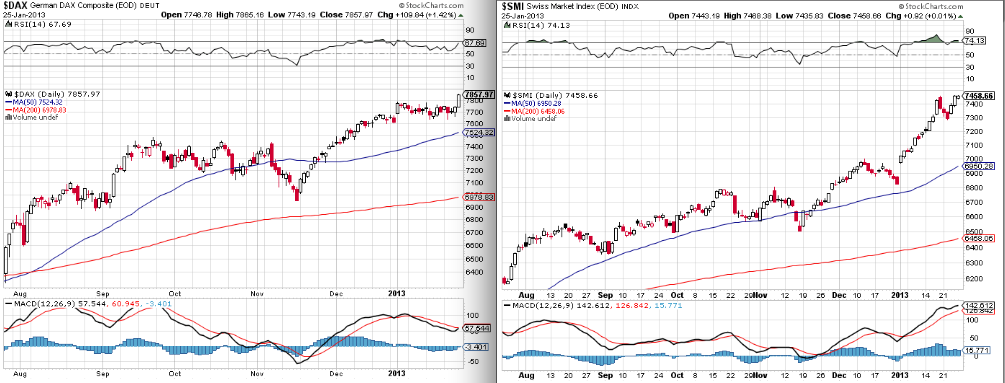

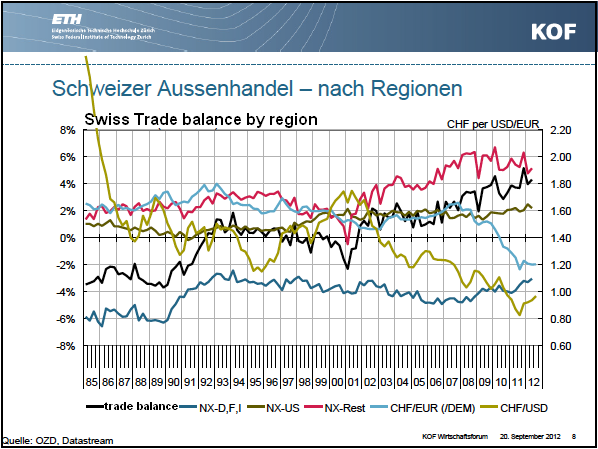

Chinese economy is weaker, the Brent oil price under 100$ , the German DAX near 7500, the USD/JPY near 100, the Australian dollar is dipping. Most assets that are positively correlated to CHF are weaker. Time for EUR/CHF to rise?

Read More »

Read More »

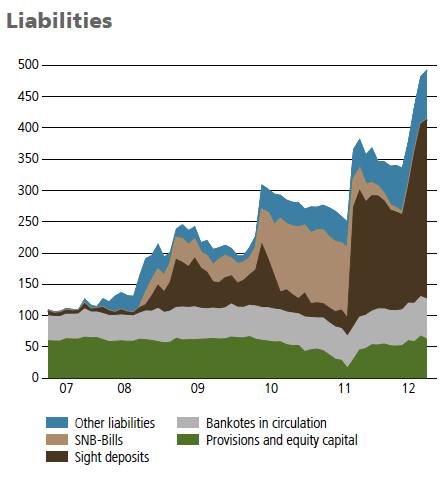

SNB Liabilities (deposits & bank notes) at New Record High

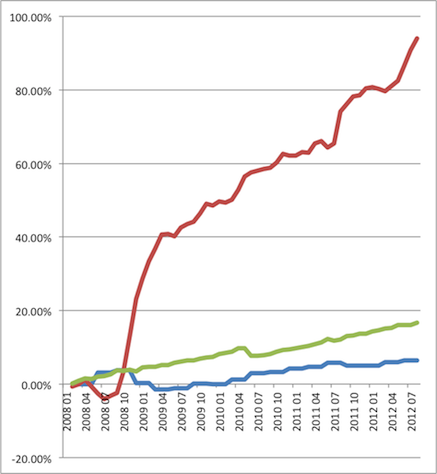

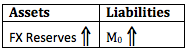

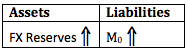

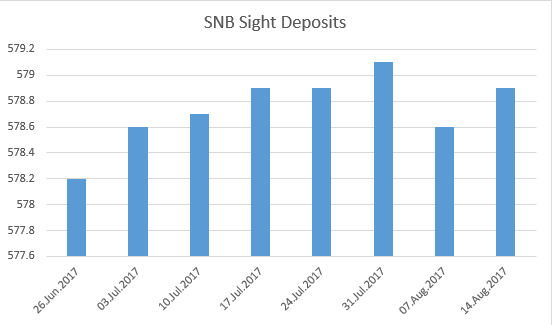

SNB sight deposits are rising again, by 700 million CHF in one week. But the amount of cash in form of bank notes and coins has risen by 10% since September. It seems that the central bank is now not only virtually printing (via sight deposits) but also physically. SNB liabilities reached a new record high. Details

Read More »

Read More »

SNB Sight Deposits Fall by 1.2 Billion CHF, Weeks ending February 1 and 8

The latest improvement in U.S. unemployment and good PMIs, finally let the sight deposits (money supply) at the SNB fall by 800 million francs in week ending on February 1 and 400 million for the one of Feb 8 . See the recent history of sight deposits.

Read More »

Read More »

SNB Sight Deposits Rise by 100 Million CHF, Week January28

While FX traders and some hedge funds are long EUR/CHF and some short covering happened, sight deposits show a different picture. They rise again, this time with 100 million francs (see details) in one week. Risk-off investors are not convinced yet that the euro crisis is finished, while other investors keep profit of the rising SMI...

Read More »

Read More »

SNB Sight Deposits Rise by 2 Bln. Francs, M3 by 10 Bln., Week January 21

While FX traders and some hedge funds go long the EUR/CHF, sight deposits at the SNB rise by 2 bln. francs (see details) in one week, M3 by nearly 10 bln. (nearly 2%) francs in one single month (see

Read More »

Read More »

SNB Sight Deposits Week November 23

Total sight deposits at the SNB rose by nearly 1 billion to 374 bn francs in the week ending on November 23th. “Other sight deposits”, the ones of foreign banks and Swiss companies, fell by one billion francs, but the ones of local institutes increased by nearly 2 billion francs.

See full detail on our explanation, historical and our expected development of

Read More »

Read More »

SNB Sight Deposits Week November 16

Total sight deposits at the SNB rose by 0.5 billion to a total of 373 bn. francs in the week ending on November 16th. "Other sight deposits", the ones of foreign banks and Swiss companies, fell by 600 million francs, but the ones of local institutes increased by more than 1 billion francs.

See full detail on our explanation, historical and our expected development of

Read More »

Read More »

SNB Monetary Data Week October 26

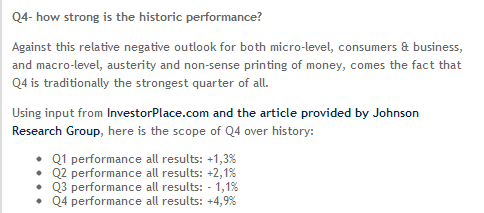

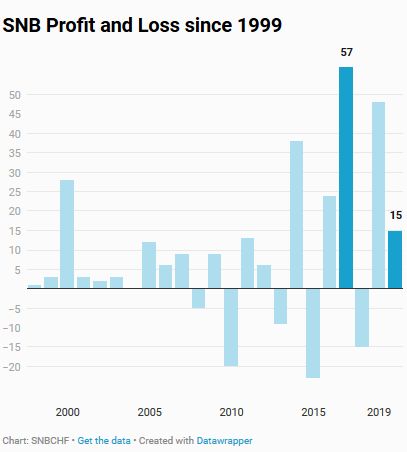

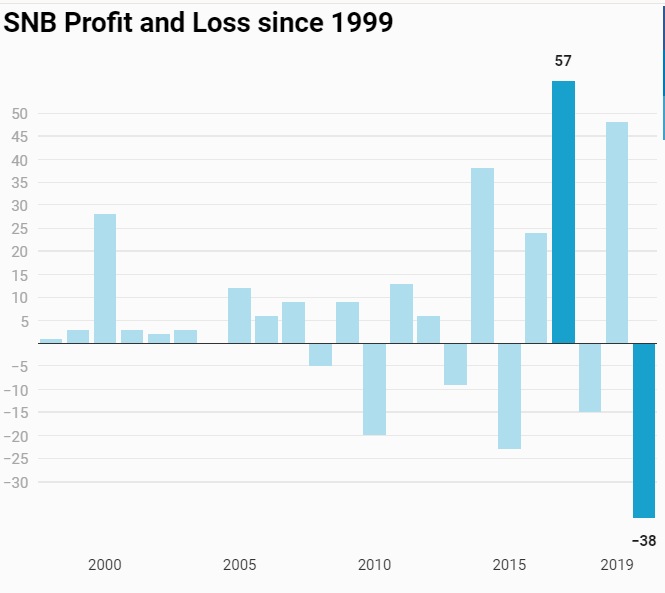

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Despite the seasonal effects between October and March, the SNB is not able to sell currency reserves consistently. Traditionally the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was possibly already anticipated …

Read More »

Read More »

SNB Monetary Data Week October 19

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was …

Read More »

Read More »

SNB Monetary Data Week October 12

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks …

Read More »

Read More »

SNB Monetary Data Week October 5

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger and stocks rise over the autumn months …

Read More »

Read More »

SNB Monetary Data Week of September 28

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger over the autumn months till …

Read More »

Read More »

Do Swiss companies prefer to hold cash at the SNB instead of local banks ?

The most recent SNB monetary data show that more and more companies are increasing their deposits at the central bank at a quicker speed than local banks. Might this be missing trust in the Swiss banking system ?

Read More »

Read More »

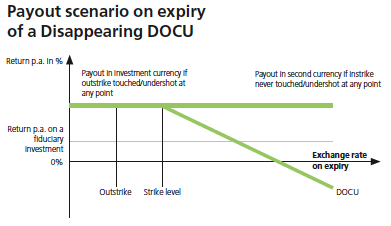

Isn’t it wonderful to trade with a strong central bank behind you?

Isn’t it wonderful to have a strong central bank like the SNB sitting behind you when trading Forex? Losses are limited to the floor of 1.20 and in the meantime you can gain forward swaps with the higher euro zone interest rates. Today the Swiss National Bank (SNB) decided in its monetary policy assessment …

Read More »

Read More »

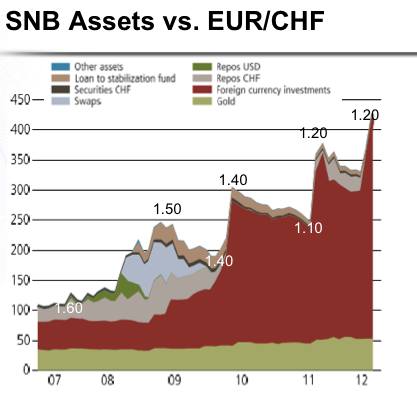

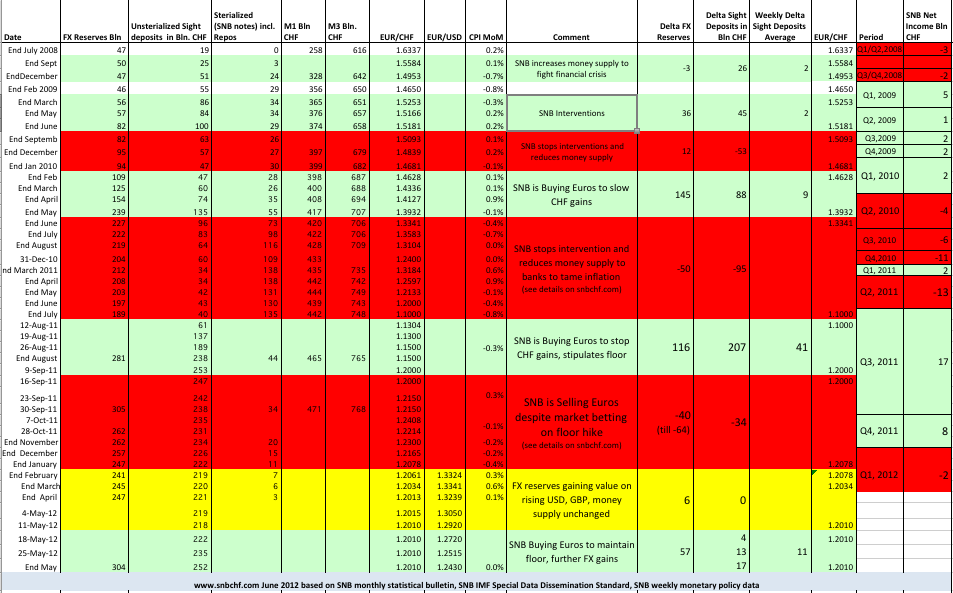

SNB prints nearly 5 billion francs in one week, FX traders poised to get ripped off

As we expected in our post “What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?“, long-time investors, global macro funds and US investment banks are moving into gold and the Swiss franc again. The SNB had to buy euros and print new Swiss francs of around 5 billion francs last week, as … Continue reading »

Read More »

Read More »

What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?

On Friday there was a big movement in the EUR/CHF. First it went up to 1.2154, fell later down to 1.2080 in the main American trading and rose again to 1.21 in the low-volume trading time. We repeat our entry from Friday, because we continuously updated the post after new developments, e.g. after the … Continue reading »

Read More »

Read More »

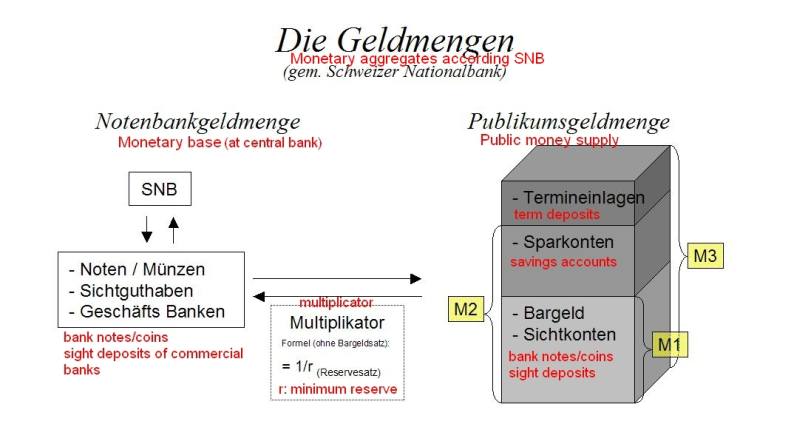

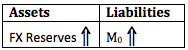

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

In this post we show that the risks the Fed, the ECB and the Bundesbank incur are far smaller than the one the Swiss SNB takes. The Fed has “just” an inflation risk, that could cost 200 billion US$, 1.2% of US GDP. The ECB and Bundesbank have the risk that the euro zone splits … Continue reading »

Read More »

Read More »

The win of the pro-bailout parties in the Greek elections was no win for the SNB

The win for the pro-bailout parties in the Greek elections was no win for the Swiss National Bank (SNB), even if the fear of an immediate bank-run and extreme money flows into Switzerland are avoided. Also the fact that QE3 is not coming in the next weeks did not help the SNB.

Read More »

Read More »

Another week, another 14 bln. francs printed

According to the newest monetary data, in the week ending June 8th, the unsterialized money supply (as measured in sight deposits of domestic and foreign banks and deposits by the Swiss confederation) increased by 14 billion Swiss francs.

Read More »

Read More »