As we expected in our post “What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?“, long-time investors, global macro funds and US investment banks are moving into gold and the Swiss franc again. The SNB had to buy euros and print new Swiss francs of around 5 billion francs last week, as today’s monetary data show. Given that the EUR/CHF was around 1.21, the SNB FX purchases were more expensive than previously.

There are still some FX traders who are convinced that the SNB will hike the floor to 1.22. Hence, currently both the SNB and these traders are short CHF. However, in order to balance the total trades, there must be some big accounts who are buying CHF.

We do not believe that the current movement is caused by the SNB itself, they would do an official announcement. An announcement would be much cheaper for the central bank because many FX traders would trade on behalf of the SNB and long-term investors would not pile into CHF as much as they currently do.

Moreover, a new floor would destroy some of the SNB credibility and the risks of huge losses would increase.

The EUR/CHF is trading around 1.21, exactly between floor and rumor.

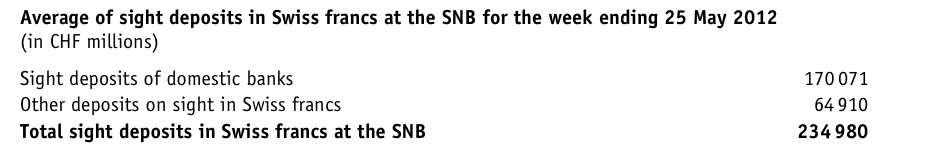

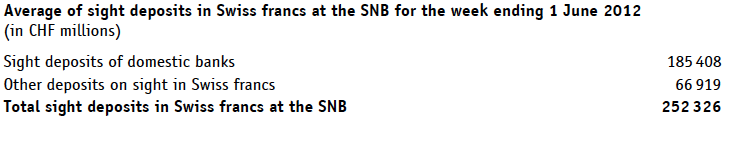

These are today’s and the latest SNB money supply numbers in terms of total deposits:

September 7: 370’673 million francs

August 31: 365’976 million francs

August 24: 362’112 million francs

The explanation of the data

Read the full details about money printing differences between SNB, ECB and Fed in our article “The big Swiss Faustian Bargain” also appeared on Zerohedge.

Tags: Deposits,Gold,Monetary Base,monetary data,money printing,QE3,Reserves,SNB sight deposits,Swiss National Bank,Switzerland Money Supply

2 comments

Joe Lucid

2012-09-28 at 00:21 (UTC 2) Link to this comment

I’m not sure I understand: if the snb is not involved in driving eurchf up then why would it purchase at a price above 1.20 (paying more than needed as you say)? It seems to me that the best explanation is that the snb wants to have the franc weaken against the euro beyond the floor. So they’re purchasing at higher prices hoping to bootstrap a trend. Which hasn’t been successful – and wouldn’t be now we know that they did the purchasing themselves.

This seems a strategy more similar to what Hildebrand did – who also caused more movement rather than implementing a purely static cap.

George Dorgan

2012-09-28 at 05:36 (UTC 2) Link to this comment

You are right, I was also doubting why the SNB should pay more than it should.

Forex traders are moving the EUR/CHF upwards, in the strong faith that the SNB will backstop their losses.

See also here or here

Forex traders’ hope is based on ECB and Fed money printing, the Swiss 0.1% GDP contraction and the knowledge that they cannot lose more than EUR/CHF 1.20. The SNB might help a little bit to maintain the channels upward (or the EUR/CHf above 1.21) to get more traders into the EUR/CHF game.

Furthermore, a higher EUR/CHF gives the impression to Swiss companies that they will lose money when they change their foreign incomes into CHF. Therefore it might be even in the interest of the SNB to maintain the exchange rate higher than the floor level.