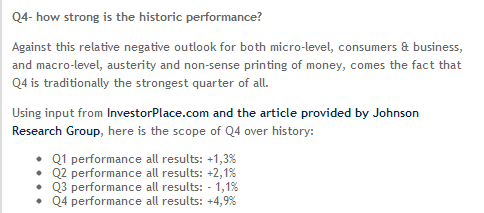

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started

Recent developments

October 12

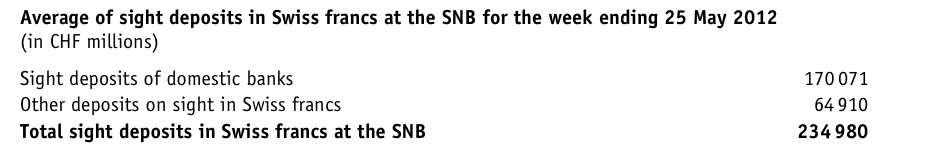

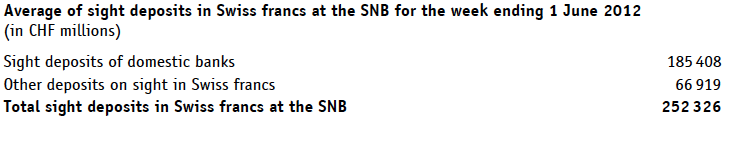

Site deposits rose by 222 million francs in the last week. Since April they have increased by a tremendous 155 billion francs until the 3rd week of September.

SNB Monetary Data, Week Ending October 5

week ending on October 12: 372’956 million francs (of which 79’814 “other deposits”)

week ending on October 5: 372’734 million francs (of which 81’673 “other deposits”)

week ending on September 28: 373’416 million francs (of which 82’171 “other deposits”)

week ending on September 21: 373’731 million francs (of which 81’425 “other deposits”)

week ending on September 7: 370’673 million francs

week ending on August 31: 365’976 million francs (of which 77’017 “other deposits”)

week ending on August 24: 362’112 million francs

week ending on August 17: 356’676 million francs

week ending on August 10: 353’304 million francs

week ending on August 03: 352’055 million francs

week ending on July 27: 341’543 million francs (of which 70’620 mil. “other deposits”)

week ending on July 20: 331’167 million francs (of which 69’769 mil. “other deposits”)

week ending on July 13: 320’783 million francs (of which 71’502mil. “other deposits”)

week ending on July 13: 320’783 million francs (of which 71’502mil. “other deposits”)

week ending on July 6: 316’901 million francs (of which 71’740 mil. “other deposits”)

week ending on June 29: 310 970 million francs (of which 73’134 mil. “other deposits”)

week ending on June 22: 300 894 million francs (of which 72 938 mil. “other deposits”)

Do Swiss companies prefer to hold cash at the SNB instead of local banks ?

In the last week, domestic banks increased deposits by 2 bln. francs, but “other deposits” (deposits of foreign banks and non-banks and liabilities towards the Swiss confederation) fell by 2 bln. francs. The reduction of “other deposits” numbers were against the previous trend and might be associated with a weakening of foreign profits for the Swiss global companies.

The previous trend:

Since July 27th, the rise of “Other deposits” was with 16% a lot stronger than the increase of deposits by local banks with 6.8%. Foreign interest for francs has calmed down, but the Swiss companies continue to achieve strong trade surpluses. One can get the impression that Swiss firms prefer to deposit cash at the central bank instead at commercial banks. The third component of “Other Deposits”, the liabilities towards the Swiss confederation see a latest figure of 9.1 bln. CHF, a number which even decreased since July by 600 million francs.

Difference between “deposits from domestic banks” and “Other sight deposits”

The “other deposits on sight in Swiss francs”, which the Swiss National Bank (SNB) publishes in its weekly Important monetary policy data (http://www.snb.ch/en/iabout/stat/statpub/impdata/id/statpub_impdata_hist), does indeed consist of all the three following categories:

- Liabilities towards the Confederation (see explanation)

- Sight deposits of foreign banks and institutions (see explanation)

- Other sight liabilities (see explanation)

Further explanation about all four categories of sight deposits you find in the annual report 2011, p. 135 and p. 143 (http://www.snb.ch/en/mmr/reference/annrep_2011_komplett/source). In addition, in the monthly publication SNB balance sheet items, you find the most current numbers for the sight deposit categories (http://www.snb.ch/ext/stats/balsnb/pdf/deen/A1_Ausweise_der_SNB.pdf). Please note, that these numbers as well as those in the annual report are end of the month/year numbers, whereas the numbers in the Important monetary policy data are weekly averages.

Kind regards

Silvia Oppliger

Deputy Head of Media Relations

Swiss National Bank

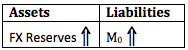

What does increase of money supply (or sight deposits) mean ?

The increase of around 2.6 billion francs in sight deposits e.g. during the week of September 14, should correspond to exactly the same increase of FX reserves, when changes in prices are excluded: 2.6 billion more money (M0 or M1 respectively) printed to buy 2.6 billion more FX reserves.The SNB did not employ swaps or repos since April 2012. Swaps or repos may distort the picture (see more details here).

How do price changes effect money supply and FX reserves ?

When the EUR/CHF rises by 1% and deposits are increasing, then the SNB must pay more for one Euro than previously. A number of 2.6 billion CHF would correspond to 1% less, namely to 2.57 billion CHF when measured with a stronger CHF. One sees that difference in price does not really matter. Moreover the dollar or yen have strongly fallen against the CHF over the “QE-unlimited” week. Therefore the 0.03 billion the SNB had to pay more for the euros (60% euro in the SNB portfolio) are reversed by maybe 0.03 billion cheaper dollars or yens. Last but not least, the SNB might have switched to buying the cheap dollar or yens selling some euros.

An example for the monetary data is shown here:

These numbers are weekly average numbers. Some editors like Thompson Reuters here use the last monthly average data also given by the SNB, but this data is simply than the data from last week.

The Limits of Money Printing

Theoretically banks could tell the SNB not to credit their accounts any more, this would prevent the SNB from printing. Still banks are sure to get the money back one day. They think that the SNB is to be able to get rid of all their currency reserves and to sterilize deposits. The SNB’s Dewet Moser writes in this paper how easy it to sterilize during 2010 and 2011. However he does not speak about the fact that the Swissie was strongly rising during this sterilization process.

Money Printing in the euro system

Inside the euro system, ECB money printing via deposits means debiting the account of the ECB and crediting the account of the National Central Banks (NCBs) of the euro system as for their participation in the ECB. This method e.g. used in the ELA (emergency liquidity financing) is done according to the following schema:

Eurosystem Participations

Eurosystem Participations per Country Source: ECB - Click to enlarge

30% of the ECB capital belongs to non-euro states like the UK, Sweden, Denmark, Poland or other non-euro EU member states.

Printing money means that the ECB increases its debt towards the NCBs in the ratio of the euro system participations, namely Bundesbank 27%, Banque de France 20%, Banca d’Italia 20% and Banco de Espana 12%.

If the ECB buys peripheral bonds with this money, it implies an implicit transfer from the Bundesbank and the Banque de France and other Northern states to the periphery.

The Bundesbank will refinance this money via increasing its debt at German commercial banks. These again will have more reserves which they might invest via the money multiplier to give more loans to German firms and housing. Apart from more and more debt due to Germany, this operation will increase inflation over the medium and long-term.

The ECB often employs tenders (via SMP, MTO, LTRO or OMP) to allow commercial banks to refinance her directly. In this case banks reserves at the central bank do not increase, therefore it is also called sterilized. Since these lending banks mostly come from Germany and other Northern states, it is just another form of money transfer from the Northern states to the periphery.

Read the full details about the differences in money printing among SNB, ECB and Fed in our article “The big Swiss Faustian Bargain” also appeared on Zerohedge.

Are you the author? Previous post See more for Next post

Tags: ECB,M0 base money,M1,Monetary Base,monetary data,Monetary Policy,money printing,seasonal,SNB sight deposits,Swiss National Bank