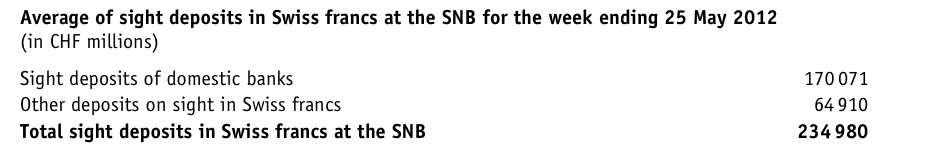

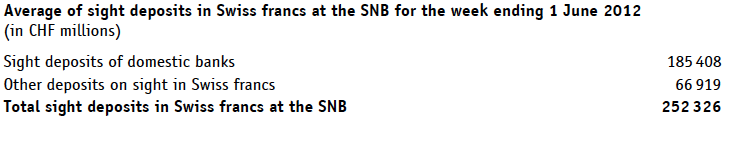

The most recent SNB monetary data show that more and more companies are increasing their deposits at the central bank at a quicker speed than local banks. Might this be missing trust in the Swiss banking system ?

SNB Monetary Data, Week Ending September 21

week ending on September 21:373’731 million francs (of which 81’425 “other deposits”)

week ending on September 14: 373’297 million francs

week ending on September 7: 370’673 million francs

week ending on August 31: 365’976 million francs

week ending on August 24: 362’112 million francs

week ending on August 17: 356’676 million francs

week ending on August 10: 353’304 million francs

week ending on August 03: 352’055 million francs

week ending on July 27: 341’543 million francs (of which 70’620 mil. “other deposits”)

week ending on July 20: 331’167 million francs (of which 69’769 mil. “other deposits”)

week ending on July 13: 320’783 million francs (of which 71’502mil. “other deposits”)

week ending on July 13: 320’783 million francs (of which 71’502mil. “other deposits”)

week ending on July 6: 316’901 million francs (of which 71’740 mil. “other deposits”)

week ending on June 29: 310 970 million francs (of which 73’134 mil. “other deposits”)

week ending on June 22: 300 894 million francs (of which 72 938 mil. “other deposits”)

Recent developments

September, 21:

Site deposits increased only by 500 billion francs, the weakest number since May 11, 2012, when the total numbers was at levels around 218 bln. Since then, the US recovery has begun stuttering and the SNB site deposits have increased by a tremendous 155 billion francs.

In the last week, domestic banks reduced deposits by 2 bln. francs, but “other deposits” (deposits of foreign banks and non-banks and liabilities towards the Swiss confederation) increased by 2.5 bln. But the total increase of money supply was only 500 million francs.

Despite trader chatter “SNB will be able to sell their euros” or “traders now saying CHF not EUR likely to be funding currency in Europe now”, and against what some Swiss papers reported today, the SNB money supply is still on the rise. This means that the SNB is still buying foreign currencies.

Since July 27th, the rise of “Other deposits” was with 15.4% a lot stronger than the increase of deposits by local banks with 7.0%.

With the good Swiss trade balance data the repatriation of profits in Swiss francs seems to continue. Given the stronger risk-appetite, foreigners (and also foreign banks) are currently not that keen on Swiss francs any more.

Therefore one can get the impression that Swiss companies prefer to deposit cash at the central bank instead at commercial banks. The third component of “Other Deposits”, the liabilities towards the Swiss confederation are traditionally small with a latest figure of 10 bln. CHF.

The big Short Swiss franc bet of Forex traders after the Swiss GDP contraction and the easing operations of the world’s two biggest central banks seems to be finished.

After the weak IFO data, the EUR/CHF has fallen under 1.21 again.

Difference between “deposits from domestic banks” and “Other sight deposits”

The “other deposits on sight in Swiss francs”, which the Swiss National Bank (SNB) publishes in its weekly Important monetary policy data (http://www.snb.ch/en/iabout/stat/statpub/impdata/id/statpub_impdata_hist), does indeed consist of all the three following categories:

- Liabilities towards the Confederation (see explanation)

- Sight deposits of foreign banks and institutions (see explanation)

- Other sight liabilities (see explanation)

Further explanation about all four categories of sight deposits you find in the annual report 2011, p. 135 and p. 143 (http://www.snb.ch/en/mmr/reference/annrep_2011_komplett/source). In addition, in the monthly publication SNB balance sheet items, you find the most current numbers for the sight deposit categories (http://www.snb.ch/ext/stats/balsnb/pdf/deen/A1_Ausweise_der_SNB.pdf). Please note, that these numbers as well as those in the annual report are end of the month/year numbers, whereas the numbers in the Important monetary policy data are weekly averages.

Kind regards

Silvia Oppliger

Deputy Head of Media Relations

Swiss National Bank

What does increase of money supply (or sight deposits) mean ?

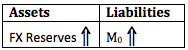

The increase of around 2.6 billion francs in sight deposits e.g. during the week of September 14, should correspond to exactly the same increase of FX reserves, when changes in prices are excluded: 2.6 billion

more money (M0) printed to buy 2.6 billion more FX reserves.The SNB did not employ swaps or repos since April 2012. Swaps or repos may distort the picture (see more details here).

How do price changes effect money supply and FX reserves ?

When the EUR/CHF rises by 1% and deposits are increasing, then the SNB must pay more for one Euro than previously. A number of 2.6 billion CHF would correspond to 1% less, namely to 2.57 billion CHF when measured with a stronger CHF. One sees that difference in price does not really matter. Moreover the dollar or yen have strongly fallen against the CHF over the “QE-unlimited” week. Therefore the 0.03 billion the SNB had to pay more for the euros (60% euro in the SNB portfolio) are reversed by maybe 0.03 billion cheaper dollars or yens. Last but not least, the SNB might have switched to buying the cheap dollar or yens selling some euros.

An example for the monetary data is shown here:

The difference between “sight deposits of domestic banks” and “Other deposits on sight in Swiss francs” are essentially the origin (foreign banks contained in “other”) and the type (non-banks contained in “other”). More details here.

The Limits of Money Printing

Theoretically banks could tell the SNB not to credit their accounts any more, this would prevent the SNB from printing. Still banks are sure to get the money back one day. They think that the SNB is to be able to get rid of all their currency reserves and to sterilize deposits. The SNB’s Dewet Moser writes in this paper how easy it to sterilize during 2010 and 2011. However he does not speak about the fact that the Swissie was strongly rising during this sterilization process.

Money Printing in the euro system

Inside the euro system, ECB money printing via deposits means debiting the account of the ECB and crediting the account of the National Central Banks (NCBs) of the euro system as for their participation in the ECB. This method e.g. used in the ELA (emergency liquidity financing) is done according to the following schema:

Eurosystem Participations

Eurosystem Participations per Country Source: ECB - Click to enlarge

30% of the ECB capital belongs to non-euro states like the UK, Sweden, Denmark, Poland or other non-euro EU member states.

Printing money means that the ECB increases its debt towards the NCBs in the ratio of the euro system participations, namely Bundesbank 27%, Banque de France 20%, Banca d’Italia 20% and Banco de Espana 12%.

If the ECB buys peripheral bonds with this money, it implies an implicit transfer from the Bundesbank and the Banque de France and other Northern states to the periphery.

The Bundesbank will refinance this money via increasing its debt at German commercial banks. These again will have more reserves which they might invest via the money multiplier to give more loans to German firms and housing. Apart from more and more debt due to Germany, this operation will increase inflation over the medium and long-term.

The ECB often employs tenders (via SMP, MTO, LTRO or OMP) to allow commercial banks to refinance her directly. In this case banks reserves at the central bank do not increase, therefore it is also called sterilized. Since these lending banks mostly come from Germany and other Northern states, it is just another form of money transfer from the Northern states to the periphery.

Read the full details about the differences in money printing among SNB, ECB and Fed in our article “The big Swiss Faustian Bargain” also appeared on Zerohedge.

Are you the author? Previous post See more for Next post

Tags: ECB,international investment position,M0 base money,Monetary Base,monetary data,Monetary Policy,money printing,SNB sight deposits,Swiss National Bank,Trade Balance