Tag Archive: debt

Inflation

(Traveling and unable to provide a technical overview this week.) Rising price pressures,

stronger and more persistent than generally expected, has been the main

challenge for consumers, businesses, and policymakers. It will stay top of mind in the week

ahead as both the world's two largest economies, the US and China, report July

consumer and producer prices. During the Great Depression, the

central governments discovered their balance sheets,...

Read More »

Read More »

The end of central banking as we know it

The severest crisis the European Central Bank (ECB) ever faced coincided with the early days of a new Executive Board. Over the past year and a half, the board’s six members, including the ECB’s president and vice president, have all been replaced, either because they resigned, or because their eight-year mandate expired.

Read More »

Read More »

They’ve Gone Too Far (or have they?)

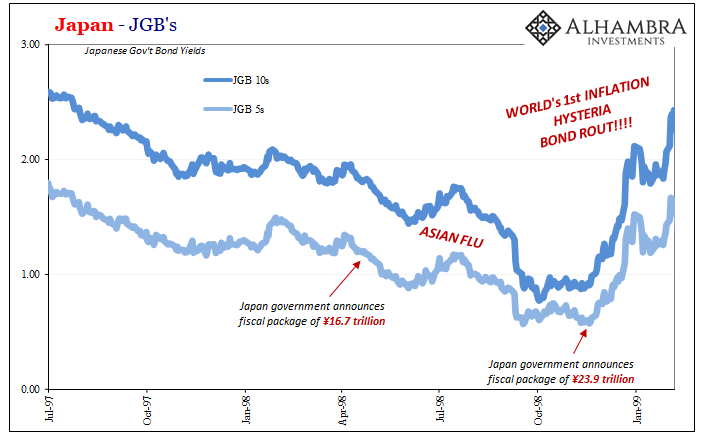

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

What to Expect from the World Bank and IMF

The spring meetings of the World Bank and IMF will be held virtually this week amid a profound economic crisis spurred by a novel coronavirus. Unlike previous such viruses, this went global in such a destructive way that many countries have responded the same way. Encouraging social distancing, closing non-essential businesses, and enforcing lockdowns.

Read More »

Read More »

FX Weekly Preview: Sources of Imbalance and the Pushback Against New Divergence

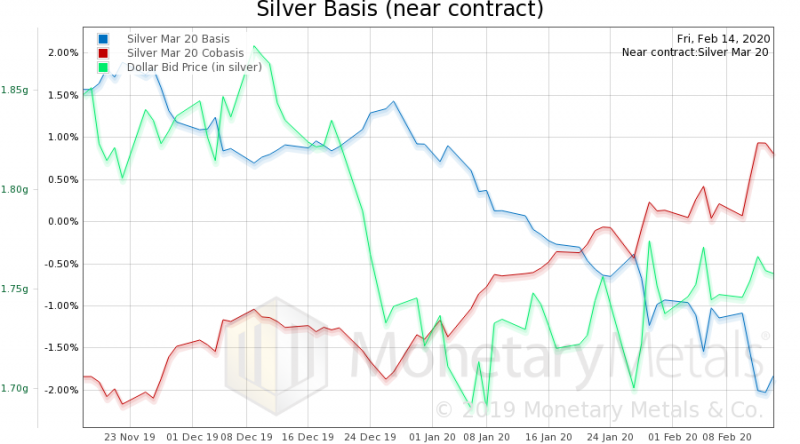

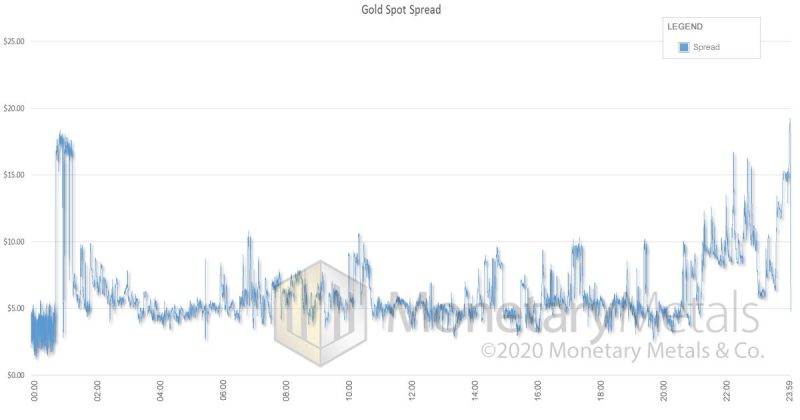

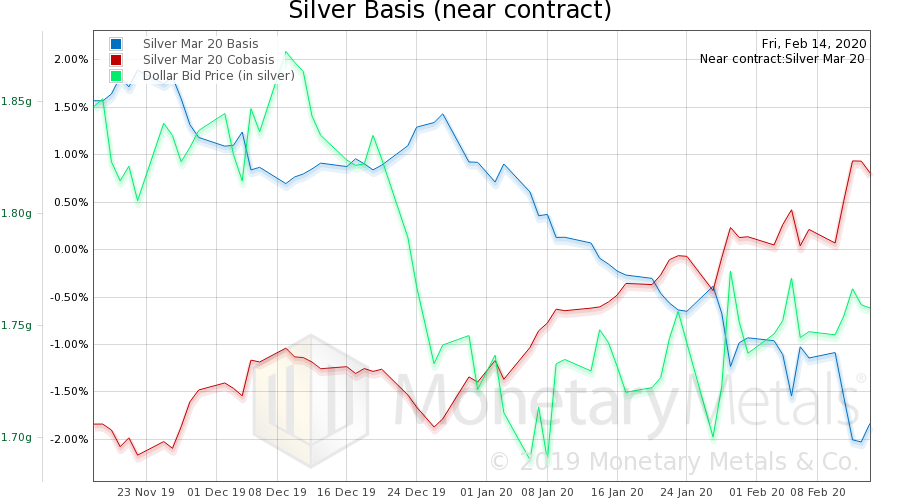

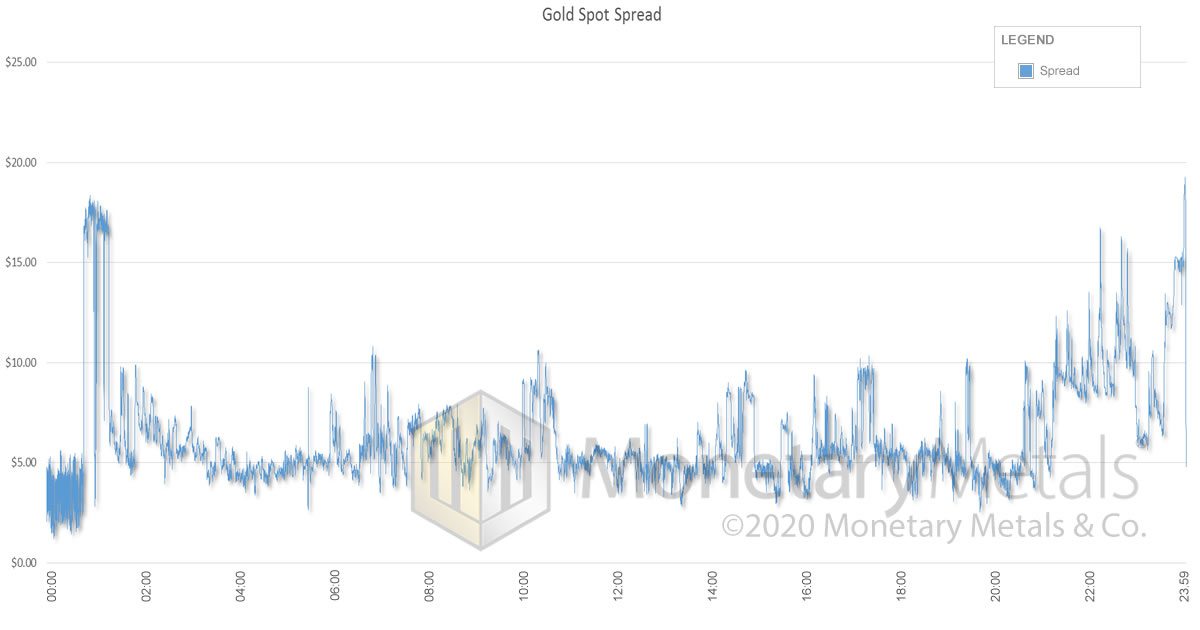

The US dollar's surge alongside gold has eclipsed the equity market rally as the key development in the capital markets. Even the traditional seemingly safe-haven

yen was no match for the greenback. The dollar appeared to have been rolling over in Q4 19, as the sentiment surveys in Europe improved, Japanese officials seemingly thought the economy could withstand a sales tax increase, and data suggested the Chinese economy was gaining some...

Read More »

Read More »

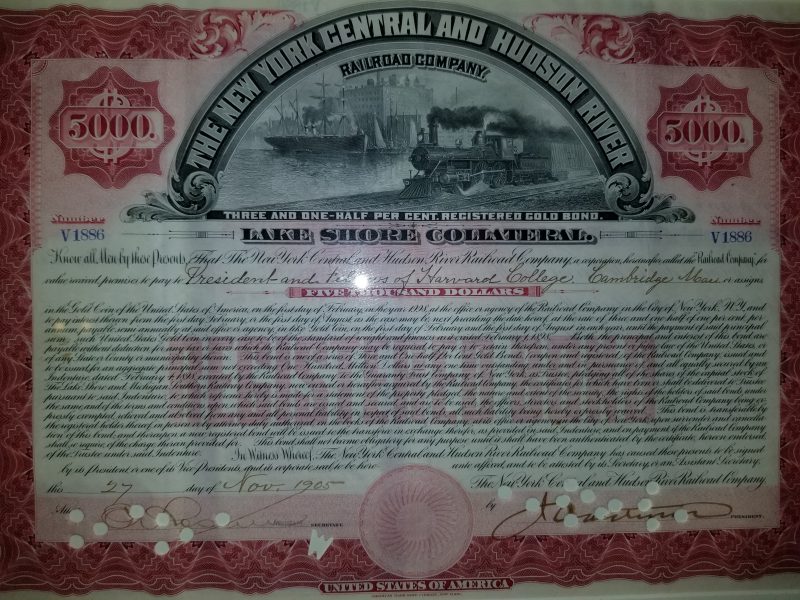

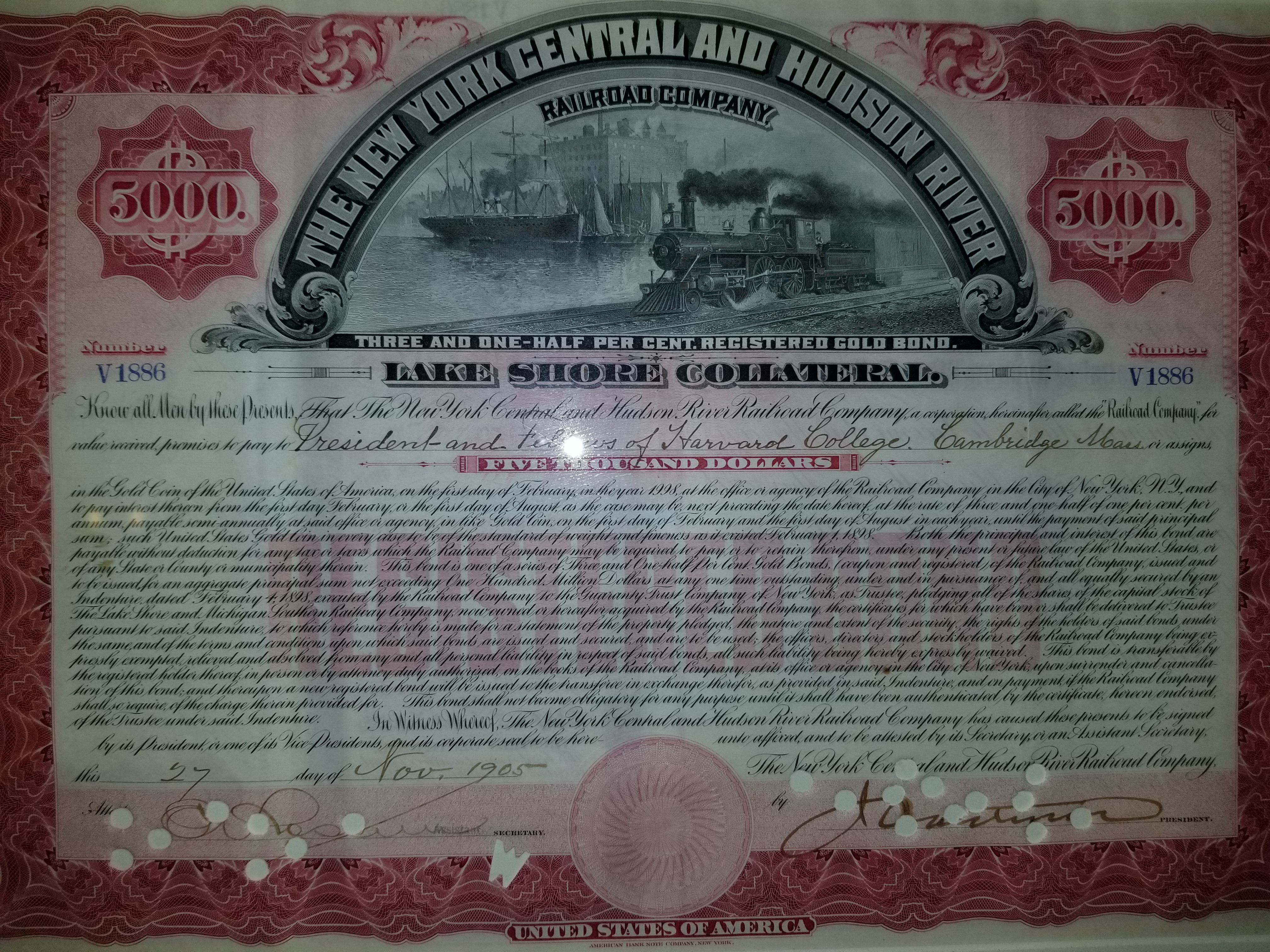

The Benefits of Issuing Gold Bonds

A gold bond is debt obligation that is denominated in gold, with interest and principal paid in gold. As I will explain below, it’s a way for the issuer to pay off its debt in full, and there are other advantages. Sometimes, I find that it’s helpful to show a picture of what I’m talking about. At the Harvard Club in New York, an old gold bond is hanging on the wall among other memorabilia.

Read More »

Read More »

Currency Risk That Isn’t About Exchange Values (Eurodollar University)

This week the Bureau of Economic Analysis will release updated estimates for Q2 GDP as well as Personal Consumption Expenditures (PCE) and Personal Incomes for July. Accompanying those latter two accounts is the currently preferred inflation standard for the US economy. The PCE Deflator finally hit 2% and in two consecutive months, after revisions, earlier this year.

Read More »

Read More »

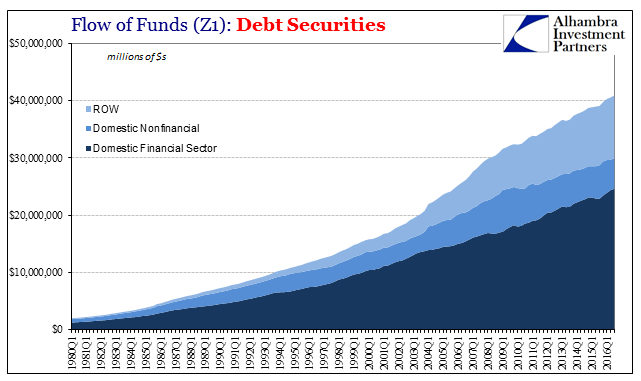

Do Record Debt And Loan Balances Matter? Not Even Slightly

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated with some of the worst. It...

Read More »

Read More »

No Paradox, Economy to Debt to Assets

It is surely one of the primary reasons why many if not most people have so much trouble accepting the trouble the economy is in. With record high stock prices leading to record levels of household net worth, it seems utterly inconsistent to claim those facts against a US economic depression.

Read More »

Read More »

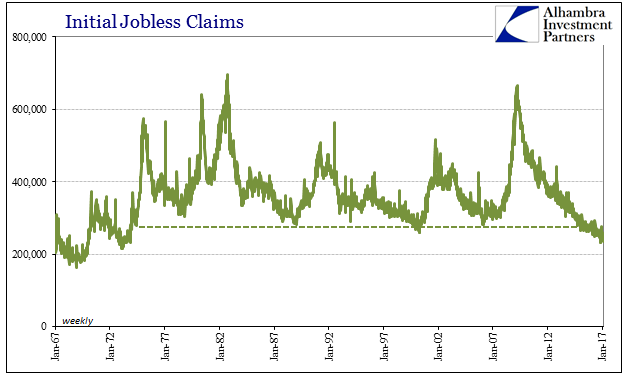

Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years.

Read More »

Read More »

BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the "VIX is now broken." Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the "central banks' central bank" has agreed with the...

Read More »

Read More »

China: Services Companies Benefit on Lower Tax with VAT introduction

Yesterday, China announced one of the most important tax reforms of the past twenty years. It is replacing a business tax on gross revenue for non-manufacturing companies with a VAT. Manufacturing companies have been subject to a VAT approach subject

Read More »

Read More »

Great Graphic: Measuring Cost of Extend and Pretend

There is a debate. On one hand is Summers, who argues that modern economies have entered an era of secular stagnation. Full utilization of the factors of production and particularly capital and labor is not possible without stimulating aggregate demand in a way that facilitates bubbles. The broad strokes of the argument can be found …

Read More »

Read More »

What happens if the debt ceiling raises

2023-01-20

by Stephen Flood

2023-01-20

Read More »