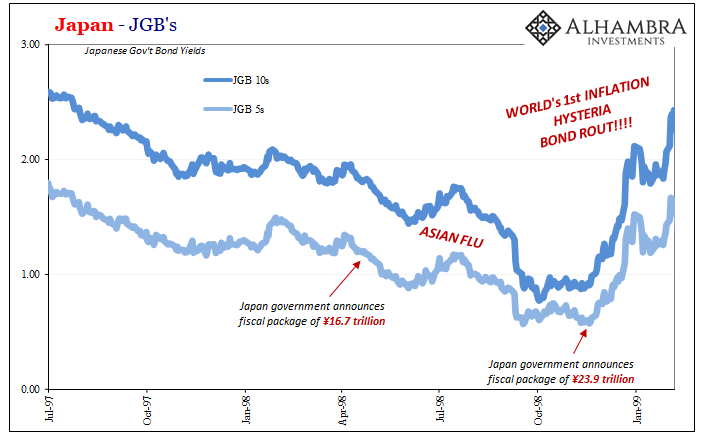

| Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

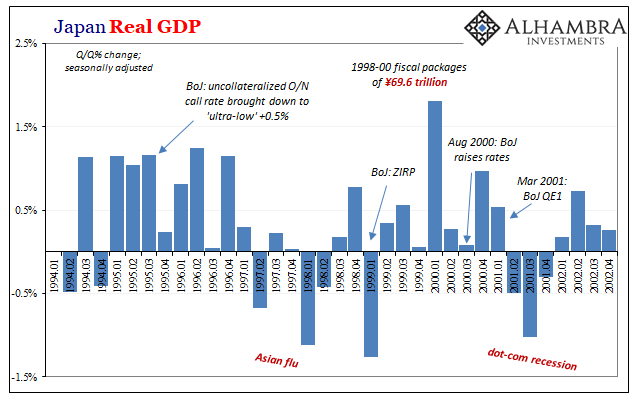

The JGB 10-year yield had dropped to a low of just 77.2 bps during the depths of 1998’s Asian Financial Crisis (or “flu”, so noted for its regional contagious dollar shortages). Having backed up modestly from that low in early October ’98 to around 90 bps by mid-November (sounds familiar), a few days after November 16, 1998, the massacre was in full effect. It wouldn’t end until February 5, 1999, where by then the JGB 10s had skyrocketed (in yield) to a seemingly inflationary fire of 243 bps. That was a rout.

Yes, stimulus frenzy; the traditional belief that government spending of this magnitude must always lead to certain inflationary doom added to the growing concerns over how the Japanese government was simply borrowing way, way too much to finance all this “stimulus.” They’d surely break the JGB market by overdoing it. You see, not only was there a massive ¥23.9 trillion fiscal package unveiled in November ’98, there had already been one for ¥16.7 trillion put forward that April. |

|

| Whatever deflationary malaise that Japan’s growing “lost decade” had created up to that time, fiscal recklessness of a scale never before seen in the modern world had undoubtedly, it was thought, pushed passed the boundaries of control.

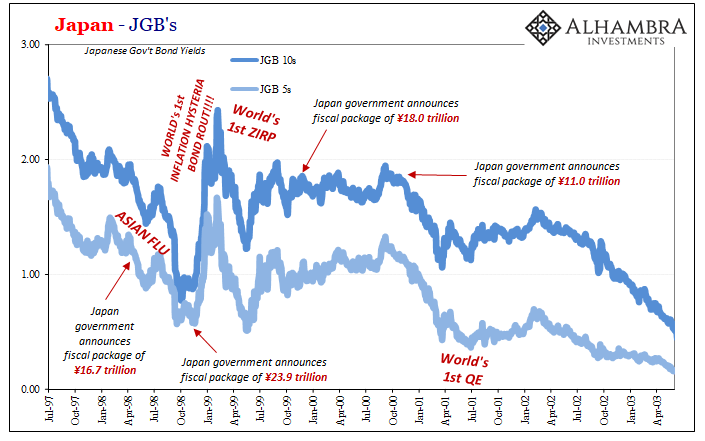

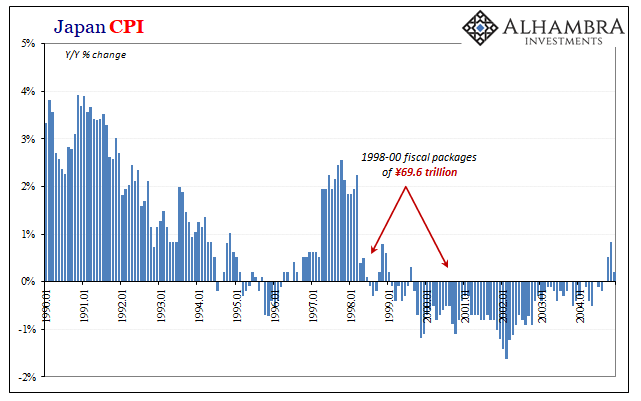

In addition, the global economy was also on the mend during this time – meaning that the JGB market had everything in the world stacked up against it. Massive domestic stimulus, including what was then unthinkably low interest rate policy courtesy of the Bank of Japan, all added on top of the economic rebound breaking out seemingly around the rest of Asia pulling upward on the Japanese economy while it did. But – this being Japan you knew there was a “but” coming – it didn’t last beyond those three months. For the eternal inflation vigilantes among the JGB and Economist crowds, their fun was limited to not even a full quarter year’s “I told you so.” For all the surefire this and guaranteed that, the Japanese economy rebounded, sure, but never recovered. Instead, by early ’00, yet another recession loomed just over the horizon even though the economy had barely budged out from its previous one. The practical effect, obviously, was a further plunge in bond yields especially as the predicted, expected consumer price blowout never materialized; consumer prices, in fact, dropped right back into outright deflation and stayed there pretty much that whole time. Nothing had actually changed, at least not anything meaningful. |

|

| Over the next several years, the BoJ would break even more “rules” and conventions first with the Zero Interest Rate Policy (ZIRP) which wasn’t all that much more than the low interest rate policy adopted only a few years before, and then finally what was supposed to have been the BIG ONE: quantitative easing.

And during all that convention-busting, Japan’s government did not sit idle. On the contrary, more “stimulus” – though not nearly as big as the combined 1998 packages. By that point in 2000, on the cusp of another recession, even the Japanese and Western media was yawning at the announcements of even more trillions (see above). |

|

| Bond yields did remain substantially higher than their 1998 lows during the period (up until recession was nigh in the summer of 2000), but it wasn’t the inflationary inferno many had promised. Presumed recklessness of all kinds hadn’t blown up markets or the economy, or markets and the economy, it merely led to a situation where bond market participants were content to hold on and see how the downside risks played out.

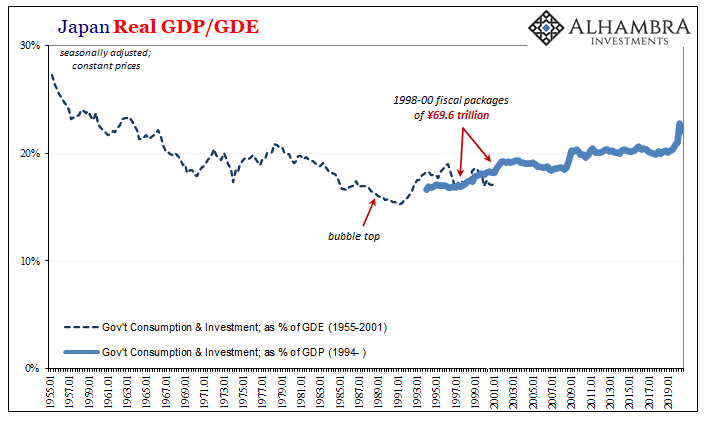

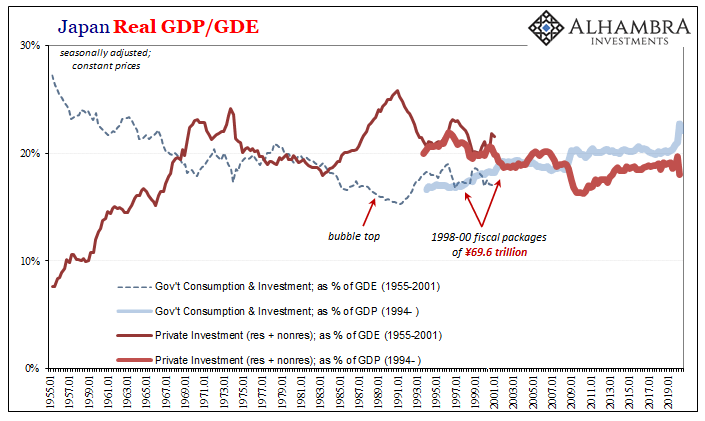

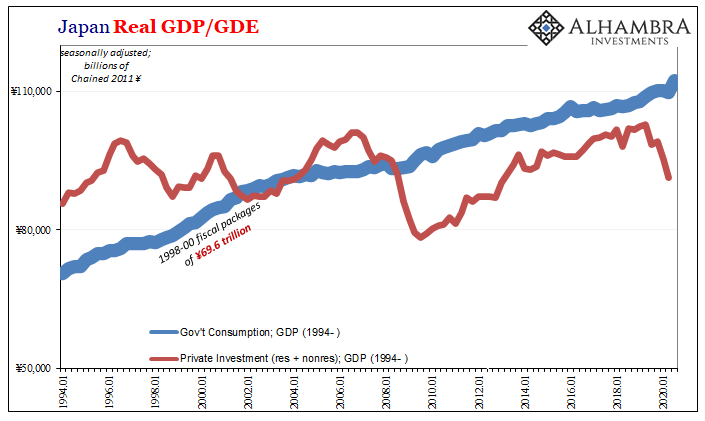

As they eventually did. This example, while ignored in the mainstream today, hasn’t been unappreciated in bond markets outside JGB’s. New conventions about “stimulus” have been written and traded. One reason why, all that government spending and borrowing “crowding out”, sort of, the private economy. In a situation where risks are not balanced, tilted openly toward the deflationary despite so much inflationary rhetoric, why wouldn’t the market prefer lending to the safest obligor (government) while at the same time eschewing funding on the private side? The Japanese government had done the bond market a favor by being forced to issue more debt, supplying what was in demand which that market happily absorbed. In 1997, after “stimulus” spending earlier in the decade in the immediate aftermath of the initial crash, central government debt as a proportion of GDP had gone up to 74% (from a low of 38% in ’91). By 2001, the ratio was 104%; beyond the previously assumed threshold which was supposed to have triggered bond vigilantes and all the horrific consequences they’ve long feared. What happened instead was that government grew in proportion of the overall economy – which didn’t. Stimulus didn’t stimulate; the alleged inflationary fuel never in danger of catching fire because there was no legitimate basis for it. Private investment most of all, it remained restrained no matter what the official sector proposed or which individual policy it pursued. |

|

| And all the while, the bond market continued to flourish; yields dropped and remained low for years, broken only occasionally.

Sure, like ’99 and ’00, bond rates rose a bit as they have here at times during the post-crisis era but only when reflationary periods (rebounds short of recovery) happen to show up. But, as we saw back then, this wasn’t game changing mechanics a minute away from repeating Weimar Germany. Such a thing was never a realistic chance, even during those three months between ’98 and ’99. In the grand scheme of lost decades, even that one legit bond rout was tiny. |

|

| There is this pervasive belief that a government, any fiscal authority, working in concert with a central bank can unleash inflation if only it puts its mind to it. In post-money central bank lore, all that’s required is “shock and awe”; a play upon people’s expectations. Huge numbers challenging previously established conventions.

The data and experience, however, consistently shows this is not the case; anywhere. On the contrary, what becomes clear is that whichever type government action is almost always proportional to the economic hole which provoked it. |

|

| Size says nothing about its effectiveness, rather the degree of trouble already befallen whichever system.

A new convention has quietly taken over as a result. |

|

| The difference, always this difference, between these stubbornly incurable situations in the economy and the regular business cycle by which these inflationary concerns may hold validity is…the permanent shock. This is what changes everything.

“L” situation, rather than “V.” If an economy isn’t legitimately recovering, “stimulus” is nothing more than for show. The “L” always wins. The times when it seems like it won’t, those are far too brief and, in the grand scheme of things, genuinely uninspiring. There are still those today who say that Japan is an isolated case, or its tortured history a product of Japanese factors alone. |

|

| And they claim these things even as the US, Europe, and most of the rest of the world have followed along almost exactly the Japanese blueprint. From QE to budget busting, the actions have been eerily similar and so have the results.

This time is different, they always say. This time, they’ve gone too far! It’s not the government which holds the key, no matter which number it might wish to attach. The answer, and the problem, only begins with the letter “L.” |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of Japan,bond market,bond yields,Bonds,currencies,debt,Deflation,economy,Featured,Federal Reserve/Monetary Policy,Fiscal spending,Government Bonds,inflation,Interest rates,Japan,JGB,Markets,newsletter,QE,stimulus,Yield Curve,ZIRP