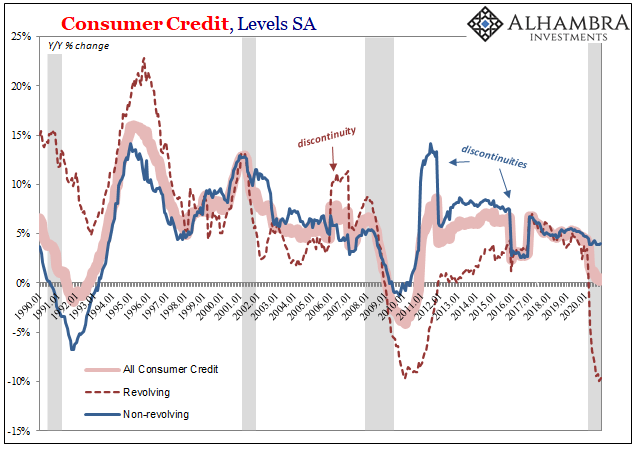

| Revolving consumer credit declined again in November 2020, according to data released by the Federal Reserve last week. Though the monthly seasonally-adjusted change was small, it still represents significant uncertainty and material mistrust of the underlying economic condition among a broad section of consumers. Those who are paying down their credit card balances, while avoiding taking on higher revolving debts, they are the very consumers Fed policymakers are counting on to lead any recovery rather than subvert it.

In terms of non-revolving credit, the federal government continues to do what it does and will always do regardless of the circumstances. |

US Consumer Credit SA, Jan 2006 - 2020 |

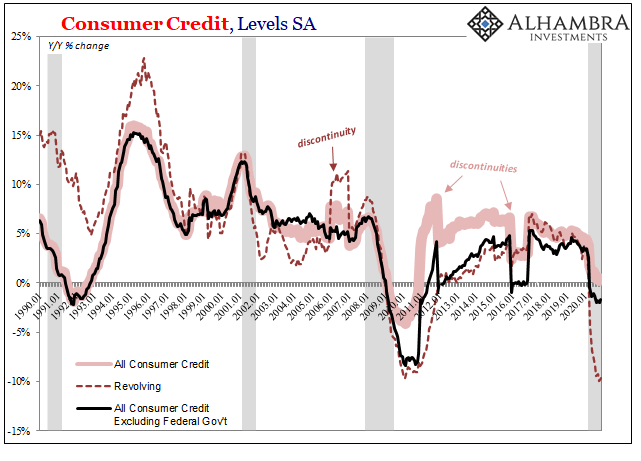

| Private banks and non-bank financial entities have added back some credit they’d expunged earlier in 2020. Even so, the rate is minimal indicating that the financial sector remains as way about these same factors.

Total consumer credit (both revolving and non-revolving) held by non-government entities in November was 1.7% below what it had been in the same month of the previous year. Revolving credit alone continues to be down just about double-digits. |

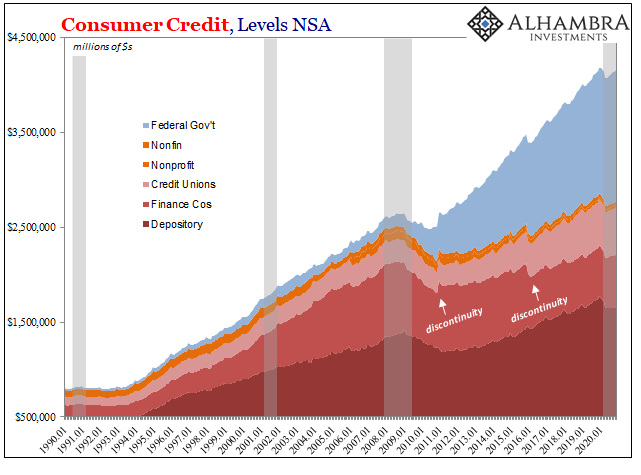

US Consumer Credit by Holder, Jan 1990 - 2020 |

US Consumer Credit YoY, Jan 1990 - 2020 |

|

US Consumer Credit YoY ex Govt, Jan 1990 - 2020 |

|

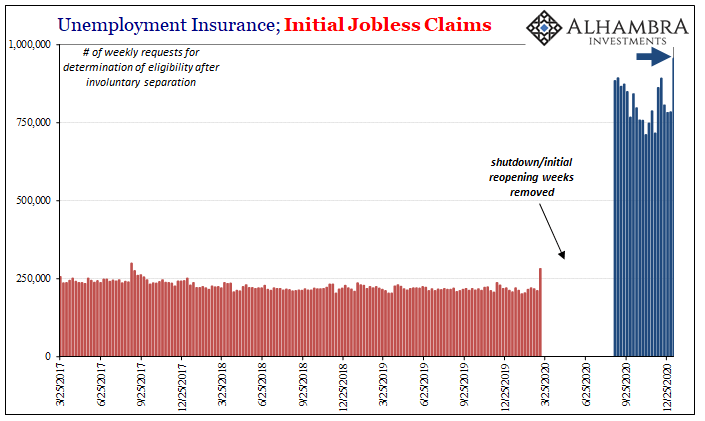

| The primary reason for all this is, quite simply, the labor market. As we saw with December’s payroll report, the employment situation took a step backward after having its rebound halted months ago only around halfway back. The result is, as of the end of 2020, an ongoing deficit of about 10 million payrolls.

The worst month during the Great “Recession”, the one with the largest cumulative deficit, was “only” 8.7 million. Those figures do not include the estimated 9 million Americans who continued to be employed last month but experienced work or hourly disruption(s) anyway. In addition, there should have been at least another 1.6 million jobs created which never had the chance. |

US Payrolls Private Growth, Jan 2020 - 2021 |

| Widespread caution is entirely merited, no matter how much sentiment might have been introduced by QE (and its sentimental effects on share prices).

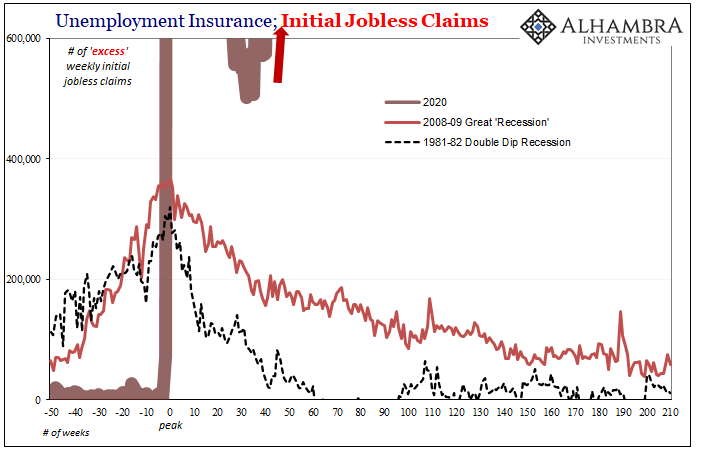

The longer this keeps up, no matter how many or how big the government writes its upcoming checks, it might be a minor miracle should the personal savings rate end 2021 somewhere below 50%. On Thursday, the Department of Labor reported (weekly Thursday ritual) an enormous surge of initial jobless claims. Seasonally-adjusted, the tally made it back close to 1 million again. At 965,000 the first week in 2021, it’s way off the charts of where “recovery” should be (excess claims). |

US Unemployment Jobless Claims Initial, Mar 2017 - Dec 2020(see more posts on U.S. Initial Jobless Claims, ) |

US Unemployment Jobless Claims Excess(see more posts on U.S. Initial Jobless Claims, ) |

|

US Unemployment Jobless Claims Continued, Mar 2017 - Dec 2020(see more posts on U.S. Initial Jobless Claims, ) |

|

US Unemployment Jobless Claims, Jan 2020 - Dec 2020 |

|

| What that already indicates for January is the very real possibility that payrolls will shrink yet again, for the second month running and at a higher likelihood of an even more negative number than December.

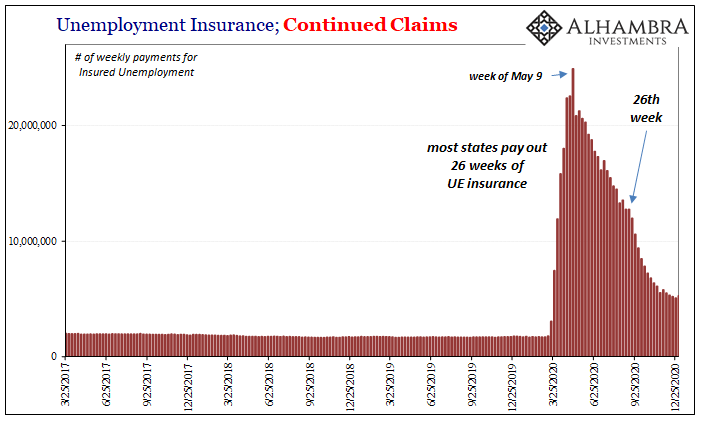

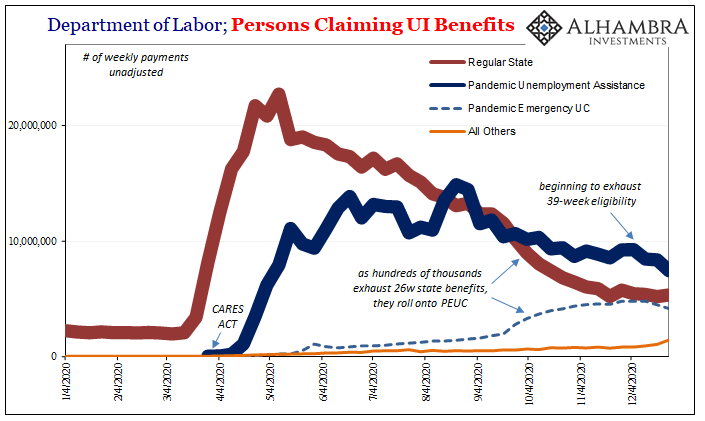

In addition, because of the shift toward the bad side labor market the number of continued claims also increased by just about 200,000 – even as hundreds of thousands keep exhausting their regular 26-weeks of state unemployment insurance. And while many have rolled on to the federal government’s extended, there are now millions more who are rolling off the feds’ various pandemic assistance programs having exhausted their eligibility there, too. The PUA, for example, had dropped 1.8 million from the first week in December to the latest data (for these) for the week of December 26. |

US Federal Reserve: Foreign Exchange Rates, Jan 2008 - 2021 |

| This coincides with 39 weeks since the start of the recession (though some claims were retroactively paid), the max number the federal government had originally set for PUA payments.

What “reflationary” markets are betting is that none of this will matter; that, yes, it’s really, really ugly right now for way, way too many people, but giving the vaccine(s) enough time and under the cover of Joe Biden’s TGA funding, today won’t have any impact on what’s expected to be a much brighter tomorrow. Or, if it does, then there won’t be any material consequences because Uncle Sam will pay everyone their losses incurred. Reasonable belief, or rationalized conceit? The problem isn’t those, necessarily, rather it’s the lost economic capacity and potential that only increases as second and third order effects multiply given how this deficit and constant disruption remains as huge as it is with no sign of its end. Some markets may be able to imagine beyond the horizon and see only normality, but as regular American workers get jerked around week after week, month after month, businesses, too, the more negative pressures and changes – the kind of long run damage all this “stimulus” is supposed to avoid – further sets in. More than just defensively paying down credit card debt. |

US Dollar Index Future, Jan 2017 - 2021 |

Not for nothing, there were enormous “stimulus” checks written in 2020, too, along with huge doses of “money printing” and overt “market support” provided by the Federal Reserve (allegedly). When initially undertaken, it became quite widely believe how it would end up just that easy easing into the “V”-shaped recovery back to full again.

While it may be easy, you shouldn’t, as these millions of workers and business can’t, ignore that none of that happened the first time. Not even close, off by tens of millions. Markets, in particular, were imagining an end to 2020 that sure didn’t look anything like this.

Same thing 2021? Maybe not, vaccine and all, but it’s not an immaterial risk as the losses keep piling up long after they were supposed to have reversed (why haven’t yields, like the dollar, really moved all that much?)

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter