When the Swiss National Bank (SNB) scrapped its currency floor three years ago, its monetary policy strategy was clear: to fight Swiss franc appreciation. It did so verbally, by calling the currency “significantly overvalued”, and physically, by implementing a negative interest rate and intervening in the foreign exchange market as necessary.

Three years on, the interest rate on sight deposits at the SNB remains unchanged at a record low of – 0.75%. What’s more, over this time the SNB has intervened in the FX market by spending CHF 86 billion on foreign currency assets in 2015, another CHF 67 billion in 2016 and an estimated (based on the weekly variation of deposits at the SNB) CHF 44 billion in 2017. The only change over this period was that the SNB’s assessment of the Swiss franc had changed from “significantly overvalued” to “highly valued” bySeptember 2017.

There are several reasons to believe that the SNB may soon start to normalise its monetary policy. First, the Swiss macroeconomic outlook has improved: Swiss growth is picking up and becoming broader -based across a range of sectors, while inflation is also gradually rising. Second, the Swiss franc has weakened and the pressure on the currency has become somewhat softer. Third, other central banks (in particular the Fed and the ECB) are gradually removing some of their own stimulus. The key question is when and how the SNB will normalise?

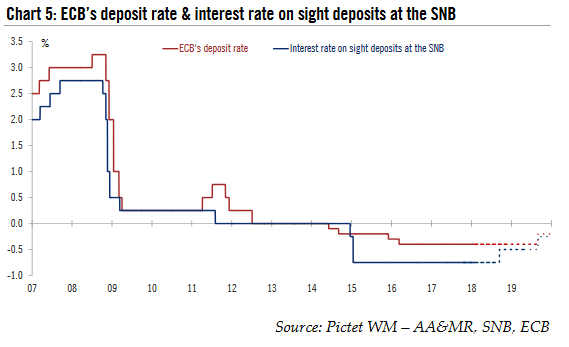

Our best guess is that there will be a first rate hike of 25bp in December 2018 (assuming that the European Central Bank (ECB) will have signalled the end of its QE programme). This would mean its policy rate would remain below the ECB’s current deposit rate of – 0.4 0%. A second hike is then projected for Q3 2019, when we also expect the ECB to raise policy rates for the first time.

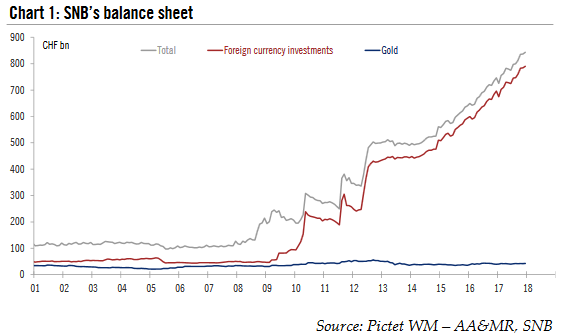

Communication change firstIn the press conference following its December meeting, SNB President Thomas Jordan made it clear that policy normalisation is not yet being discussed, in part because the SNB still sees the situation in the FX market as fragile. A change of communication about future monetary policy is likely to come during H2 2018 as the SNB will want to wait for sure signs that the ECB is ending its QE programme and that an ECB deposit rate hike is on the cards for Q3 2019, as we expect . The SNB will also want to wait for the outcome of the Italian elections this March because of their potential impact on the Swiss franc. What about the balance sheet?As a result of its expansionary monetary policy, the SNB’s balance sheet has increased significantly in size, and this has been the subject of much political pressure and debate. Since 2007, the SNB’s balance sheet has expanded eightfold. In December 2017, the assets it held amounted to CHF 843 billion (see Chart 1), representing 127 % of Switzerland’s GDP. 94% of its balance sheet is composed of foreign-currency investments, setting the SNB apart from other central banks, such as the Fed, ECB and Bank of Japan, whose large balance sheets consist primarily of bonds denominated in their own currencies. Unlike in the US, the euro area and Japan, the scope for QE based solely on buying domestic assets is limited in Switzerland due to their limited supply. That being said, compared with other central banks, the SNB does not need to worry about policy space because it is unlikely to run out of foreign assets to buy. |

SNB Balance Sheet, 2001 - 2018 |

| The SNB provides a quarterly breakdown of its foreign currency reserves by asset class, currency and fixed income credit rating. As at Q4 last year, 21% was in equities, 68% in government bonds and 11% in other bonds (see Chart2). At the currency level, 40% was in euros, 35% in US dollars, 8% in the Japanese yen, 7% in sterling, 3% in the Canadian dollar and 7% in other currencies. 59% of its fixed income holdings were in AAA -rated bonds, 24% in AA issues and 12% in A-rated bonds. Their average maturity was 4.7 years.

The management of SNB’s foreign currency reserves is linked to monetary policy. The SNB uses three investment criteria in managing its investments: security, liquidity and return, with the first two being the most important. An important feature is that the SNB doesn’t hedge its foreign currency investments since a currency hedging would directly influence monetary policy. Any hedging would be equivalent to purchasing Swiss francs against a foreign currency. In a speech last year, Andréa M Maeschler, a member of the SNB’s board, mentioned that “ currency risk accounts for 85% of the total risk to which SNB investments are exposed. In a typical Swiss pension fund’s investment portfolio, however, this share is just 36%”. For this reason, the SNB considers diversification as a key pillar of its investment strategy. The SNB does not provide a precise breakdown of its balance sheet by country, although it is known that a substantial portion is invested in highly liquid government bonds denominated in US dollars and euros. A few years ago, the SNB was hit by an S&P report , claiming that “French and German borrowing costs fell sharply in 2012, largely because of bond buying by Switzerland’s central bank aimed at weakening the Swiss franc”. The reduction of the SNB’s balance sheet will not be without market consequences. The sales it makes would be likely to lead to increase d supply of core euro area bonds and thus reduce the spreads of issues from the periphery relative to Bunds. For the most sensitive aspect of its portfolio, its equity holdings , the SNB does not engage in active stock picking. Shares are managed passively by replicating a combination of different indices. There are also some investment constraints; in particular, the SNB avoids investing in mid – and large -cap banks and bank -like institutions. Nor does it invest in firms that produce internationally condemned weapons, violate human rights or cause environmental damage. It also avoids making strategic investments or investing in shares or bonds issued by Swiss companies. |

SNB’s asset class breakdown ( Q4 2017) |

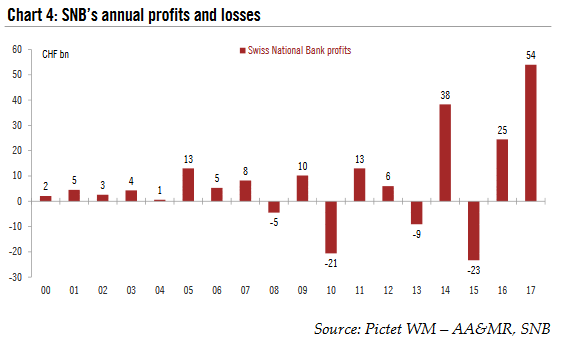

Record high profits in 2017The SNB can experience large profits or losses as a result of FX moves or changes in the valuations of the assets it holds. In fact, 2017 was an exceptional year in this regard: it expects to have made a profit of CHF 54 billion last year (according to provisional calculations – final figures will be published on 5 March) thanks to the weaker franc, low bond yields and higher stock prices. This is more than double its 2016 profit and its biggest profit ever. The profit on its foreign currency positions amounted to CHF 49 billion, its gold holdings increased in value by CHF 3 billion and its Swiss positions by CHF 2 billion. |

SNB’s annual profits and losses, 2000 - 2017 |

Brainstorming on possible “exit” scenario with FX reservesThe huge amount of currency reserves accumulated by the SNB has long attracted lots of interest in Switzerland and abroad. The question is whether or not the SNB’s balance sheet will ever decrease. The SNB has claimed many times that the SNB’s balance sheet can be reduced as fast as it has increased. One might argue, however, that the SNB could be swimming against the tide, bearing in mind that, structurally, the Swiss franc has a tendency to appreciate and that as a safe haven currency it is not immune from appreciating if political risks worldwide arise. We have listed below some possible or widely discussed solutions for the SNB to deal with its foreign currency reserves. – Start selling its assets Further Swiss franc depreciation could create political pressure on the SNB to act proactively by starting to sell assets proactively. There are several possibilities here. The SNB might decide to reduce risk in its balance sheet by selling equities or low er-rated non-government bonds. Another possibility could be to start taking profits by selling AAA-rated euro area bonds with negative yields faster to spread losses upon redemption . As we stated above, this would lead to an increased supply of core bonds and thus reduce peripheral spreads. The idea of a sovereign wealth fund (SWF), such as in Norway or Singapore, has always met with strong interest in Switzerland. The idea would be to create an SWF with the SNB’s foreign currency reserves (all or part) that could benefit the Swiss economy. Nevertheless, the SNB has always been fairly clear on this: a sovereign wealth fund is not on the cards, the main reason being that the amount of SNB reserves is the result of monetary policy actions and is subject to variations. As a consequence, any limitation on the SNB’s room for monetary manoeuvre could jeopardise its monetary policy efficiency. The SNB has to be able to draw down the currency reserves to shift its stance if needed. – Strategic investment in (Swiss) firms Why does the SNB not invest in Swiss firms instead of investing in foreign firms? The solution seems appealing for the Swiss economy. However, the SNB has ruled out any strategic investment in firms. This could create a conflict of interest for the SNB. The central bank has a public mandate and taking a strategic investment position in a firm would mean that the State was intervening in the private sector. – Helicopter money Helicopter money has been the subject of growing interest among politicians and economists , even in Switzerland. The basic principle of helicopter money is that as a central bank aims to stimulate aggregate demand and inflation, an effective tool would be simply to give everyone direct money transfers. Although it could be seen as appealing to receive money from the SNB, this option would put upward pressure on the Swiss franc. Conclusion: a hike before the ECBOverall, what ultimately matters for the SNB is price stability. We are still a long way off its definition of price stability (i.e. a rise in the national consumerprice index of less than 2%), which is why the SNB is likely to remain cautious and true to its current ‘two-pillar’ strategy of negative interest rates and intervening in the FX market if needed. Nevertheless, the reasons to start thinking about policy normalisation are piling up, making a continuation of its accommodative monetary policy look increasingly challenging. We therefore expect a first rate hike of 25bp in December 2018 (see Chart 5). Our impression is that the most likely outcome would be for the SNB to stop reinvesting the principal repayments at some point, leading to a passive reduction of its balance sheet. |

ECB ’s deposit rate & interest rate on sight deposits at the SNB , 2007 - 2018 |

Tags: Macroview,newslettersent

1 comment

Jesse Livermore

2018-02-07 at 14:09 (UTC 2) Link to this comment

Market manipulators at SNB are working overtime these days…now, with the stock markets around the world correcting the Fed and ECB will most likely prop it up, but if we would have an extended downturn/correction money would flow into the currencies and with that the CHF would most likely get stronger again – how many “resources” is the SNB willing to throw at it for the CHF to not go to parity with the EURO?