Category Archive: 6a) Gold & Monetary Metals

Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

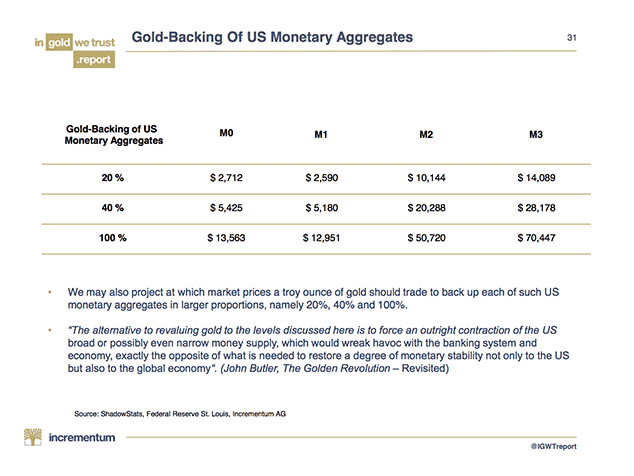

Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book.

Read More »

Read More »

Gold Up 74percent and One Of Top Performing Assets Since Last Market Peak 10 Years Ago

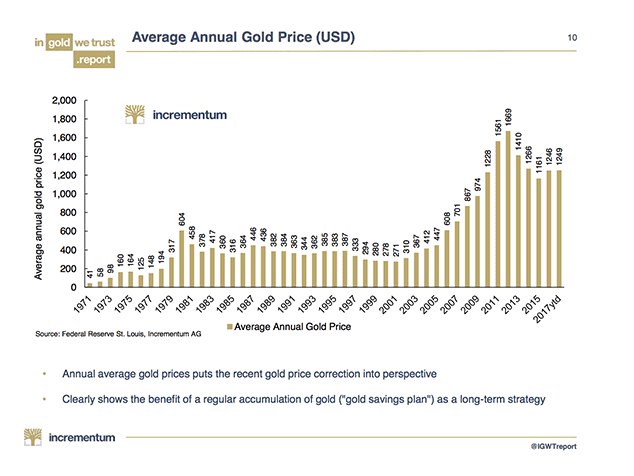

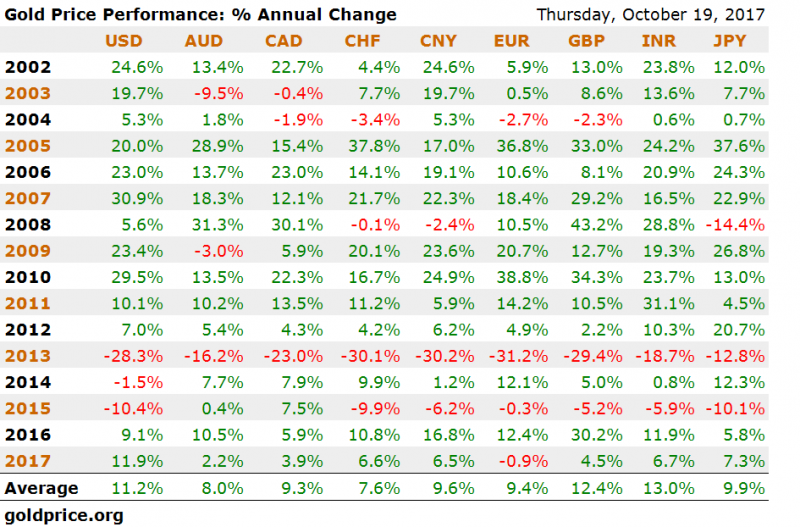

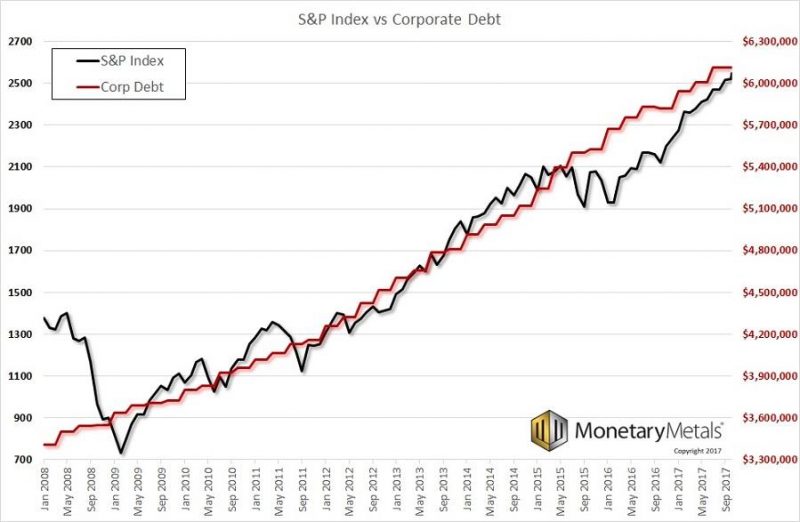

10 year anniversary of pre-Global Financial Crisis market peak in S&P 500 on October 9th. Gold up 74% since the last market peak a decade ago; 11% pa in USD, 9.4% pa in EUR and 12.4% pa in GBP. Precious metal has climbed $736/oz on Oct 9th 2007 to $1278.75 ten-years later. S&P 500’s 102% climb is thanks to asset-pumping policies by central banks, rather than value. Gold’s performance is slowly forcing mainstream to re-consider gold.

Read More »

Read More »

How Gold Bullion Protects From Conflict And War

What Steel’s study shows is that, as with any monetary force, it is how it is managed rather than what it is that carries responsibility for conflicts and the resulting financial situation. Steel’s work also demonstrates the strength and protection access to gold will give a country or army during times of conflict.

Read More »

Read More »

Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Authored by Kevin Muir via The Macro Tourist blog, Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility.

Read More »

Read More »

Silver Bullion Prices Set to Soar

Gold prices have far outpaced gains in silver so far this year, but silver will emerge as the winner for the second year in a row. With a per-ounce price of $17.41 for silver futures as of Friday, analysts say the white metal is poised for a big climb, particularly as the gold-to-silver ratio stands well above historical averages.

Read More »

Read More »

Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

Brexit UK vulnerable as gold bar exports distort UK trade figures. Britain’s gold exports worth more than any other physical export. Gold accounted for more than one in ten pounds of UK exports in July 2017. UK’s stock of wealth has collapsed from a surplus of £469bn to a net deficit of £22bn – ONS error. Brexiteers argue majority of trade is outside EU, this is due to large London gold exports. Single gold bar (London Good Delivery) is, at today’s...

Read More »

Read More »

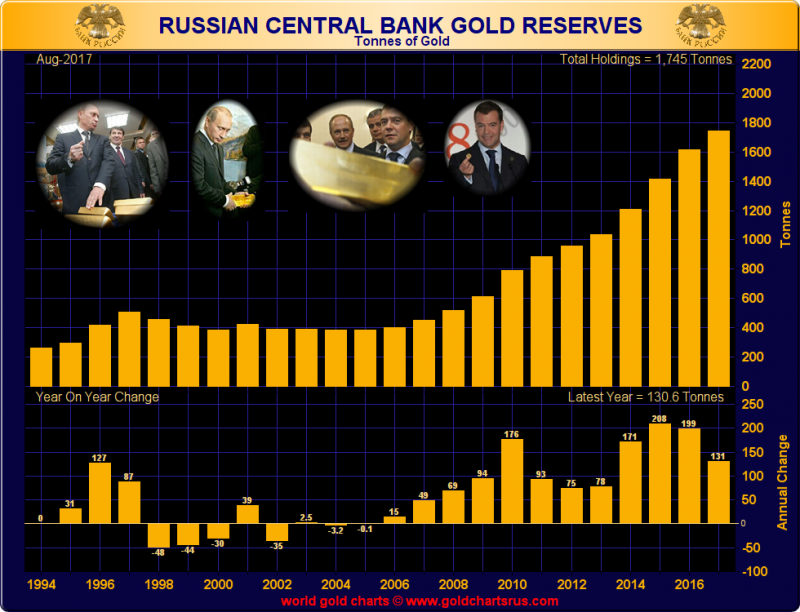

Neck and Neck: Russian and Chinese Official Gold Reserves

Official gold reserve updates from the Russian and Chinese central banks are probably one of the more closely watched metrics in the gold world. After the US, Germany, Italy and France, the sovereign gold holdings of China and Russia are the world’s 5th and 6th largest. And with the gold reserves ‘official figures’ of the US, Germany, Italy and France being essentially static, the only numbers worth watching are those of China and Russia.

Read More »

Read More »

The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece was released ‘the story’ was...

Read More »

Read More »

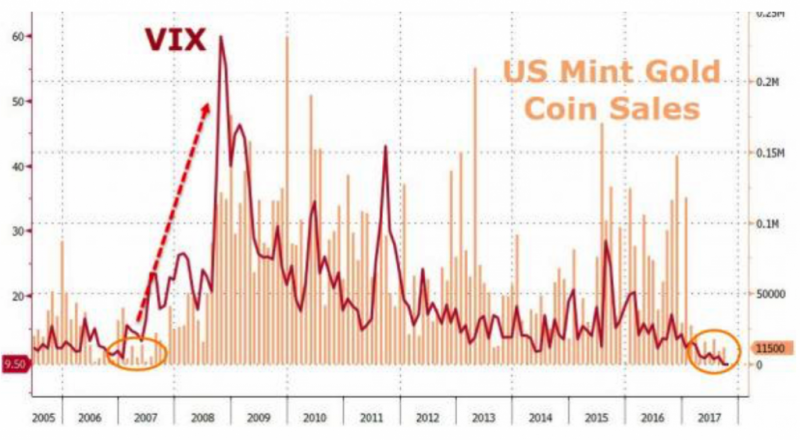

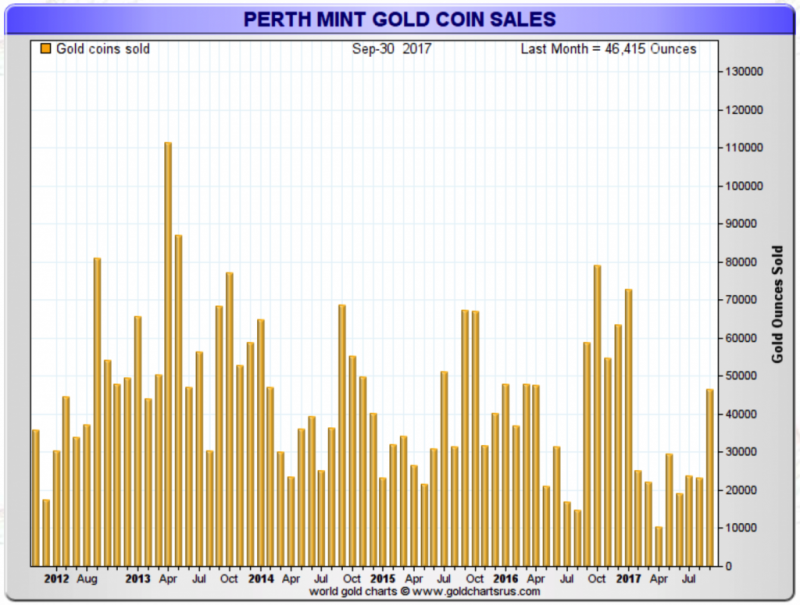

U.S. Mint Gold Coin Sales and VIX Point To Increased Market Volatility and Higher Gold

US Mint gold coin sales and VIX at weakest in a decade. Very low gold coin sales and VIX signal volatility coming. Gold rises 1.7% this week after China’s Golden Week; pattern of higher prices after Golden Week. U.S. Mint sales do not provide the full picture of robust global gold demand. Perth Mint gold sales double in September reflecting increased gold demand in both Asia and Europe. Middle East demand likely high given geopolitical risks. Iran...

Read More »

Read More »

Swiss Flush $3 Million In Gold And Silver Down The Drain Every Year

When it comes to flushing valuables down the toilet, the Swiss are hardly "Austrians", and appear to be equity-opportunity dumpers, whether it is fiat or hard money. Last month we reported that Switzerland was gripped in a mystery, after it was discovered that someone tried to flush $120,000 in €500 bills down the toilet in a bathroom close to a UBS bank vault as well as three nearby restaurants, which in turn clogged the local toilets requiring...

Read More »

Read More »

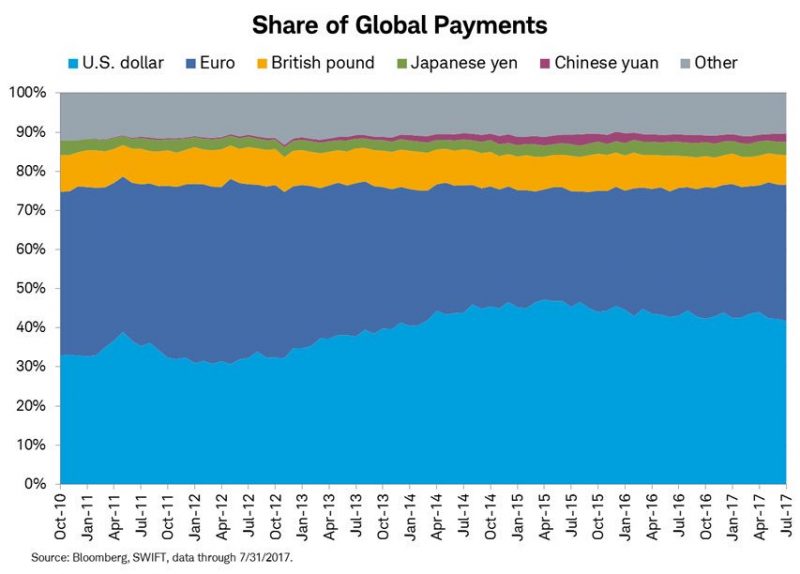

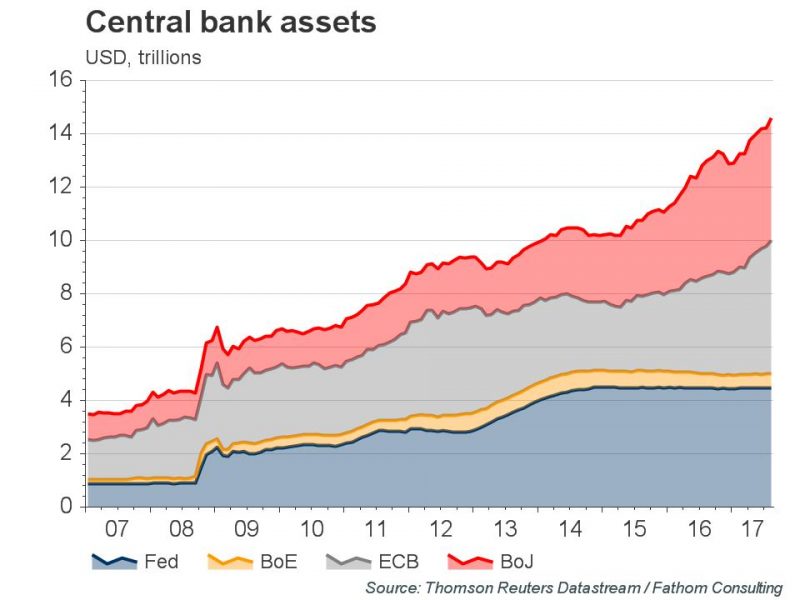

Global Outlook – Mad, Mad, Mad, MAD World: News in Charts

Global Outlook – Mad, Mad, Mad, MAD World: News in Charts by Fathom Consulting via Thomson Reuters. Alarm bells are ringing for economic fundamentalists such as Fathom Consulting. Asset prices look increasingly out of step with fundamentals, and in some cases they look downright bubbly. And other geopolitical developments are similarly alarming. One might even describe them as…

Read More »

Read More »

Young Guns of Gold Podcast – ‘The Everything Bubble’

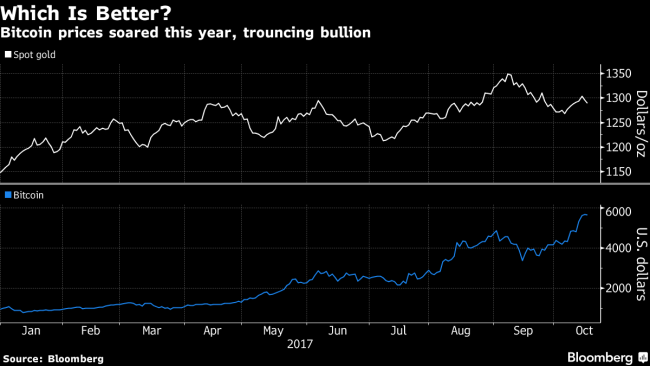

Young Guns of Gold Podcast – ‘The Everything Bubble’. Precious Metal Roundtable discuss gold in 2017 and outlook. Gold +9.1% year to date; Performing well given Fed raising rates, lack of volatility and surge in stock markets. “People are expecting too much from gold”. Economy: Inflation indicators, recession on the horizon, global debt issues. Global demand: ETF inflows, Russia central bank purchases, Germany investment figures and international...

Read More »

Read More »

3 million francs of gold and silver found in Swiss sewers

Call it “dirty money” if you wish, because there’s about CHF 3 million in gold and silver found each year in Swiss sewage. But no one is going to get rich, according to a just-published report by the Swiss Federal Institute of Aquatic Science and Technology (Eawag). Recovering the estimated CHF 1.5 million in gold, and the same in silver, that passes through Swiss wastewater each year, wouldn’t be cost-effective, says the report. On the bright...

Read More »

Read More »

Perth Mint Gold Coins Sales Double In September

Perth Mint gold coins see sales double on month in September. Perth Mint silver bullion coin sales surge 78% in September. Perth Mint sold 46,415 ounces of gold in September. Nearly six times more gold coins sold at Perth Mint than U.S. Mint in September. Sales surge at Perth Mint from low base; could indicate trend change and higher demand in coming months

Read More »

Read More »

Gold Investment In Germany Surges – Now World’s Largest Gold Buyers

Gold investment in Germany surged in past 10 years. Germans are largest gold buyers in world: WGC research. Gold investment in Germany surges to €6.8B in 2016. Gold demand per person is highest in world – double Chinese, UK and U.S. demand. Gold one of the most popular investment for retail investors especially those with high incomes. 59% of respondents agreed with the statement that gold will never lose its value in the long-term. 48% agreed with...

Read More »

Read More »

Yahoo Hacking Highlights Cyber Risk and Increasing Importance of Physical Gold

Yahoo admits every single one of 3 billion accounts hacked in 2013 data theft. Equifax hacking and security breach exposes half of the U.S. population. Some 143 million people vulnerable to identity theft. Deloitte hack compromised sensitive emails and client data. JP Morgan hacked and New York Fed hacked and robbed. International hacking group steals $300 million. Global digital banking and financial system not secure

Read More »

Read More »