Category Archive: 6a) Gold & Monetary Metals

The Asymmetry of Bubbles: the Status Quo and Bitcoin

Regardless of one's own views about bitcoin/cryptocurrency, what is truly remarkable is the asymmetry that is applied to questioning the status quo and bitcoin. As I noted yesterday, everyone seems just fine with throwing away $20 billion in electricity annually in the U.S. alone to keep hundreds of millions of gadgets in stand-by mode, but the electrical consumption of bitcoin is "shocking," "ridiculous," etc.

Read More »

Read More »

Bitcoin – Die Tulpenknolle des Computerzeitalters

Von 10 auf 100 auf 1’000 auf 10’000 Dollar. Das ist die Kursentwicklung von Bitcoins in den wenigen Jahren seit ihrem Bestehen bis gestern früh. Der Vergleich mit der Tulpenmanie in der Hochblüte Hollands ist nicht mehr fern. Der Preis einer kostbaren Tulpenzwiebel stieg im 17. Jahrhundert in Holland auf das über 60-fache eines durchschnittlichen damaligen Jahressalärs.

Read More »

Read More »

Bitcoin Facts

When we last wrote more extensively about Bitcoin (see Parabolic Coin – evidently, it has become a lot more “parabolic” since then), we said we would soon return to the subject of Bitcoin and monetary theory in these pages. This long planned article was delayed for a number of reasons, one of which was that we realized that Keith Weiner’s series on the topic would give us a good opportunity to address some of the objections to Bitcoin’s fitness as...

Read More »

Read More »

Buy Gold As Fed Shows Uncertainty And Concern Over Financial ‘Imbalances’

FOMC minutes show uncertainty and concern about markets are affecting officials’ decision-making. Officials were cautious when evaluating market conditions and the ‘damaging effects on the economy’. Worry about ‘potential buildup of financial imbalances’ and a sharp reversal in asset prices’. Members seem oblivious to impact of inflation on households and savings. Physical gold and silver remain the only assets for real diversification and...

Read More »

Read More »

Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust

Geopolitical risk highest “in four decades” should push gold higher – Citi. Elections, political and macroeconomic crises and war lead to gold investment. Political uncertainty in Germany means “gold likely to remain in good demand as a safe haven” say Commerzbank. “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history” – Commerzbank. Reduce counter party risk: own safe haven allocated and...

Read More »

Read More »

Ne conservez pas votre or dans une banque. Egon Von Greyerz

Ne détenez pas d’or dans une banque suisse ou dans n’importe quelle autre banque. Nous voyons régulièrement des exemples dans des banques suisses de taille moyenne et de grande taille qui devraient fortement inquiéter les clients. En voici quelques-uns : Un client entrepose de l’or physique dans une banque, mais lorsqu’il souhaite le transférer vers des coffres privés, l’or n’y est plus et la banque doit s’en procurer.

Read More »

Read More »

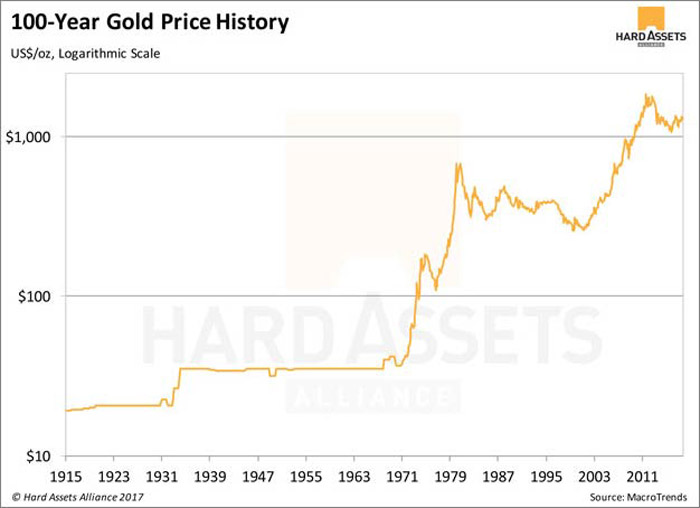

Gold Versus Bitcoin: The Pro-Gold Argument Takes Shape

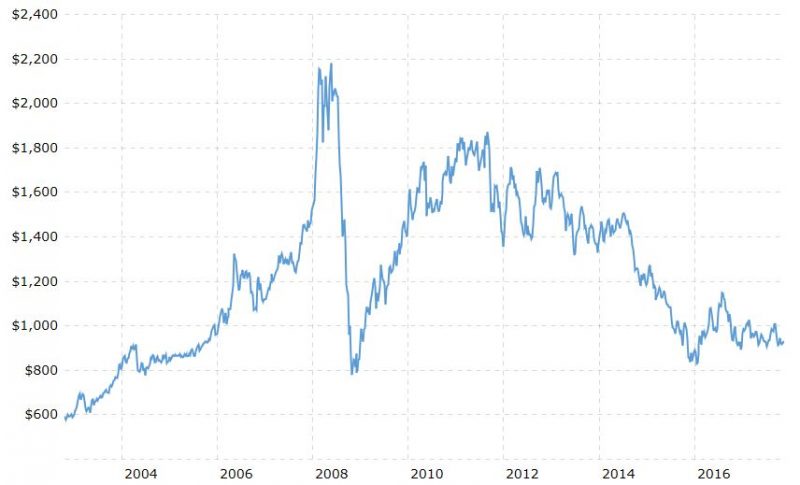

Gold versus Bitcoin: The pro-gold argument takes shape. Why cryptocurrencies will not replace gold as a store of value. Similarities between crypto and gold but that does not make them substitutes. Gold remains a highly liquid market, cryptocurrencies continue to be fragmented and difficult to spend. Bitcoin does not make it an effective hedge against stocks

Read More »

Read More »

Brexit Budget – Grim Outlook As UK Economy Downgraded

Brexit budget – Grim outlook as UK economic forecasts downgrade. UK Chancellor uses housing market policy as smoke-screen for deteriorating economy. UK budget matters more than ever due to BREXIT risks. Policy on stamp duty will fail to aid worsening housing market. Real GDP expected to grow by just 1.5%, 40% less than projections 2 years ago. Households now face an unprecedented 17 years of stagnation in earnings. Critics claim Budget failed to...

Read More »

Read More »

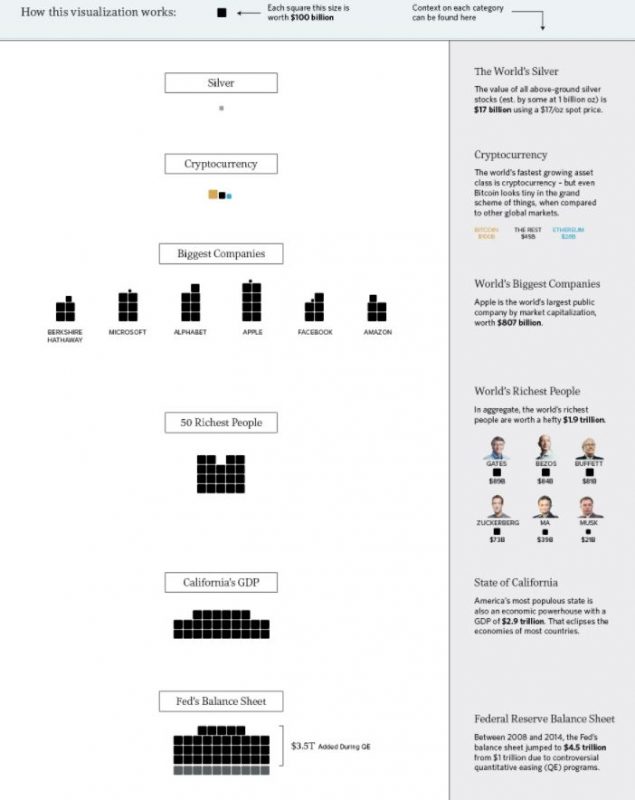

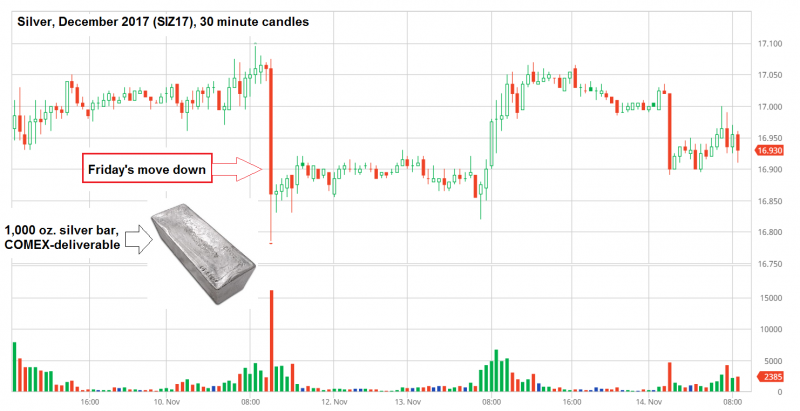

Money and Markets Infographic Shows Silver Most Undervalued Asset

Money and Markets Infographic Shows Silver Most Undervalued Asset. Silver remains severely under owned and under valued asset. Entire silver market worth tiny $100 billion shown in one tiny square. “All of the World’s Money and Markets in One Visualization”. Must see ‘Money and Markets’ infographic shows relative size of key markets: silver bullion, gold bullion, cryptocurrencies/ bitcoin, largest companies, 50 richest people, Fed balance sheet,...

Read More »

Read More »

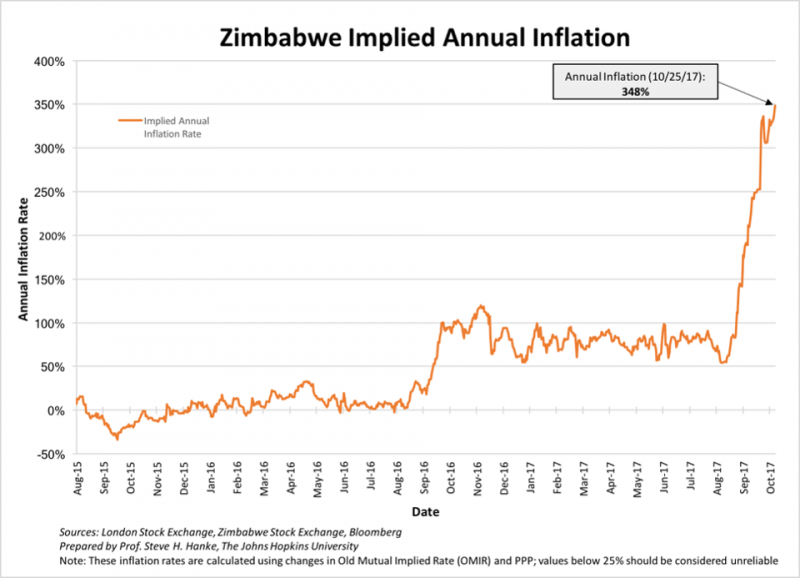

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe. Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis. Venezuela's new 100,000-bolivar note is worth less oday thehan USD 2.50. Maduro announces plans to eliminate all physical cash. Gold rises in response to ongoing crises.

Read More »

Read More »

UK Debt Crisis Is Here – Consumer Spending, Employment and Sterling Fall While Inflation Takes Off

UK debt crisis is here – consumer spending, employment and sterling fall while inflation takes off. Personal debt crisis coming to fore – litigation cases go beyond 2008 levels. October consumer spending fell by 2% in October, the fastest year-on-year decline in four years. Britons ‘face expensive Christmas dinner’ as food price inflation soars. Gold investors buying physical gold due to precarious UK and US outlook

Read More »

Read More »

Protect Your Savings With Gold: ECB Propose End To Deposit Protection

Protect Your Savings With Gold: ECB Propose End To Deposit Protection. New ECB paper proposes ‘covered deposits’ should be replaced to allow for more flexibility. Fear covered deposits may lead to a run on the banks. Savers should be reminded that a bank’s word is never its bond and to reduce counterparty exposure. Physical gold enable savers to stay out of banking system and reduce exposure to bail-ins

Read More »

Read More »

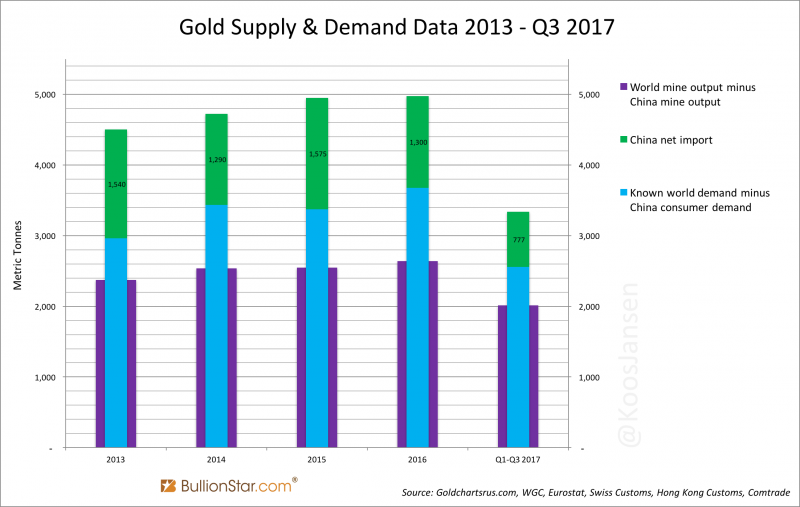

China Gold Import Jan-Sep 777t. Who’s Supplying?

While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day.

Read More »

Read More »

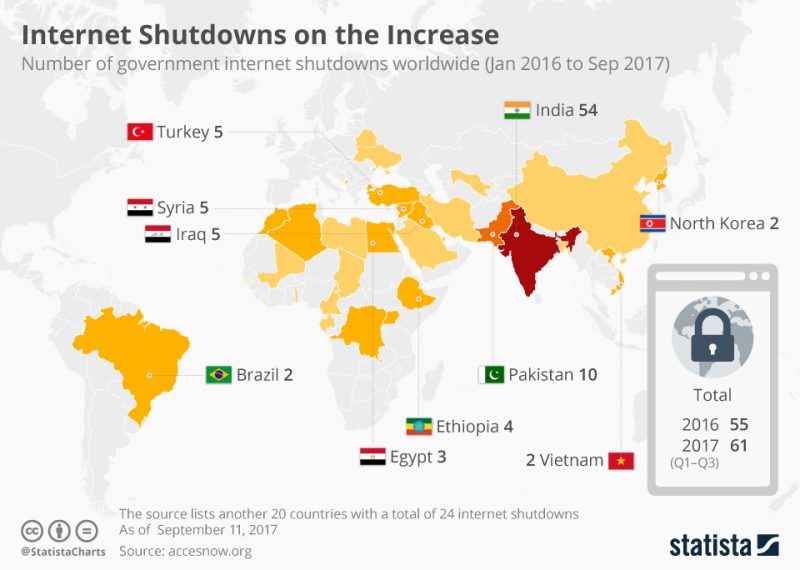

Internet Shutdowns Show Physical Gold Is Ultimate Protection

Internet shutdowns (116 in two years) show physical gold is ultimate protection. Number of internet shutdowns increased in 2017 as 30 countries hit by shutdowns. Democratic India experienced 54 internet shutdowns in last two years; Brazil 2. EU country Estonia, a technologically advanced nation, experienced a shutdown. Gallup poll shows Americans more worried about cybercrime than violent crime. Governments use terrorist threat as reason for...

Read More »

Read More »

Gold Coins and Bars Saw Demand Rise 17percent to 222T in Q3

Gold coins and bars saw demand rise 17% to 222t in Q3, driven largely by China. Chinese investors bought price dips, notching up fourth consecutive quarter of growth. Jewellery, ETF demand fell while gold coins and bars saw increased demand. Central banks bought a robust 111t of gold bullion bars (+25% y-o-y). Russia, Turkey & Kazakhstan account for 90% of 111t of central bank demand. Turkey increased gold purchases and saw broad based physical...

Read More »

Read More »

Prepare For Interest Rate Rises And Global Debt Bubble Collapse

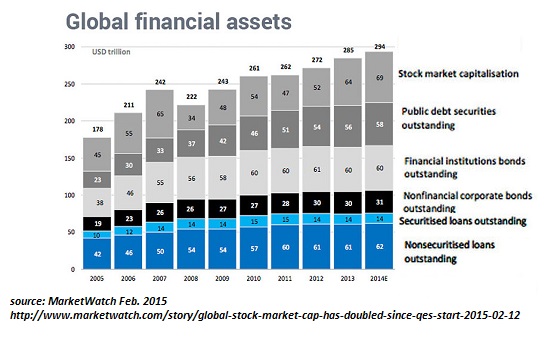

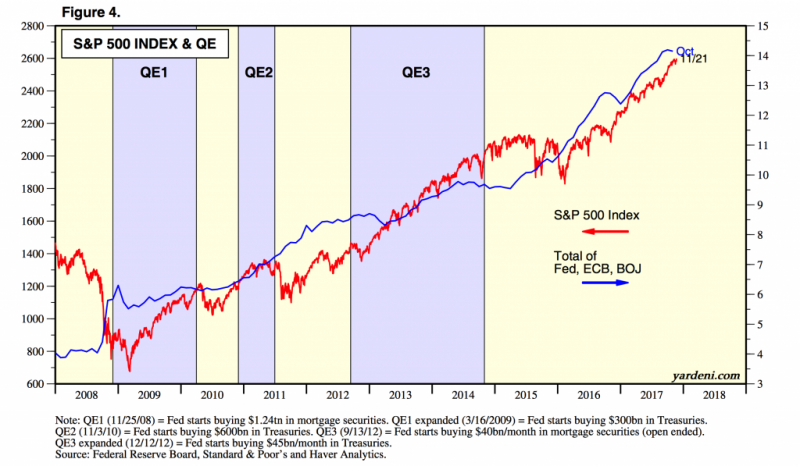

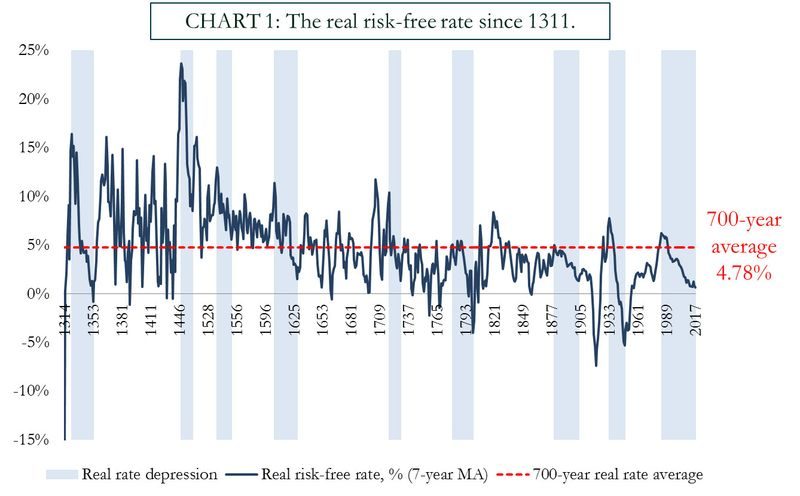

Diversify, rebalance investments and prepare for interest rate rises. UK launches inquiry into household finances as £200bn debt pile looms. Centuries of data forewarn of rapid reversal from ultra low interest rates. 700-year average real interest rate is 4.78% (must see chart). Massive global debt bubble – over $217 trillion (see table). Global debt levels are building up to a gigantic tidal wave.

Read More »

Read More »

Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’

Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’Platinum “may be one of the cheap assets out there” and “is cheap when compared with stocks or bonds” according to Dominic Frisby writing in the UK’s best selling financial publication Money Week.

Read More »

Read More »