The troika wants you to accept another bailout deal, to service Greek debts a while longer. Since bailouts mean borrowing more, you cannot avoid default in the end. Going deeper into debt is no good for anyone.

However, Greece has no future so long as it clings to the euro.

Read More »

Category Archive: 6a) Gold & Monetary Metals

Keith Weiner: Inflation Caused the Greek Tragedy

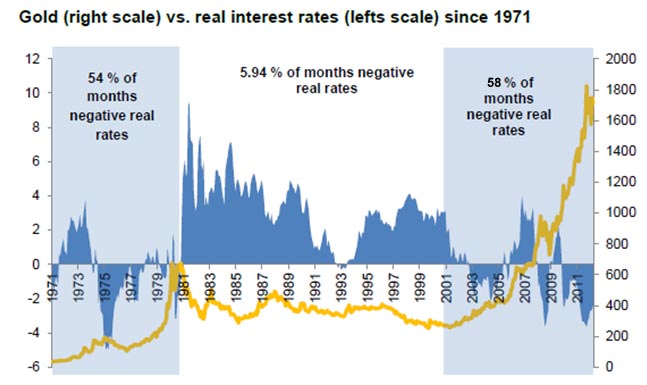

By inflation, I don’t refer to rising consumer prices in Athens. My Greek friends tell me that prices have been steady there in recent years. The focus on prices is the greatest sleight of hand ever perpetrated. It diverts your attention away from the real action.

Inflation is the counterfeiting of credit. It is borrowing, when you can’t pay and you know it. Inflation is taking money under false pretenses, and issuing fraudulent bonds.

This...

Read More »

Read More »

Dem Ausland ausgeliefert, wegen Gazprom – Danke, Eveline #NOT

Nun sind wir also bereits soweit in der Schweiz, dass man sich nur schon durch die Auswahl seiner Aktienpositionen suspekt macht. Heute habe ich von der Swissquote Bank SA folgende Nachricht erhalten, die sich auf meine gehaltenen Aktien Aktienrechte...

Read More »

Read More »

What Good is the Texas Gold Depository?

You’re getting onto a highway. You want to go to your destination but there are roadblocks. The barriers are stacked up in layers. Even if one is removed, you still can’t get anywhere. So is it worth it to start eliminating obstacles, even though it won’t clear the road yet?

On June 12, 2015 Texas said yes.

The road we’re talking about is the path forward to the gold standard.

Read More »

Read More »

They’re Coming to Take Away Your Cash

They're coming to take away your cash. Not for the sake of control or steal your money, but to protect the banks.

Read More »

Read More »

Peter Regli – unwissend? ferngesteuert? verblendet?

Peter Regli, Divisionär ausser Dienst (a D), ehemaliger Unterstabschef Nachrichtendienst der Schweizer Armee (USC ND), ehemaliger Leiter des Nachrichtendienstes der Flieger- und Fliegerabwehrtruppen, ehemaliger Assistent in der Schweizer Botschaft in...

Read More »

Read More »

Armeediskussion: “Reihen schliessen” – das falsche Rezept

Verordnete Einigkeit ist der falsche Weg in der aktuellen WEA-Diskussion. Es braucht die ehrliche Auseinandersetzung mit den Kritikern. Die Ablehnung des Gripen steckt vielen Offizieren, aber auch dem VBS, noch in den Knochen. Zum ersten Mal versenkt...

Read More »

Read More »

Arizona Governor Ducey Vetoes Gold

Arizona Gov. Doug Ducey vetoed a bill Wednesday that would have made Arizona the third state behind Utah and Oklahoma to recognize gold and silver as legal tender. This isn’t yet another in a long series of articles lamenting the Federal Reserve, power, politicians, corruption, and the hopelessness of fighting the status quo.

Read More »

Read More »

Das Gold-Gschichtli der SNB

Dem Jahresbericht 2014 der SNB entnehmen wir ab Seite 63: Lagerung der Goldreserven Gemäss Art. 99 Abs. 3 der Bundesverfassung hält die Nationalbank einen Teil ihrer Währungsreserven in Gold. Die Nationalbank gab im Frühling 2013 bekannt, dass sie 30...

Read More »

Read More »

The Gold Standard For Democrats

Keith Weiner describes how the Fed pushes down the interest rate and due to that, it drives up prices of food and rents. This implies that businesses are clearly priviliged against workers. The gold standard does the opposite, if prefers savings and workers. Hence Democrats should be fan of the gold standard.

Read More »

Read More »

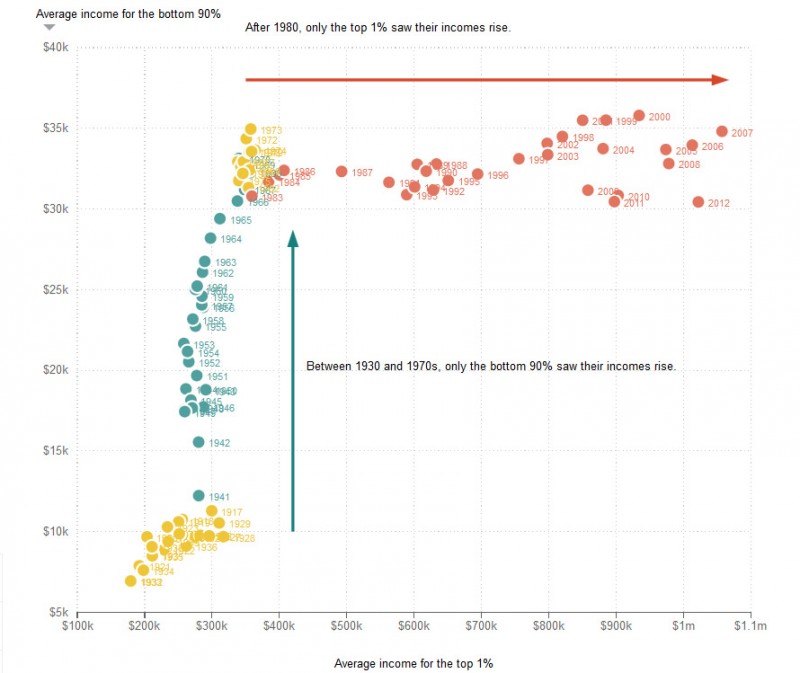

Your Personal Debt Is Not Entirely Your Fault

When the cost of borrowing is too low, it becomes an irresistible siren song luring people into debt, borrowing becomes too cheap and spending too easy. No wonder that you don’t put 10% of your paycheck into the bank every month for future uncertainties. The Fed, with its zero interest policy, deserves much of the blame for your financial troubles.

Read More »

Read More »

Why Did Both Silver and Gold Become Money?

Keith Weiner explains why gold and silver, two shiny metals, have become money. They fill different human needs, and evolved through different paths. Money solves a problem called the coincidence of wants. Moreover he looks on the choice between gold and silver.

Read More »

Read More »

America Needs The Gold Standard More Than Ever

The United States needs the gold standard more than ever. The gold standard is neither barbaric nor impractical, and it is more urgently needed every day. This is because the standard of paper money is failing. It has set in motion an accelerating series of crises, each worse than the previous. The nation cannot continue to borrow to infinity, nor can the U.S. endure zero interest much longer.

Read More »

Read More »

Government Debt: Not Unfunded Liabilities but Fraudulent Promises

According to Keith Weiner of the Gold Standard Institute USA, the U.S. government reports its debt at more than 17 trillion dollars, often called "unfunded liabilities". To put this sum in perspective, it’s well over 50 thousand bucks for every man, woman, and child in America. The best way to help everyone understand the truth is to use plain and accurate language. Instead of using the term unfunded liabilities, he suggests "fraudulent promises".

Read More »

Read More »

Will “the 1%” Accept the Gold Standard?

Keith Weiner explains why the 1% wealth will not like the gold standard, they want to keep achieving trading profits caused by asset price inflation.

Read More »

Read More »

Small Step Forward for Gold In Arizona

On February 4, 2015 Keith Weiner testified before the Arizona House Federalism and States’ Rights Committee in support of HB 2173. The bill would recognize gold and silver as legal tender and eliminates taxes on them.

Read More »

Read More »

The Six Major Fundamental Factors that Determine Gold and Silver Prices

Gold and silver are the most complicated assets to price. Stocks, currencies, commodities mostly depend on their fundamental data, supply and demand. Gold and silver, however, are priced indirectly.

Read More »

Read More »