Category Archive: 6a) Gold & Monetary Metals

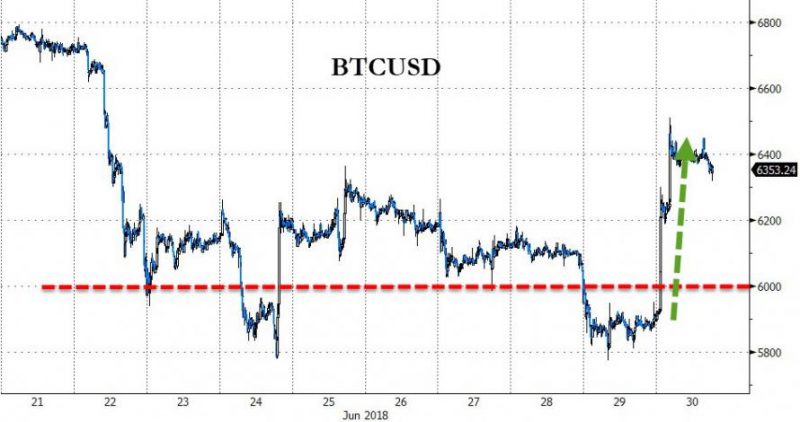

Bitcoin Soars Most In 3 Months, Back Above $6,000

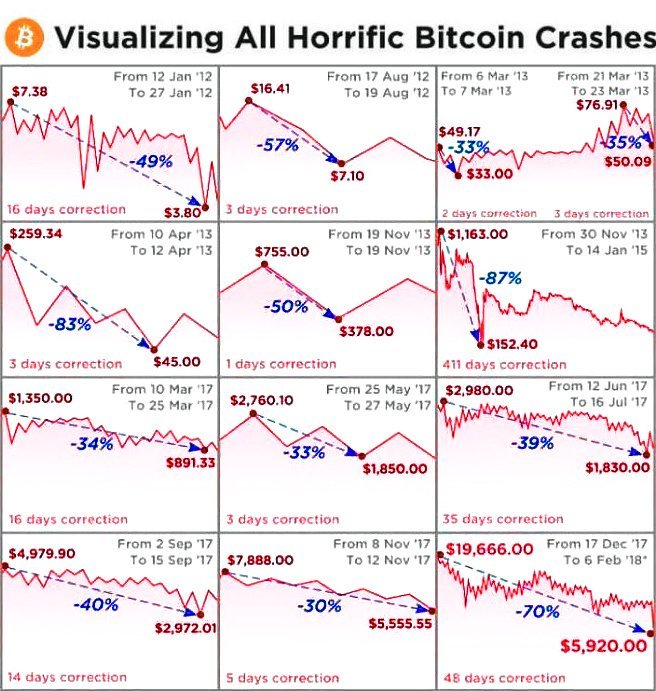

After crossing below $6,000 for the 4th time in a week yesterday, Bitcoin surged overnight - jumping by as much as 10% at one point, the most in 3 months. The 10% surge is a notable outlier after weeks of constant downward pressure, but we note it's already fading modestly along with the rest of cryptos.

Read More »

Read More »

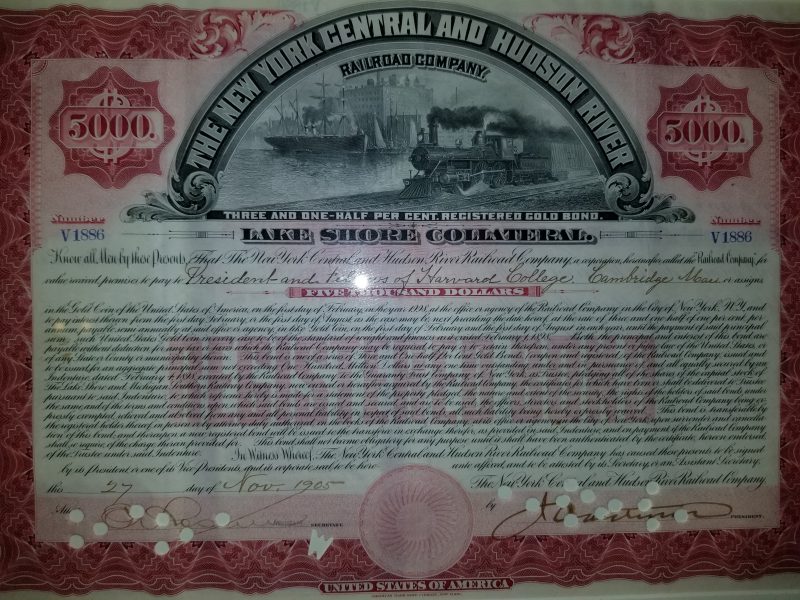

The Benefits of Issuing Gold Bonds

A gold bond is debt obligation that is denominated in gold, with interest and principal paid in gold. As I will explain below, it’s a way for the issuer to pay off its debt in full, and there are other advantages. Sometimes, I find that it’s helpful to show a picture of what I’m talking about. At the Harvard Club in New York, an old gold bond is hanging on the wall among other memorabilia.

Read More »

Read More »

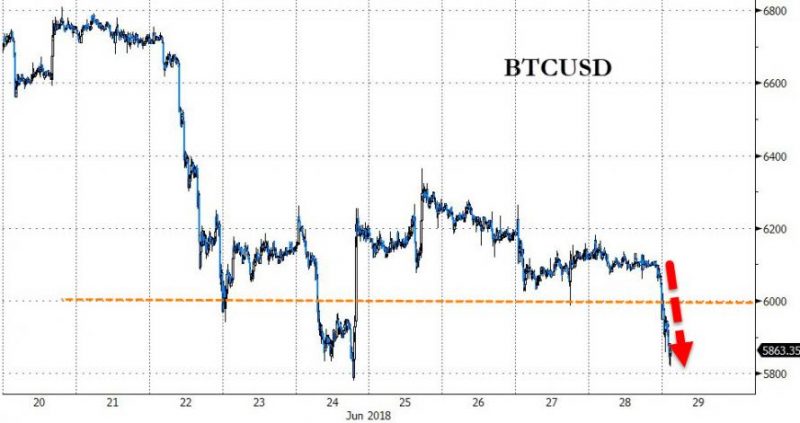

Cryptos Slide Accelerates Since Congress Warned Bitcoin Poses Threat To US Election

Bitcoin has tumbled back below $6,000 in early Asia trading and the rest of the crypto space is following suit. No imediate catalyst for the move - aside from technical pressure - but tougher AML rules in South Korea and US Congress being told Bitcoin is a threat to the US election may have sparked it earlier in the week and this is follow-through.

Read More »

Read More »

What’s so special about crypto?

Towards the end of 2017, Bitcoin — and with it other cryptocurrencies — experienced a real hype. Within a few months, prices shot through the ceiling. The euphoria was ginormous and in hindsight pure madness. With the new year, the disillusionment arrived. The market capitalization of all cryptocurrencies fell by more than half and prices plunged.

Read More »

Read More »

Bitcoin: les causes de la chute historique sous la barre des 6 000$.

Bitcoin : les causes de la chute historique sous la barre des 6 000$. 2 articles de Adrien Pittore/ Entreprise news. Le 21 juin dernier était historique pour les cryptomonnaies. Le cours du Bitcoin a fait une chute spectaculaire, passant sous la barre des 6 000$. Une valeur qu’il dépassait depuis novembre 2017. Pour autant, les spécialistes ne s’accordent pas sur les raisons de ce plongeon. Tour d’horizon.

Read More »

Read More »

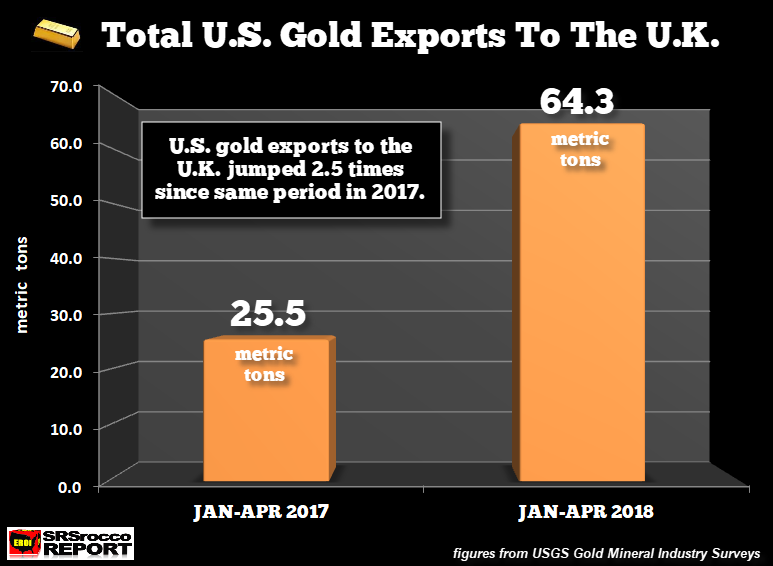

Gold Exports To London From U.S. Surge 152 percent In 2018

Gold Exports To London From U.S. Surge 152% In 2018. – U.S. gold exports to UK (primarily) London jumped over 150% from 25.5 metric tons to 64.3 mt in the first four months of 2018 (yoy). – Largest countries receiving U.S. gold exports are China/ Hong Kong, Switzerland and the UK. – U.S. gold exports to London (UK) alone nearly as much as total U.S. gold production. – Gold flowing from weak hands in West to strong hands in the East

Read More »

Read More »

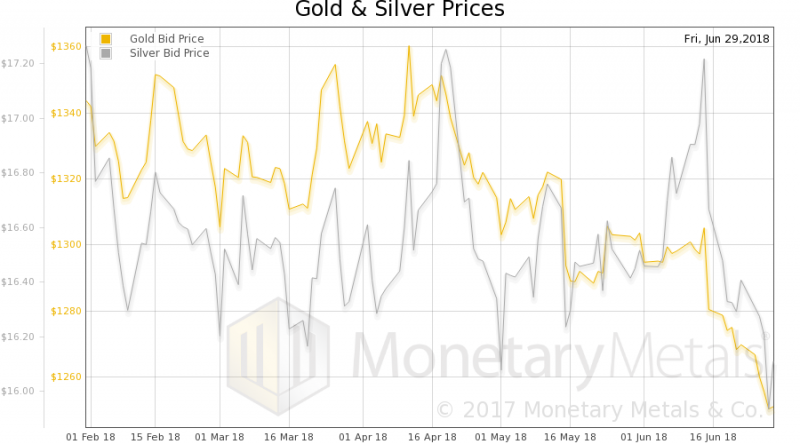

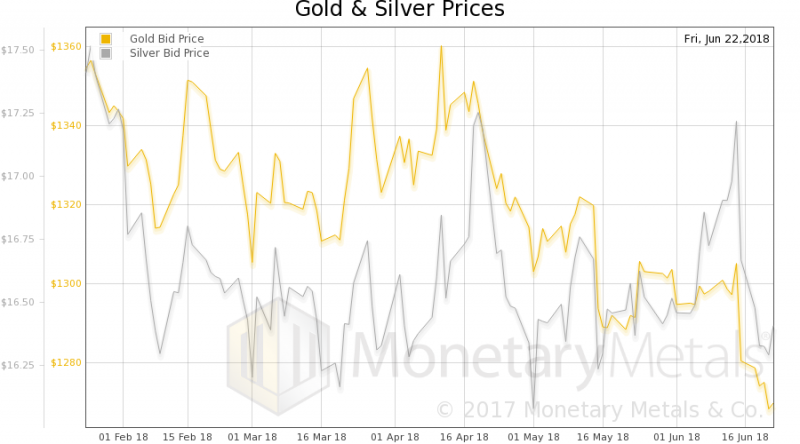

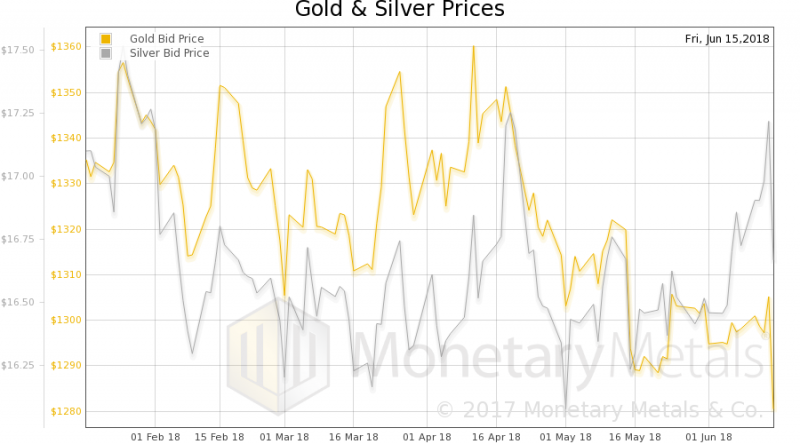

The Wealth Effect, Report 24 Jun 2018

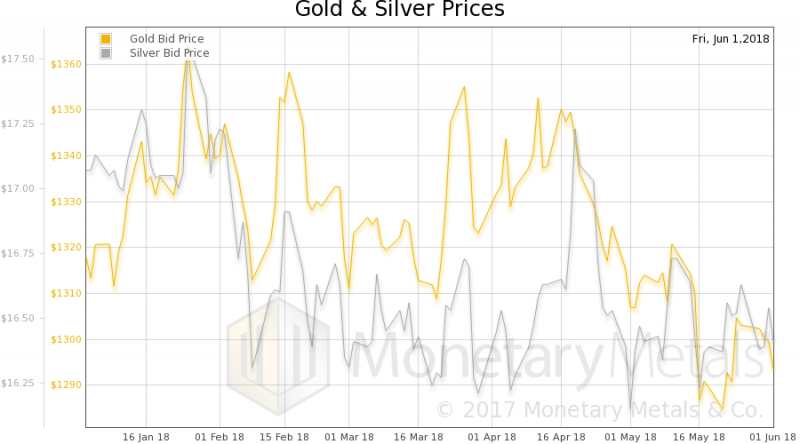

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

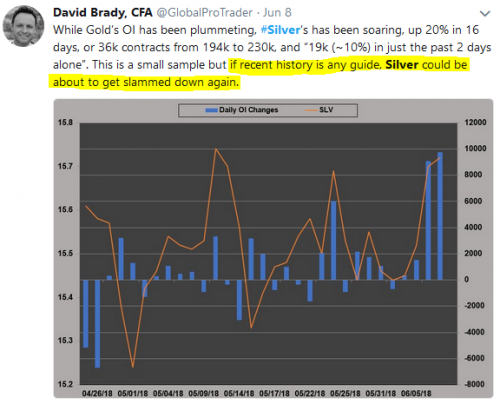

Manipulation of Gold and Silver Is “Undeniable”

Manipulation in precious metals is undeniable. Now so chronic that it is obvious and therefore predictable. Central banks around the world are repatriating their gold from the U.S. in preparation for some major event to come. I want to be long … “when that event occurs”.

Read More »

Read More »

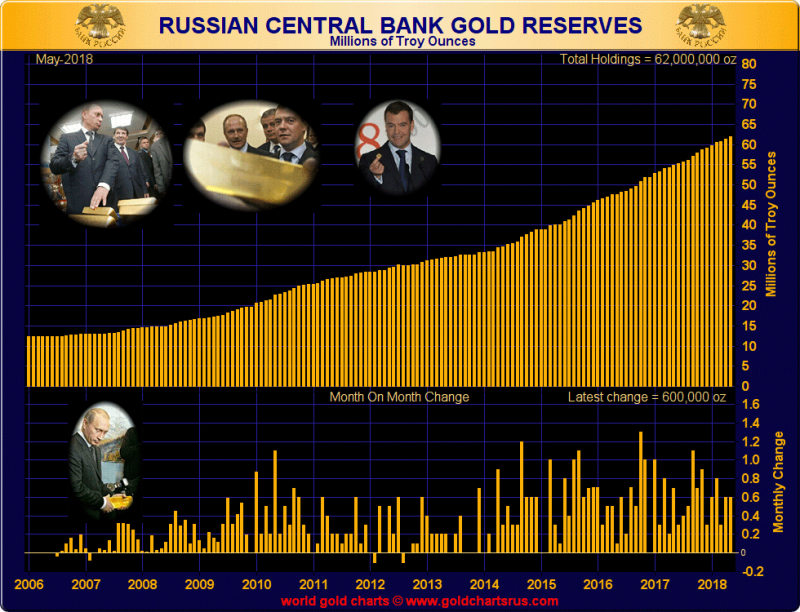

Russia Buys 600,000 oz Of Gold In May After Dumping Half Of US Treasuries In April

Russia adds another 600,000 oz to it’s gold reserves in May. Holdings of U.S. government debt slashed in half to $48.7 billion in April. ‘Keeping money safe’ from U.S. and Trump – Danske Bank. Trump increasing the national debt by another 6% to $21.1 trillion in less than 18 months. Asian nations accumulating gold as shield against dollar devaluation and trade wars.

Read More »

Read More »

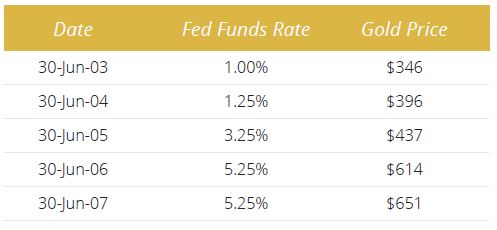

“Perfect Environment For Gold” As Fed To Weaken Dollar and Create Inflation

“Fed is tightening into weakness and will eventually over-tighten and cause a recession”. “More inflation and a weaker dollar” is “the perfect environment for gold”. Geopolitical shocks will return when least expected and gold will soar in flight to safety.

Read More »

Read More »

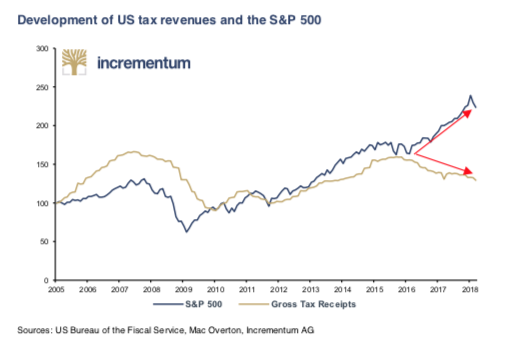

In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast with Ronald-Peter Stoeferle

In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast (Episode 5) interview with Ronald-Peter Stoferle. We interview our friend Ronald-Peter Stoeferle, partner in Incrementum in Liechtenstein and author of the must read, annual gold report ‘In Gold We Trust’ in this the fifth episode of the Goldnomics Podcast.

Read More »

Read More »

Cryptocurrency Technicals – Navigating the Bear Market

Long time readers may recall that we regard Bitcoin and other liquid big cap cryptocurrencies as secondary media of exchange from a monetary theory perspective for the time being. The wave of speculative demand that has propelled them to astonishing heights was triggered by market participants realizing that they have the potential to become money.

Read More »

Read More »

Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘.

Read More »

Read More »

“Without Gold I Would Have Starved To Death” – ECB Governor

– “Without gold I would have starved to death” – Ewald Nowotny, governor of Austrian central bank and member of ECB’s governing council

– “I was born in 1944. When I was a baby, my mother could only buy food because she still had some gold coins…”

– “When the going gets tough, gold becomes the ultimate money” reports Die Presse

Read More »

Read More »

Swiss Government Pension Fund To Buy Gold Bars Worth Some $700 Million

Swiss Government Pension Fund Allocating 2% Of Pension Fund To Gold Bars. The Swiss government pension fund, Switzerland’s AHV/AVS fund, has decided to diversify into physical gold bars in their substantial CHF35.2bn (€30.5bn) pension portfolio. At the end of last week the first pillar buffer fund tendered a custodianship and storage for CHF 700m (EUR 600m / USD 700m / GBP 525m) in gold bars via IPE Quest.

Read More »

Read More »

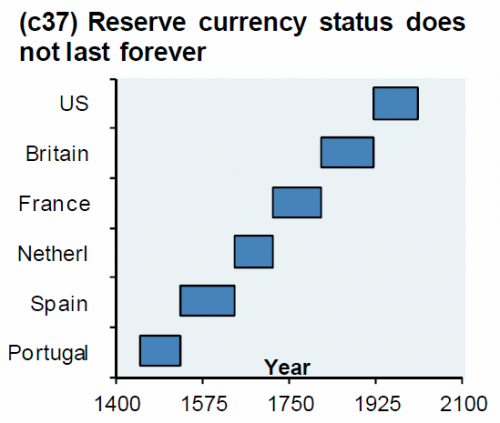

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” Later

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” In Physical Later. Guest post by Dominic Frisby of Money Week. This year’s “gold standard” of gold-related research has just come out. Conveniently enough – given gold’s “safe haven” reputation – it’s arrived just in time for another major financial market scare, this time in the form of Italy. Below, I consider some of the most pertinent points…

Read More »

Read More »

Gold And Silver Bullion Obsolete In The Crypto Age?

What is the outlook for the global economy, financial markets, crypto currencies such as bitcoin and gold and silver bullion in the digital age? Fresh insights as CrushtheStreet.com interview Mark O’Byrne who gives his diagnosis on the outlook for gold in 2018, and looks at the long-term relevance of precious metals in the digital age of crypto and the blockchain alongside Bitcoin’s emergence as a potential digital store of value.

Read More »

Read More »