Category Archive: 6a) Gold & Monetary Metals

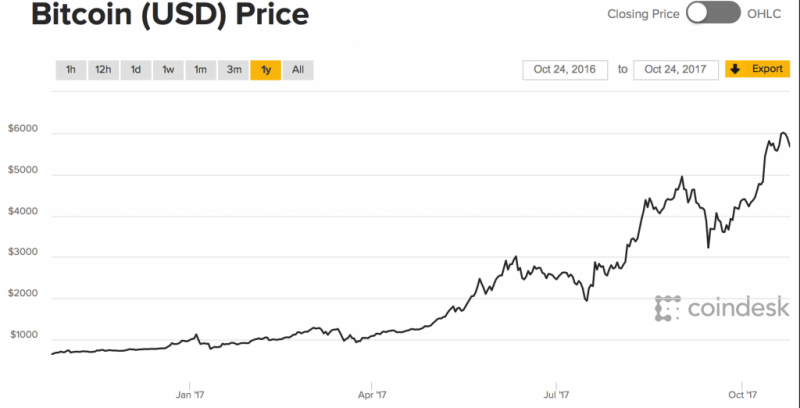

How Will Bitcoin React in a Financial Crisis Like 2008?

Whenever I raise the topic of bitcoin and cryptocurrencies, I feel like an agnostic in the 30 Years War between Catholics and Protestants. There is precious little neutral ground in the crypto-is-a-bubble battle; one side is absolutely confident that bitcoin and the other cryptocurrencies are in a tulip-bulb type bubble, while the other camp is equally confident that we ain't seen nuthin' yet in terms of bitcoin's future valuation.

Read More »

Read More »

Stumbling UK Economy Shows Importance of Gold

UK economy outlook bleak amid Brexit, debt woes and rising inflation. Confidence in UK housing market at five-year low. UK high street sales crash at fastest rate since 2009. Number registering as insolvent in England and Wales hit a five-year high in Q3. UK public finance hole of almost £20bn in the public finances set to grow to £36bn by 2021-22. Protect your savings with gold in the face of increased financial woes in UK.

Read More »

Read More »

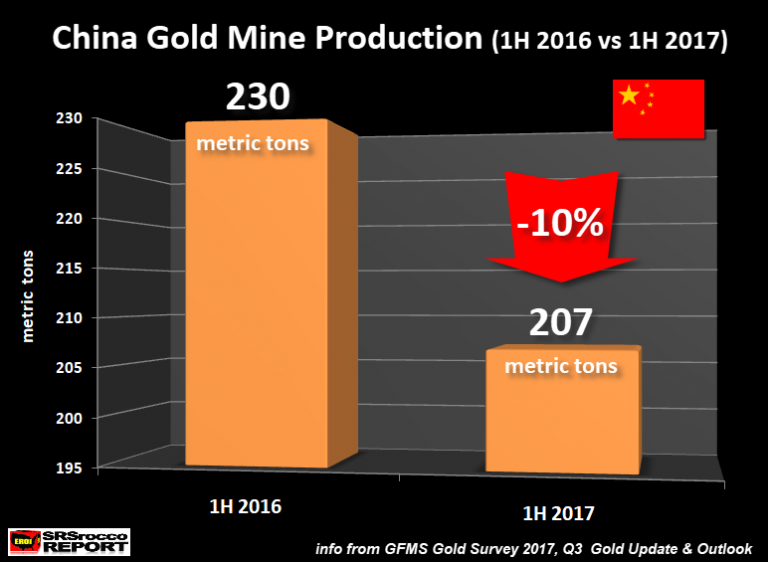

World’s Largest Gold Producer China Sees Production Fall 10 percent

Gold mining production in China fell by 9.8% in H1 2017. Decreasing mine supply in world’s largest gold producer and across the globe. GFMS World Gold Survey predicts mine production to contract year-on-year.

Peak gold production being seen in Australia, world’s no 2 producer. Peak gold production globally while global gold demand remains robust.

Read More »

Read More »

Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic.

Read More »

Read More »

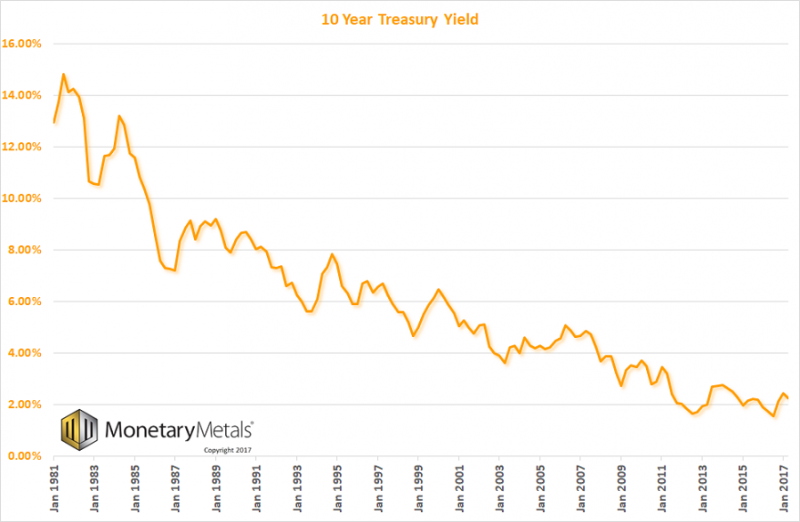

The Big Reversal: Inflation and Higher Interest Rates Are Coming Our Way

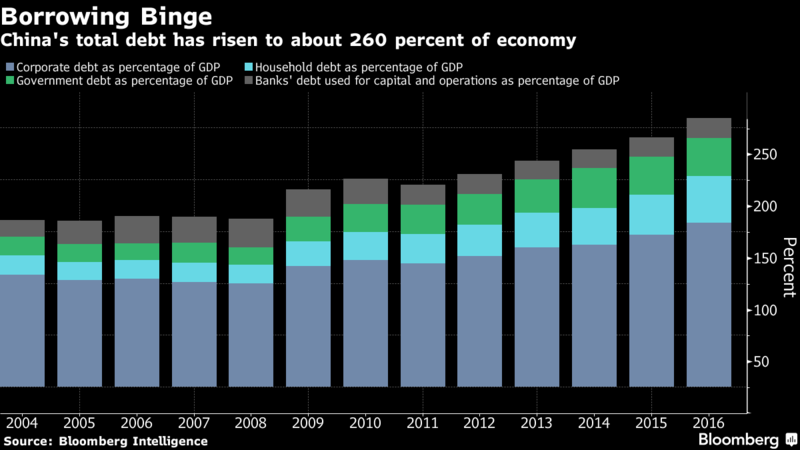

This interaction will spark a runaway feedback loop that will smack asset valuations back to pre-bubble, pre-pyramid scheme levels. According to the conventional economic forecast, interest rates will stay near-zero essentially forever due to slow growth. And since growth is slow, inflation will also remain neutral.

Read More »

Read More »

German Investors Now World’s Largest Gold Buyers

Today, gold is increasingly viewed by German investors as a regular form of saving: 25% of those surveyed in 2016 said their gold purchase had been part of a regular review of their investments, while 23% said it was part of their retirement planning.

Read More »

Read More »

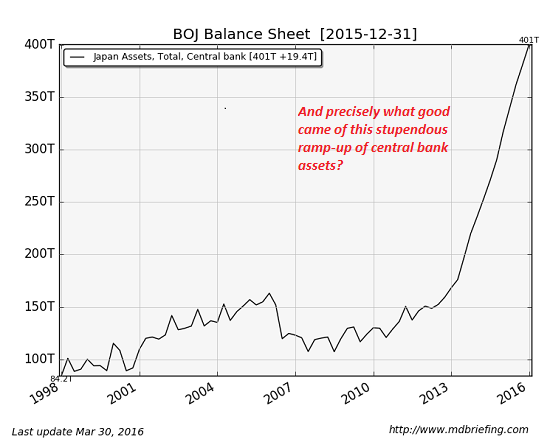

Gold Price Reacts as Central Banks Start Major Change

Bank of England raised interest rates for the first time in ten years. President Trump announces Jerome Powell as his choice to lead the U.S. Federal Reserve. Most investors outside the US Dollar and Euro see gold prices climb after busy week of central bank news. Inflation now at five-year high of 3%. Inflation, low-interest rate, debt crises and bail-ins still threaten savers and pensioners.

Read More »

Read More »

Why Switzerland Could Save the World and Protect Your Gold

Precious metals advisor Claudio Grass believes Switzerland can serve as an example to rest of world. Switzerland popular for gold storage due to understanding of the risks inherent in fiat money and gold’s value as a store of wealth. International investors opt to store gold in Swiss allocated accounts due to tradition of respecting private property.

Read More »

Read More »

Invest In Gold To Defend Against Bail-ins

Italy’s Veneto banking meltdown destroyed 200,000 savers and 40,000 businesses. EU bail-in rules have wiped out billions for savers and and businesses, with more at risk. Bail-ins are not unique to Italy, all Western savers are at risk of seeing savings disappear. Counterparty-free, physical gold bullion is best defence against bail-ins.

Read More »

Read More »

Wozniak and Thiel Fuel Bitcoin-Gold Debate: Gold Comes Out On Top

Gold versus bitcoin debate makes further headlines as tech experts weigh in. Peter Thiel tells Saudi conference he believes bitcoin is underestimated and compares to gold. Steve Wozniak tells Money 20/20 that bitcoin is a better standard of value than gold and U.S. dollar. Both men recognise that the US dollar has little value and there are worthy competitors to its crown as reserve currency. Gold continues to hold its value and has multiple uses,...

Read More »

Read More »

Le vol de l’or de Chine.

L’histoire de la Chine et de son obsession pour l’or a été ravivée cette année, comme nous le prouvent les chiffres des importations effectuées via de Hong Kong et négociées sur le Shanghai Gold Exchange. Mais au vu des articles que nous, commentateurs du marché de l’or, écrivons au sujet de l’amour de la Chine pour l’or, il est surprenant de constater qu’il y a moins de cent ans, le pays perdait l’équivalent de milliers d’années de...

Read More »

Read More »

Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

Gold is better store of value than bitcoin – Goldman Sachs report. Gold will continue to perform well thanks to uncertainty and wealth demand. Bitcoin’s volatility continues to impact its role as money. Gold up 12% in 2017, bitcoin over 600%. BTC is six times more volatile than gold – see chart.

Read More »

Read More »

Why Governments Will Not Ban Bitcoin

Those who see governments banning ownership of bitcoin are ignoring the political power and influence of those who are snapping up most of the bitcoin. To really understand an asset, we have to examine not just the asset itself but who owns it, and who can afford to own it. These attributes will illuminate the political and financial power wielded by the owners of the asset class.

Read More »

Read More »

Russia Buys 34 Tonnes Of Gold In September

Russia adds 1.1 million ounces to reserves in ongoing diversification from USD. 34 ton addition brings Russia’s Central Bank holdings to 1,779t; 6th highest. Russia’s gold reserves are at highest point in Putin’s 17-year reign. Russia’s central bank will buy gold for its reserves on the Moscow Exchange.

Read More »

Read More »

Next Wall Street Crash Looms? Lessons On Anniversary Of 1987 Crash

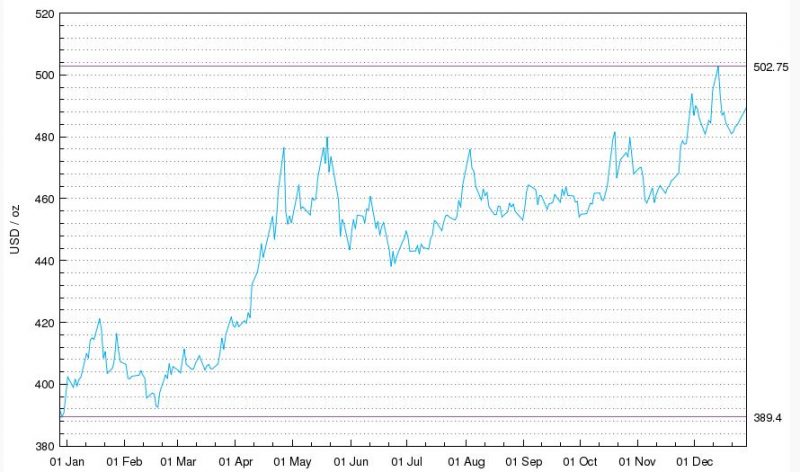

Next Wall Street Crash looms? Lessons on anniversary of crash. 30 years since stock market ‘Black Monday’ crash of 1987. Dow Jones Industrial Average fell 22.6% on October 19, 1987. S&P 500, FTSE and DAX fell 20%, 11% & 9% respectively. Gold rose 24.5% in 1987 (see chart), acting as safe haven. Prior to crash, stocks hit successive record highs despite imbalances. Imbalances that lead to 1987 crash are much worse today

Read More »

Read More »