(Montpelier, Vermont) – On the heels of overwhelming votes to remove all taxes from purchases of precious metals in Mississippi, legislators in Vermont have introduced a measure to curtail the controversial tax in their own state.

Introduced yesterday by Rep. Peterson, Demar, Highly, and Smith, House Bill 295 would cancel sales taxes on larger-sized purchases of “rare coins of numismatic value, gold or silver bullion or coins, or gold or silver tender of any nation traded and sold according to its value as precious metal.”

In the past two years alone, the governors of Alabama, Ohio, Arkansas, Tennessee, and Virginia each signed legislation to enact or extend sales tax exemptions on precious metals in their states.

Both chambers of the Mississippi legislature this week voted to pass this exemption in their state, positioning Mississippi to become the 43rd state to eliminate the outmoded practice of taxing the only form of money mentioned in the U.S. Constitution.

The proposed Vermont exemption, however, would only apply when “the sales are valued at $1,000 or more and that the first $1,000 of value shall remail taxable.”

While removing sales taxes from larger transactions is viewed as a positive step, continuing to tax transactions under $1,000 specifically discriminates against small-time savers, arguably the people who can least afford the tax.

Virginia had maintained a similar $1,000+ exemption, before the discriminatory provision targeting smalltime savers was eliminated in 2022 via legislation that made all gold and silver purchases exempt, regardless of transaction size.

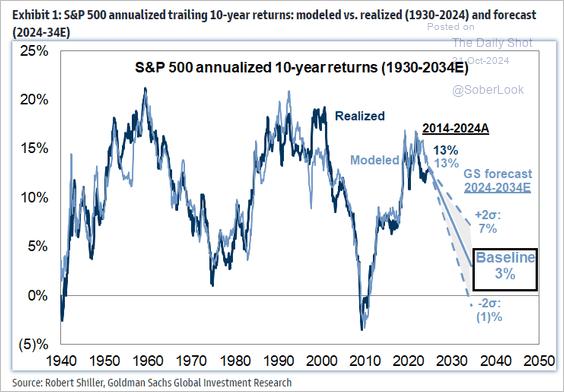

As a result of skyrocketing federal debt along with excessive issuance of Federal Reserve note dollars (or their electronic equivalent), savers have been losing significant purchasing power as inflation rages across America.

Holding some savings in gold and silver is one way to protect one’s purchasing power. House Bill 295 is good policy for several reasons:

- Levying sales taxes on precious metals makes no sense because they held for resale. Sales taxes are typically levied on final consumer goods. Computers, shirts, and shoes carry sales taxes because the consumer is “consuming” the good. Precious metals are inherently held for resale, not “consumption,” making the imposition of sales taxes on precious metals illogical from the start.

- Studies have shown that taxing precious metals is an inefficient form of revenue collection. The results of a Michigan study, for example, demonstrated that any sales tax proceeds a state collects on precious metals may be surpassed by the state revenue lost from conventions, businesses, and economic activity that are driven out of the state.

The harm is exacerbated when you consider that ALL of Vermont’s neighbors (New York, Massachusetts, and New Hampshire) have already stopped taxing gold and silver.

- Taxing gold and silver harms in-state businesses. It’s a competitive marketplace, so buyers will take their business to neighboring states, thereby undermining Vermont jobs. Levying sales tax on precious metals harms in-state businesses who will lose business to out-of-state precious metals dealers. Investors can easily avoid paying $117 in sales taxes, for example, on a $1,950 purchase of a one-ounce gold bar.

- Gold and silver are the only money mentioned in the U.S. Constitution. Article 1, Section 10 states that “no state shall make any Thing but Gold and Silver a tender in payment of debts.” Exchanging one form of U.S. money for another should not be taxed.

- Other types of savings or investment do not carry a sales tax. Gold and silver are held as forms of savings and investment. Vermont does not assess a sales tax on the purchase of stocks, bonds, ETFs, real estate, currencies, and other financial instruments.

- Taxing precious metals is harmful to small-time savers. Purchasers of precious metals aren’t usually fat-cat investors. Most who buy precious metals do so in small increments as a way of saving money. Precious metals investors are purchasing precious metals as a way to preserve their wealth against the damages of inflation. Inflation harms the poorest among us, including pensioners, Vermonters on fixed incomes, wage earners, savers, and more.

The national backlash against inflation caused by federal spending, debt, and money printing is growing. State legislators this year have already introduced an unprecedented number of bills to remove government impediments to buying, saving, and using gold and silver.

The Green Mountain State is currently ranked 50th out of 50th – dead last — in the 2023 Sound Money Index. By passing HB 295, Vermont can vastly improve its Sound Money Index ranking, as well as become the 44th state to end sales taxes on precious metals.

Pro-sound money legislation has been introduced this year in Alaska, Minnesota, Tennessee, Missouri, Oklahoma, Wisconsin, West Virginia, Wyoming, Idaho, Oklahoma, Oregon, Kentucky, South Carolina, and several other states.

Img credit: Boracasli/WikiCommons

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter