Home › 6a) Gold & Monetary Metals › 6a.) GoldCore › China and the US at sovereign debt war

Permanent link to this article: https://snbchf.com/2023/01/flood-china-sovereign-debt-war/

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF hovers around 0.8650, upside likelihood appears possible as the US election looms

6 hours ago -

US Dollar rallies on Wednesday with US yields surging higher

2 days ago -

USD/CHF depreciates to near 0.8650, downside risk seems restrained due to higher US yields

3 days ago -

USD/CHF Price Forecast: Corrects to near 0.8630 despite upbeat US Dollar

4 days ago -

USD/CHF Price Prediction: Consolidates within short-term uptrend

9 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 4.2 billion francs compared to the previous week

11 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

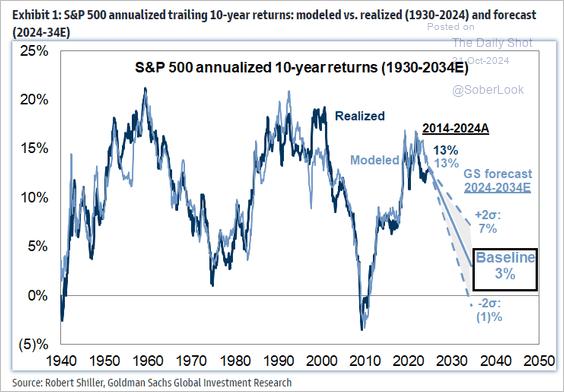

Lower Forward Returns Are A High Probability Event

Lower Forward Returns Are A High Probability Event -

USD/CHF hovers around 0.8650, upside likelihood appears possible as the US election looms

-

Teslas Geheimwaffe: Die Fabrik, nicht das Auto?

Teslas Geheimwaffe: Die Fabrik, nicht das Auto? -

Dreading Republican Rule

-

US Wahl schon entschieden? Was passiert nach der Wahl?

US Wahl schon entschieden? Was passiert nach der Wahl? -

Why You Should Start SMALL in Real Estate – Jaren Sustar

Why You Should Start SMALL in Real Estate – Jaren Sustar -

Wie viel Geld macht wirklich glücklich?

Wie viel Geld macht wirklich glücklich? -

Erik Prince, Peter Thiel, and Other “Libertarian” Advocates for the Warfare State

-

The Pyramid Scheme of Home Insurance

-

The Revolution Continues: The Ranks of Anti-Fed Republicans Grow

More from this category

Lower Forward Returns Are A High Probability Event

Lower Forward Returns Are A High Probability Event25 Oct 2024

- USD/CHF hovers around 0.8650, upside likelihood appears possible as the US election looms

25 Oct 2024

- Dreading Republican Rule

24 Oct 2024

- Erik Prince, Peter Thiel, and Other “Libertarian” Advocates for the Warfare State

24 Oct 2024

- The Pyramid Scheme of Home Insurance

24 Oct 2024

- The Revolution Continues: The Ranks of Anti-Fed Republicans Grow

24 Oct 2024

- Gold’s Future Depends Crucially on China

24 Oct 2024

- What is Bolstering the Chinese Economy?

24 Oct 2024

Swiss Bankers Association critical of “Too-big-to-fail” measures

Swiss Bankers Association critical of “Too-big-to-fail” measures24 Oct 2024

- Free Markets Don’t Need Government Regulation

24 Oct 2024

- Trump’s Latest Tariff Plan Just Replaces One Tax with Another

24 Oct 2024

Turn Around Tuesday Comes Late

Turn Around Tuesday Comes Late24 Oct 2024

- Playing With Fire and Its Critics

24 Oct 2024

- No Compromise With the Fed!

24 Oct 2024

- Living With Hamilton’s Curse

24 Oct 2024

VanEck senkt Ethereum-Preisziel deutlich nach Modellaktualisierung

VanEck senkt Ethereum-Preisziel deutlich nach Modellaktualisierung24 Oct 2024

- About Natural Order and its Destruction

24 Oct 2024

- The Fed Does Not Benefit Ordinary Americans

24 Oct 2024

- How Capitalism Defeats Racism

24 Oct 2024

- Why Should We Fight Wars for Ukraine and Israel?

24 Oct 2024

China and the US at sovereign debt war

Published on January 27, 2023

Stephen Flood

My articles My videosMy books

Follow on:

US dollar hegemony has long been a standard feature of the global financial and economic system. But developments in recent years and months (weeks, even) suggests there are more than a handful of countries who are looking to rely less on the US dollar. Instead countries who have long been at the mercy of the US dollar are looking to take their finances into their own hands…and gold is set to play a key role.

The U.S. and China are reportedly ‘taking steps to renew their engagement and cooperation … however, it is one step forward and 10 steps backwards.

The U.S. political dysfunction over raising the debt ceiling is the latest crack in rapidly disintegrating international cooperation.

China, one of the largest foreign holders of U.S. debt (China holds about US$870 billion in U.S. government debt), is weighing in on the issue by telling the U.S. to solve its own debt problems.

The comments came After U.S. Treasury Secretary Janet Yellen called China a “barrier” to debt reform in Africa this week, Chinese officials in Zambia had a pointed response – get your own house in order. The Chinese Embassy in Zambia said on its website Tuesday “the biggest contribution that the U.S. can make to the debt issues outside the country is to act on responsible monetary policies, cope with its own debt problem, and stop sabotaging other sovereign countries’ active efforts to solve their debt issues” (Reuters, 01/23).

The U.S. and International Monetary Fund have put pressure on China to restructure debt owed by the world’s poorest countries.

Background on the brewing sovereign debt crisis

During Covid international organizations set up the Debt Service Suspension Initiative (DSSI) to help low-income countries deal with Covid-related economic problems.

DSSI was set up by the G20 at the urging of the International Monetary Fund and World Bank – out of 73 eligible countries 43 participated in the initiative which suspended debt payments from May 2020 to December 2021 to the tune of US$12.9 billion in debt-service payments. However, after the end of the DSSI, the world’s poorest countries faced a mountain of debt and with rising interest rates the cost of servicing that debt continued to grow.

There was also an initiative by international organizations referred to as the ‘common framework’ which was aimed to help the world’s poorest countries restructure debt. However, the lack of transparency and coordination has hampered progress. China, as the largest lender to low-income countries, has been called upon to restructure its holdings.

Now the pressure is being put on China to write off other countries’ sovereign debt.

Not only are international agencies and the U.S. asking China to restructure its holdings of other countries debts, but this week: “Treasury Secretary Janet Yellen called on China to forgive debts owed by Zambia, whose two-year struggle to restructure a $17.49 billion pile of foreign-currency loans and bonds has become a cautionary tale for other developing countries … Zambia, like other poor countries, borrowed heavily from Beijing and Western fund managers that snapped up its dollar-denominated bonds to build infrastructure and finance other government projects. Chinese lenders owe about one-third of Zambia’s foreign debt ” (WSJ, 01/23).

The unfolding of the sovereign debt crisis

Zambia’s finance minister is blaming the weakness in the ‘Common Framework’ debt restructuring process itself, saying that it has left him at the mercy of the countries that designed the framework to move them forward. Other countries such as Ghana are waiting to see how the process is resolved in Zambia before officially signing onto the “Common Framework”.

The post covid environment of the soaring U.S. dollar, high inflation and interest rate hikes by the Federal Reserve and other central banks have added to the debt burdens and have increased servicing costs.

China wants the World Bank and IMF to share in the losses from the restructuring but these international organizations are pushing back saying that they took losses in the early 2000s – and even The U.S. is opposed to China’s demands on multilateral institutions and local-currency debt.

And it is a catch-22 for Zambia because the IMF won’t release its first tranche of the bailout for the country of US$1.3 billion until the debt restructuring is complete with China and other bilateral lenders.

The brewing sovereign debt crisis and the insistence of Western countries, and international institutions such as the IMF and World Bank that China takes losses on its investments is another crack in international cooperation.

What does all this mean for holders of physical silver and gold? It means once again that zero counterparty risk is a huge benefit [maybe the biggest] of holding metals. Ghana itself has finally seen this wisdom and begun forcing gold producers in that country to sell portions of production to the government.

China, for much the same reason, is buying physical gold from other countries and also from gold miners within its jurisdiction. In fact, China recently announced they have record holdings of gold.

Ghana and China recognize that debt is a tool for the manipulation of others. And they see from experience that debt is also a battleground because borrowers often shirk and lenders are often hypocrites.

This is why China offers loans to others but continues to stack physical for itself. As we have said previously, there is a reason why central banks bought record amounts of gold last year. And even those who didn’t buy gold continue to hold it.

The financial crisis, covid, the Russia-Ukraine war and now the economic hardship around the world is causing central banks and governments to ensure they have the security of gold as they know it acts as an insurance when hard times get even harder.

Full story here Are you the author?Follow on:

No related photos.

Tags: China,Commentary,Economics,Featured,Finance,Geopolitics,Government Bonds,government debt,inflation,Investing,National Debt,News,newsletter