Category Archive: 5) Global Macro

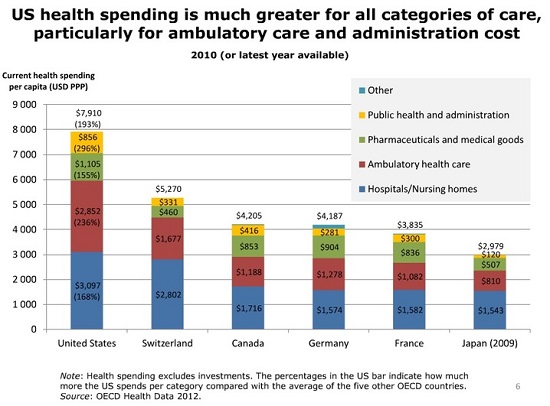

U.S. Healthcare Isn’t Broken–It’s Fixed

If you want to understand why the U.S. healthcare system is bankrupt, financially, morally and politically, then start with this representative anecdote from a U.S. physician. I received this report from correspondent J.F. on the topic of direct advertising of pharmaceutical products to the public (patients).

Read More »

Read More »

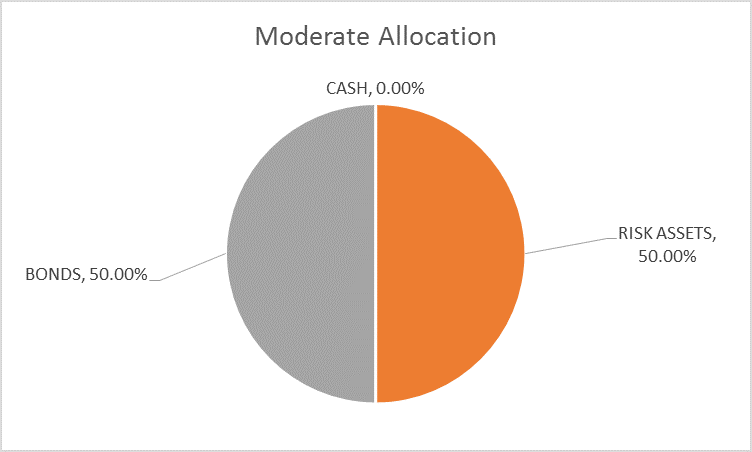

Global Asset Allocation Update

The risk budget changes this month as I add back the 5% cash raised in late October. For the moderate risk investor, the allocation to bonds is still 50% while the risk side now rises to 50% as well. I raised the cash back in late October due to the extreme overbought nature of the stock market and frankly it was a mistake. Stocks went from overbought to more overbought and I missed the rally to all time highs in January.

Read More »

Read More »

All The World’s A (Imagined) Labor Shortage

Last year’s infatuation with globally synchronized growth was at least understandable. From a certain, narrow point of view, Europe’s economy had accelerated. So, too, it seemed later in the year for the US economy. The Bank of Japan was actually talking about ending QQE with inflation in sight, and the PBOC was purportedly tightening as China’s economy appeared to many ready for its rebound.

Read More »

Read More »

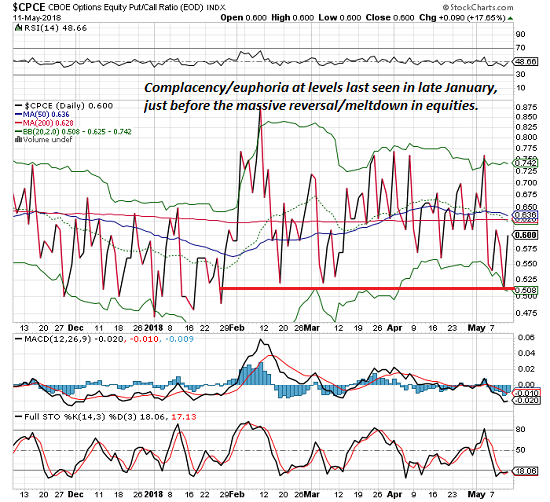

A Funny Thing Happened on the Way to Market Complacency / Euphoria

Fortunately for Bulls, none of this matters. A relatively reliable measure of complacency/euphoria in the stock market just hit levels last seen in late January, just before stocks reversed in a massive meltdown, surprising all the complacent/euphoric Bulls. The measure is the put-call ratio in equities. Since this time is different, and the market is guaranteed to roar to new all-time highs, we can ignore this (of course).

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday on a week note and capped of another generally negative week. Worst performers last week were ARS, BRL, and TRY while the best were ZAR, RUB, and KRW. We remain negative on EM FX and look for losses to continue. US retail sales data Tuesday pose further downside risks to EM FX.

Read More »

Read More »

How Safe Are We? Our Blindness to Systemic Dangers

How do we explain our obsession with relatively low risk dangers and our collective blindness to manufactured/marketed scourges that kill tens of thousands of people annually? If you've bought a new vehicle recently, you may have noticed some "safety features" that strike many as Nanny State over-reach. You can't change radio stations, for example, if the vehicle is in reverse.

Read More »

Read More »

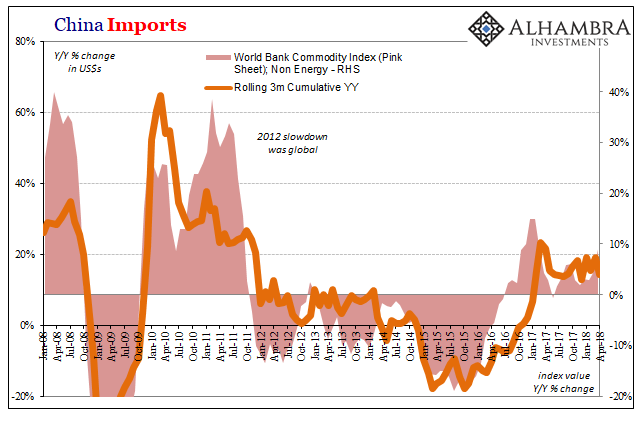

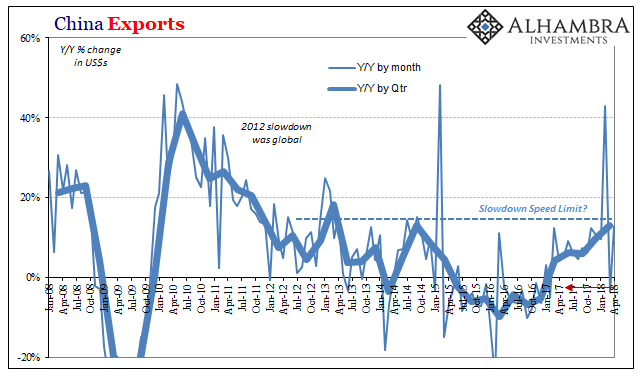

What China’s Trade Conditions Say About The Right Side Of ‘L’

Chinese exports rose 12.9% year-over-year in April 2018. Imports were up 20.9%. As always, both numbers sound impressive but they are far short of rates consistent with a growing global economy. China’s participation in global growth, synchronized or not, is a must. The lack of acceleration on the export side tells us a lot about what to expect on the import side.

Read More »

Read More »

Watching Imports

The US trade deficit, a sensitive political topic these days, declined sharply in March. It had expanded significantly (more deficit) in January and February, reaching nearly -$76 billion (seasonally adjusted) in the latter month, before posting -$68 billion in the latest figures. Exports rose while imports fell in March, making for the largest single month change in the trade condition in many years.

Read More »

Read More »

What Really Happened In Europe

The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say.

Read More »

Read More »

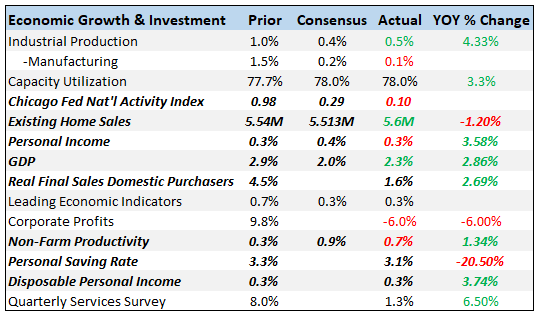

Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy.

Read More »

Read More »

Emerging Markets Preview: The Week Ahead

EM FX came under intense selling pressures last week. The worst performers were ARS, TRY, and MXN while the best were PHP, KRW, and TWD. US rates are likely to remain the key driver for EM FX, and so PPI and CPI data will be closely watched this week. We believe EM FX will remain under pressure.

Read More »

Read More »

Emerging Markets: What Changed

Bank Indonesia is taking measures to stabilize the local bond market. The Philippine central bank is tilting more hawkish. Czech National Bank cut its inflation forecasts. The Turkish government is loosening fiscal policy to drum up popular support. S&P downgraded Turkey to BB- with stable outlook. Argentina officials are taking significant measures to support the peso. Brazil central bank made a subtle shift in its FX intervention strategy.

Read More »

Read More »

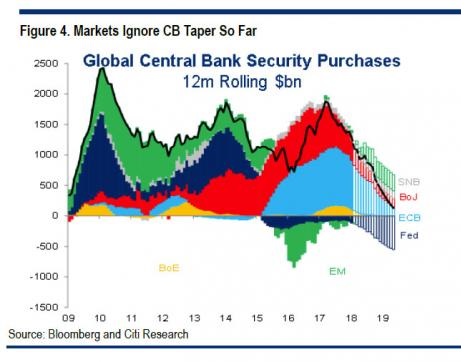

Taking the Pulse of a Weakening Economy

Corporate buybacks provide the key analogy for the economy as a whole. Central banks have been running a grand experiment for 9 years, and now we're about to find out if it succeeds or fails. For 9 unprecedented years, central banks have pushed the pedal of monetary stimulus to the metal: near-zero interest rates, monumental purchases of bonds, mortgage-backed securities, stocks and corporate bonds.

Read More »

Read More »

What Lies Beyond Capitalism and Socialism?

The status quo, in all its various forms, is dominated by incentives that strengthen the centralization of wealth and power. As longtime readers know, my work aims to 1) explain why the status quo -- the socio-economic-political system we inhabit -- is unsustainable, divisive, and doomed to collapse under its own weight and 2) sketch out an alternative Mode of Production/way of living that is sustainable, consumes far less resources while providing...

Read More »

Read More »

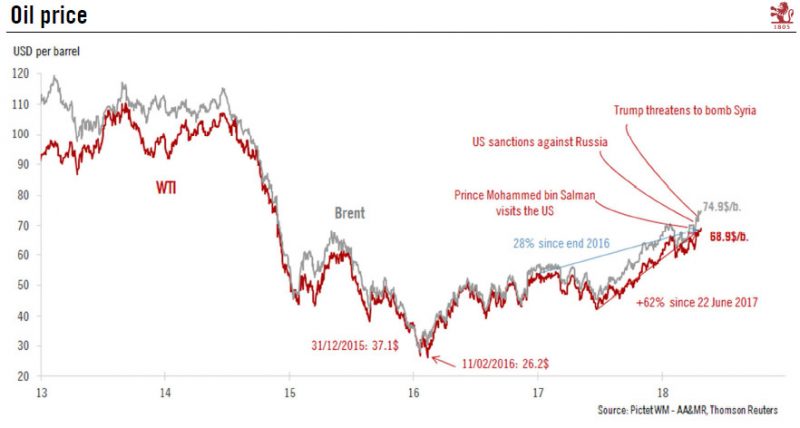

Where next for oil prices?

On 19 April, the price of a barrel of oil reached USD69.56 for West Texas Intermediate (WTI) and reached USD75.27 for Brent, today, the highest price since 2014. Since 9 April, oil prices have been significantly above their longterm fundamental equilibrium value. Three factors explain what has happened.

Read More »

Read More »

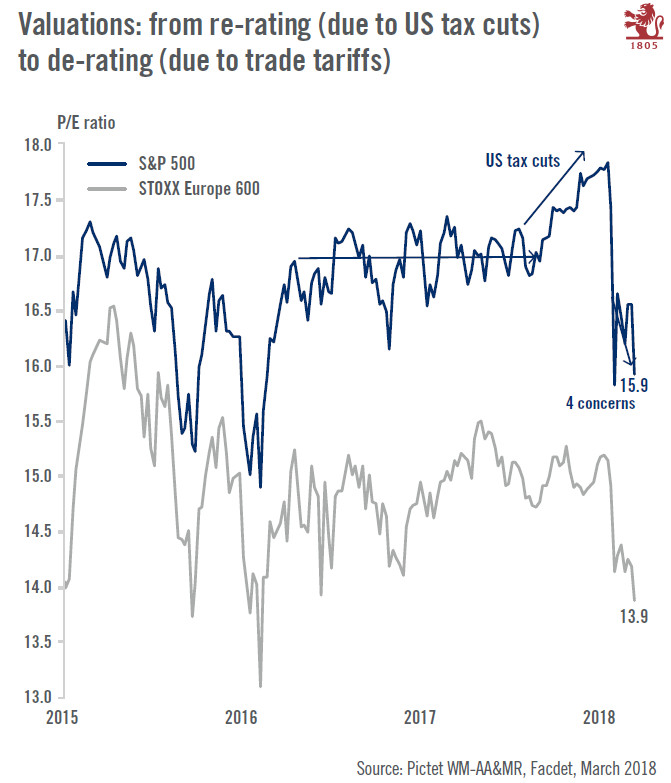

House View, April 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes. While macroeconomic and corporate fundamentals still favour risk assets, challenges have been steadily increasing and a lot of good news is already priced into valuations. We sold part of our equity overweight during the early March rally.

Read More »

Read More »

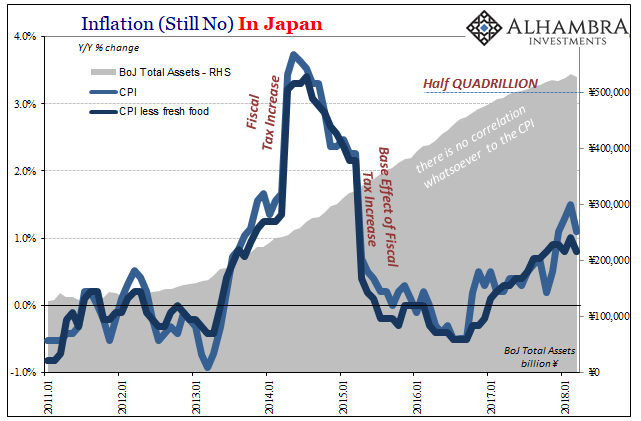

Transitory’s Japanese Cousin

Thomas Hoenig was President of the Federal Reserve’s Kansas City branch for two decades. He left that post in 2011 to become Vice Chairman of the FDIC. Before that, Mr. Hoenig as a voting member of the FOMC in 2010 cast the lone dissenting vote in each of the eight policy meetings that year (meaning he was against QE2, too). This makes him, apparently, the hawk of all hawks.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a firm note, capping off a generally softer week overall. TRY and PHP were the best performers last week, while CLP and ZAR were the worst. US core PCE, ISM manufacturing, FOMC meeting, and jobs data all pose risks to EM this week. We remain a bit defensive on risk assets in general now.

Read More »

Read More »

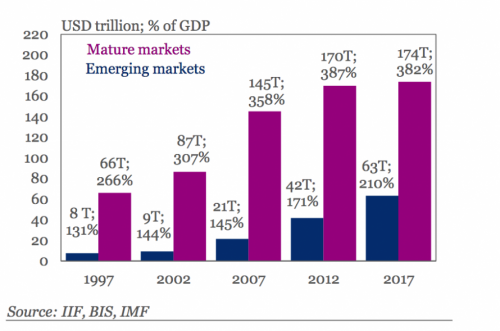

La dette bat des records et menace l’économie mondiale

L’endettement mondial, qui a atteint 164.000 milliards de dollars en 2016 et représente 225% du PIB mondial, représente un risque pour l’économie, a prévenu mercredi le FMI. L’endettement mondial atteint des records, sous l’impulsion de la Chine, au point de dépasser largement les niveaux de 2009, juste après la faillite de la banque Lehman Brothers, et de représenter un risque pour l’économie, a prévenu mercredi le FMI.

Read More »

Read More »

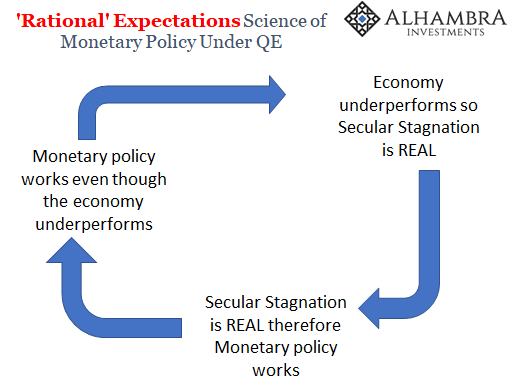

The Science of Japanification

The term itself gives it away. They called it quantitative easing for a specific reason. Both words mean to convey substantial concepts. The first part, quantitative, was used because it sounds deliberate, even scientific. It implies a program where great care and study was employed to come up with the exact right amount. It’s downright formulaic, where you intend that by doing X you can predictably create Y.

Read More »

Read More »