Thomas Hoenig was President of the Federal Reserve’s Kansas City branch for two decades. He left that post in 2011 to become Vice Chairman of the FDIC. Before that, Mr. Hoenig as a voting member of the FOMC in 2010 cast the lone dissenting vote in each of the eight policy meetings that year (meaning he was against QE2, too). This makes him, apparently, the hawk of all hawks.

In January 2011, in his capacity as still President in the Kansas City branch, Hoenig told an audience in Kansas City that though he was no longer a voting member of the Committee (he had starting in 2011 rotated off as regional branch presidents do) his same concerns remained.

As we begin 2011, recent economic data indicate a firmer tone in the outlook, and I am increasingly confident that the recovery is both sustainable and likely to gain strength over the next several quarters.

The primary danger to his outlook as he saw it then was the fiscal deficit. As to the other, he said, “A second concern I have is the consequences that will follow when we combine our current fiscal projections with a highly accommodative monetary policy.” The issue for him was, as in 2010, lags. According to his view, the FOMC was in danger of not thinking far enough ahead. They were being too cautious and risked letting inflation run wild given how much stimulus, so called, had been invented and introduced.

am pleased to be able to say that in my view the economy is in recovery, although at a moderate pace. Over time, barring unexpected surprises, the recovery should gain momentum, which will encourage hiring and slowly bring down the unemployment rate. About that, “unexpected surprises” were just around the corner. Merely a few months forward, the BEA would show that the US economy had already entered a downturn (as Hoenig was speaking) and ultimately the global eurodollar system would experience another major crisis that summer. And during that near-panic, the FOMC would carry on deliberations stunned, truly bewildered not just that it was happening but that something so serious ever could given so much presumed liquidity and “money printing.”

We all know in economics that policy actions or anything for that matter has lagged effects. A shock doesn’t cause immediate collapse, nor does an actual rather than imagined injection of money. The 2008 panic wasn’t just those two weeks in early October, it had really started the prior August and wouldn’t end until the following March.

But the idea of lags has become like so many other terms bastardized to fit the current circumstances; or, more accurately, to excuse contemporary conditions for how they don’t conform wrapped into the idea that they will tomorrow given enough time. Like the word “transitory”, this is taking “lag” way too far. From yesterday in Japan: Fears over the future of Abenomics are mounting at a time when the BOJ is finally beginning to see the results of five years of its ultra-loose policy stance.

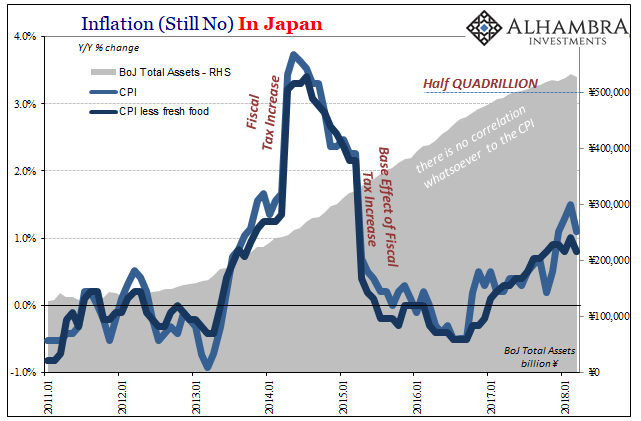

For those keeping score, the Bank of Japan has engaged in constant and massive LSAP’s for more years than anyone could have ever imagined. They began to take on the most absurd proportions in 2013, five years ago, with the intrusion of QQE. The idea was positively Krugman-esque, the mythical S-curve jump to be created by this doctrine of credibly promise to be irresponsible. As of the end of Marcy 2018, BoJ has obtained total assets of ¥528.5 trillion. Half a quadrillion.

Inflation in Japan, Jan 2011 - Apr 2018

(see more posts on Japan Consumer Price Index / Inflation, )Can five years still be considered under any lagged effect? And not yet to actual success, but, as the quote above points out, the possibility that it is “finally beginning.” So much time has passed, half a decade, are we not way, way beyond cause and effect? The article was also written a day too early. The setbacks it described was not the CPI, but the yen’s recent strength and Abe’s mounting political scandals which might imperil the current monetary policy.

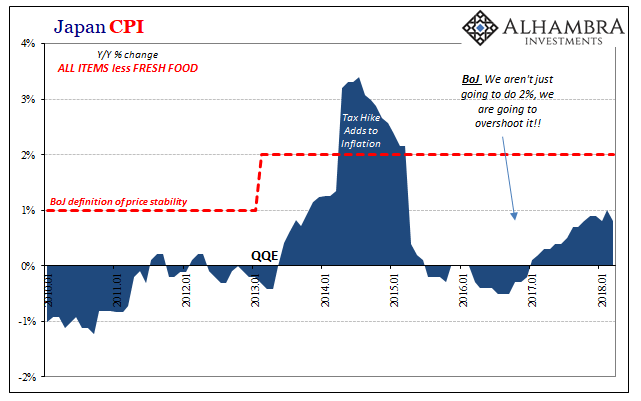

Today, the Ministry of Internal Affairs reports Japanese consumer prices fell -0.4% month-over-month, bringing the CPI back down to just 1.1% year-over-year, leaving it still only about halfway to its target. Excluding fresh food prices, the Japanese “core” rate was less than 1% yet again.

Japan Consumer Price Index, Jan 2010 - Apr 2018

(see more posts on Japan Consumer Price Index / Inflation, )Obviously, this is a problem not unique to Japan. It’s as if the island chain’s “deflationary mindset” has been its chief export since 2008. None of the central banks around the world seem able to answer for the persistent undershoot (if they ever do, then they might then be able to tackle the more important and related issue of global Japanification). Comically enlarged lags, obliterating the word “transitory”, persistent questions about inflation despite trillions and maybe even quadrillions, these are all signs and evidence of the same thing. Ben Bernanke at Thomas Hoenig’s Jackson Hole Symposium in 1999:

The principal conclusion of this paper has been stated several times. In brief, it is that flexible inflation-targeting provides an effective, unified framework for achieving both general macroeconomic stability and financial stability. Given a strong commitment to stabilizing expected inflation, it is neither necessary nor desirable for monetary policy to respond to changes in asset prices, except to the extent that they help forecast inflationary or deflationary pressures.

Japan Consumer Price Index, Jan 2010 - Apr 2018

(see more posts on Japan Consumer Price Index / Inflation, )Think about what he said except in the contrary where the first part of that quote is wrong. What if it didn’t matter what or how much any central bank did as what it calls “stimulus” because what followed over a period of years, half or even a full decade, was macroeconomic and financial instability? It would rewrite not just what’s going on today, but what’s gone on for decades (from bubbles to conundrums).

With so many tested varieties in so many different geographical locations, the wide range of QE’s and LSAP’s have shown, proved actually, central bankers have no idea how to influence inflation. And given that inflation is always and everywhere a monetary phenomenon, monetary policy has no connection with money.

Or, maybe it really is just one enormous lag, and Thomas Hoenig’s concerns were just a little early. Seven years early.

Full story here Are you the author? Previous post See more for Next post

Tags: Abenomics,Bank of Japan,CPI,currencies,economy,Federal Reserve/Monetary Policy,inflation,Japan,Japan Consumer Price Index / Inflation,lsap,Markets,Monetary Policy,money,newslettersent,QE,QQE

Permanent link to this article: https://snbchf.com/2018/05/snider-transitorys-japanese-cousin/