Tag Archive: CPI

Dollar Consolidation is Morphing into Correction

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The failure of computer systems has disrupted airlines, banks, media companies, and the London Stock Exchange, ostensibly stemming from an update from a third-party software update, according to Microsoft. The dollar is trading with a firmer bias. The consolidation, we anticipated, appears to be morphing into a correction. Weaker than expected retail sales...

Read More »

Read More »

Dollar Crushed, Stocks Slump

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The dollar is broadly lower, and stocks are under pressure. Comments by a Japanese official, which did not appear to break new ground, coupled with Trump's interview in BusinessWeek, where he was critical that Japan was benefiting from a weak yen, despite having apparently spent some $80 bln this year trying to stop it from falling, may have been the trigger....

Read More »

Read More »

Euro is Little Changed, while the Yen is Softer to Start the New Week

Overview: The dollar is narrowly mixed against the G10 and emerging market currencies today. The euro is little changed, holding on to last week's gains, after the surprising French election results, where the focus shifts finding a prime minister that can carry a majority of the new and closely divided National Assembly. Despite firm underlying wage data, the Japanese yen has given back its initial gains, and the dollar is pushing back above...

Read More »

Read More »

No Turn Around Tuesday as Greenback Remains Firm

Taking the next few days off. Will be back with week ahead commentary on July 6. Overview: The sharp jump in US long-term interest rates has helped lift the greenback in recent sessions and it remains firm against most of the G10 currencies today. The Canadian dollar is the best performer, and it is nearly flat. The intraday momentum indicators warn that after a mostly consolidative Asia Pacific and European morning, the greenback may probe...

Read More »

Read More »

Will the PCE Deflator Really Contain New Information?

Overview: The US dollar is narrowly mixed as North American participants prepare to return for the last session of the first half. Despite firmer than expected Tokyo CPI and stronger than expected industrial output, the market lifted the greenback around JPY161.25 before profit-taking pressures bought it back toward session lows near JPY160.65 in Europe. President Biden is thought to have lost last night's debate with Trump, but it does not appear...

Read More »

Read More »

Double Whammy: US CPI and Federal Reserve

Overview: Position adjustments ahead of today's US CPI and FOMC

meeting are giving the dollar a modestly heavier tone today. Each of these

events are typically a source of volatility in their own right and together

they promise an eventful North American session. The yen is the only exception

among the G10 currencies, but even there, the dollar is holding below

yesterday's highs. Even sterling's relative resilience this week was unmarred

by the...

Read More »

Read More »

The Greenback is Mostly Softer

Overview: The dollar initially extended its

pre-weekend and yesterday's heavier tone before finding a better bid in the

European morning. Still, as North American dealers return to their posts the

dollar is still mostly softer against the G10 currencies, but it is little

changed to slightly firmer against the Japanese yen. Most emerging market

currencies are firmer, but the South African rand is softer ahead of their

election, the Mexican peso is...

Read More »

Read More »

UK CPI Disappoints

Overview: A hawkish hold by the Reserve Bank

of New Zealand and a firmer than expected UK CPI reading have allowed the New

Zealand dollar and sterling to show resilience in the face of the US dollar's

broadly firmer tone. And even there, the Kiwi and pound have seen their early

gains pared. The Swiss franc is the weakest of the G10 currencies today and has

fallen to a new 12-month low against the euro. Emerging market currencies are

mixed. Central...

Read More »

Read More »

Will USD be Bought on the Fact after Being Sold on Expectations of a Softer CPI?

Overview: The

dollar is trading heavily against the G10 currencies and most of the currencies

from emerging markets. The market expects softer US CPI (and retail sales)

today. Any decline in the year-over-year core rate would put it at its lowest

level since April 2021. Still, this has been anticipated, and the market seems

vulnerable to "sell the rumor, buy the fact" type of activity. After

all, the Fed will see another employment and...

Read More »

Read More »

Dollar Consolidates Softer Ahead of Tomorrow’s CPI

Overview: The dollar is trading with

a softer bias in mostly narrow ranges against the G10 currencies. It did not

rally much ahead of the US jobs data, and it was not able to sustain the upside

momentum afterwards, despite the jump in US yields. Former St. Louis Fed President

Bullard, who still has a strong reputation in the market, told Bloomberg TV

yesterday that three cuts were his base case this year. The Scandis and

Antipodeans are the...

Read More »

Read More »

Ueda’s Comments Weigh on Yen as the Market Awaits US CPI

Overview: The US CPI has become one of the most important high-frequency economic reports for the capital markets. The dollar is going into the report narrowly mixed against the G10 currencies. Comments by BOJ Governor Ueda about the weakness in consumption of non-durable goods was seen by some as reducing the likelihood of a change in policy next week.

Read More »

Read More »

Ueda’s Comments Knock the Yen Back, while the Euro Flirts with $1.08

Overview: The US dollar is mixed today. The dollar-bloc currencies and the Scandis are enjoying a slightly firmer tone, while the euro and sterling are edging higher in European turnover.

Read More »

Read More »

Soft US CPI Today Paves Way for Fed Pivot Tomorrow

Overview: The US dollar is trading softer against all the

G10 currencies ahead of what is expected to be a soft November CPI report,

which paves the way for a pivot by the FOMC tomorrow. It is expected to signal

that policy may be sufficiently restrictive and anticipate being able to cut

rates next year more than it thought in September, even if not as much as is

priced into the market. Among emerging market currencies, central European

currencies...

Read More »

Read More »

Dollar Recovers After Losses Extended in Asia

Overview: On the back of lower interest rates, the greenback's

slide was extended in early Asia Pacific turnover, but it has recovered. As

North American trading begins, the dollar is firmer against all the G10

currencies but the New Zealand dollar, which has been aided by the hawkish hold

of the central bank, and an immaterial gain in the Swiss franc. Emerging market

currencies are mixed. Central European currencies and the Mexican peso are...

Read More »

Read More »

Corrective Forces Help the Dollar Stabilize

Overview: Corrective

forces helped the dollar stabilize yesterday and it enjoys a firmer today. The

euro has slipped below $1.09, and the dollar has resurfaced above JPY149.00. The

FOMC minutes seem dated by the more than 30 bp decline in the US 10-year yield,

the 7% rally in the S&P 500 and roughly 3% drop in the Dollar Index. The

implied year-end 2024 Fed funds rate has fallen by 10 bp to 4.51% (5.33%

currently). The Japanese government...

Read More »

Read More »

Is the Market Putting on Risk Ahead of the Weekend?

Overview: The US dollar is trading with a softer

bias. Among the G10- currencies, only the euro and Swiss franc are the laggards

and are nearly flat. In shifting expectations, the market sees the Reserve Bank

of Australia as the most likely to hike rates again, while the swaps market

appears to be bringing forward cuts by the European Central Bank and the Bank

of Canada. The Australian dollar is the strongest G10 currency today and this

week. After...

Read More »

Read More »

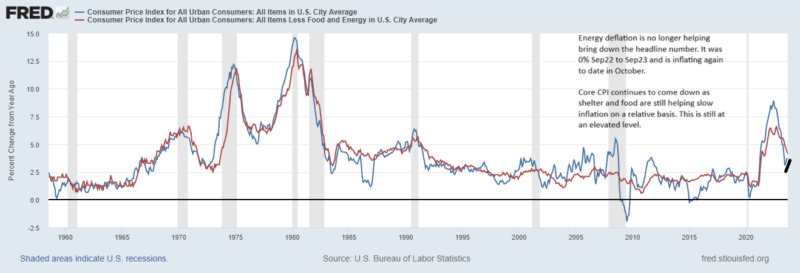

Macro: Sep CPI stuck at 3.7% YOY

The most anticipated release of the week came in … “Unchanged” or sticky stuck from the August at 3.7% yoy. But it’s worth mentioning as we will discuss below that this is up from June CPI which was 3.09% yoy. Core CPI which excludes food and energy because of their volatility sits at 4.13% yoy down from 4.39% last month.

Let’s look under the hood a bit because headlines will mention “sticky” CPI and there are some reasons that CPI will indeed...

Read More »

Read More »

Market Awaits US Data and Leadership

Overview: The dollar staged a major technical

reversal yesterday, in a dramatic reaction to a considerably weaker JOLTs

report than expected, spurring a large drop in US interest rates. And this is

despite press reports that the participation rate in the survey is half of what

was three years ago. We suspect the price action said as much about market

positioning as it did about the data. The path to the US jobs data on Friday

goes through...

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is.

Read More »

Read More »