| The US trade deficit, a sensitive political topic these days, declined sharply in March. It had expanded significantly (more deficit) in January and February, reaching nearly -$76 billion (seasonally adjusted) in the latter month, before posting -$68 billion in the latest figures. Exports rose while imports fell in March, making for the largest single month change in the trade condition in many years.

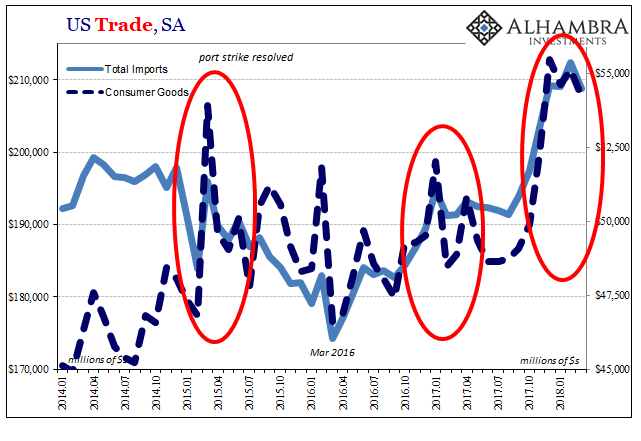

That may mean something in Washington or Beijing, but it largely suggests the erosion of a couple temporary factors. The first is Harvey and Irma receding farther into the past. The aftermath of the storms saw a tremendous increase in import activity, particularly in consumer goods. |

US Trade Balance, Jan 2014 - May 2018(see more posts on U.S. Trade Balance, ) |

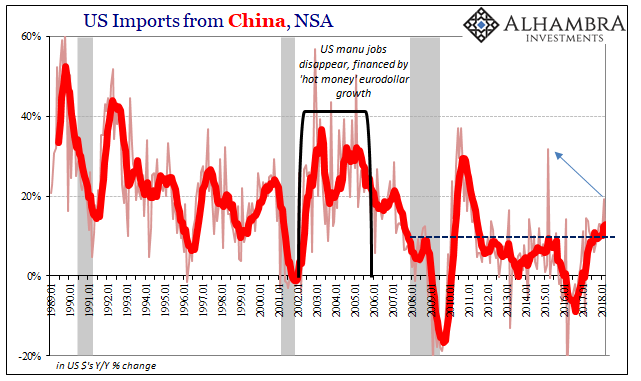

| The second is the trade issue itself. According to Chinese export estimates, there was indicated a massive rush to move product outside the country in February. In all likelihood, a lot of it had to do with trying to beat whatever tariffs or restrictions might have been, or still might be, imposed in the ongoing, unresolved dispute. On the US side, imports from China demonstrated that pattern but to a much lesser degree (continuing to raise questions about where all those Chinese goods actually went in February, or whether there were fake goods mixed within serving to channel nothing more than funding into the country from Hong Kong or elsewhere).

Chinese imports rose 11.8% year-over-year in March following a 19.2% rise in February. Taking into account holiday factors, as well, the 11.8% is among the weaker gains recently. Whatever the cause, it still doesn’t suggest a determined uptick in US demand for Chinese products. |

US Imports, Jan 1989 - May 2018 |

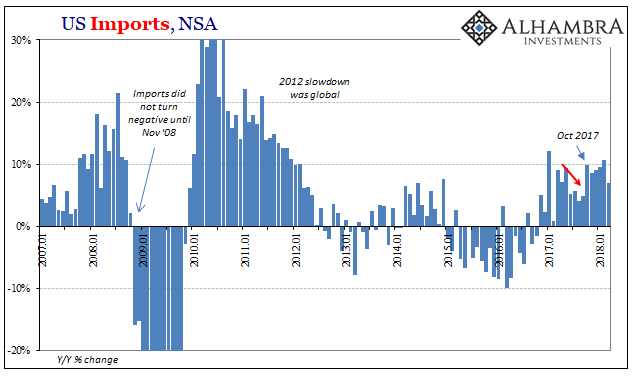

| Overall, US imports increased 6.9% in March 2018 from March 2017 (unadjusted). |

US Imports, Jan 1989 - May 2018 |

| That’s also the weakest gain in several months, the lowest since last September before all the storm effects converged. |

US Imports, Jan 2007 - May 2018 |

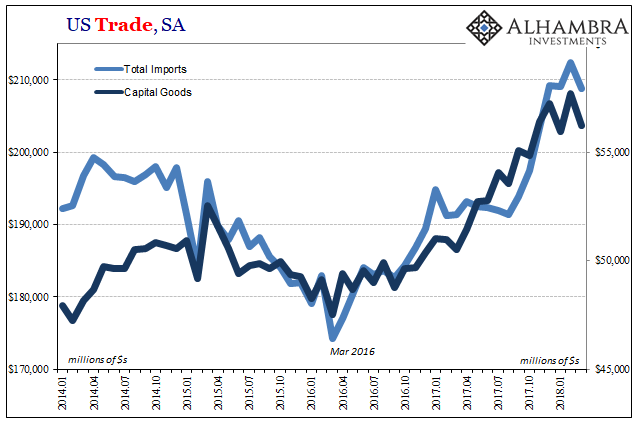

| Among the categories of imports holding back growth, inbound capital goods were reduced in March. The growth in this segment predated last year’s storms, suggesting that though Harvey and Irma may have contributed to it that wasn’t likely the reason for the upswing. That trend, however, has now been stalled for five consecutive months, the first major break in it dating back to the start of “reflation” in 2016. |

US Trade Balance, Jan 2014 - May 2018(see more posts on U.S. Trade Balance, ) |

| The Census Bureau reports that the top decreases for imports of capital goods occurred in computer accessories and telecommunications equipment. It also calculates that while trade with Europe was up in March, imports from Germany were down sharply (after rising the prior two months). |

US Trade Balance, Jan 2014 - May 2018(see more posts on U.S. Trade Balance, ) |

While angst along the US-China trade route have taken center stage, Germany is behind only China, Mexico, and Japan in terms of imbalance. The second on that list, Mexico, is already embroiled in difficult negotiations regarding its position (NAFTA). For all of 2017, the US merchandise deficit with the European export powerhouse was a hefty -$64.2 billion (compared to -$375 billion with China). By way of comparison, the US actually posted a small merchandise surplus with the UK (+$3.3 billion), a -$23 billion deficit with South Korea, and +$7.6 billion against Brazil.

The large decline in German imports may mean the same thing as we suspect of China’s; that some in Germany concerned about being drawn in to the dispute (steel, for one) were rushing to get ahead of any sanctions and therefore stepped up shipments in January and February.

The role of capital goods in any of these cases may be more macro than any country specific issues. There isn’t nearly enough data that would lead to solid conclusions, so these are areas we are going to be watching in the months ahead. For my own purposes, I’m more interested in cap goods than Germany, and far more interested in China overall having nothing to do with politics (as a proxy for US demand acceleration, or not).

Full story here Are you the author? Previous post See more for Next postTags: China,currencies,economy,exports,Federal Reserve/Monetary Policy,Germany,global trade,imports,Markets,newslettersent,U.S. Trade Balance