Category Archive: 5) Global Macro

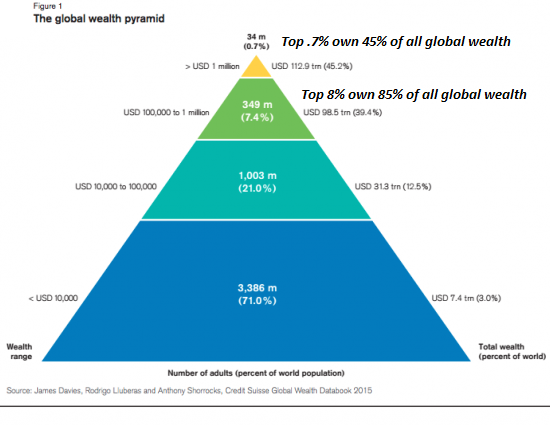

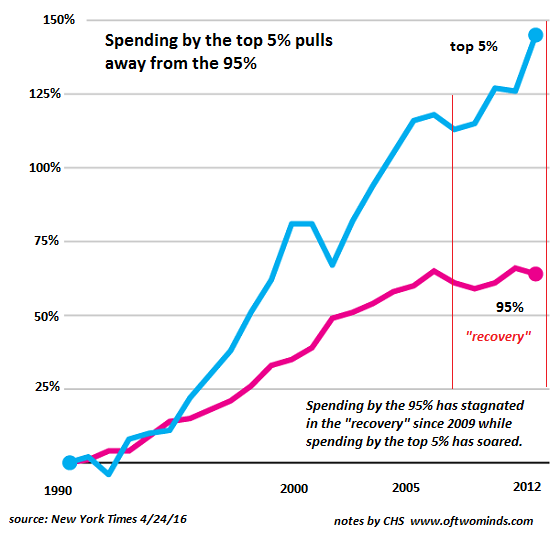

25 Years of Neocon-Neoliberalism: Great for the Top 5 percent, A Disaster for Everyone Else

It cannot be merely coincidental that the incomes and wealth of the top 5% have pulled away from the stagnating 95% in the 25 years dominated by neocon-neoliberalism. One unexamined narrative I keep hearing is: "OK, so neocon-neoliberalism was less than ideal, but Trump could be much worse." Let's start by asking: would Syrian civilians agree with this assessment?

Read More »

Read More »

Emerging Markets: What has Changed

Prime Minister Phuc said Vietnam will ease the limits on foreign ownership of banks this year. Russia’s government is working on measures to limit ruble volatility, including possible FX purchases. Turkey’s central bank start auctioning FX swaps to help support the lira. Brazil’s central bank resumed rolling over FX swaps. Brazilian Supreme Court Judge Zavascki was tragically killed in a plane accident. Chile’s central bank started the easing...

Read More »

Read More »

Draghi Lets Steam out of Euro

US reported stronger than expected series of data, including a large drop in weekly jobless claims for the week of the next NFP survey. Draghi remained dovish, with key phrases retained. Euro needs to break $1.0575 now to confirm a top is in place. Markets still uncertain ahead of the start of the new Administration.

Read More »

Read More »

Will Our Grandchildren Wonder Why We Didn’t Build a Renewable Power Grid When It Was Still Affordable?

Anyone seeking clarity on the energy picture a decade or two out is to be forgiven for finding a thoroughly confusing divide. On the one hand, we have reassuring projections from the U.S. Energy Information Administration (EIA) that assume current production of fossil fuels will remain steady for decades to come.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week mixed. Markets continue to grapple with the outlook for the so-called Trump Trade, which we believe is intact. MXN and TRY recovered from the relentless selling of recent days, but both remain vulnerable. Indeed, if the jump in US yields on Friday continues this week, most of EM should remain under pressure.

Read More »

Read More »

Dear Self-Proclaimed “Progressives”: as Apologists for the Neocon-Neoliberal Empire, You Are as Evil as the Empire You’ve Enabled

Dear Self-Proclaimed "Progressive": I love you, man, but it has become necessary to intervene in your self-destruction. Your ideological blinders and apologies for the Establishment's Neocon-Neoliberal Empire are not just destroying your credibility, they're destroying the nation and everywhere the Empire intervenes.

Read More »

Read More »

Emerging Markets: What has Changed

China’s government has asked banks to balance their yuan inflows and outflows. Indonesia partially lifted a ban on exports of nickel ore and bauxite. Czech President Zeman picked two new central bankers as the end of the koruna cap looms. Turkish central bank is taking limited measures to support the lira. Turkey’s parliament voted 338-134 to discuss proposed constitutional changes that would increase the power of the presidency.

Read More »

Read More »

What’s Truly Progressive?

What's progressive? Pushing power, agency, skills, capital and solutions down to the individual, household, community, enterprise, town and city levels and focusing on doing more with much less.

Read More »

Read More »

The Eight Forces That Are Pressuring Profits

If there is any economic assumption that goes unquestioned, it's the notion that profits will remain robust for the foreseeable future. This assumption ignores the tidal forces that are now flowing against profits. Any discussion of corporate profits must start by noting the astonishing rise in U.S. corporate profits since the heyday of the late 1990s dot-com boom. From $800 billion to $2.4 trillion in a few years is not just extraordinary--it's...

Read More »

Read More »

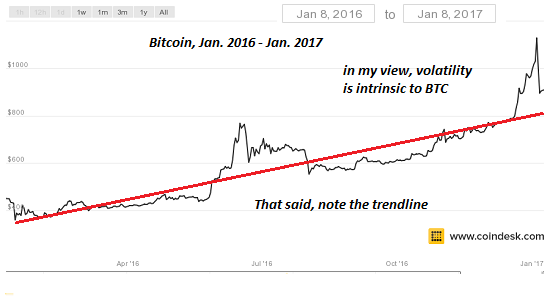

Why Don’t the U.S. Dollar and Bitcoin Drop to Their Tangible Value, i.e. Zero?

I have covered the many reasons why the U.S. dollar (USD) has strengthened in dozens of posts over the past 5 years, (Could the U.S. Dollar Rise 50%?, January 12, 2011), and I described the positive dynamics of bitcoin last summer in An Everyman's Guide to Understanding Cryptocurrencies (June 13, 2016), back when bitcoin was under $600.

Read More »

Read More »

Why Profits Are Faltering

Profits are faltering for structural reasons that are not easily resolved. The bedrock assumption of the Bull market is that corporate profits will keep rising indefinitely. Hiccups are allowed, but current stock market valuations are implicitly based on profits expanding.

Read More »

Read More »

We Can Only Afford One, So Choose Wisely: Social Security/Medicare, Cartel Cronyism or Inflation (a.k.a. Central Banking)

Here's the problem with central banks seeking higher inflation: costs go up but wages don't. It's easy to quantify the annual cost of Social Security/Medicare, and not so easy to calculate the cost of Cartel Cronyism and Central Bank-created inflation.Cartel cronyism is a hidden tax on the entire economy, as is Central Bank-created inflation.

Read More »

Read More »

Prosperity = Abundant Work + Low Cost of Living

If we seek a coherent context for the new year, we would do well to start with the foundations of widespread prosperity. While the economy is a vast, complex machine, the sources of widespread prosperity are not that complicated: abundant work and a low cost of living.

Read More »

Read More »

Fragmentation and the De-Optimization of Centralization

Many observers decry the loss of national coherence and purpose, and the increasing fragmentation of the populace into "tribes" with their own loyalties, value systems and priorities. These observers look back on the national unity of World War II as the ideal social standard: everyone pitching in, with shared purpose and sacrifice. (Never mind the war killed tens of millions of people, including over 400,000 Americans.)

Read More »

Read More »

Emerging Market: Week Ahead Preview

EM FX was a mixed bag over the past week. Dollar softness vs. the majors allowed some in EM to gain traction, with ZAR and PEN the biggest gainers since Christmas. On the other hand, ARS TRY, and INR were the biggest losers. With markets coming back to life, we expect EM to remain broadly under pressure as the same major investment themes remain in place.

Read More »

Read More »

Modi’s Great Leap Forward

India’s Prime Minister, Narendra Modi, announced on 8th November 2016 that Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes would no longer be legal tender. Linked are Part-I, Part-II, Part-III, Part-IV, Part-V, Part-VI and Part-VII, which provide updates on the demonetization saga and how Modi is acting as a catalyst to hasten the rapid degradation of India and what remains of its institutions.

Read More »

Read More »

Why I’m Hopeful

Readers often ask me to post something hopeful, and I understand why: doom-and-gloom gets tiresome. Human beings need hope just as they need oxygen, and the destruction of the Status Quo via over-reach and internal contradictions doesn't leave much to be happy about.

Read More »

Read More »

Ungovernable Nation, Ungovernable Economy

Yesterday I described the conditions that render the U.S. ungovernable. Here is a chart of why the U.S. economy will also be ungovernable. Longtime readers are acquainted with the S-curve model of expansion, maturity, stagnation and decline.

Read More »

Read More »

What Triggers Collapse?

A variety of forces will disrupt or obsolete existing modes of production and the social order.

Though no one can foretell the future, it is self-evident that the status quo—dependent as it is on cheap oil and fast-expanding debt—is unsustainable. So what will trigger the collapse of the status quo, and what lies beyond when the current arrangements break down? Can we predict how-when-where with any accuracy?

All prediction is based on...

Read More »

Read More »

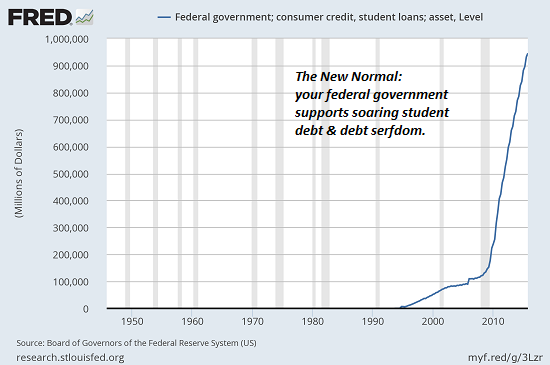

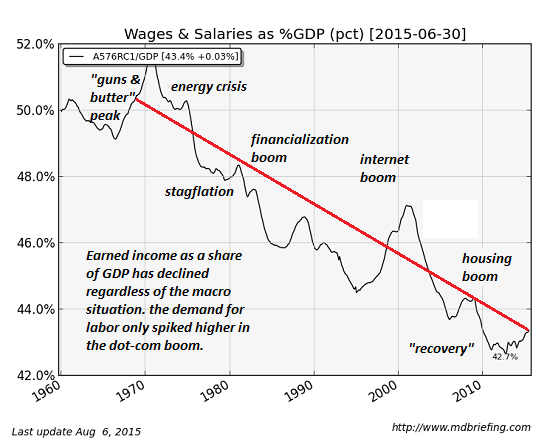

Will Tax Cuts and More Federal Borrowing/Spending Fix What’s Broken?

Charles Hugh Smith combines the best graphs on the declining wage share of GDP in this post. He answers the question if the tax cuts and more federal borrowing and spending can solve what is broken in the U.S. economy.

Read More »

Read More »