Category Archive: 5) Global Macro

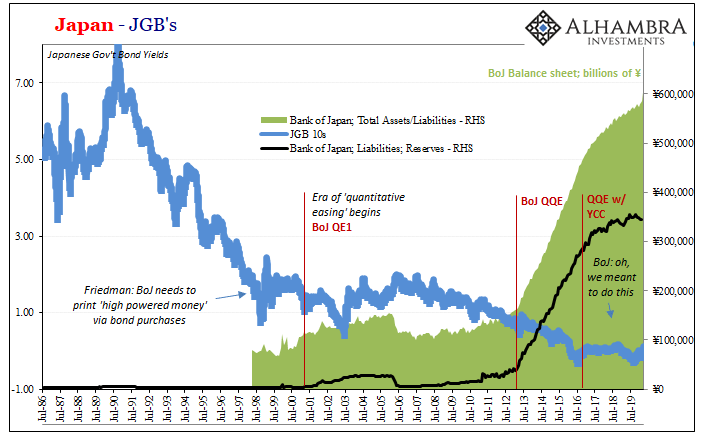

From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and...

Read More »

Read More »

The Post-Covid Economy Will Be Very Different From the Pre-Pandemic Bubble Economy

As the old models break down, opportunities for new models will arise. Unstable, unsustainable systems can lull observers into a comfy complacency as instability increases beneath a thin veneer of apparent stability. That's the systemic story of the past 20 years: all the extremes that were needed to maintain the veneer of stability have increased the instability building beneath the complacent confidence.

Read More »

Read More »

Dollar Broadly Weaker After Reports of Possible Brexit Compromise

The dollar remains under pressure; there is a debate as to the root causes of recent dollar weakness. May auto sales will be the only US data release today; protests in the US are further denting Trump’s re-elections prospects, at least according to betting odds. The G7 meeting planned at Camp David this month was postponed after German Chancellor Merkel declined his invitation.

Read More »

Read More »

We’re Living the Founding Fathers’ Nightmare: America Is Corrupt to the Core

Our ruling elites, devoid of leadership, are little more than the scum of self-interested, greedy grifters who rose to the top of America's foul-smelling stew of corruption. The Founding Fathers were wary of institutional threats to liberty and the citizenry's sovereignty, which included centralized concentrations of power (monarchy, central banks, federal agencies, etc.) and the tyranny of corruption unleashed by small-minded, self-interested,...

Read More »

Read More »

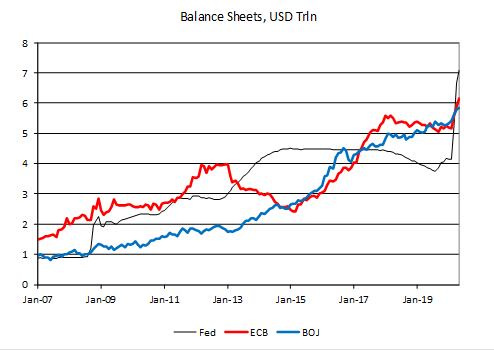

All-Stars #107 Jeff Snider: Huge Money Printing Speaks For Itself….

All-Stars #107 Jeff Snider: Huge Money Printing Speaks For Itself, So Why Is Jay Powell Trying To Sell It So Aggressively?

Download chartbook: https://bit.ly/3cppakW

Please visit our website https://www.macrovoices.com to register your free account to gain access to supporting materials.

Read More »

Read More »

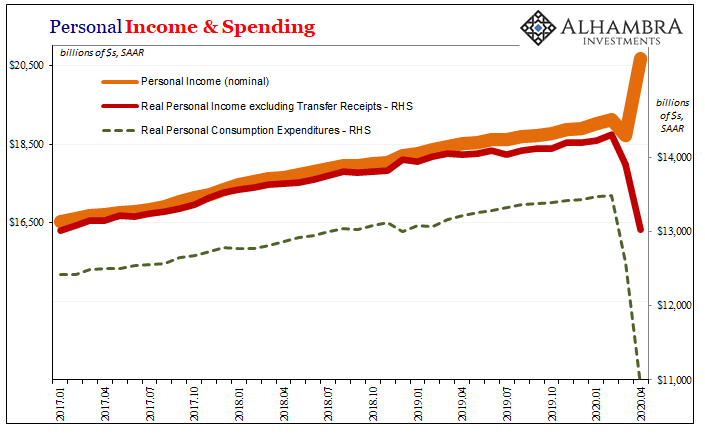

Personal Income and Spending: The Other Side

The missing piece so far is consumers. We’ve gotten a glimpse at how businesses are taking in the shock, both shocks, actually, in that corporations are battening down the liquidity hatches at all possible speed and excess. Not a good sign, especially as it provides some insight into why jobless claims (as the only employment data we have for beyond March) have kept up at a 2mm pace.These are second order effects.

Read More »

Read More »

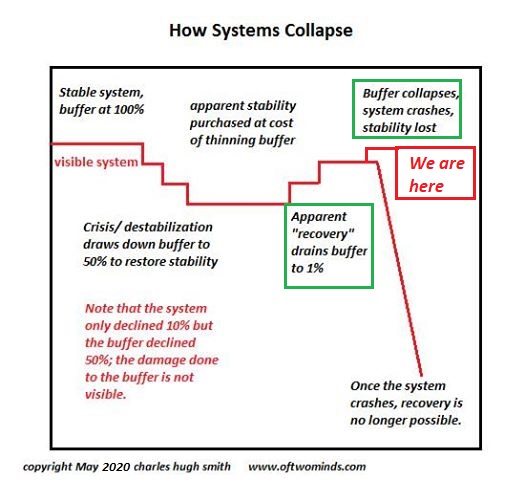

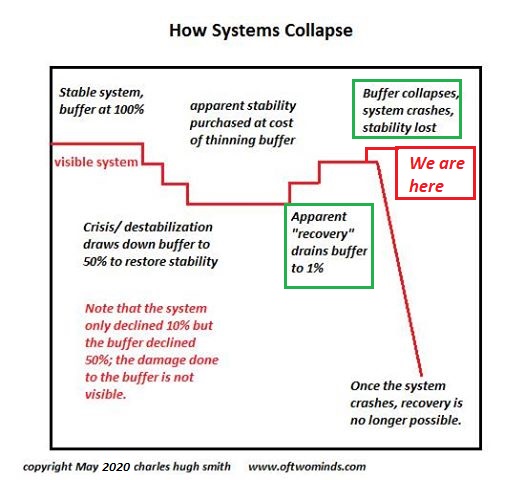

This Is How Systems Collapse

Flooding the financial system with "free money" only restores the illusion of stability. I updated my How Systems Collapse graphic from 2018 with a "we are here" line to indicate our current precarious position just before the waterfall: For those who would argue we're nowhere near collapse, consider that over 20% of the Federal Reserve's $2 trillion spew of free money went directly into the pockets of America's billionaires.

Read More »

Read More »

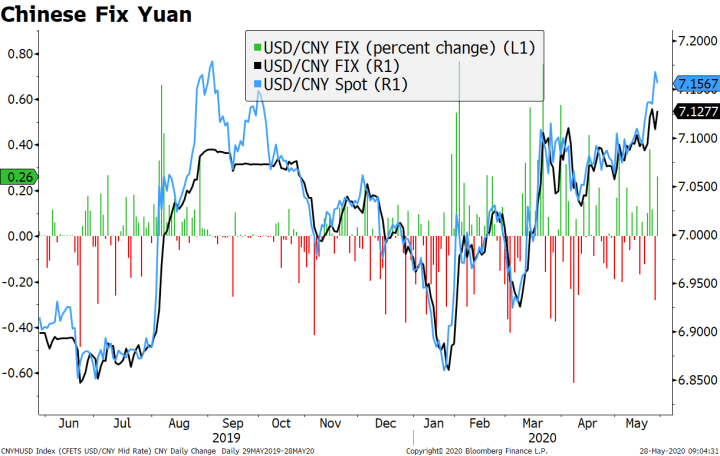

Dollar Firm as US-China Tensions Continue to Rise

Tensions between the US and China continue to rise; the dollar is finding some traction. Fed Beige Book contained no surprises; NY Fed President Williams said the Fed is “thinking very hard” about targeting yields; weekly jobless claims are expected at 2.1 mln vs. 2.438 mln last week .

Read More »

Read More »

CHARLES HUGH SMITH – That System Is Completely And Incredibly Unfair

SUBSCRIBE For The Latest Issues About ; #DEEP STATE #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ For More Info; https://www.youtube.com/channel/UCjG4MtXKu6a9MFNYUK0WcZA/videos?view_as=subscriber

Read More »

Read More »

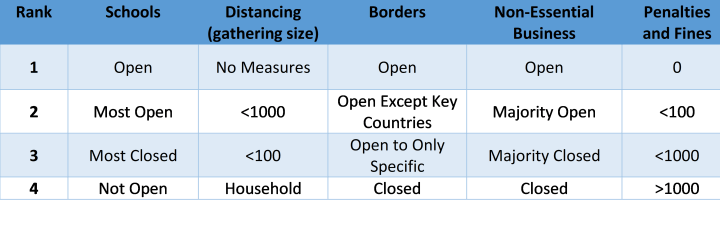

Asia Lockdowns vs. Re-Openings

We apply the five-factor model used to analyse lockdowns and openings in developed markets and in Latin America to Asian Markets. It evaluates the restrictions imposed by different countries in the region, how they compare in terms of severity of lockdown, and where they are heading in the spectrum of reopening. The scale we use measures grade restrictions from 1 (open) to 4 (closed) across the following five factors: (a) schools/universities, (b)...

Read More »

Read More »

The Event Has RevealedThe Structural Fragilities Of America,The [CB] Model Failed:Charles Hugh Smith

Prepare Today And SAVE $100 Off A Full 4-WEEK SUPPLY My Patriot Supply http://preparewithx22.com Today’s Guest: Charles Hugh Smith Todays Interview: Todays interview is with Charles Hugh Smith, Charles talks cv-19 in Hawaii and how the island is handling it. The discussion then branches off into centralization, the [CB] and how the people have the …

Read More »

Read More »

How scientists calculate climate change | The Economist

Climate activists talk a lot about following “the science” around climate change. What actually is the science and how is it calculated? Read more here: https://econ.st/3ci07Qy

Find our school briefings series here, including our recent climate explainers: https://econ.st/2Zeo7kV

Sign up to receive The Economist’s fortnightly newsletter to keep up to date with our latest coverage on climate change: https://econ.st/3dZrKz6

Find The Economist’s...

Read More »

Read More »

How scientists calculate climate change | The Economist

Climate activists talk a lot about following “the science” around climate change. What actually is the science and how is it calculated? Read more here: https://econ.st/3ci07Qy Find our school briefings series here, including our recent climate explainers: https://econ.st/2Zeo7kV Sign up to receive The Economist’s fortnightly newsletter to keep up to date with our latest coverage …

Read More »

Read More »

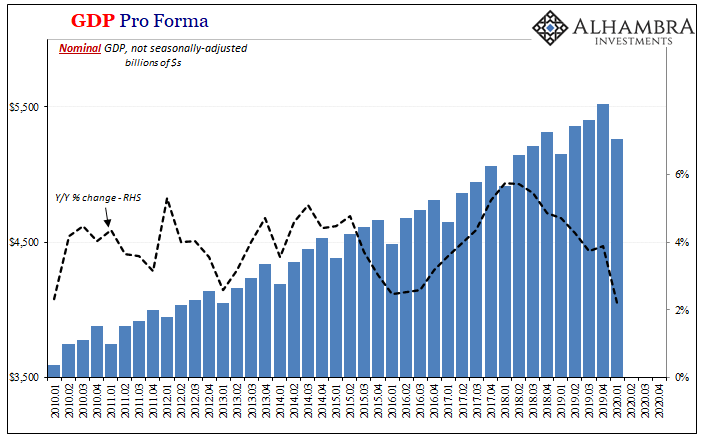

Getting A Sense of the Economy’s Current Hole and How the Government’s Measures To Fill It (Don’t) Add Up

The numbers just don’t add up. Even if you treat this stuff on the most charitable of terms, dollar for dollar, way too much of the hole almost certainly remains unfilled. That’s the thing about “stimulus” talk; for one thing, people seem to be viewing it as some kind of addition without thinking it all the way through first.You have to begin by sizing up the gross economic deficit it is being haphazardly poured into – with an additional emphasis...

Read More »

Read More »

Charles Hugh Smith on Meeting the Challenges of the “New Normal” World

Charles Hugh Smith on Meeting the Challenges of the “New Normal” World http://financialrepressionauthority.com/2020/05/27/the-roundtable-insight-charles-hugh-smith-on-meeting-the-challenges-of-the-new-normal-world/

Read More »

Read More »

Hong Kong Turbulence Likely to Rise as US-China Relations Worsen

Recent moves by China call into direct question the “one country, two systems” approach. Hong Kong assets have held up surprisingly well but we see turbulence ahead as US-China relations are set to deteriorate further.

Read More »

Read More »

An Economy That Cannot Allow Stocks to Decline Is Too Fragile To Survive

The fragile ice shelf of speculative bets and debt clinging to the mountainside is making strange creaking sounds-- will you listen or will you ignore it because 'the Fed has our back'? Feast your eyes on the chart below of the Nasdaq 100 stock market Index, which is dominated by the six FAAMNG (rhymes with "famine") stocks: Facebook, Apple, Amazon, Microsoft, Netflix and Google which now account for over 20% of the entire U.S. stock market's...

Read More »

Read More »

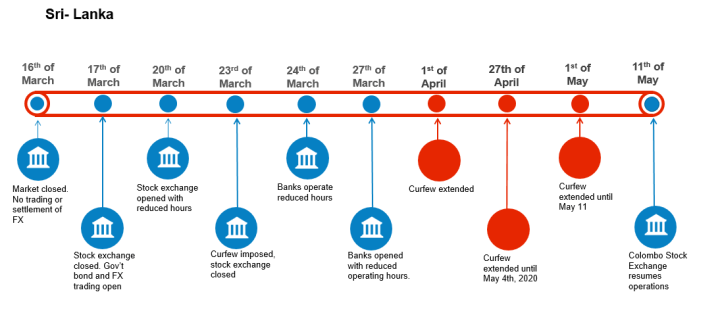

Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot, Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity.

Read More »

Read More »

Covid-19: why the economy could fare worse than you think | The Economist

Three months after lockdown was relaxed in China, its economy is now running at around 90% of normal levels. Although 90% may sound fine, for many it could be catastrophic. Read more here: https://econ.st/2AeZ86k

Further reading:

Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: https://econ.trib.al/YD53WI6

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ

Read...

Read More »

Read More »