Category Archive: 5) Global Macro

The Gathering Storm

July 4th is an appropriate day to borrow Winston Churchill's the gathering storm to describe the existential crisis that will envelope America within the next decade. There is no single cause of the gathering storm; in complex systems, dynamics feed back into one another, and the sum of destabilizing disorder is greater than a simple sum of its parts.

Read More »

Read More »

Can eco-tourism help save the ocean? | The Economist

Indonesia’s Coral Triangle is one of the most biodiverse places on the planet, but destructive fishing practices are threatening ocean life. Meet the conservation pioneers who are reviving these waters—bringing species back from the brink of extinction. Click here to subscribe to The Economist on YouTube: https://econ.st/2zc9nHO Daily Watch: mind-stretching short films throughout the working …

Read More »

Read More »

Charles Hugh Smith Use Logic The Deal We Are At The End Of The Economic Cycle

All our reports and Daily Alert News are backed up by source links. We work very hard to bring you the facts and We research everything before presenting the report. Subscribe for Latest on Financial Crisis, Oil Price, Global Economic Collapse, Dollar Collapse, Gold, Silver, Bitcoin, Global Reset, New World Order, Economic Collapse, Economic News, …

Read More »

Read More »

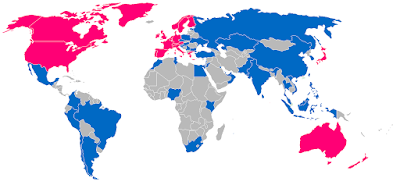

US Vs China – Is It ‘Art Of The Deal’ Or Economic Warfare?

While monetary tightening remains the main risk for global stock markets, the threat of a trade war continues to dominate the headlines...

Read More »

Read More »

Charles Hugh Smith: We Desperately Need Shared Values, Connection & Positive Social Roles

Full description and comments at: https://www.peakprosperity.com/podcast/114151/charles-hugh-smith-we-desperately-need-shared-values-connection-positive-social-roles We’ve recently published a series of commentary on PeakProsperity.com addressing the epidemic of disconnection, dissatisfaction and demoralization that society is increasingly suffering from today: – Feeling Isolated? (...

Read More »

Read More »

How to revive public healthcare | The Economist

Britain’s National Health Service is facing unprecedented challenges—70 years after it was first created. Lord Ara Darzi is a world-leading surgeon and a former British health minister. This is his prescription for nursing the NHS back to health. Click here to subscribe to The Economist on YouTube: https://econ.st/2NlVzNZ Daily Watch: mind-stretching short films throughout the …

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended Friday mixed, capping off a mostly softer week. TRY, MXN, and RUB were the top performers and the only ones up against USD, while ARS, CLP, and BRL were the worst. Looking ahead, US jobs data on Friday pose some risks to EM, coming on the heels of a higher than expected 2% y/y rise in PCE. China will also remain on the market’s radar screen, with the first snapshots of June economic activity just starting to emerge. We remain...

Read More »

Read More »

Emerging Markets: What Changed

PBOC fixed USD/CNY at the highest level since December 14. Bank Indonesia delivered a larger than expected 50 bp to 5.25%. Bulgarian Prime Minister Boyko Borissov survived a second no-confidence vote this year. Turkish President Recep Tayyip Erdogan was re-elected but with sweeping new powers. Saudi Arabia, Kuwait, and UAE are reportedly in talks to help stabilize Bahrain.

Read More »

Read More »

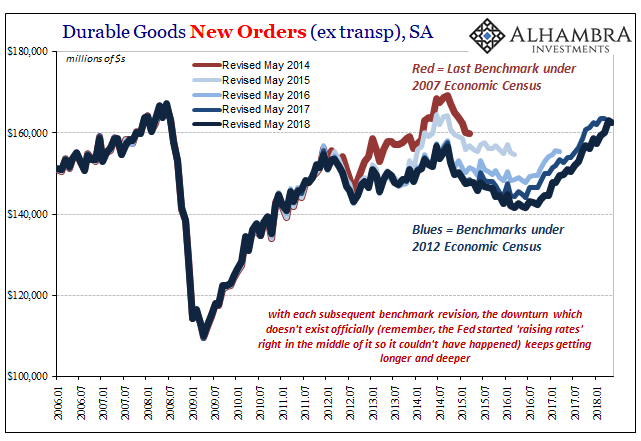

Revisiting The Revised Revisions

I missed durable goods last month for scheduling reasons, which was a shame given that May is the month each year for benchmark revisions to the series. Since new estimates under the latest revisions were released today, it seems an appropriate time to revisit the topic of data bias, and why that matters. What happens with durable goods (or any data for that matter, the process is largely the same) is that the Census Bureau conducts smaller surveys...

Read More »

Read More »

James Comey on emails, the “American giant” and the end of Donald Trump | The Economist Podcast

James Comey, former director of the FBI, spoke to Anne McElvoy, The Economist’s head of radio, for The Economist asks podcast. Timecoded chapters listed below: Chapter One – James Comey on border separations 00:40 Economist asks about family separation policy 01:41 Economist asks about Melania Trump’s fashion choice 03:11 Economist asks about President Trump’s moral …

Read More »

Read More »

Is match-fixing sports biggest threat? | The Economist

The beauty of sport is the unknown-anything can happen. But what if the contest is rigged? Match-fixing is a global criminal enterprise that is more prevalent than you may think. Click here to subscribe to The Economist on YouTube: https://econ.st/2tGuZ9h Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: …

Read More »

Read More »

Make Capital Cheap and Labor Costly, and Guess What Happens?

Employment expands in the Protected cartel-dominated sectors, and declines in every sector exposed to globalization, domestic competition and cheap capital. If you want to understand why the global economy is failing the many while enriching the few, start with the basics: capital, labor and resources. What happens when central banks drop interest rates to near-zero? Capital becomes dirt-cheap.

Read More »

Read More »

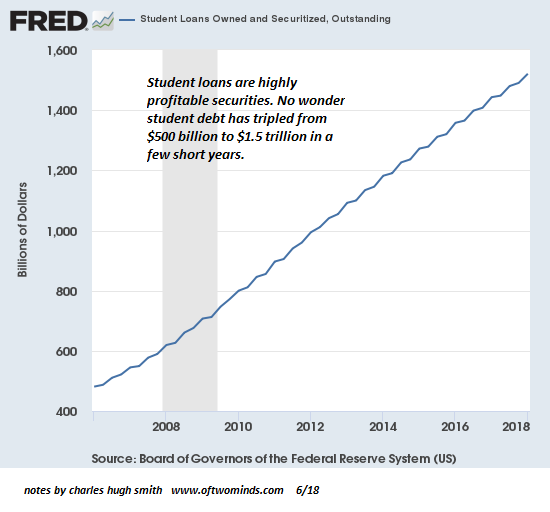

Dear High School Graduates: the Status Quo “Solutions” Enrich the Few at Your Expense

You deserve a realistic account of the economy you're joining. Dear high school graduates: please glance at these charts before buying into the conventional life-course being promoted by the status quo. Here's the summary: the status quo is pressuring you to accept its "solutions": borrow mega-bucks to attend college, then buy a decaying bungalow or hastily constructed stucco box for $800,000 in a "desirable" city, pay sky-high income and property...

Read More »

Read More »

How to win a penalty shootout I The Economist

Penalty shootouts provide some of the tensest World Cup moments. We’ve crunched the data and teamed up with one of the world’s top female footballers to examine the secret of taking the perfect spot kick. Click here to subscribe to The Economist on YouTube: https://econ.st/2tGuZ9h Daily Watch: mind-stretching short films throughout the working week. For …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday mixed, and capped off a mixed week overall as the dollar’s broad-based rally was sidetracked. EM may start the week on an upbeat after PBOC cut reserve requirements over the weekend. Best EM performers last week were ARS, MXN, and TRY while the worst were THB, IDR, and BRL.

Read More »

Read More »

RMR: Special Guest – Charles Hugh Smith – Of Two Minds (06/25/2018)

We are political scientists, editorial engineers, and radio show developers drawn together by a shared vision of bringing Alternative news through digital mediums that evangelize our civil liberties. Please subscribe for the latest shows daily! http://www.roguemoney.net https://www.facebook.com/ROGUEMONEY.NET/ https://twitter.com/theroguemoney

Read More »

Read More »

Emerging Markets: What Changed

Nor Shamsiah Mohd Yunus was named the new Governor of Malaysia’s central bank. Moody's cut the outlook on Pakistan's B3 rating to negative from stable. National Bank of Hungary tiled more hawkish. Israeli Prime Minister Benjamin Netanyahu’s wife was charged with misusing public funds. MSCI added Saudi Arabia and Argentina to its Emerging Markets index.

Read More »

Read More »

Bi-Weekly Economic Review (VIDEO)

Information and opinions about the economy and markets from Alhambra Investments CEO Joe Calhoun.

Read More »

Read More »

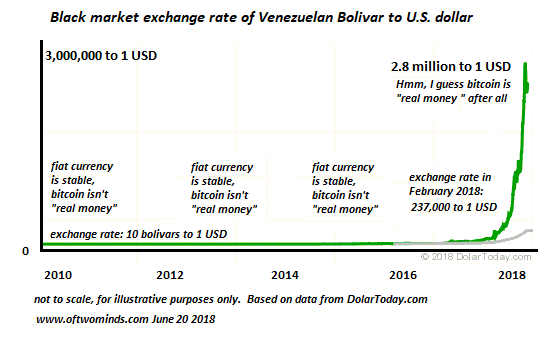

Gresham’s Law and Bitcoin

Rather suddenly, the state issued fiat currency bolivar lost 99% of its purchasing power. Gresham's law holds that "bad money drives out good money," meaning that given a choice of currencies (broadly speaking, "money" that serves as a store of value and a means of exchange), people use depreciating "bad" to buy goods and services and hoard "good" money that is appreciating or holding its value.

Read More »

Read More »

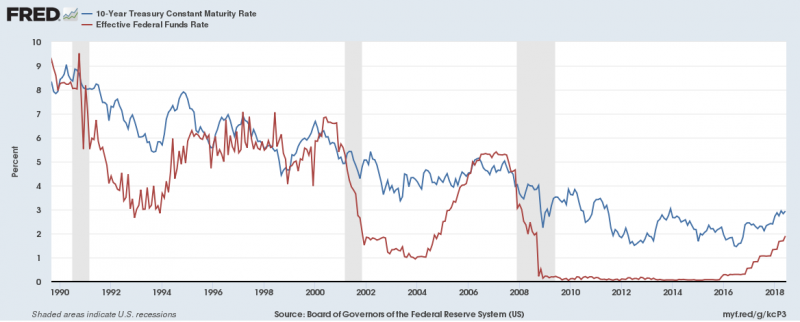

Bi-Weekly Economic Review

Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility.

There has been for some time now a large short position held by speculators in the futures market for Treasuries.

Read More »

Read More »