Category Archive: 5) Global Macro

The Path to Inflation: “Helicopter Money”

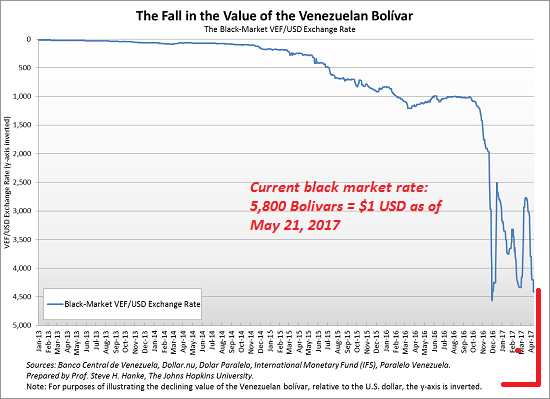

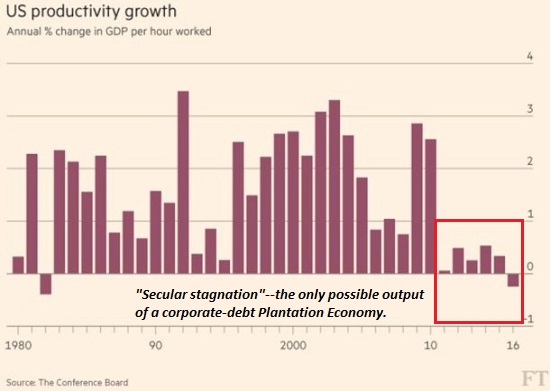

Yet conventional economists are virtually unanimous that deflation is the danger and inflation is a "good thing" we need to spur so servicing existing debt becomes easier for debtors. Due to the deflationary pressures of technology and stagnant wages for the bottom 90%, the consensus sees low inflation as far as the eye can see.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed last week on a firm note as weak US jobs data supported the notion that the Fed will find it hard to tighten in H2. No major US data will be reported this week and the FOMC embargo for the June 14will be in effect. As such, there is little on the near-term horizon that might help the dollar, so it’s likely to remain on the defensive this week.

Read More »

Read More »

How Debt-Asset Bubbles Implode: The Supernova Model of Financial Collapse

Gravity eventually overpowers financial fakery. When debt-asset bubbles expand at rates far above the expansion of earnings and real-world productive wealth, their collapse is inevitable. The Supernova model of financial collapse is one way to understand this. As I noted yesterday in Will the Crazy Global Debt Bubble Ever End?, I've used the Supernova analogy for years, but didn't properly explain why it illuminates the dynamics of financial...

Read More »

Read More »

Emerging Markets: What has Changed

The Indonesian cabinet is discussing revisions to the 2017 state budget. The Thai central bank plans to reform some FX rules. South African President Zuma survived the no confidence vote within his own ANC. Brazil’s central bank signaled a slower pace of easing ahead after it cut 100 bp again. Moody’s cut the outlook on Brazil’s Ba2 rating from stable to negative.

Read More »

Read More »

Will the Crazy Global Debt Bubble Ever End?

We've been playing two games to mask insolvency: one is to pay the costs of rampant debt today by borrowing even more from future earnings, and the second is to create wealth out of thin air via asset bubbles. The two games are connected: asset bubbles require leverage and credit.

Read More »

Read More »

Who will decide the outcome of the British election? | The Economist

It’s less than a week until Britain’s snap election and Adrian Wooldridge, the Economist’s political editor, is on the hunt for the swing voters. Will it be Theresa May’s Conservatives or Jeremy Corbyn’s Labour leading the country come June 9th? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films …

Read More »

Read More »

Simple (economic) Math

The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing funds to...

Read More »

Read More »

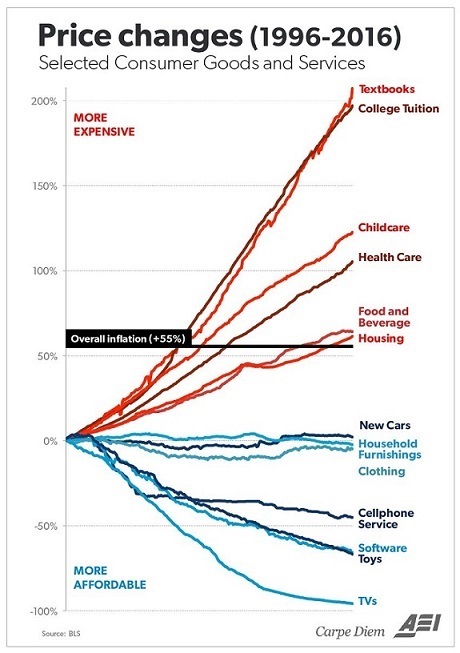

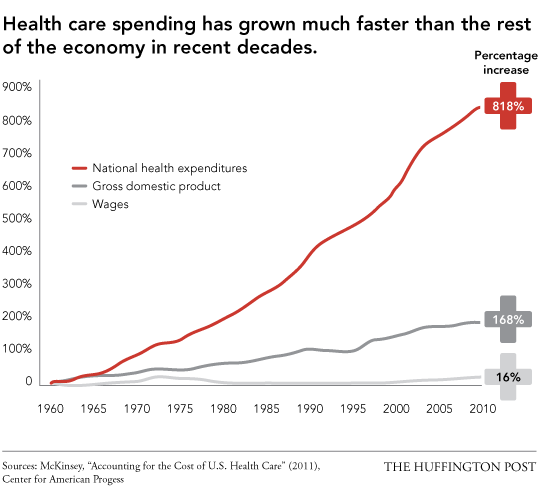

Inflation Isn’t Evenly Distributed: The Protected Are Fine, the Unprotected Are Impoverished Debt-Serfs

The Consumer Price Index (CPI) measure of inflation is bogus on a number of fronts, a reality I've covered a number of times: though the heavily gamed official CPI is under 2% for the past four years, the real rate is 7% to 12%, depending on whether you happen to live in locales with soaring rents/housing and healthcare costs.

Read More »

Read More »

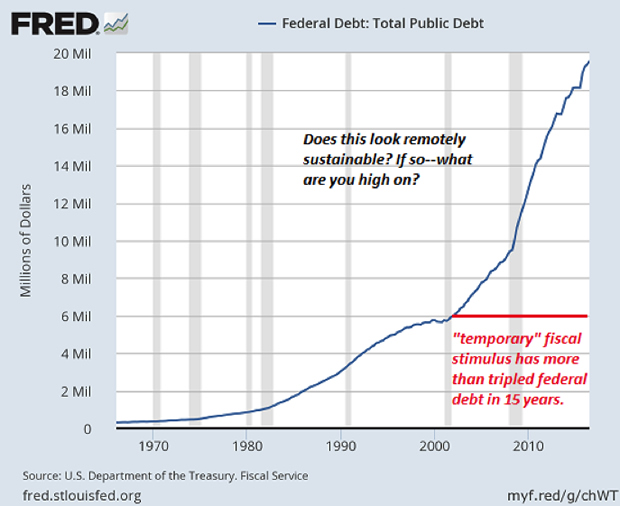

The Keynesian Cult Has Failed: “Emergency” Stimulus Is Now Permanent

Can we finally admit that eight years of following the Keynesian coloring-book have not just failed, but failed spectacularly? What do we call a status quo in which & emergency measures" have become permanent props? A failure. The "emergency" responses to the Global Financial Meltdown of 2008-09 are, eight years on, permanent fixtures.

Read More »

Read More »

Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean.

Read More »

Read More »

Jean-Marie Guéhenno’s talking points on running a UN peacekeeping mission

The United Nations deploys over 100,000 personnel across 16 peacekeeping operations. On the International Day of UN peacekeepers, Jean-Marie Guéhenno, a former head of UN peacekeeping, on how to run a successful mission. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from …

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX closed last week on a mixed note, with markets struggling to find a compelling investment theme. The US jobs data this week could provide some more clarity on Fed policy. We still think markets are still underestimating political risk in the big EM countries, including Brazil (Moody’s outlook moved to negative), Mexico (election in state of Mexico), South Africa (ANC debates Zuma’s fate), and Turkey (ongoing crackdown on opposition).

Read More »

Read More »

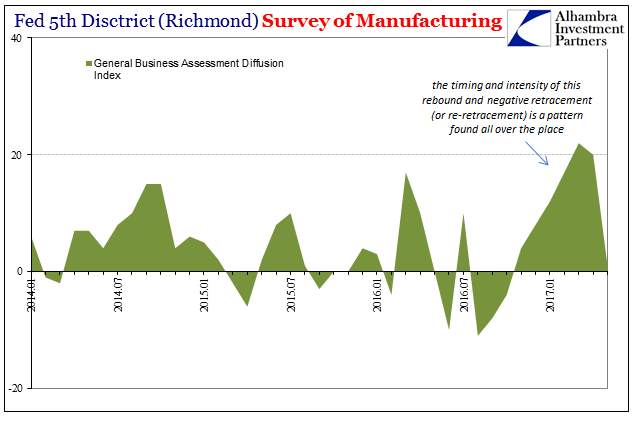

Suddenly Impatient Sentiment

Two more manufacturing surveys suggest sharp deceleration in momentum, or, more specifically, the momentum of sentiment (if there is such a thing). The Federal Reserve’s 5th District Survey of Manufacturing (Richmond branch) dropped to barely positive, calculated to be just 1.0 in May following 20.0 in April and 22.0 in March.

Read More »

Read More »

RMR: Exclusive Interview with Charles Hugh Smith (05/27/2017)

“V” welcomes back Charles for an in-depth discussion regarding Charles’s blogs: TINA’s Legacy: Free Money, Bread and Circuses and Collapse, How Higher Education Became an Obscenely Profitable Racket That Enriches the Few at the Expense of the Many (Student Debt-Serfs) and Want to Understand Rising Wealth Inequality? Look at Debt and Interest. Charles’s website: http://www.oftwominds.com/ …

Read More »

Read More »

Emerging Markets: What has Changed

Moody's downgraded China's rating from Aa3 to A1 with stable outlook. Reports suggest that the PBOC has informed local banks that it is changing the way it sets the daily fix. Moody's downgraded Hong Kong’s rating to Aa2 from Aa1 with stable outlook. Philippine President Duterte declared martial law on Mindanao island. Egypt's central bank unexpectedly hiked rates by 200 bp. S&P moved the outlook on Bolivia’s BB rating from stable to negative....

Read More »

Read More »

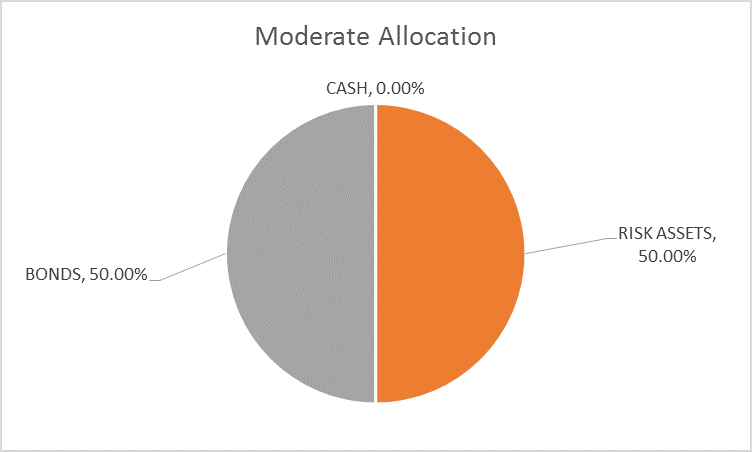

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs.

Read More »

Read More »

After a terrorist attack: a survivor’s view on how to move forward

In 2011, Bjorn Ihler survived a horrific terrorist attack in Norway. Since then he’s worked as a peace activist and dedicated his life to countering terrorism. He offers his perspective after the bombing in Manchester. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 22 people died in the Manchester attack on May 22nd …

Read More »

Read More »

State of Denial: The Economy No Longer Works As It Did in the Past

If there is one reality that is denied or obscured by the Status Quo, it is that the economy no longer works as it did in the past. This is the fundamental economic context of our current slide into political-social disintegration.

Read More »

Read More »

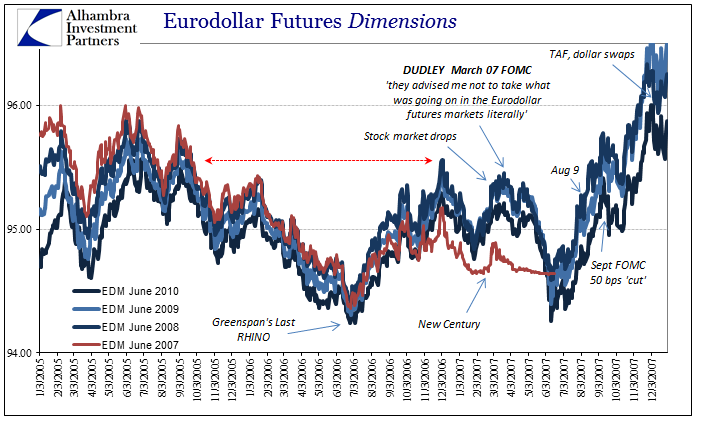

Less Than Nothing

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs.

Read More »

Read More »

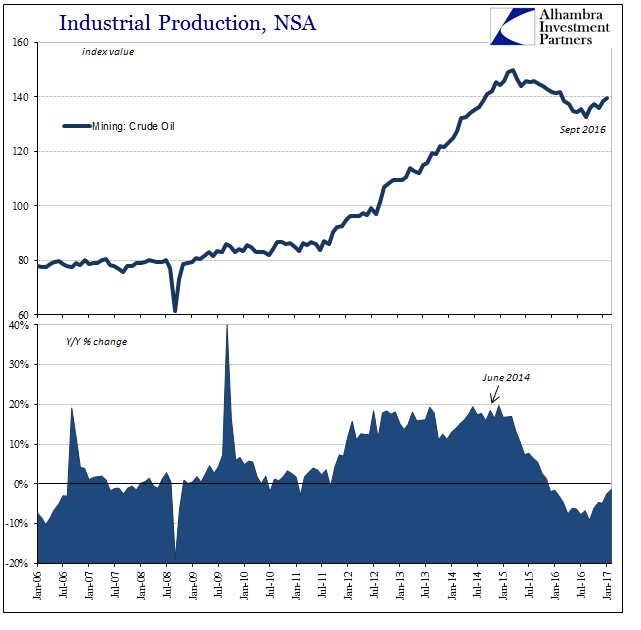

Commodity and Oil Prices: Staying Suck

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their pain.

Read More »

Read More »