Summary

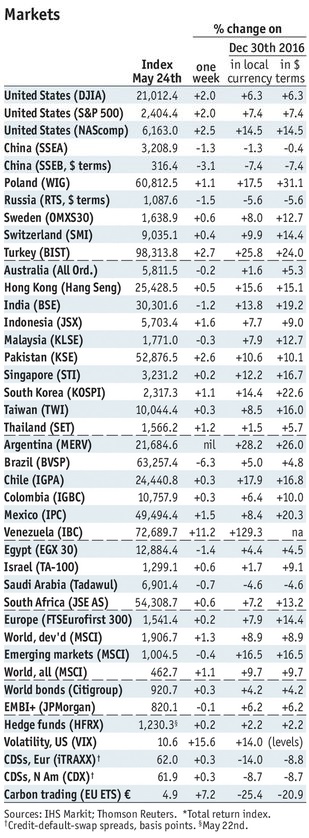

Stock MarketsIn the EM equity space as measured by MSCI, Korea (+2.9%), Brazil (+2.7%), and Turkey (+2.6%) have outperformed this week, while Hungary (-2.9%), Indonesia (-1.3%), and UAE (-1.2%) have underperformed. To put this in better context, MSCI EM rose 2.1% this week while MSCI DM rose 0.9%. In the EM local currency bond space, Brazil (10-year yield -94 bp), South Africa (-12 bp), and Thailand (-10 bp) have outperformed this week, while Russia (10-year yield +12 bp), Colombia (+2 bp), and Mexico (+2 bp) have underperformed. To put this in better context, the 10-year UST yield was flat at 2.24%. In the EM FX space, ZAR (+2.9% vs. USD), MXN (+1.3% vs. USD), and MYR (+1.2% vs. USD) have outperformed this week, while COP (-0.9% vs. USD), BRL (-0.4% vs. USD), and PEN (-0.1% vs. USD) have underperformed. |

Stock Markets Emerging Markets, May 24 Source: economist.com - Click to enlarge |

ChinaMoody’s downgraded China’s rating from Aa3 to A1 with stable outlook. It cited the risk of a material rise in economy-wide debt levels as the economy slows. It is Moody’s first downgrade of China since 1989. Our own sovereign ratings model has China’s implied rating at A+/A1/A+. We have been warning of downgrade risks from S&P (AA-) and Moody’s, but Fitch’s A+ appears to be on target. Reports suggest that the PBOC has informed local banks that it is changing the way it sets the daily fix. The bank says it will add a “counter-cyclical factor.” It is not exactly clear what this means, but we wouldn’t make too much of it since it probably just formalizes a process that’s already in place. We note that Singapore runs a managed float against a basket but it’s a total black box. Many in Asia also run managed floats, so it’s a bit naïve to expect any different from China. Moody’s downgraded Hong Kong’s rating to Aa2 from Aa1 with stable outlook. Moody’s noted that “credit trends in China will continue to have a significant impact on Hong Kong’s credit profile due to close and tightening economic, financial and political linkages with the mainland.” Our own sovereign ratings model has Hong Kong’s implied rating at AA-/Aa3/AA- and so downgrade risks remain to actual ratings of AAA/Aa2/AA+. PhilippinePhilippine President Duterte declared martial law on Mindanao island due to renewed clashes between government troops and militants linked to ISIS. This is the first imposition of martial law in the Muslim region in the south since 2009. It will be in place for 60 days. Defense Secretary Lorenzana said martial law would likely include the setting up of checkpoints, curfews, and suspension of any writ of habeas corpus. Ominously, Duterte said he might extend martial law to the entire country. EgyptEgypt’s central bank unexpectedly hiked rates by 200 bp. No change was expected, though the hike was long overdue. Inflation is still accelerating after the November EGP devaluation and is at a cycle high 31.5% in April. This was the first move since the 300 bp hike that accompanied the devaluation. BoliviaS&P moved the outlook on Bolivia’s BB rating from stable to negative. It warned that persistent current account deficits could contribute to macroeconomic imbalances and weaken Bolivia’s external profile. After running current account surpluses from 2003-2014, lower commodity prices pushed Bolivia into deficit since 2015. BrazilReports suggest Brazil President Temer is losing support from his own PMDB. Several PMDB lawmakers are floating the idea that the top courts annul the 2014 election. While these lawmakers remain unnamed, PMDB leader Senator Calheiros has come out publicly in favor of a “negotiated exit” for Temer. |

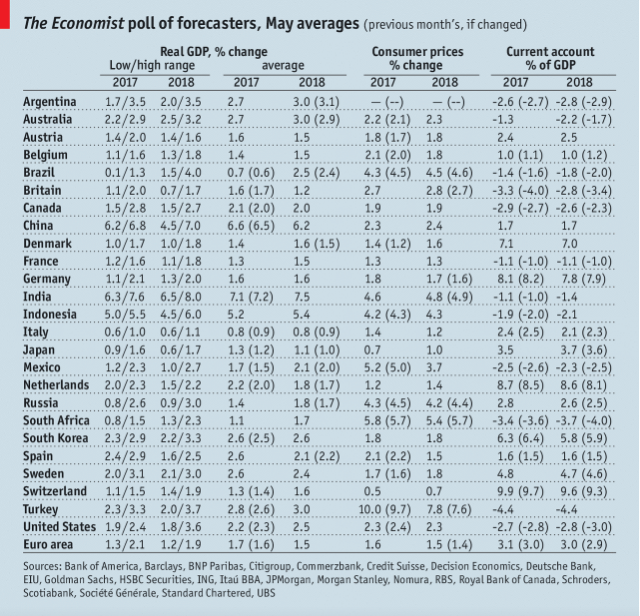

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, May 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent