Category Archive: 5) Global Macro

Bi-Weekly Economic Review: Has The Fed Heard Of Amazon?

The economic surprises keep piling up on the negative side of the ledger as the Fed persists in tightening policy or at least pretending that they are. If a rate changes in the wilderness can the market hear it? Outside of the stock market one would be hard pressed to find evidence of the effectiveness of all the Fed’s extraordinary policies of the last decade.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mixed Friday to cap off a mostly lower week. Obviously, we're seeing a bit of a washout in EM after the hawkish FOMC. Market was overly complacent and very long EM going into the FOMC meeting. The big question is how deep this selloff gets. For the better part of this year, EM dips have been met with renewed buying. We remain cautious on EM and think that investors should avoid the high beta currencies like ZAR, TRY, BRL, MXN.

Read More »

Read More »

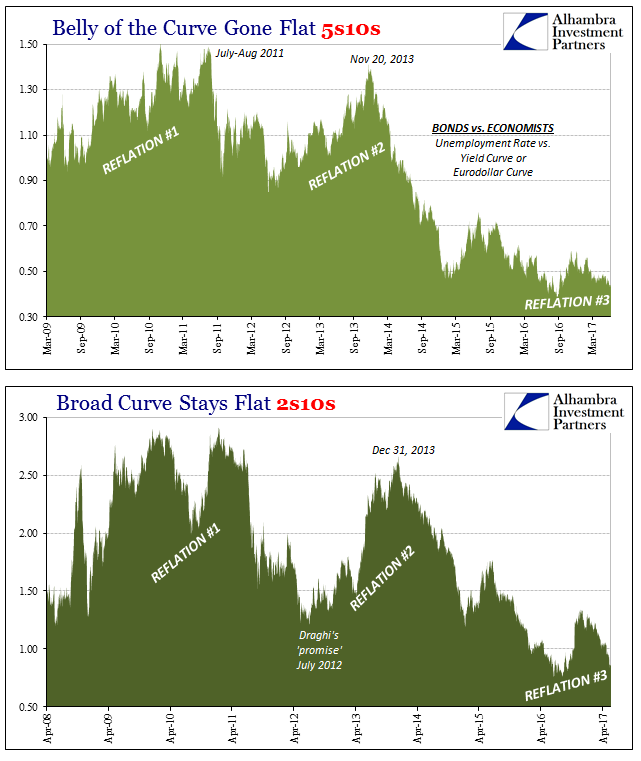

Deciphering Curves

What is the yield curve supposed to look like? It’s a simple question that doesn’t actually have an answer. And because it doesn’t, there is a whole lot of confusion about bond yields.

Read More »

Read More »

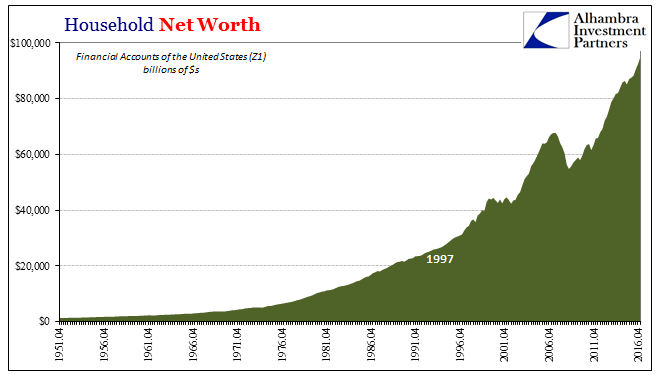

Wealth Paradox Not Effect

US Household Net Worth rose to a record $94.8 trillion in Q1 2017. According to the Federal Reserve’s Financial Accounts of the United States (Z1), aggregate paper wealth rose by more than 8% year-over-year mostly as the stock market shook off the effects of “global turmoil.” It was the best rate of expansion since the second quarter of 2014 just prior to this “rising dollar” interruption.

Read More »

Read More »

Emerging Markets: What has Changed

Philippines central bank forecast a current account deficit this year, the first one in fifteen years. Kuwait refrained from matching the Fed’s 25 bp hike. The US Senate voted overwhelmingly to step up sanctions against Iran and Russia. Moody’s downgraded South Africa by a notch to Baa3 with negative outlook. South Africa plans to require that all local mines be 30% black-owned.

Read More »

Read More »

Questions Persist About China Trade

Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became noticeable.

Read More »

Read More »

Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant.

Read More »

Read More »

The Impact Investing Summit

4:40pm Oxford-style debate: This house believes that investors and bankers, not politicians or social movements, are the best hope for avoiding climate disaster. Moderator: Matthew Bishop, senior editor, The Economist Group Speakers: Lisa Ashford, chief executive officer, Ethex Mark Campanale, founder, Carbon Tracker Mark Goldring, chief executive officer, Oxfam Lutfey Siddiqi, visiting professor-in-practice, Centre for …

Read More »

Read More »

Why do so few of China’s LGBT people come out? | The Economist

Being gay in China is still a massive taboo. In fact, only 3% of gay men and 6% of gay women describe themselves as “completely out”, and an estimated 70% of gay Chinese have entered into heterosexual marriages. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Why do so few lesbian, gay, bisexual …

Read More »

Read More »

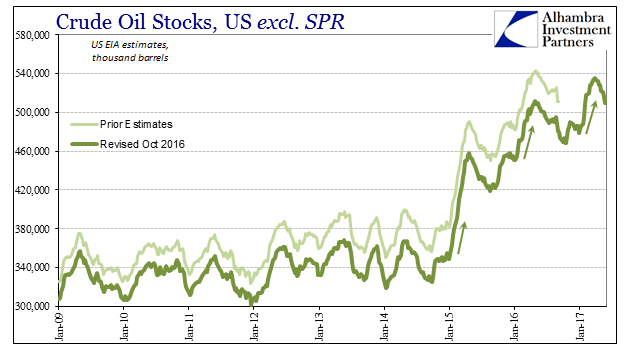

All About Inventory

Andy Hall has been called the God of Oil. As chief of Astenbeck Capital, he has proven at times that even gods can be mortal. In the “rising dollar” period, for example, after making money on the way down Mr. Hall went bullish.

Read More »

Read More »

Forced Finally To A Binary Labor Interpretation

JOLTS figures for the month of April 2017, released today, highlight what is in the end likely to be a more positive outcome for them. It has very little to do with the economy itself, as what we are witnessing is the culmination of extreme positions that have been made and estimated going all the way back to 2014.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mixed last week but in general held up well in the aftermath of Super Thursday. The global backdrop seems relatively benign right now despite the FOMC meeting this week. We still think investors have to be picky. TRY, ZAR, and BRL at current levels seem too rich given the underlying risks in all three.

Read More »

Read More »

Signs of Something, Just Not Wage Acceleration

I have been writing for many years that they really don’t know what they are doing. I only wish it was that simple. There has been developing another layer or dimension to that condition, a second derivative of stupid, whereby when faced with this now well-established fact the same people, experts and authorities all, they have no frame of reference to figure out what next to do. In other words, they really don’t know what to do when they realize...

Read More »

Read More »

Emerging Markets: What has Changed

The Reserve Bank of India cut its inflation forecast for FY2017/18. South Korean President Moon suspended the installation of the remaining components of the THAAD missile shield. S&P cut Qatar one notch to AA-. Turkey looks likely to get caught up in yet another regional conflict. Brazil’s structural reform agenda has been delayed as President Temer remains on the ropes.

Read More »

Read More »

The Anti-Perfect Jobs Condition

The irony of the unemployment rate for the Federal Reserve is that the lower it gets now the bigger the problem it is for officials. It has been up to this year their sole source of economic comfort. Throughout 2015, the Establishment Survey improperly contributed much the same sympathy, but even it no longer resides on the plus side of the official ledger.

Read More »

Read More »

Dollars And Sent(iment)s

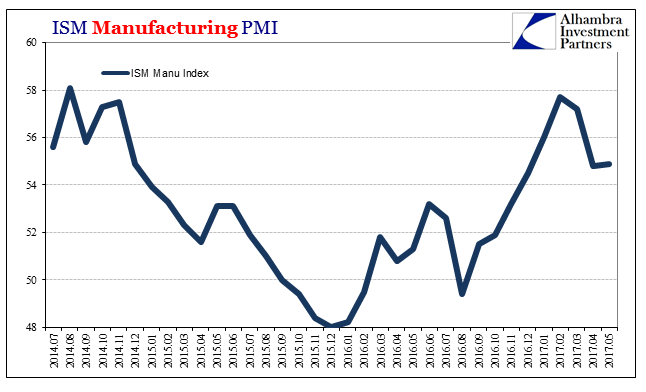

Both US manufacturing PMI’s underwhelmed just as those from China did. The IHS Markit Index was lower than the flash reading and the lowest level since last September. For May 2017, it registered 52.7, down from 52.8 in April and a high of 55.0 in January. Just by description alone you can appreciate exactly what pattern that fits. The ISM Manufacturing PMI was slightly higher in May than April, 54.9 versus 54.8, but still down from a February peak...

Read More »

Read More »

Ridding the ocean of plastic | The Economist

By 2050 the plastic in the world’s oceans could weigh more than the fish. On World Oceans Day actor Adrian Grenier, and young entrepreneur Boyan Slat, look for solutions to the problem. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Eight million tonnes of plastic pollution are washed into the ocean every year. …

Read More »

Read More »

Why the melting Arctic matters to us all | The Economist

Donald Trump is pulling America out of the Paris climate agreement. But if nothing is done to reduce greenhouse-gas emissions, cities such as New York and Mumbai will have to defend themselves from flooding by the end of the century as sea levels rise. An earlier version of this video wrongly stated that the Maldives …

Read More »

Read More »

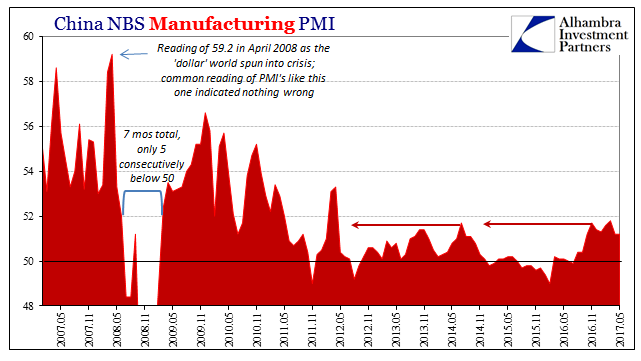

Pay No Attention To 50

China’s PMI’s were uniformly disappointing with respect to what Moody’s was on about last week. Chinese authorities expended great effort and resources to get the economy moving forward again after several years of “dollar”-driven deceleration. here was a massive “stimulus” spending program where State-owned FAI expenditures of about 2% of GDP were elicited to make up for Private FAI that at one point last year was actually contracting.

Read More »

Read More »

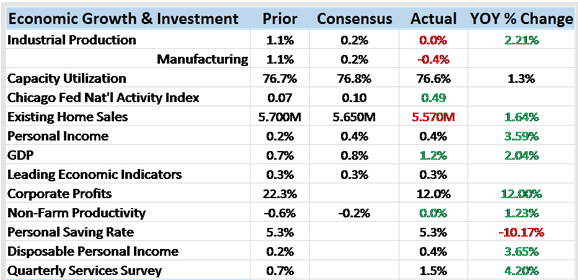

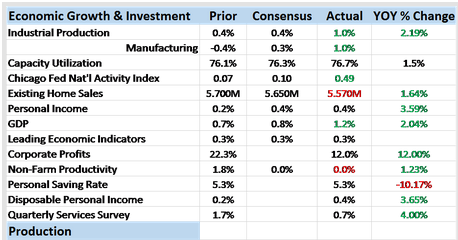

Bi-Weekly Economic Review: The Return of Economic Ennui

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters.

Read More »

Read More »