Category Archive: 5) Global Macro

All In The Curves

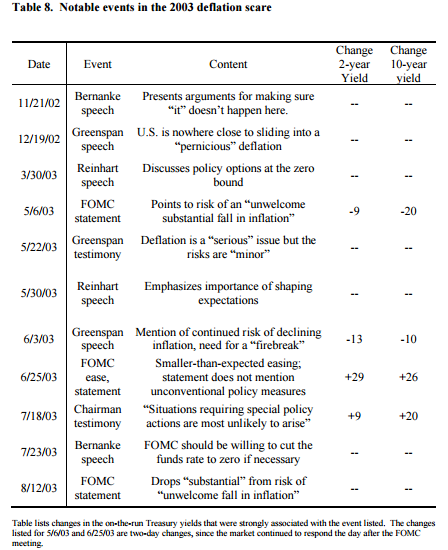

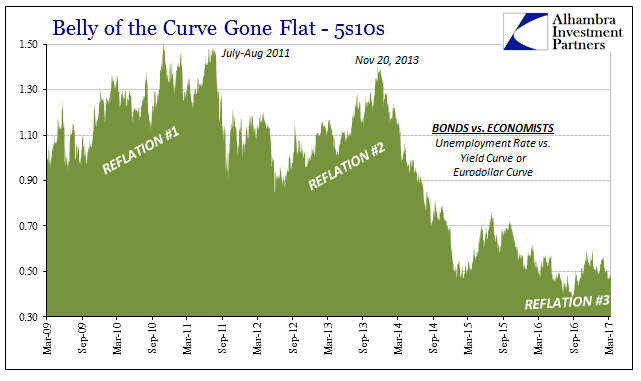

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December.

Read More »

Read More »

Emerging Markets: What has Changed

Reserve Bank of India will introduce a new monetary policy tool. Moody’s raised the outlook on Russia’s Ba1 rating from stable to positive. Fitch cut Saudi Arabia’s rating a notch to A+. Moody’s cut the outlook on Turkey’s Ba1 rating from stable to negative. China has temporarily suspended beef imports from Brazil.

Read More »

Read More »

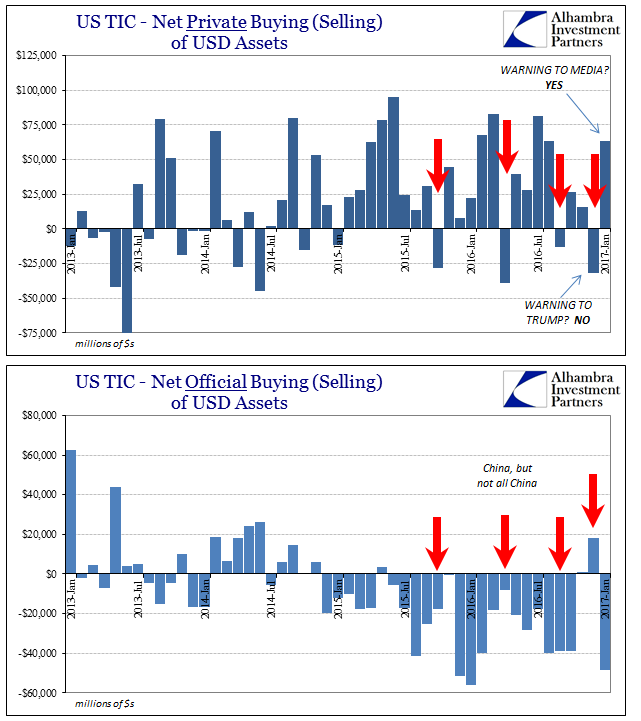

TIC Analysis of Selling

When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke reserved for disreputable leaders of...

Read More »

Read More »

Central Bankers Are Creating A World Where We Are All Serfs: Charles Hugh Smith

Today’s Guest: Charles Hugh Smith Websites: Of Two Minds http://www.oftwominds.com Books: Get a Job, Build a Real Career… Why Things Are Falling Apart and What We Can Do About It A Radically Beneficial World http://amzn.com/1517160960 Most of artwork that are included with these videos have been created by X22 Report and they are used as …

Read More »

Read More »

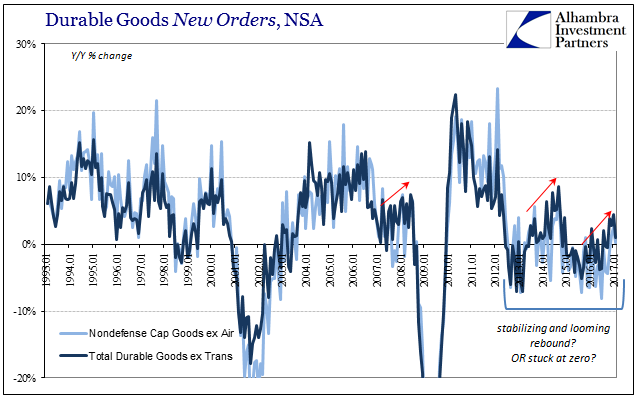

Durable Goods After Leap Year

New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version.

Read More »

Read More »

What could threaten Amazon’s empire? | The Economist

Amazon accounts for more than half of every dollar spent online in America and is the world’s leading provider of cloud computing. But can the company avoid the attention of the regulators? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 This week we put Amazon on the cover. Amazon is a remarkable company …

Read More »

Read More »

The deep ocean is the final frontier on planet Earth | The Economist

Watch the latest in the Ocean series – How to stop plastics getting into the ocean: https://youtu.be/D7EdgCxFZ8Q The ocean covers 70% of our planet. The deep-sea floor is a realm that is largely unexplored, but cutting-edge technology is enabling a new generation of aquanauts to go deeper than ever before. Click here to subscribe to …

Read More »

Read More »

Non-Randomly Surveying RMB

China’s central bank, unlike other central banks, is constantly active almost never resting. Because it is always in motion, the PBOC can seem to be “adding” liquidity at the very same time it might be “draining” it. Its specific actions should never be interpreted as standalone procedures related solely to some unknown policy stance. That is particularly true given that we know what their stance is and has been – neutral.

Read More »

Read More »

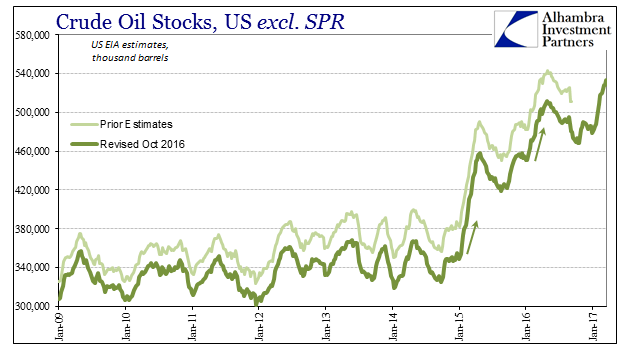

Economics Through The Economics of Oil

The last time oil inventory grew at anywhere close to this pace was during each of the last two selloffs, the first in late 2014/early 2015 and the second following about a year after. Those events were relatively easy to explain in terms of both price and fundamentals, though the mainstream managed to screw it up anyway (“supply glut”).

Read More »

Read More »

Pressure, Sure, But From Where?

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule.

Read More »

Read More »

Was There Ever A ‘Skills Mismatch’? Notable Differences In Job Openings Suggest No

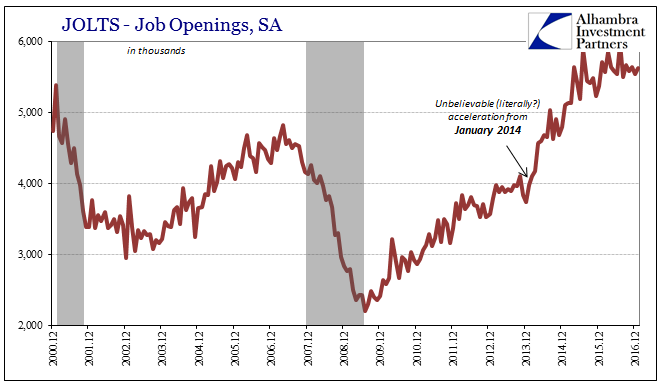

Perhaps the most encouraging data produced by the BLS has been within its JOLTS figures, those of Job Openings. It is one data series that policymakers watch closely and one which they purportedly value more than most. While the unemployment and participation rates can be caught up in structural labor issues (heroin and retirees), Job Openings are related to the demand for labor rather than the complications on the labor supply side.

Read More »

Read More »

Solutions Abound–on the Local Level

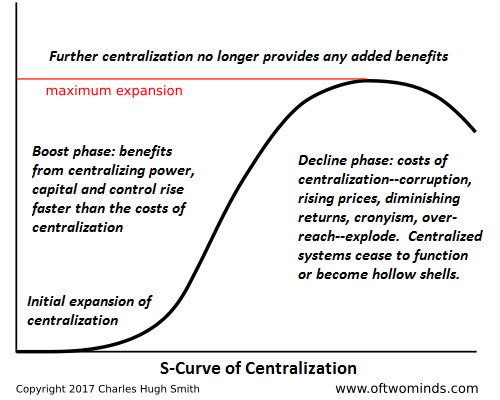

Rather than bemoan the inevitable failure of centralized "fixes," let's turn our attention and efforts to the real solutions: decentralized, networked, localized.Those looking for centralized solutions to healthcare, jobs and other "macro-problems" will suffer inevitable disappointment. The era in which further centralization provided the "solution" has passed: additional centralization (Medicare for All, No Child Left Behind, federal job training,...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX had a stellar week, ending on a strong note in the aftermath of what the market perceived as a dovish Fed hike Wednesday. Every EM currency except ARS was up on the week vs. USD, with the best performers ZAR, TRY, COP, and MXN. There are some risks ahead for EM this week, with many Fed speakers lined up and perhaps willing to push back against the market’s dovish take on the FOMC.

Read More »

Read More »

Industrial Symmetry

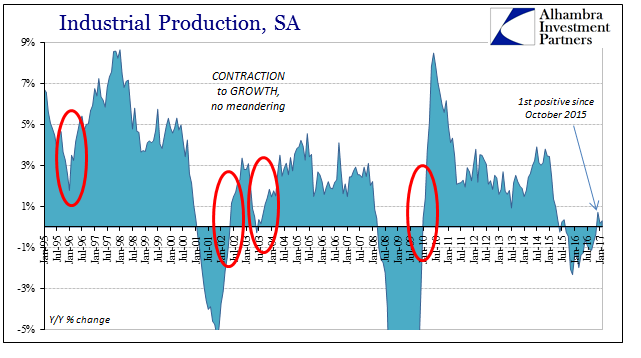

There has always been something like Newton’s third law observed in the business cycles of the US and other developed economies. In what is, or was, essentially symmetry, there had been until 2008 considerable correlation between the size, scope, and speed of any recovery and its antecedent downturn, or even slowdown. The relationship was so striking that it moved Milton Friedman to finally publish in 1993 his plucking model theory he had first...

Read More »

Read More »

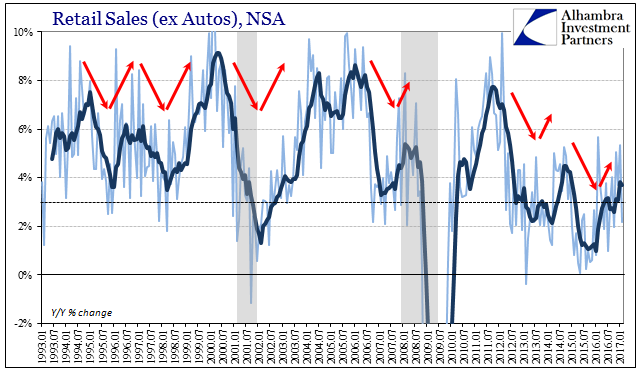

Retail Sales: Extra Day Likely, no Meaningful Difference

Retail sales comparisons were for February 2017 skewed by the extra day in February 2016. With the leap year February 29th a part of the base effect, the estimated growth rates (NSA) for this February are to some degree better than they appear. Seasonally-adjusted retail sales were in the latest estimates essentially flat when compared to the prior month (January). That leaves too much guesswork to draw any hard conclusions.

Read More »

Read More »

Emerging Markets: What has Changed

The PBOC increased the rates it charges for OMO and MLF by 10 bp. Indian Prime Minister Modi’s BJP won elections in the state of Uttar Pradesh. Czech central bank broached the possibility of a koruna cap exit later than mid-2017. Kuwait became the first OPEC member to call for extended output cuts.

Read More »

Read More »

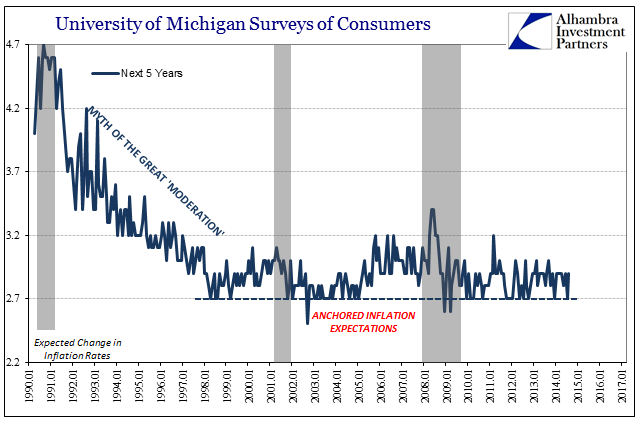

Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate.

Read More »

Read More »

What’s the most common method of contraception? | The Economist

Almost a century ago Dr Marie Stopes opened the first birth control clinic. We go out on the streets to ask which are the most common methods of contraception worldwide today. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from …

Read More »

Read More »

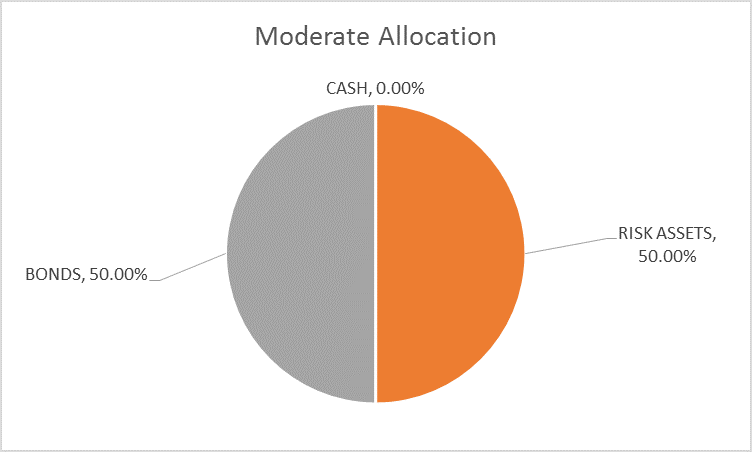

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle.

Read More »

Read More »

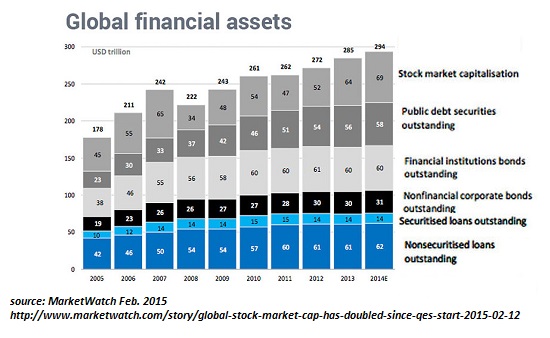

Now That Everyone’s Been Pushed into Risky Assets…

If we had to summarize what's happened in eight years of "recovery," we could start with this: everyone's been pushed into risky assets while being told risk has been transformed from something to avoid (by buying risk-off assets) to something you chase to score essentially guaranteed gains (by buying risk-on assets).

Read More »

Read More »