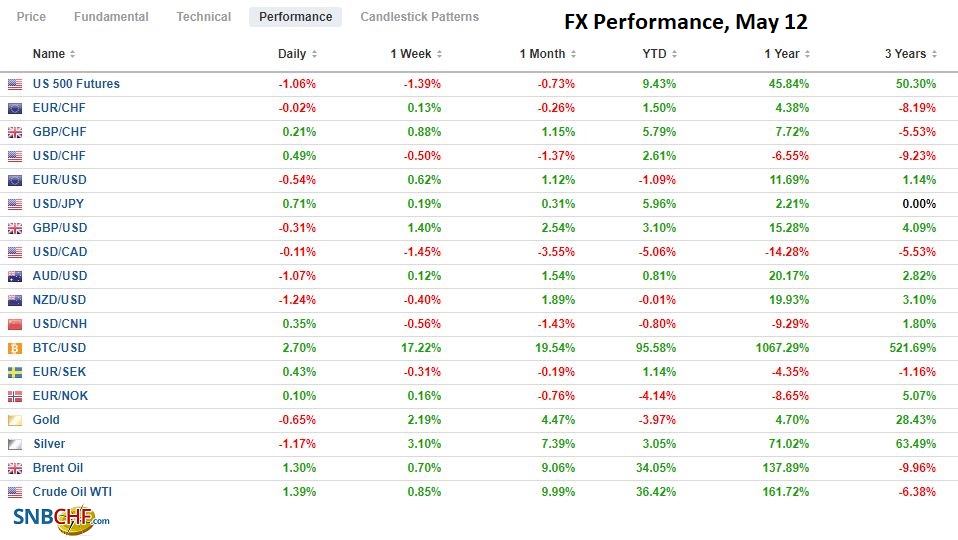

Swiss FrancThe Euro has fallen by 0.07% to 1.0966 |

EUR/CHF and USD/CHF, May 12(see more posts on Business, EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The markets remain on edge. Asia Pacific and US equities have yet to find stable footing, and inflation fears are elevated. The foreign exchange market has turned quiet as the dollar consolidates its recent losses. China and Hong Kong escaped the sell-off equities that saw Tokyo and Seoul fall over 1%, but Taipei was the highlight with a stunning 8.6% intrasession plunge before recouping a little more than half. A combination of more Covid-related restrictions and the global sell-off of tech took a tool. TSMC, which is 30% of Taiwan’s index, finished nearly 2% lower after a more than 9% slump. The US removed Xiaomi from the blacklist, and shares rallied in Hong Kong. The less-tech sensitive Dow Jones Stoxx 600 is trading steadily after dropping nearly 2% yesterday. US futures are still heavy. Ahead of today’s auction, the US 10-year yield is slightly softer, around 1.61%. European bond yields are also around a basis point or so lower. On the back of a larger than expected Australian fiscal stimulus, its 10-year yield jumped five basis points to 1.76%. The Antipodeans are the weakest among the major currencies, off about 0.45%-0.50% near midday in Europe, while the others are 0.05%-0.15% softer. The Canadian dollar is the only major posting a small gain against the greenback. Emerging market currencies are mostly lower as well. The Turkish lira and the South Korean won are off almost 0.5% to bear the brunt. Gold is consolidating after recovering from $1818 to $1838 yesterday. Crude oil remains bid, and the June WTI contract is mostly holding above $65 today. |

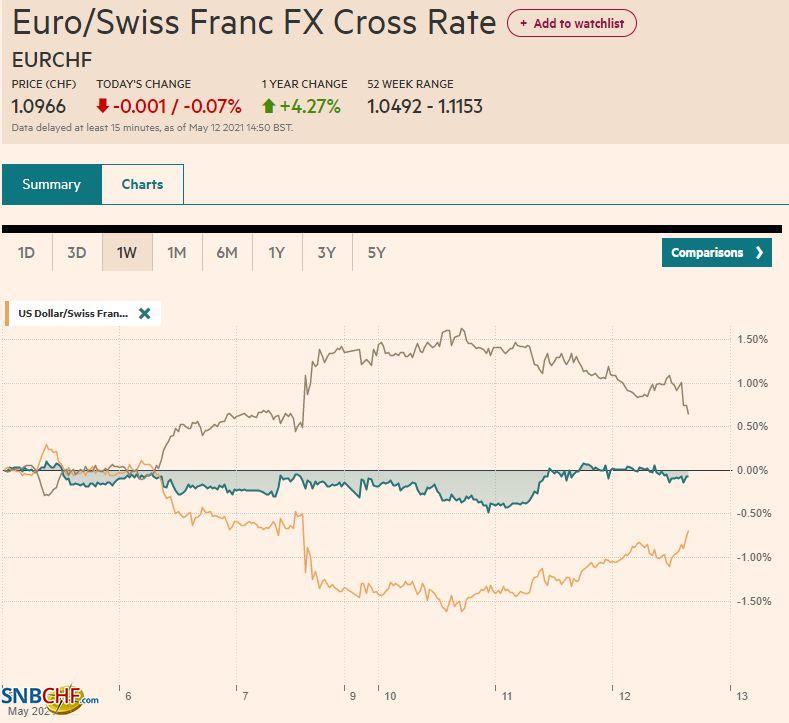

FX Performance, May 12 |

Asia Pacific

Australia’s budget unveiled late yesterday points to a larger than expected deficit as the government prepares for next year’s election and supports the monetary effort to spur a strong recovery. New initiatives for infrastructure and social efforts, such as elderly care and tax cuts, were among the highlights. S&P warned that the fiscal stance justifies its negative outlook for Australia’s AAA rating.

China reported a larger than expected slowdown in lending last month. New bank loans slowed to CNY1.47 trillion from CNY2.73 trillion in March. Non-bank lending slowed from CNY610 billion to CNY380 bln. That put total aggregate financing at CNY1.85 trillion compared with CNY3.34 trillion March and well below the CNY2.29 trillion anticipated. Separately, reports suggest that officials are allowing an accelerated rate of failures.

For the second consecutive session, the dollar has not traded above JPY109. Yesterday was the first time since April 27. The greenback has spent the first half of the week trading inside the pre-weekend range (~JPY108.35-JPY109.30). Initial support is now seen near JPY108.60. The US yields seem more important than equities for the exchange rate.

The Australian dollar approached $0.7900 on Monday before reversing lower. After consolidating yesterday, it has been pushed to $0.7785, the (50%) retracement of the leg up that began on May 4 near $0.7675. The next retracement is about $0.7760. Initial resistance is in the $0.7720-$0.7740 band.

The Chinese yuan slipped against the dollar for the second consecutive session. It is the first back-to-back decline in over a month. In recent days, we have noted that the PBOC’s reference rate deviated from bank models by among the most since the new transparent approach was unveiled a few months ago. This was understood as a type of signal seeking to stabilize the yuan. Today’s fix was at CNY6.4258 compared to the bank models in Bloomberg’s survey that projected CNY6.4249, a more normal deviation.

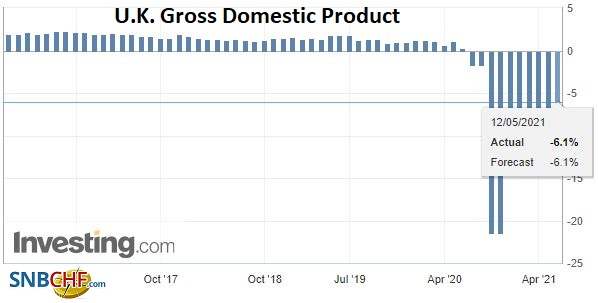

United KingdomThe main takeaway from the slew of UK data is not that the economy contracted by 1.5% in Q1; it was that the economy finished the quarter stronger than expected. The March monthly GDP rose by 2.1% after February’s growth was revised to 0.7% from 0.4%. The weakness in the quarterly GDP figures was a function of the sharp 2.5% contraction in January. The March data included a 1.8% rise in industrial output, led by a 2.1% jump in manufacturing, which was twice what economists projected. Construction output soared by 5.8%, and the February series was revised to 2.3% from 1.6%. Perhaps the most impressive element was the much smaller than expected trade deficit. The overall shortfall stands at GBP1.97 bln, less than half of the median in Bloomberg’s survey, and the February deficit was revised to GBP856 mln from GBP7.12 bln initial estimate. Meanwhile, the tension over Jersey and fishing rights, which has seen both the UK and France deploy naval vessels earlier this month, continue to deescalate. Jersey postponed new licensing requirements, and the French fishermen are allowing Channel Island fishing boat to unload their catches. |

U.K. Gross Domestic Product (GDP) YoY, Q1 2021(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

EurozoneElsewhere, the eurozone’s aggregate industrial production disappointed in March with a 0.1% gain, rather than the 0.8% increase expected, and the February series was revised to show a 1.2% decline instead of the 1.0% fall initially reported. In addition, Norway reported its mainland economy contracted by 1% in Q1, a bit more than expected. However, overall economic output eased by 0.6%, mitigated in part by the upward revision to 0.8% in Q4 20 from 0.6%. Unlike the UK economy that expanded in February and March, the Norwegian economy contracted every month in Q1, though the pace moderated. Nevertheless, the central bank is planning on lifting rates toward the end of the year. Lastly, Sweden’s April CPI rose 0.2% for a 2.2% year-over-year increase, in line with expectations. The Riksbank targets the underlying inflation measure that used a fixed interest rate, and that is a little higher than the headline at 2.5%. However, that underlying rate excluding energy is up a milder 1.7% year-over-year. The Riksbank is unseen as well behind the Norges Bank in adjusting monetary policy. After three days stalling in the $1.2170-$1.2180 area, the euro eased to a three-day low near $1.2115. However, the session low does not appear in place. The $1.2105 area corresponds to a (38.2%) retracement of the rally from last week’s low near $1.1985, and the 50%-mark is near $1.2085. Sterling remains firm but flattish on the day. It reached $1.4165 yesterday and has held below $1.4150 today. Still, like yesterday, it found support ahead of $1.4100. The intraday technicals warn of the risk of another test on the lows. Below $1.4100, chart support is seen near $1.4050. |

Eurozone Industrial Production YoY, March 2021(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

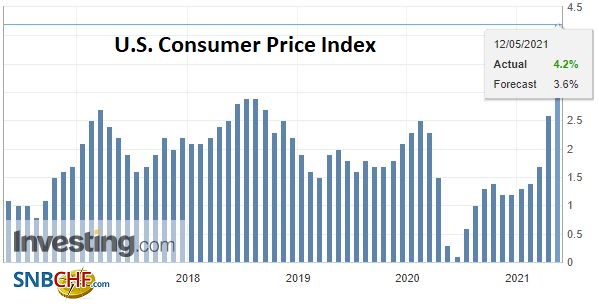

United StatesThe focus is on today’s report on US April CPI. Everyone is well aware of the base effect. April 2020 CPI fell by 0.7%. It will drop out of the 12-month comparison and be replaced by a positive number, and the headline rate may jump to 3.6% from 2.6% in March. This will prove transitory. Consider that in both June and July last year, the monthly CPI rose by 0.5%. These too will drop out and be replaced by lower numbers, and the year-over-year will ease. However, there is another source of inflation that may prove transitory. It has to do with bottlenecks and shortages frequently amid relatively low inventories. The uneven re-opening domestically and internationally is going to create some imbalances. The resulting higher prices will bring in profit-seekers, where barriers to entry are low, and supply will expand. One way to get a handle on how consumer prices are doing this year is to annualize the monthly numbers. For example, assume that CPI rose by 0.2% in April as the median forecast in Bloomberg’s survey would have it. That would mean in the first four months, CPI rose by a cumulative 1.5% or a little more than 4.5% at an annualized rate. That is separate from the base effect. |

U.S. Consumer Price Index (CPI) YoY, April 2021(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Canada’s economic diary is light today, while Mexico reports March industrial production figures. Output slowed to a crawl in December (0.06%) but has gradually picked up this year (0.18% in January and 0.43% in February). Helped by rising auto output, economists look for a 0.7% rise in March. Tomorrow the central bank meets. The board, which now has a majority of AMLO appointments, wants to ease monetary policy, but its hands are tied by the elevated price pressures. Last week, Mexico reported a year-over-year increase of 6.08% in April’s CPI. The pace accelerated every month this year after a 3.15% rate in December 2020. Back in the US, four Fed officials speak today, including Vice Chairman Clarida, who discusses the economic outlook. Rosengren speaks on crypto, which may draw attention. Bostic address the Council on Foreign Relations, and Harker discusses higher education.

The US dollar continues to find traction against the Canadian dollar, difficult to sustain. It took out yesterday’s high of around CAD1.2125 by a few ticks and stopped shy of Monday’s high of about CAD1.2140. It has been unable to distance itself much from the four-year low seen Monday and yesterday near CAD1.2080. There seems to be little meaningful support ahead of CAD1.20. The US dollar recorded an outside up day against the Mexican peso yesterday by trading on both sides of Monday’s range and settling above Monday’s high. Follow-through buying lifted the dollar to a three-day high just north of MXN20.06, which nearly met the (50%) retracement target of the decline from last week’s high (~MXN20.3270). Support is seen near MXN19.9450, and a move above MXN20.08 would target the pre-weekend high around MXN20.1350. Brazil reported a little firmer than expected CPI yesterday (6.76% for April after 6.10% in March). It underscored the central bank’s signal of a third 75 bp rate hike next month. The US dollar is testing the BRL5.20 support. The low for the year was set in early January near BRL5.12.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Australia,Brazil,China,Currency Movement,EUR/CHF,Featured,Mexico,newsletter,Norway,Sweden,Taiwan,U.K.,USD/CHF