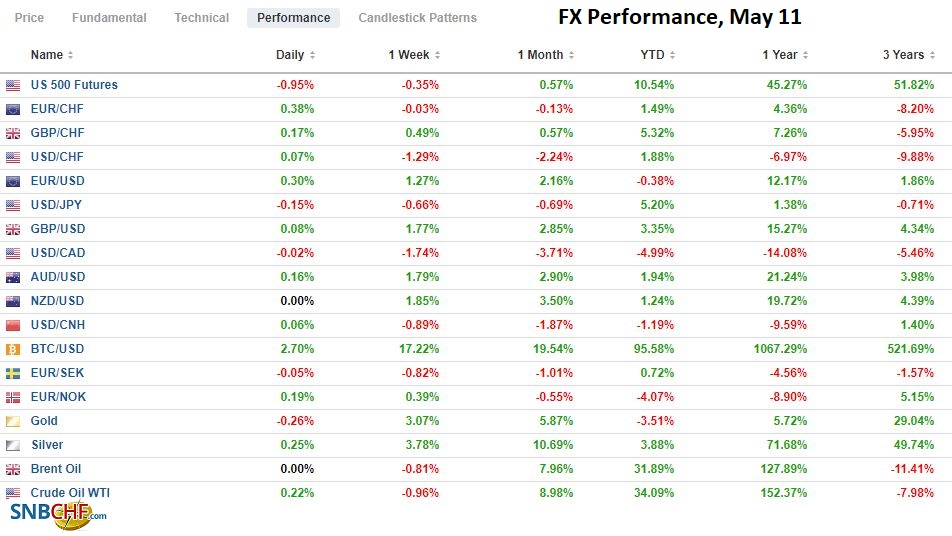

Swiss FrancThe Euro has risen by 0.37% to 1.0969 |

EUR/CHF and USD/CHF, May 11(see more posts on Business, EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The sell-off in US shares yesterday has triggered sharp global losses today, and there is no flight into fixed income as benchmark yields are higher across the board. Nor is the dollar serving as much as a safe haven. It is mostly softer against the major currencies. Japan and Taiwan led the Asia Pacific equity markets lower. Chinese shares stand out with a recovery in late turnover in the region to allow a higher close. In Europe, the Dow Jones Stoxx 600 is flirting with a 2% drop, which would be the largest this year, and in the US, the sell-off is continuing, and the S&P 500 and NASDAQ are poised to gap lower at the opening. The US 10-year yield, which settled last week below 1.58%, is at 1.61% today, while European benchmark yields are 3-4 bp higher. In the foreign exchange market, the Swiss franc, the Japanese yen, and the US dollar often touted as safe havens weak, while the Scandis and euro lead on the upside. The freely accessible emerging market currencies, like the Russian ruble, South African rand, and Mexican peso, are firm. Central and Eastern European currencies are generally doing better than Asian currencies. Gold is little changed around $1836 and continues to face resistance near $1850. June WTI is about 1% lower and is approaching its 20-day moving average (~$63.65), which it has not closed below since mid-April. The Colonial pipeline attack is attributed to Russia-based Darkside, and a shortage of gasoline is being seen. Reports suggest it will take a few more days to fully re-open it. |

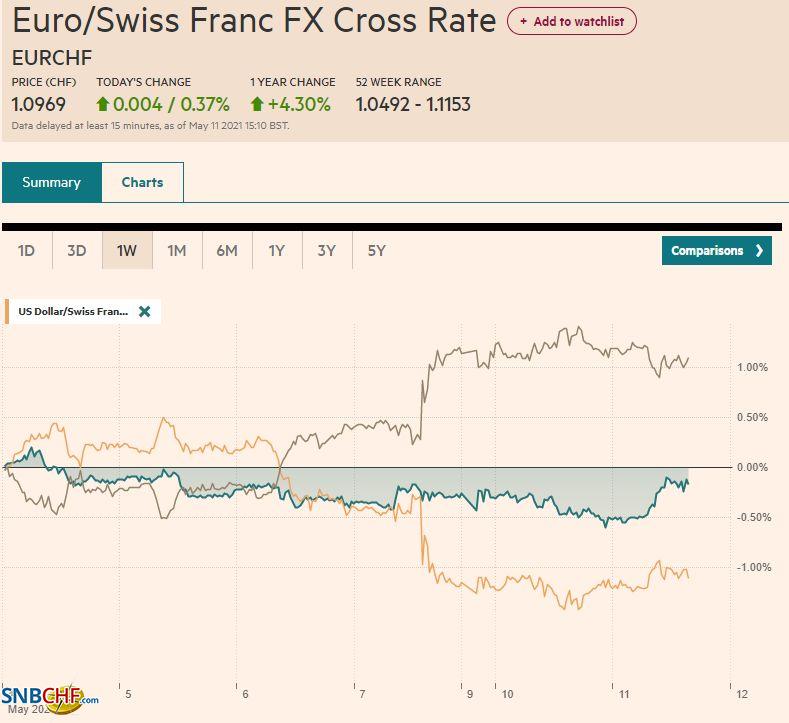

FX Performance, May 11 |

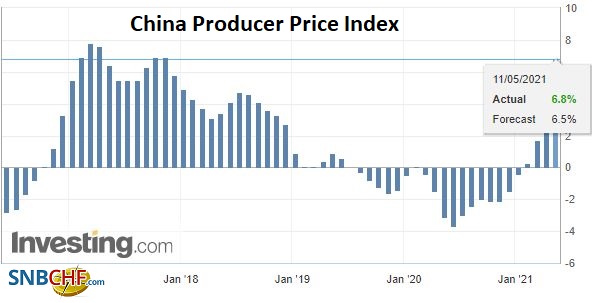

ChinaThe PBOC is unlikely to feel any special urgency to normalize monetary policy after today’s inflation report. April’s headline CPI rose by 0.9% from a year ago, a touch less than expected after a 0.4% gain in March. On the month, they fell by 0.3% after a 0.5% decline in March. A key development behind the subdued reading is that food price inflation has broken. Food prices are off by 0.7% year-over-year. It is the third consecutive decline. Pork prices are over a fifth lower than a year ago. Non-food prices are up 1.3%. The core rate stands 0.7% above year-ago levels. |

China Consumer Price Index (CPI) YoY, April 2021(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| On the other hand, producer prices rose 6.8% year-over-year, which was slightly faster than expected, accelerating from a 4.4% rate in March. Iron ore and non-ferrous metal prices were a key driver and do not appear to have peaked. |

China Producer Price Index (PPI) YoY, April 2021(see more posts on China Producer Price Index, ) Source: Investing.com - Click to enlarge |

Japan

Japan’s household spending surged by 6.2% in March, more than four times the gain projected by the median forecast in Bloomberg’s survey. However, it is a bit of a fluke. Moreover, the surge appears to have occurred between formal emergencies, which suggests several governors want it to be extended now nationwide. It is also seen as unsustainable because real disposable income fell (0.9%) for the fifth consecutive month. This points to families going into savings to pay for consumption.

The US and G7 have called on the World Health Organization to invite Taiwan to its May 24 meeting. It sounds like it ought to be uncontroversial, but it is anything but. There are some international organizations that only countries can join. Taiwan is not a member of these organizations. The US and G7 talk about the international rule of law. The World Health Organization can invite Taiwan as an observer at the May 24 meeting, but the rules require a vote of the members, and the US and G7 would likely lose the vote. China is opposed, of course. It worries that it is the thin edge of wedge or a slippery slope that will lead to Taiwan being recognized as a country.

Separately, Taiwan is the premier producer of state-of-the-art semiconductors. The US car companies and other producers want to buy more semiconductor chips from Taiwan’s TSMC. The bilateral US trade deficit with Taiwan reached nearly $30 bln last year, roughly doubling since the end of 2018. Since the end of 2018, the Taiwanese dollar has appreciated by 10.4% against the US dollar, making it the strongest currency in Asia, and indeed the strongest emerging market currency. Yet, despite the extenuating circumstances of 2020, the US needs to buy more semiconductor chips from it. With the Taiwanese dollar being one of the strongest currencies in the world, the US put Taiwan on its watch list for currency manipulation. The US still refuses to state unambiguously that it will defend Taiwan from attack, not simply to keep Beijing wondering, but to discourage Taiwan from declaring independence.

The dollar is trading within yesterday’s range against the Japanese yen (~JPY108.45-JPY109.05), which itself was in the pre-weekend range (~JPY108.35-JPY109.30). It is in a 20-tick range below JPY109, where an $830 mln option is set to expire today. After reversing lower yesterday and settling on its lows (~$0.7830), the Australian dollar slipped to around $0.7820 before rebounding to test $0.7850. Turnover is quiet, and the market seems to lack much conviction now. The Chinese yuan is slightly softer today, its third loss since April 9. For the third day, the PBOC set the dollar’s reference rate notably stronger than the bank models suggested, which, as we noted before the weekend, looks like a subtle protest. Today’s fix was at CNY6.4254, while the average forecast in the Bloomberg survey was CNY6.4222. Previously, the fix was often within 10 pips of the models. The dollar is near CNY6.4225 after settling near CNY6.4165 yesterday.

Europe

Germany’s May ZEW survey was better than expected. The assessment of the current situation stands at -40.1 compared with -48.8 in April. It is the best since February 2020 and finished 2019 near -20. The expectations component rose to 84.4 from 70.7, which also better than expected. It did not get above 77.5 last year. It seems broadly consistent with other data suggesting that the accelerated vaccination effort is laying the basis for stronger economic activity after the contraction in Q1.

The idea that the SNP was seeking an immediate referendum for independence was always a straw man argument. SNP leader and First Minister Sturgeon’s proposal was always clear on this. Addressing the public health crisis was the top priority. She had advocated a referendum toward the middle of the new five-year local government term. That would put somewhere in late 2023. Sterling gains, attributed in some quarters because the referendum is not imminent, seems like a stretch. Last week, the Bank of England signaled that the UK was going to join the first tier of major countries adjusting monetary policy. Norway’s central bank reaffirmed its intention to hike rates later this year. The Bank of Canada has taken the first step to slow its bond purchases and brought forward when the economic slack will be absorbed (H2 22), which is understood to suggest the timeframe of the first hike. The implied yield of the December 2022, short-sterling three-month interest rate futures contract is around 37 bp. It finished 2020 below five basis points. The Bank Rate is current at 10 bp, and the June 2021 short-sterling futures contract implied yield is about eight basis points, suggest a 25 bp hike has been discounted by the end of next year.

Some reports suggest that UK Prime Minister Johnson will use the Queen’s Speech that lays out the government’s legislative agenda to advocate the scrapping for the fixed five-year parliamentary terms that former Tory Prime Minister Cameron oversaw. Ostensibly, this would allow Johnson to call a snap election while Labour is in a weakened position, and the government can draw support from the fiscal stimulus and the vaccine rollout. The only reason to change the rules now is if Johnson wanted to have an election before the end of the current parliamentary session in 2024.

After reversing lower yesterday, there was an opportunity to pare the euro’s nearly two-cent gain seen in the last two sessions last week. However, the euro found support near $1.2125, where an option for nearly 1.3 bln euro is struck is set to expire today. Yesterday’s high was just shy of the $1.2180 level, and today’s high so far is near $1.2170. The $1.2200 may be psychologically important, but the high from late February (~$1.2245) may be more important technical resistance. Sterling also remains firm. It reached almost $1.4160 yesterday, its best level since February 25, and is in about a quarter of a cent range today on either side of $1.4125. The euro dropped through GBP0.8590 yesterday to record a one-month low. It has steadied today and is straddling the GBP0.8600 level. A break of GBP0.8565 could send it back to the early April low near GBP0.8470.

United States

The US sold $111 bln in bills yesterday and comes back today selling $40 bln of a 42-day cash management bill, and kicks off the quarterly refunding with a $58 bln of a three-year note offering. Investors who bought the three-year note at last month’s sale locked in 37.6 bp annual yields. The generic three-year yield is now below 30 bp. The 3-year note and tomorrow’s 10-year note attract a range of buyers, not so much with the 30-year bond. Lifer insurance companies, mortgage lenders, and some pension funds, but not typically foreign central banks, At the end of 2019, the 30-year yield was a little more than 35 bp on top of the 10-year yield. It peaked earlier this year near 85 bp and is now rising after slipping below 65 bp in early April. Separately, note that in addition to the US Treasury and US corporates selling debt today, Canada is expected to bring a five-year US dollar bond to market, its first such offering since January 2020. It is expected to be priced around eight basis points above the five-year Treasury yield.

Mexican President AMLO has been determined to unwind the liberalization of the energy market. He argues liberalization really means the privatization of Mexico’s public wealth. He has made some inroads, but yesterday a Mexican court temporarily suspend the new law that gave the government the right to suspend fuel permits if it judged national security was at risk. It also allows PEMEX to take over the facilities of the companies whose fuel permits were suspended. Brazil’s central bank has raised rates by 75 bp twice this year and has signaled its intent to do so again next month. It is not economic vigor that is prompting the move, but rising price pressures. Today’s inflation report is expected to show prices continue to accelerate last month. The IPCA measure is expected to rise to nearly 6.75% in April from 6.1% in March and about 4.5% at the end of last year. The year-over-year rate has been rising since hitting 1.88% in May 20220.

The US JOLTS report will be looked upon for clues into labor market dynamics after last week’s huge miss on the nonfarm payroll report. Ahead of tomorrow’s April CPI report, where the base effect will peak, a barrage of Fed officials speak today. That said, no fresh ground is likely to be broken today. The poor jobs report is seen as reinforcing the consensus at the Fed.

The US dollar fell to new four-year lows against the Canadian dollar yesterday near CAD1.2080. It is flat today despite the weakness in stocks and oil. Initial resistance is seen near CAD1.2140 and then the CAD1.2180-CAD1.2200. Better technical support for the greenback is not seen until CAD1.20. The US dollar is trading heavily against the Mexican peso. It was turned back from an attempt on MXN20.00 and has returned to the recent lows near MXN19.86. Support from the end of last month was established in the MXN19.78-MXN19.80 area. A break would target the MXN19.55 low seen in January.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brazil,China,China Consumer Price Index,China Producer Price Index,EUR/CHF,Featured,inflation,Mexico,newsletter,U.K.,USD/CHF